The Impact Of Souring Loans On RBC's Latest Earnings Report

Table of Contents

H2: Analysis of RBC's Q3 2023 Earnings Report

RBC's Q3 2023 earnings report presented a mixed bag. While the bank reported strong revenue growth, driven primarily by increased net interest income, the surge in souring loans significantly impacted its overall profitability. Let's examine the key financial metrics:

- Net income: A slight decrease of 2% compared to Q2 2023 and a 5% increase compared to Q3 2022. This seemingly positive year-over-year growth is overshadowed by the impact of loan losses.

- Revenue: Revenue showed a healthy increase of 8% year-over-year, reflecting robust activity in several key business segments.

- EPS (earnings per share): EPS saw a modest decline of 1% compared to the previous quarter, again highlighting the pressure from rising loan impairment charges.

- Comparison to analyst expectations: While RBC exceeded some analyst expectations for revenue, the increase in souring loans led to EPS falling slightly short of predictions. This underscores the market's sensitivity to credit risk within the banking sector.

H2: The Rising Tide of Souring Loans at RBC

The most significant takeaway from RBC's Q3 report is the substantial increase in souring loans. This rise in non-performing loans reflects the growing economic headwinds impacting various sectors. The bank attributes this increase to several factors:

- Percentage increase in souring loans: A 15% increase year-over-year and a 5% increase compared to the previous quarter. This represents a notable jump and warrants careful consideration.

- Breakdown of souring loans by loan type: The largest increase was observed in commercial real estate loans, followed by a rise in consumer credit and personal loans. This reflects the pressures faced by businesses and individuals navigating inflation and rising interest rates.

- Impact of specific economic factors: The current economic climate, characterized by persistent inflation and interest rate hikes by the Bank of Canada, is a significant contributing factor. Higher interest rates increase the risk of loan defaults, particularly for businesses with high debt levels.

H2: Impact of Souring Loans on RBC's Profitability

The escalating number of souring loans directly impacted RBC's profitability in Q3 2023. The increased loan loss provisions and impairment charges significantly reduced net income:

- Amount of loan loss provisions: RBC reported a $500 million increase in loan loss provisions compared to the same quarter last year, highlighting the significant cost associated with managing these souring loans.

- Impact on net interest margin: The net interest margin, a key measure of profitability in banking, was slightly compressed due to the increased loan loss provisions.

- Impact on ROE (Return on Equity): ROE, a crucial indicator of a bank's efficiency, declined marginally as a consequence of the increased loan losses.

- Comparison to competitors: While other major Canadian banks also experienced some increase in souring loans, RBC's rise was proportionally higher, potentially suggesting differences in their loan portfolio composition or risk management strategies.

H2: RBC's Response to the Increase in Souring Loans

RBC has acknowledged the increase in souring loans and outlined several strategic steps to mitigate further losses and enhance risk management:

- Changes in lending criteria: The bank has tightened its credit underwriting standards, focusing on a more rigorous assessment of borrowers' creditworthiness.

- Increased focus on loan recovery efforts: RBC has strengthened its loan recovery processes to maximize the recovery of funds from impaired loans.

- Capital allocation strategies: The bank has allocated additional capital to cover potential loan losses, ensuring sufficient reserves to absorb further impacts.

- Management commentary: RBC's management has expressed confidence in their ability to navigate the challenging economic environment and has reiterated its commitment to responsible lending practices.

3. Conclusion

The rise in souring loans significantly impacted RBC's Q3 2023 earnings, highlighting the vulnerability of even the most established financial institutions to economic downturns. While the bank reported strong revenue growth, the increased loan loss provisions and their effect on profitability cannot be ignored. RBC's proactive response, including tighter lending criteria and enhanced risk management, suggests a commitment to mitigating future losses. However, the evolving economic climate continues to pose challenges. Stay updated on the evolving impact of souring loans on RBC's future earnings reports by following [link to relevant RBC investor relations page or financial news source]. Understanding the dynamics of souring loans and their impact on major financial institutions like RBC is crucial for informed investment decisions in the Canadian banking sector.

