The Impact Of US Politics On Elon Musk's Net Worth And Tesla's Future

Table of Contents

Government Regulations and Tesla's Growth

Government regulations in the US play a pivotal role in Tesla's success, influencing its growth trajectory and profitability in significant ways. These regulations impact Tesla's operations on multiple fronts, from boosting sales through incentives to increasing production costs via stringent safety and emissions standards.

Environmental Policies and Subsidies

Federal and state environmental policies are crucial for the electric vehicle (EV) market, and Tesla is a major beneficiary. The availability of tax credits and subsidies directly affects consumer demand and Tesla's bottom line.

- Impact of the Clean Energy Tax Credit: This federal incentive significantly reduces the upfront cost for consumers purchasing EVs, driving sales for Tesla and other EV manufacturers. Changes to this credit, as seen in previous legislative cycles, can have an immediate impact on Tesla's sales figures.

- State-level incentives for EV adoption: Many states offer additional incentives, such as rebates or preferential registration fees, which further boost Tesla's market share in those regions. The patchwork of state-level policies creates a complex regulatory landscape that Tesla must navigate effectively.

- Potential changes under different administrations: Political shifts can drastically alter the landscape of incentives. A change in administration could lead to modifications or even the elimination of these crucial subsidies, potentially impacting Tesla's sales and market position considerably.

Analyzing the potential changes in these policies is crucial for understanding Tesla's long-term financial projections. A reduction or removal of subsidies could significantly affect Tesla's profitability and ability to compete with traditional automakers.

Automotive Safety and Emission Standards

Stricter automotive safety and emission standards, while aimed at protecting the environment and consumers, also present challenges for Tesla.

- Compliance costs: Meeting increasingly stringent regulations necessitates significant investments in research, development, and testing, increasing manufacturing costs.

- Influence on innovation in safety features: The push for advanced safety features, driven by regulatory requirements, can be a catalyst for innovation, strengthening Tesla's competitive edge. However, the rapid pace of technological advancement can also strain resources.

- Potential for stricter future regulations: The future may see even more rigorous regulations, potentially leading to higher compliance costs and impacting Tesla's pricing strategies.

Tesla's ability to successfully navigate and adapt to these regulations is critical for maintaining its competitive position in the automotive industry. The cost of compliance directly influences Tesla's pricing and its ability to offer competitive EVs.

Trade Wars and Global Supply Chains

Tesla's global operations make it highly susceptible to the impacts of international trade policies and geopolitical instability. The company's intricate supply chains are vulnerable to disruptions caused by trade wars and sanctions.

Tariff Impacts on Tesla's Manufacturing and Sales

Trade disputes and tariffs on materials or finished goods significantly affect Tesla's manufacturing costs and sales, both domestically and internationally.

- Impact of tariffs on imported components: Tesla relies on a global supply chain for various components. Tariffs on these imported parts directly increase production costs, squeezing profit margins.

- Effects on Tesla's pricing strategy: Increased costs due to tariffs can force Tesla to raise prices, potentially impacting its competitiveness and sales volume.

- Potential relocation of production facilities: To mitigate the impact of tariffs, Tesla may consider relocating manufacturing to regions with more favorable trade policies, a complex and costly undertaking.

Managing global supply chains amidst trade conflicts is a considerable challenge for Tesla. The company needs to develop robust strategies to mitigate the negative effects of trade wars and safeguard its operations.

Geopolitical Risks and International Expansion

International political instability and trade sanctions pose significant risks to Tesla's international expansion and market access.

- Challenges in specific markets (e.g., China): Navigating the complex regulatory and political landscape in key markets like China requires significant effort and careful consideration of geopolitical risks.

- Impact of sanctions on operations in certain regions: Sanctions imposed on certain countries could directly impact Tesla's ability to operate or sell its vehicles in those regions.

- Potential for political risk insurance: To mitigate the risks associated with operating in politically unstable regions, Tesla might need to consider investing in political risk insurance.

Tesla's ability to succeed in international markets is intrinsically linked to its ability to navigate geopolitical complexities. A stable and predictable political environment is essential for sustainable growth outside the US.

Political Ideology and Public Opinion

The prevailing political climate and public opinion significantly influence Tesla's brand image, stock price, and overall valuation. Elon Musk's own political actions further complicate this dynamic.

