The Lingering Impact Of Pandemic Fiscal Support On Inflation

Table of Contents

The Surge in Aggregate Demand

The pandemic's economic fallout spurred governments globally to enact substantial fiscal stimulus packages. These initiatives, including direct stimulus checks, enhanced unemployment benefits, and loan guarantee programs, injected significant purchasing power into the economy. This surge in aggregate demand, however, collided head-on with a severely constrained supply. Pandemic-related disruptions, including supply chain bottlenecks, factory closures, and labor shortages, hampered the ability of businesses to meet this unexpectedly high demand.

- Increased consumer spending fueled by stimulus checks: The rapid infusion of cash into households led to a significant increase in consumer spending, particularly on durable goods.

- Rise in demand for goods and services exceeding available supply: This mismatch between supply and demand created upward pressure on prices, a key driver of inflation.

- Contribution of increased demand to inflationary pressures: The inability of the supply side to keep pace with the surge in demand became a significant contributor to the inflationary pressures observed globally.

The interplay between heightened aggregate demand and constrained supply created a perfect storm for inflation, significantly impacting the cost of goods and services. This period highlighted the delicate balance between supporting the economy during a crisis and potentially fueling inflationary pressures. Keywords like "aggregate demand," "stimulus checks," "consumer spending," "supply chain disruptions," and "inflationary pressures" are crucial in understanding this complex economic phenomenon.

The Role of Government Spending

Beyond direct stimulus to consumers, governments also engaged in extensive government spending on infrastructure projects and other initiatives as part of their pandemic response. While intended to stimulate economic activity and create jobs, this government spending also contributed to inflationary pressures. Increased government contracts led to competition for resources and labor, driving up prices.

- Government investment in infrastructure and its effect on material costs: Large-scale infrastructure projects increased demand for construction materials, leading to price increases for everything from lumber to steel.

- Competition for resources and labor leading to price increases: The increased demand for resources and labor created bidding wars, further driving up costs and contributing to inflationary pressures.

- The interplay between government spending and private sector investment: Government spending also competed with private sector investment for resources, potentially exacerbating inflationary pressures.

Understanding the inflationary consequences of government spending requires careful analysis of its interaction with the private sector and its impact on resource allocation. Keywords such as "government spending," "infrastructure investment," "fiscal policy," and "inflationary consequences" are essential to grasping the full picture.

The Labor Market and Wage Inflation

The pandemic also significantly impacted the labor market. Enhanced unemployment benefits, while intended to provide crucial support to laid-off workers, arguably influenced labor participation rates. The resulting labor shortages contributed to significant wage growth, another factor fueling inflation.

- The impact of enhanced unemployment benefits on workers' willingness to return to work: The availability of extended unemployment benefits may have reduced the incentive for some individuals to actively seek new employment.

- Increased bargaining power for workers in a tight labor market: With fewer workers available, businesses faced increased pressure to offer higher wages to attract and retain employees.

- Wage increases contributing to the upward pressure on prices: These wage increases, while beneficial to workers, contributed to the upward pressure on prices as businesses passed on increased labor costs to consumers.

The relationship between unemployment benefits, labor participation rates, wage inflation, and the overall inflationary spiral is a complex one, warranting further investigation. The keywords "labor market," "wage inflation," "unemployment benefits," "labor participation rate," and "inflationary spiral" are vital for comprehending this aspect of the post-pandemic economy.

Monetary Policy Response and its Effectiveness

Central banks worldwide responded to the surge in inflation by implementing monetary policy tightening measures, primarily through interest rate hikes. The aim was to cool down the economy and curb inflationary pressures. However, the effectiveness of these measures in mitigating the impact of pandemic fiscal support has been a subject of ongoing debate.

- Central bank response to rising inflation: Central banks around the world raised interest rates to combat inflation.

- Interest rate hikes and their impact on economic growth: These rate hikes, while aiming to curb inflation, also risk slowing economic growth, potentially leading to a recession.

- The challenges in balancing inflation control with economic stability: Central banks face the difficult task of balancing the need to control inflation with the need to maintain economic stability.

The effectiveness of monetary policy in addressing the inflationary consequences of pandemic fiscal support continues to be evaluated. Keywords such as "monetary policy," "interest rates," "central banks," "inflation control," and "economic growth" are pivotal in understanding this complex policy challenge.

Conclusion: Long-Term Implications and Future Outlook

The lingering impact of pandemic fiscal support on inflation is a multifaceted issue with long-term implications. The surge in aggregate demand, government spending, labor market dynamics, and the response of monetary policy have all played significant roles in shaping the current inflationary environment. The ongoing debate among economists underscores the complexity of the situation and the uncertainties surrounding the future trajectory of inflation. Understanding the complex interplay between fiscal policy, monetary policy, and inflation remains crucial. To gain a deeper understanding of the lingering impact of pandemic fiscal support on inflation, further research into the specific economic data from various countries, as well as analysis of different economic models, is essential. This includes exploring the long-term effects of the fiscal measures on productivity, investment, and long-run inflation expectations. You can find relevant economic data and research from sources like the International Monetary Fund (IMF), the World Bank, and national central banks. Let's continue to analyze and discuss the lingering impact of pandemic fiscal support on inflation to better inform future economic policy.

