The Gut-Wrenching Truth About Buy-and-Hold: Is The Long Game Worth It?

Table of Contents

Buy-and-hold, the seemingly simple strategy of purchasing assets and holding them for an extended period, is often touted as the path to financial freedom. Images of leisurely retirements, funded by steadily appreciating investments, dance in our heads. But the reality is far more complex. The buy-and-hold strategy, while potentially lucrative, demands a steely resolve and a deep understanding of its inherent risks. This article delves into the gut-wrenching truths about buy-and-hold, exploring its benefits and drawbacks to help you determine if this long-term investment approach is right for you.

The Allure of Buy-and-Hold: Understanding the Potential Benefits

Buy-and-hold investing offers several compelling advantages, attracting many investors to its seemingly straightforward approach.

Long-Term Growth Potential: The Power of Compounding

The magic of buy-and-hold lies in the power of compounding. Over decades, even modest returns can snowball into significant wealth.

- Increased potential for significant capital appreciation: As your investments grow, their returns generate further returns, accelerating your wealth accumulation.

- Beating inflation: Long-term investing helps your money outpace inflation, preserving its purchasing power over time.

- Tax advantages of long-term capital gains: Holding investments for a longer period often results in lower capital gains tax rates compared to short-term trades.

Consider this: A 7% annual return on a $10,000 investment compounded over 30 years yields over $76,000. While past performance is not indicative of future results, historical market data demonstrates the potential for significant long-term growth.

Minimizing Transaction Costs: Saving on Fees and Commissions

Frequent trading eats into your profits. Buy-and-hold minimizes these costs.

- Lower brokerage fees: You pay fewer commissions when you buy and sell less frequently.

- Reduced capital gains taxes from frequent selling: Lower tax liability contributes to higher overall returns.

- Less emotional decision-making: Frequent trading often leads to impulsive choices based on market fluctuations rather than a well-defined investment strategy.

By reducing trading activity, you keep more of your investment gains. Comparing the transaction costs of active day trading versus a long-term buy-and-hold strategy clearly highlights this advantage.

Passive Income Generation (Real Estate Focus): Building a Steady Stream of Income

For real estate investors, buy-and-hold offers the potential for substantial passive income streams.

- Consistent cash flow from rental properties: Rent payments provide a regular income, supplementing your other earnings.

- Potential for property value appreciation: Real estate values tend to increase over the long term, adding to your wealth.

- Tax deductions related to rental properties: Various tax deductions can reduce your tax burden associated with rental property ownership.

However, it's crucial to acknowledge potential drawbacks like property management fees and periods of vacancy, which can impact your overall rental income.

The Gut-Wrenching Realities: Confronting the Drawbacks of Buy-and-Hold

While the long-term prospects of buy-and-hold are enticing, it's crucial to acknowledge the challenges.

Market Volatility and Drawdowns: The Emotional Rollercoaster

Market fluctuations are unavoidable. Buy-and-hold exposes you to significant short-term losses.

- Emotional distress during market corrections: Watching your investments plummet can be incredibly stressful, even if you're a long-term investor.

- Potential need for emergency funds: If you need access to your money quickly, selling assets during a market downturn could result in substantial losses.

- Risk of prolonged periods of underperformance: Some investments may underperform for extended periods, testing your patience and resolve.

Historical examples of market crashes, such as the 2008 financial crisis, underscore the importance of having a high risk tolerance and a solid understanding of market cycles before embracing this strategy. A thorough risk tolerance assessment is vital.

Opportunity Cost: Missing Out on Potential Gains

Sticking with a buy-and-hold strategy means you might miss out on potentially higher returns from other strategies.

- Comparison with active trading strategies: Active traders may achieve higher returns, though they also face higher risk.

- Impact of missed market timing opportunities: Sometimes, carefully timed trades can significantly enhance returns.

- Potential for higher returns with active management (but also higher risk): Active management requires significant time, skill, and knowledge.

The decision between buy-and-hold and active trading hinges on your personal risk tolerance, investment goals, and available time and resources.

Liquidity Issues: Accessing Your Money When You Need It

Buy-and-hold inherently presents liquidity challenges.

- Time required to sell assets: Selling real estate or certain stocks can take considerable time.

- Potential losses from forced sales during market downturns: Being forced to sell at a loss to meet an urgent need can severely impact your overall returns.

- Lack of immediate access to capital: This strategy isn't ideal if you require quick access to your funds for emergencies.

Diversification and maintaining a substantial emergency fund can help mitigate liquidity issues associated with buy-and-hold.

Is Buy-and-Hold Right for You? Assessing Your Risk Tolerance and Goals

Before committing to buy-and-hold, honestly assess your individual situation.

Defining Your Investment Goals: Matching Strategy to Objectives

Your investment goals play a critical role in determining the suitability of a buy-and-hold approach.

- Retirement planning: Buy-and-hold can be an effective strategy for long-term retirement savings.