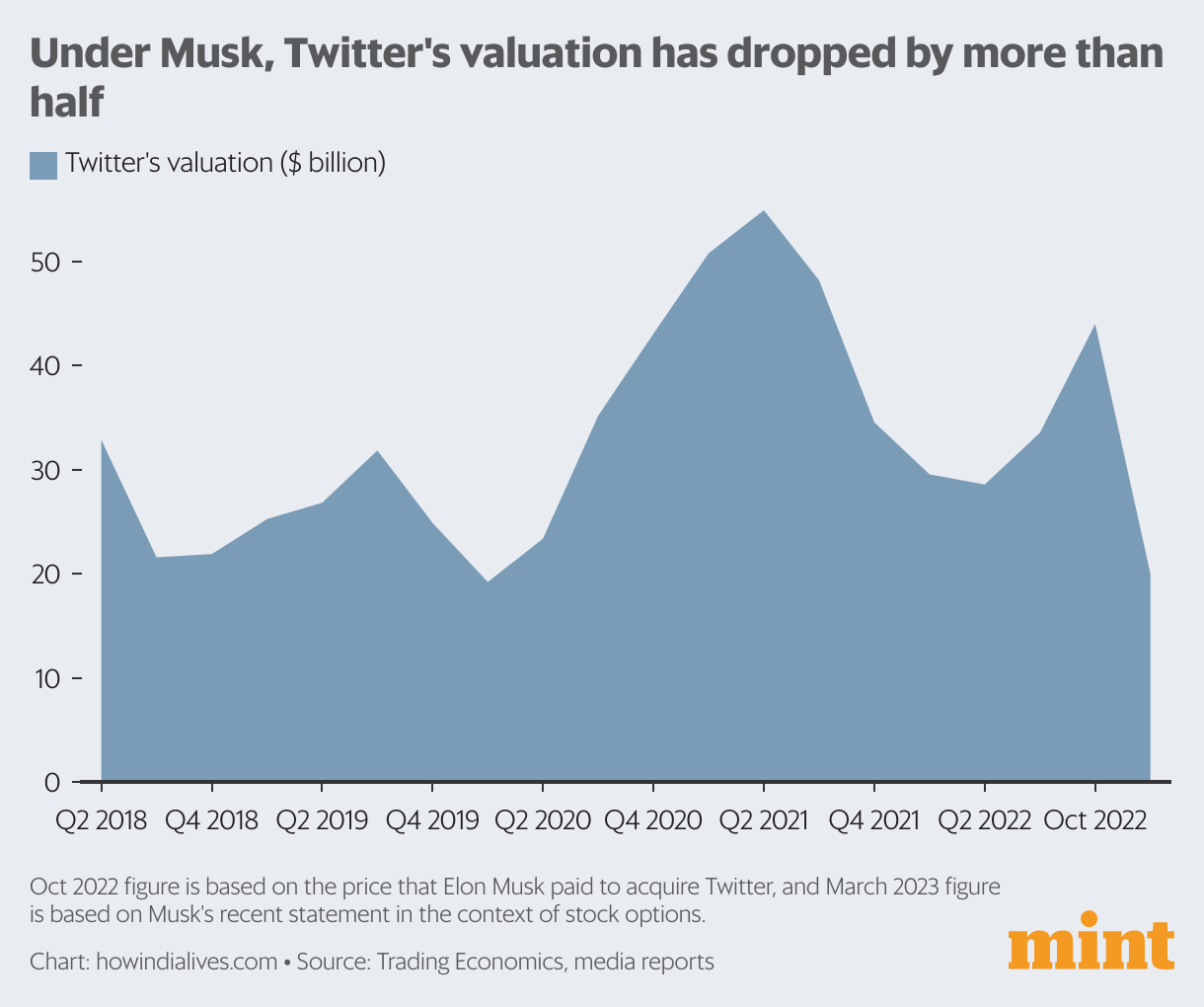

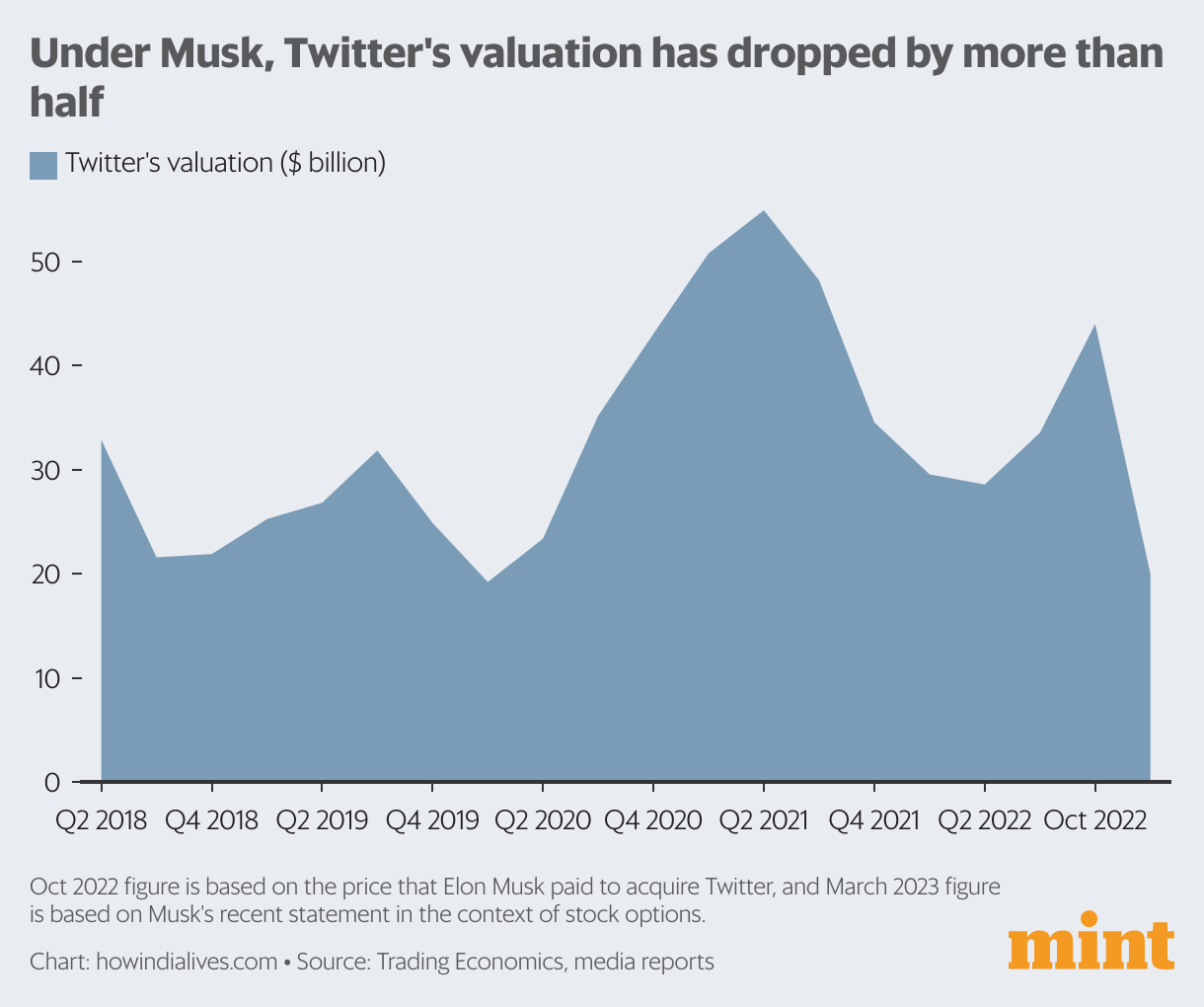

Influence of Political Discourse on Tesla's Brand and Stock Price

Political discourse surrounding environmental issues and technological advancements has a direct impact on Tesla's brand perception and stock performance.

- Impact of social media and news coverage: The narrative surrounding Tesla in the media, amplified by social media, is heavily influenced by the prevailing political climate.

- Influence of political endorsements or criticisms on consumer sentiment: Positive or negative statements from political figures can sway consumer sentiment, impacting sales and brand loyalty.

- Stock market volatility linked to political events: Tesla's stock price is frequently affected by political events and shifts in public opinion, reflecting the sensitivity of investor confidence to political factors.