Featured Posts

-

The D C Blackhawk Passenger Jet Disaster A Comprehensive Report

Apr 29, 2025

The D C Blackhawk Passenger Jet Disaster A Comprehensive Report

Apr 29, 2025 -

Get Capital Summertime Ball 2025 Tickets A Comprehensive Guide For Fans

Apr 29, 2025

Get Capital Summertime Ball 2025 Tickets A Comprehensive Guide For Fans

Apr 29, 2025 -

Dsv Leoben Praesentiert Neues Trainerteam In Der Regionalliga Mitte

Apr 29, 2025

Dsv Leoben Praesentiert Neues Trainerteam In Der Regionalliga Mitte

Apr 29, 2025 -

Pete Rose Pardon Trumps Intervention And Call For Hof Induction

Apr 29, 2025

Pete Rose Pardon Trumps Intervention And Call For Hof Induction

Apr 29, 2025 -

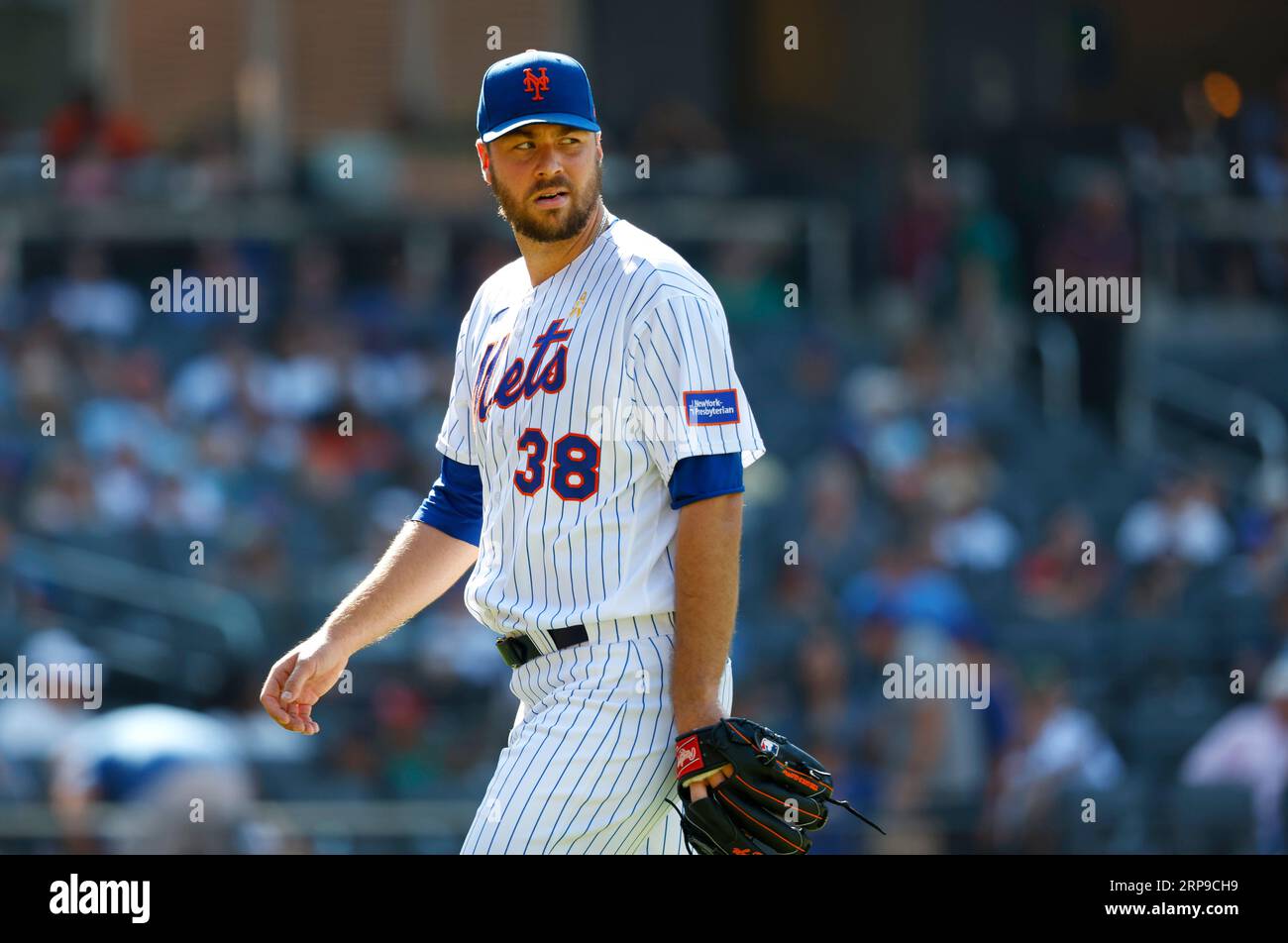

Tylor Megills Success With The Mets Pitching Strategies And Results

Apr 29, 2025

Tylor Megills Success With The Mets Pitching Strategies And Results

Apr 29, 2025

Latest Posts

-

The Most Emotional Rocky Movie According To Sylvester Stallone

May 12, 2025

The Most Emotional Rocky Movie According To Sylvester Stallone

May 12, 2025 -

Which Rocky Movie Touches Sylvester Stallone The Most

May 12, 2025

Which Rocky Movie Touches Sylvester Stallone The Most

May 12, 2025 -

Stallone Reveals His Top Rocky Movie A Touching Choice

May 12, 2025

Stallone Reveals His Top Rocky Movie A Touching Choice

May 12, 2025 -

Sylvester Stallone Picks His Most Emotional Rocky Film

May 12, 2025

Sylvester Stallone Picks His Most Emotional Rocky Film

May 12, 2025 -

Sylvester Stallones Favorite Rocky Movie The Franchises Most Emotional Entry

May 12, 2025

Sylvester Stallones Favorite Rocky Movie The Franchises Most Emotional Entry

May 12, 2025