The Looming Bond Market Crisis: Are Investors Prepared?

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

Rising interest rates are inversely correlated with bond prices. This fundamental principle of finance dictates that when interest rates rise, existing bonds with lower coupon rates become less attractive, leading to a decrease in their value. This interest rate risk poses a significant threat to investors holding large bond portfolios. Understanding this relationship is crucial for navigating the current market environment and making informed investment decisions.

- Increased borrowing costs for governments and corporations: Higher interest rates increase the cost of borrowing for both governments and corporations, impacting their ability to issue new debt and potentially affecting their creditworthiness.

- Potential for capital losses on existing bond holdings: As interest rates rise, the market value of existing bonds falls, leading to potential capital losses for investors if they need to sell their bonds before maturity.

- Reduced demand for fixed-income investments: When interest rates rise, investors may shift their investments towards higher-yielding alternatives, reducing the demand for existing bonds and further depressing their prices.

- Need for diversification within bond portfolios: To mitigate interest rate risk, investors should diversify their bond portfolios across different maturities and credit ratings, balancing risk and reward. A well-diversified portfolio can help cushion the impact of rising interest rates.

Inflation's Erosive Effect on Bond Returns

High inflation erodes the purchasing power of bond yields. If inflation outpaces the bond's interest rate, investors experience a negative real yield, resulting in a real loss in value even if the nominal yield remains positive. This is particularly concerning in an environment of persistent inflation, where the real return on bond investments can be significantly diminished.

- Inflation reducing real returns on bond investments: Inflation directly impacts the real return of a bond. A bond yielding 3% annually is less valuable if inflation is running at 4%.

- Importance of inflation-protected securities (TIPS): Treasury Inflation-Protected Securities (TIPS) are designed to protect investors from inflation risk. Their principal adjusts with inflation, ensuring that the real return isn't eroded.

- Analysis of inflation expectations and their impact on bond valuations: Market expectations of future inflation heavily influence bond valuations. Higher inflation expectations usually lead to higher interest rates and lower bond prices.

- Strategies to hedge against inflation in a bond portfolio: Strategies to hedge against inflation include investing in TIPS, incorporating commodities or real estate into your portfolio, and adjusting your bond portfolio duration based on inflation forecasts.

Geopolitical Uncertainty and its Influence on Bond Markets

Geopolitical risk significantly impacts bond markets. Events such as wars, trade disputes, and political instability can lead to increased bond market volatility and reduced investor confidence, causing bond prices to fluctuate dramatically. These unpredictable events introduce significant uncertainty into the fixed-income market.

- Impact of global conflicts on investor sentiment: Geopolitical instability often leads to a flight to safety, where investors move their money into perceived safe-haven assets like government bonds of stable economies.

- Increased demand for safe-haven assets like government bonds: During times of uncertainty, investors flock to government bonds, driving up their prices and lowering their yields.

- Potential for defaults on sovereign debt: Geopolitical risks can increase the likelihood of sovereign debt defaults, particularly in countries experiencing political turmoil or economic instability.

- Importance of assessing geopolitical risks when investing in bonds: Investors should carefully assess geopolitical risks before investing in bonds, considering the political and economic stability of the issuing country or entity.

Diversification Strategies to Mitigate Risk

Portfolio diversification is crucial in mitigating the risks associated with a bond market crisis. A well-diversified strategy spreads risk across different asset classes and reduces the impact of any single negative event. Effective bond portfolio management requires a nuanced approach to diversification.

- Investing in a mix of government and corporate bonds: Diversification across government and corporate bonds helps mitigate credit risk and interest rate risk.

- Considering different bond maturities (short-term, medium-term, long-term): A mix of bond maturities helps manage interest rate risk and provides flexibility.

- Diversifying across different geographic regions: Investing in bonds issued by various countries diversifies your exposure to different economic and political environments.

- Exploring alternative fixed-income investments: Consider alternative fixed-income instruments such as mortgage-backed securities or asset-backed securities to further diversify your portfolio and potentially enhance returns.

Conclusion

The potential for a significant bond market crisis is a real concern for investors. Rising interest rates, inflation, and geopolitical uncertainty are creating a challenging environment for fixed-income investments. However, by understanding these risks and implementing appropriate diversification strategies, investors can better protect their portfolios. Don't ignore the warning signs; proactively prepare for a potential bond market crisis by carefully evaluating your current holdings and implementing a robust risk management plan. Take control of your investment strategy and navigate the complexities of the current market landscape. Consider consulting with a financial advisor to develop a personalized plan to manage your bond market risk effectively.