Understanding the interplay between political narratives and consumer sentiment is critical for Tesla's long-term success. Maintaining a positive public image is crucial for sustained growth.

Elon Musk's Political Statements and Their Repercussions

Elon Musk's public pronouncements on political issues have at times generated controversy, impacting Tesla's brand image and stock performance.

- Examples of controversial tweets or actions: Musk's social media activity has frequently caused market volatility, highlighting the sensitivity of investor sentiment to his public statements.

- Impact on investor trust: Controversial actions can erode investor confidence and negatively affect Tesla's stock valuation.

- Potential for regulatory scrutiny: Musk's political positions may attract regulatory scrutiny, potentially leading to investigations or legal challenges.

The relationship between Elon Musk's personal brand and Tesla's corporate image requires careful management. Maintaining a balance between personal expression and safeguarding the company's reputation within the volatile US political landscape is a constant challenge.

Conclusion

The "Impact of US Politics on Elon Musk's Net Worth and Tesla's Future" is undeniable. Government regulations, trade policies, and public opinion, all heavily influenced by the US political climate, profoundly affect Tesla's growth, profitability, and the value of its CEO's significant stake. Understanding this intricate relationship is crucial for investors, consumers, and policymakers alike. To stay informed about this dynamic interplay and the future of electric vehicles, consistently follow news about US political developments and engage in informed discussions on the "Impact of US Politics on Elon Musk's Net Worth and Tesla's Future."

Featured Posts

-

Trois Hommes Sauvagement Agresses Au Lac Kir De Dijon

May 09, 2025

Trois Hommes Sauvagement Agresses Au Lac Kir De Dijon

May 09, 2025 -

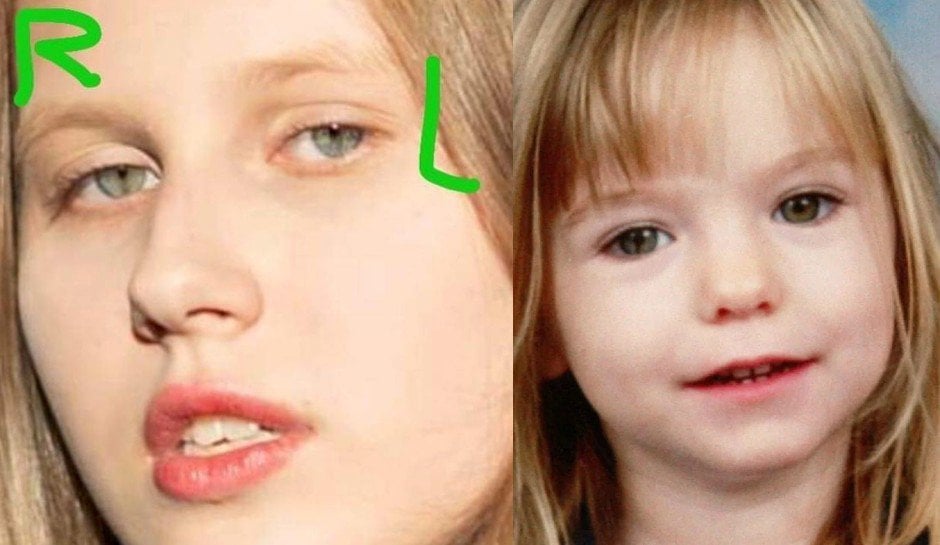

New Dna Test Results In Madeleine Mc Cann Case A 23 Year Olds Claim Examined

May 09, 2025

New Dna Test Results In Madeleine Mc Cann Case A 23 Year Olds Claim Examined

May 09, 2025 -

Exploring The Identity Of David In He Morgan Brothers High Potential 5 Prominent Theories

May 09, 2025

Exploring The Identity Of David In He Morgan Brothers High Potential 5 Prominent Theories

May 09, 2025 -

India En Brekelmans De Toekomst Van Hun Relatie

May 09, 2025

India En Brekelmans De Toekomst Van Hun Relatie

May 09, 2025 -

Los Angeles Wildfires And The Gambling Industry A Concerning Development

May 09, 2025

Los Angeles Wildfires And The Gambling Industry A Concerning Development

May 09, 2025