- Wealth building: It offers significant potential for wealth accumulation over the long term.

- Specific financial targets: Ensure your chosen strategy aligns with your specific financial targets (e.g., down payment on a house, paying for your children’s education).

- Understanding personal risk appetite: Are you comfortable weathering market downturns without panicking?

A simple self-assessment can help determine your risk tolerance and investment goals. Consider questions like: What is your time horizon? How much risk are you willing to accept? What is your financial situation?

Diversification Strategies: Spreading the Risk

Don't put all your eggs in one basket. Diversification is crucial for mitigating risk.

- Asset allocation: Spread your investments across different asset classes (stocks, bonds, real estate, etc.)

- Diversification across different asset classes: Reduces the impact of underperformance in any single asset class.

- Importance of rebalancing: Periodically adjust your portfolio to maintain your desired asset allocation.

Diversification is a key component of a successful long-term investment strategy, regardless of whether you use a buy-and-hold or active trading approach.

Seeking Professional Advice: Getting Expert Guidance

Consider seeking advice from a qualified financial advisor.

- Personalized investment advice: A financial advisor can help you develop a tailored investment strategy based on your individual circumstances.

- Tailoring a strategy to individual needs: They can guide you in choosing the appropriate investment approach for your risk tolerance and goals.

- Ongoing portfolio management: They can provide ongoing support and guidance to help you stay on track.

Seeking professional financial advice is an investment in your financial future.

Conclusion

Buy-and-hold, while often praised for its simplicity, demands a thorough understanding of its potential benefits and inherent risks. The "gut-wrenching" aspect lies in the ability to withstand market volatility and resist the urge to make impulsive decisions during periods of uncertainty. Before embracing a buy-and-hold strategy, carefully assess your risk tolerance, investment goals, and financial situation. Consider consulting with a financial advisor to determine if this long-term investment approach aligns with your individual circumstances. Remember, successful long-term investing is not solely about the strategy, but also about informed decision-making and a well-defined plan. Make informed decisions regarding your buy-and-hold strategy and achieve your financial goals.

Featured Posts

-

Is Naomi Campbell Banned From The 2025 Met Gala A Look At The Wintour Feud

May 25, 2025

Is Naomi Campbell Banned From The 2025 Met Gala A Look At The Wintour Feud

May 25, 2025 -

Dazi Trump Il Settore Moda Europeo Tra Crisi E Ripresa

May 25, 2025

Dazi Trump Il Settore Moda Europeo Tra Crisi E Ripresa

May 25, 2025 -

Executive Office365 Accounts Targeted In Multi Million Dollar Heist

May 25, 2025

Executive Office365 Accounts Targeted In Multi Million Dollar Heist

May 25, 2025 -

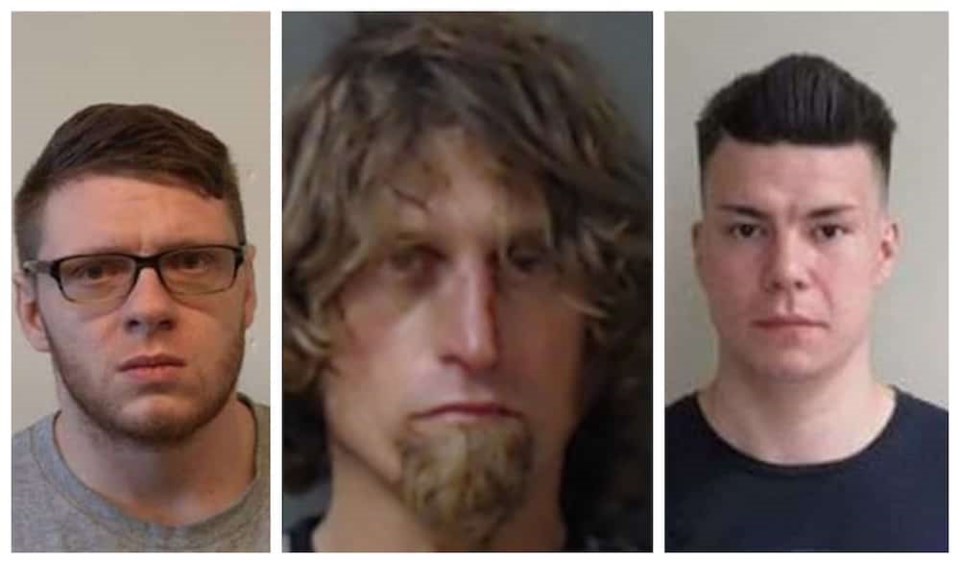

Italian Authorities Arrest Dave Turmel Canadas Most Wanted

May 25, 2025

Italian Authorities Arrest Dave Turmel Canadas Most Wanted

May 25, 2025 -

Porsche Cayenne Ev 2026 Leaked Spy Shots And Speculation

May 25, 2025

Porsche Cayenne Ev 2026 Leaked Spy Shots And Speculation

May 25, 2025