Featured Posts

-

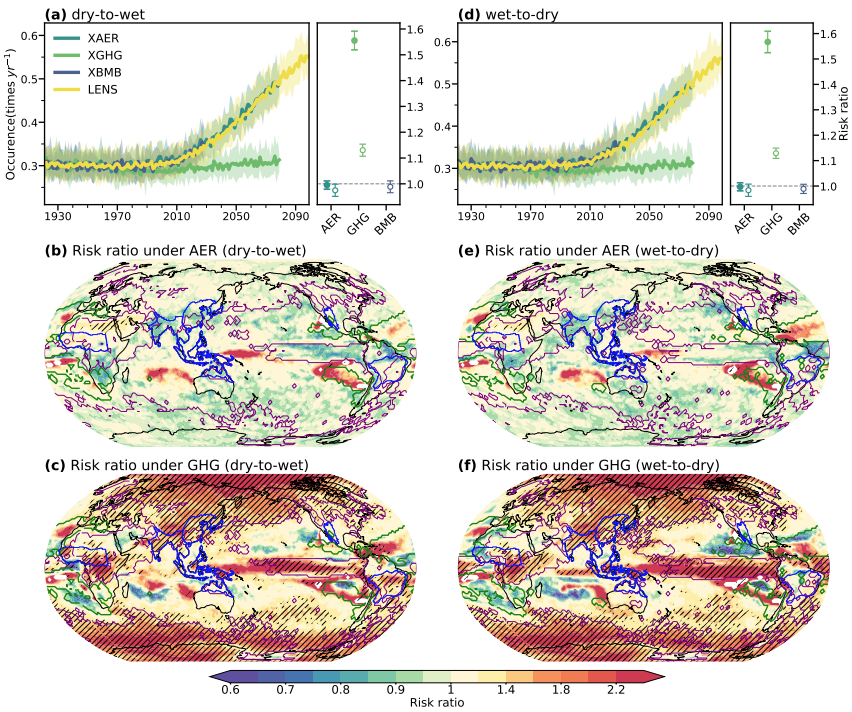

The Devastating Effects Of Dangerous Climate Whiplash In Global Cities

May 28, 2025

The Devastating Effects Of Dangerous Climate Whiplash In Global Cities

May 28, 2025 -

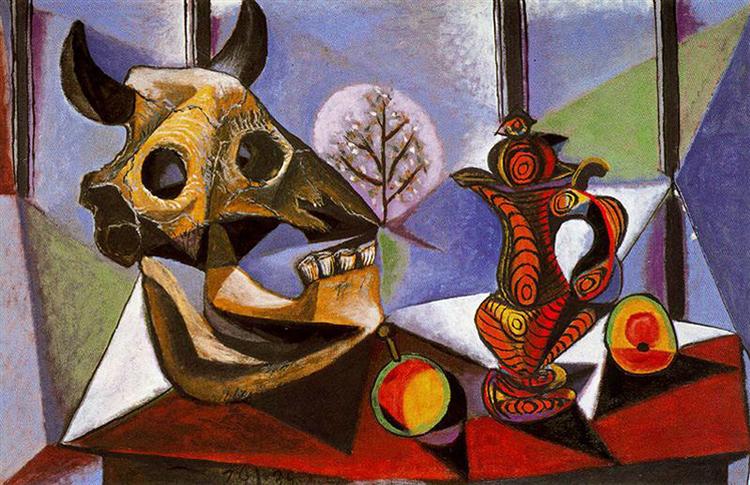

Chicagos Art History The Impact Of Picassos 1939 Exhibition

May 28, 2025

Chicagos Art History The Impact Of Picassos 1939 Exhibition

May 28, 2025 -

Welcome To Wrexham A Football Fans Guide To The Racecourse Ground

May 28, 2025

Welcome To Wrexham A Football Fans Guide To The Racecourse Ground

May 28, 2025 -

Tough Road Ahead Sinners French Open Draw Analysis

May 28, 2025

Tough Road Ahead Sinners French Open Draw Analysis

May 28, 2025 -

Welcome To Wrexham A Comprehensive Guide

May 28, 2025

Welcome To Wrexham A Comprehensive Guide

May 28, 2025

Latest Posts

-

Suffolks Wherry Vet Secures Planning Approval In Bungay

May 31, 2025

Suffolks Wherry Vet Secures Planning Approval In Bungay

May 31, 2025 -

Will Spring 2024 Mirroring 1968 Lead To A Severe Summer Drought

May 31, 2025

Will Spring 2024 Mirroring 1968 Lead To A Severe Summer Drought

May 31, 2025 -

Bungay Wherry Vet Clinic Planning Permission Granted

May 31, 2025

Bungay Wherry Vet Clinic Planning Permission Granted

May 31, 2025 -

Drought Forecast Learning From The 1968 Spring To Predict Summer Conditions

May 31, 2025

Drought Forecast Learning From The 1968 Spring To Predict Summer Conditions

May 31, 2025 -

Wherry Veterinary Practice Bungay Planning Application Successful

May 31, 2025

Wherry Veterinary Practice Bungay Planning Application Successful

May 31, 2025