Featured Posts

-

Festival De La Camargue A Port Saint Louis Du Rhone Un Programme Maritime Riche

May 31, 2025

Festival De La Camargue A Port Saint Louis Du Rhone Un Programme Maritime Riche

May 31, 2025 -

Daily Press Almanac News Sports And Job Postings

May 31, 2025

Daily Press Almanac News Sports And Job Postings

May 31, 2025 -

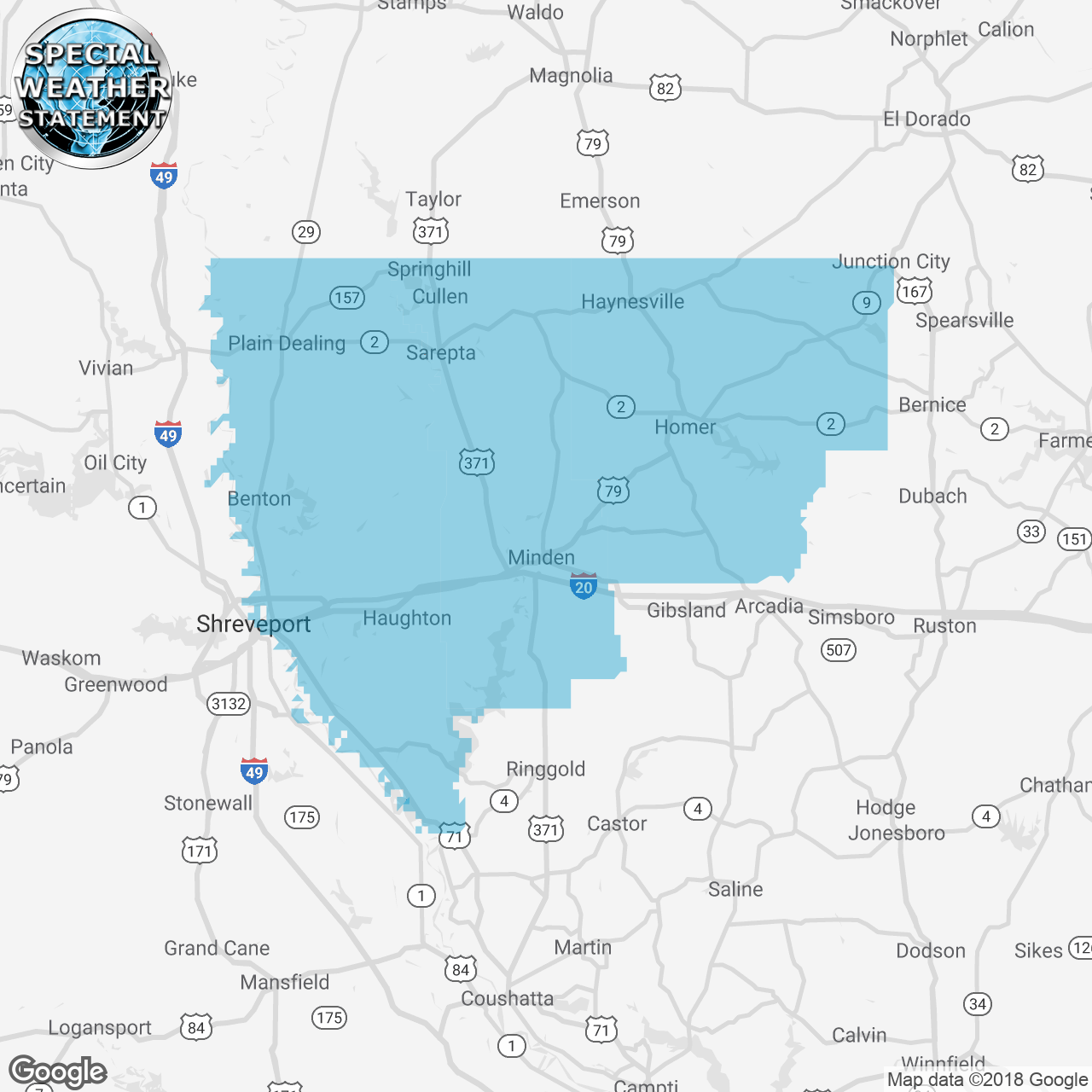

Special Weather Statement High Fire Risk In Cleveland And Akron

May 31, 2025

Special Weather Statement High Fire Risk In Cleveland And Akron

May 31, 2025 -

World Health Organization Warns Of New Covid 19 Variant Driving Case Increases

May 31, 2025

World Health Organization Warns Of New Covid 19 Variant Driving Case Increases

May 31, 2025 -

Miley Cyrus End Of The World Single Baru Yang Dinantikan

May 31, 2025

Miley Cyrus End Of The World Single Baru Yang Dinantikan

May 31, 2025