The Future Of CoreWeave And Its Stock Price

Table of Contents

CoreWeave, a rapidly expanding force in the cloud computing sector, is generating significant buzz with its innovative approach to GPU-accelerated cloud services. This article delves into the future trajectory of CoreWeave and analyzes the key factors that will likely influence its stock price, offering valuable insights for investors of all experience levels. Understanding the potential of CoreWeave stock requires examining its competitive advantages, growth prospects, and inherent risks within the dynamic landscape of the cloud computing market.

CoreWeave's Competitive Advantages and Market Position

Dominating the GPU Cloud Market

CoreWeave's unique selling proposition lies in its specialized infrastructure designed specifically for GPU-accelerated computing. This targeted approach caters to a rapidly growing clientele heavily involved in AI, machine learning, and high-performance computing. Its competitive advantages are significant:

- Superior Performance: CoreWeave boasts industry-leading performance benchmarks, enabling faster processing speeds and reduced latency for demanding applications.

- Cost-Effectiveness: Its optimized infrastructure delivers high performance at competitive pricing, making it an attractive option for businesses of all sizes.

- Scalable Infrastructure: CoreWeave's infrastructure is easily scalable, allowing users to adjust their computing resources as needed, ensuring flexibility and efficiency.

- Strong Partnerships: Strategic alliances with key technology providers further enhance its offerings and expand its market reach.

Compared to giants like AWS, Google Cloud, and Azure, CoreWeave often presents a more specialized and cost-effective solution for businesses deeply involved in GPU-intensive workloads. This niche focus allows CoreWeave to outperform competitors in specific segments of the market, contributing to its strong growth trajectory and influencing its stock price positively.

Strategic Partnerships and Acquisitions

CoreWeave's growth strategy involves strategic partnerships and potential acquisitions to expand its capabilities and market reach. While specific partnerships may evolve, the potential impact on CoreWeave's future is substantial:

- Key Partnerships (Examples): [Insert any known partnerships here, linking to relevant sources]. These partnerships enhance CoreWeave's technology offerings and broaden its access to customers.

- Potential for Future Acquisitions: Acquisitions of smaller, specialized companies could rapidly accelerate CoreWeave's innovation and expansion into new market segments.

- Expansion into New Markets: Strategic partnerships and acquisitions could facilitate entry into new geographic regions and industry verticals, driving revenue growth.

These strategic moves are crucial for maintaining CoreWeave's competitive edge and driving its stock price upwards. Successful execution of its strategic plans will be a major factor influencing investor confidence and the future value of CoreWeave stock.

Growth Potential and Future Projections for CoreWeave

The Booming AI and Machine Learning Market

CoreWeave is perfectly positioned to capitalize on the explosive growth of the AI and machine learning markets. The increasing demand for GPU computing power is fueling this growth:

- Increasing Demand for GPU Computing: AI and machine learning applications are inherently computationally intensive, requiring significant GPU power. CoreWeave is ideally suited to meet this demand.

- CoreWeave's Role in Supporting AI Development: CoreWeave provides the essential infrastructure that powers the development and deployment of cutting-edge AI models.

- Market Forecasts for AI Growth: Industry analysts predict continued exponential growth in the AI market, providing a significant tailwind for CoreWeave's revenue and stock price.

The strong correlation between AI market growth and CoreWeave's revenue projections makes it an attractive investment for those bullish on the future of artificial intelligence.

Technological Innovation and Future Developments

CoreWeave's commitment to research and development (R&D) is vital to its long-term success. Continuous innovation is key to its future:

- Investment in New Technologies: Significant investments in new technologies will ensure CoreWeave remains at the forefront of GPU computing.

- Potential for New Service Offerings: The development of innovative services and features will further enhance its competitive advantage and attract new customers.

- Focus on Sustainability and Efficiency: Commitment to sustainable practices and operational efficiency will improve its profitability and attract environmentally conscious clients.

These advancements will not only contribute to CoreWeave's long-term success but also significantly impact its stock valuation, making it a potentially lucrative investment for long-term investors.

Risks and Challenges Facing CoreWeave

Competition and Market Saturation

While CoreWeave enjoys a strong market position, competition from established players and the potential for market saturation pose significant challenges:

- Competition from Established Players: AWS, Google Cloud, and Azure remain formidable competitors, continuously investing in their GPU cloud offerings.

- Potential for Price Wars: Intense competition could lead to price wars, impacting CoreWeave's profitability and margins.

- Impact of New Entrants: The emergence of new players in the GPU cloud computing market could further intensify competition.

CoreWeave’s ability to maintain its competitive edge through innovation, strategic partnerships, and efficient operations will be crucial in navigating these challenges.

Economic Factors and Market Volatility

Broader economic conditions and market fluctuations can significantly influence CoreWeave's stock price:

- Interest Rate Hikes: Rising interest rates can impact investor sentiment and reduce demand for growth stocks.

- Inflation: High inflation can increase operating costs and reduce consumer spending, impacting demand for cloud services.

- Recessionary Pressures: A recession could significantly reduce corporate investment in technology, affecting CoreWeave's revenue.

- Impact of Geopolitical Events: Geopolitical instability can create uncertainty in the market, impacting investor confidence.

Understanding the sensitivity of CoreWeave's stock to macroeconomic factors is crucial for informed investment decisions.

Conclusion

CoreWeave's future appears promising, driven by its strong market position in the rapidly expanding GPU cloud computing sector and its strategic focus on the booming AI and machine learning markets. The company's innovative approach and commitment to R&D position it well for continued growth. However, investors should remain aware of the inherent risks associated with the technology sector and broader economic conditions. Careful consideration of the competitive landscape, potential market saturation, and macroeconomic factors is essential.

Call to Action: Stay informed about the latest developments in the cloud computing industry and CoreWeave's progress to make informed decisions regarding your investment in CoreWeave stock. Continue researching CoreWeave and its stock price to optimize your investment strategy and capitalize on the potential of this exciting company in the evolving world of GPU cloud computing.

Featured Posts

-

Trinidad Concert Minister Debates Age Limits And Song Censorship For Kartel Performance

May 22, 2025

Trinidad Concert Minister Debates Age Limits And Song Censorship For Kartel Performance

May 22, 2025 -

Mother Imprisoned For Social Media Post After Southport Stabbing Home Release Refusal

May 22, 2025

Mother Imprisoned For Social Media Post After Southport Stabbing Home Release Refusal

May 22, 2025 -

David Walliams Slams Simon Cowell Amid Britains Got Talent Dispute

May 22, 2025

David Walliams Slams Simon Cowell Amid Britains Got Talent Dispute

May 22, 2025 -

The Goldbergs Behind The Scenes Of A Popular Sitcom

May 22, 2025

The Goldbergs Behind The Scenes Of A Popular Sitcom

May 22, 2025 -

The Unexpected Hot Weather Drink That Will Cool You Down

May 22, 2025

The Unexpected Hot Weather Drink That Will Cool You Down

May 22, 2025

Latest Posts

-

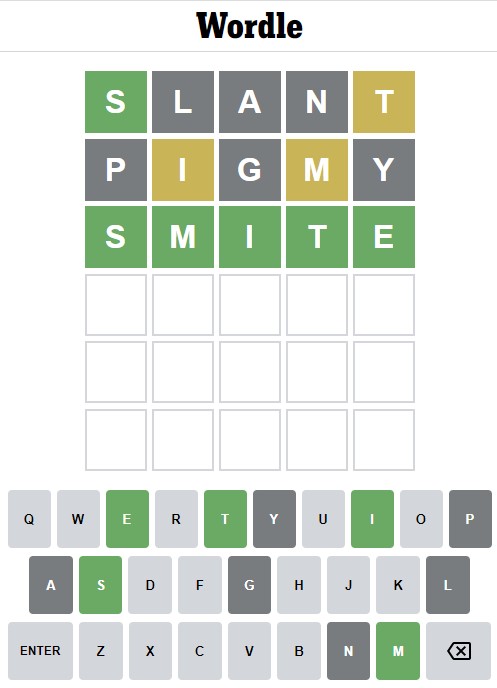

Wordle April 26 2025 Tips Clues And The Wordle Answer

May 22, 2025

Wordle April 26 2025 Tips Clues And The Wordle Answer

May 22, 2025 -

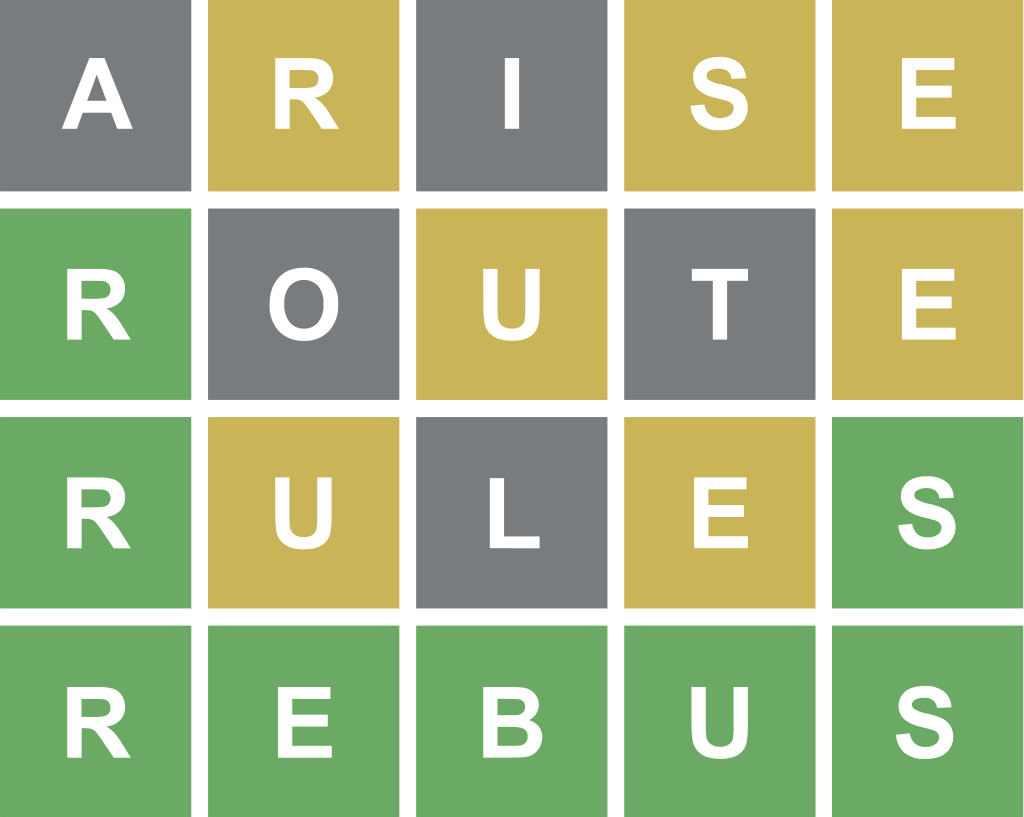

Wordle 370 March 20 Find The Answer With Our Hints And Clues

May 22, 2025

Wordle 370 March 20 Find The Answer With Our Hints And Clues

May 22, 2025 -

Wordle Hints And Answer March 20th 370

May 22, 2025

Wordle Hints And Answer March 20th 370

May 22, 2025 -

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025 -

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025