The Posthaste Effect: How The New Tariff Ruling Impacts The Canadian Economy

Table of Contents

Impact on Specific Industries

The new tariff ruling's impact varies significantly across different industries. Some sectors might experience growth due to increased domestic demand, while others face considerable challenges.

Manufacturing Sector

The Canadian manufacturing sector is particularly vulnerable to the effects of this new Canadian Tariff Ruling Impact.

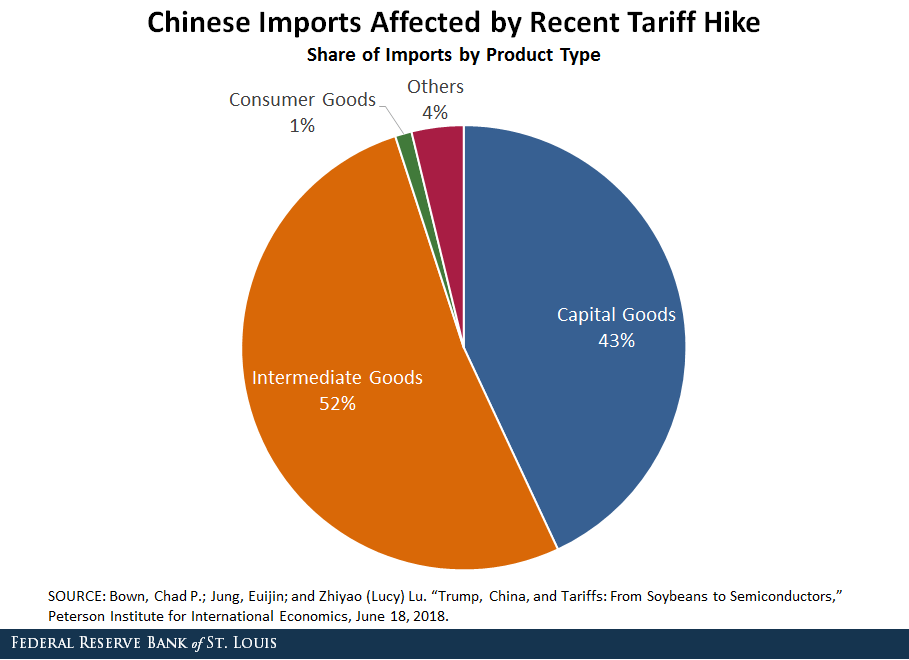

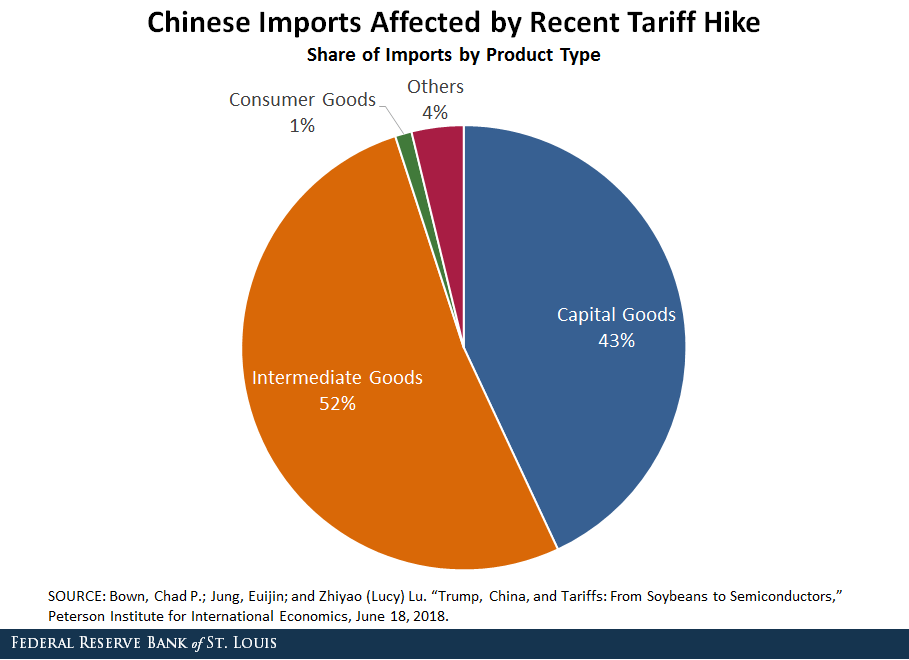

- Increased production costs: Higher import tariffs on raw materials, crucial components, and intermediate goods directly increase production costs for manufacturers.

- Potential job losses: Industries heavily reliant on imported goods may face reduced profitability, leading to potential layoffs and plant closures. The automotive manufacturing and textile industries are prime examples.

- Reduced competitiveness: Higher production costs make Canadian-made goods less competitive in both domestic and international markets, potentially leading to a decline in exports.

- Mitigation Strategies: Manufacturers can explore alternative suppliers, potentially sourcing materials from countries with more favorable trade agreements. Investing in automation and technological advancements to improve efficiency and reduce reliance on imported components is another crucial strategy.

Agricultural Sector

The agricultural sector faces a complex scenario with both challenges and potential opportunities arising from the Canadian Tariff Ruling Impact.

- Fluctuations in export prices: Retaliatory tariffs imposed by trading partners on Canadian agricultural exports, such as wheat, canola, and lumber, can lead to significant price fluctuations and reduced export volumes.

- Increased domestic demand: Conversely, the new tariffs might stimulate domestic demand for certain agricultural products, potentially benefiting some farmers.

- Challenges in accessing international markets: Navigating the complexities of new trade barriers and international trade agreements becomes crucial for Canadian agricultural producers.

- Mitigation Strategies: Diversifying export markets to reduce reliance on specific trading partners is essential. Government support programs aimed at assisting farmers in adapting to the changing trade landscape are crucial for mitigating the negative impacts of the new ruling.

Retail Sector

The retail sector will likely experience a direct impact from the Canadian Tariff Ruling Impact, largely influenced by consumer purchasing power.

- Higher prices for imported goods: Increased import costs will translate to higher prices for consumers, potentially leading to reduced consumer spending and decreased sales volumes.

- Increased competition from domestic producers: Domestically produced goods might gain a competitive edge due to the higher prices of imported alternatives.

- Potential for decreased profit margins: Retailers might face squeezed profit margins as they grapple with higher costs and potentially reduced sales.

- Mitigation Strategies: Retailers can adjust their pricing strategies, focusing on value-added services, and exploring alternative sourcing options. Highlighting the origin and quality of domestically produced goods can be a useful marketing strategy.

Economic Consequences

The implications of the Canadian Tariff Ruling Impact extend far beyond specific industries, affecting the broader Canadian economy.

Inflationary Pressures

Increased import costs due to the new tariffs are likely to contribute to inflationary pressures, potentially eroding consumer purchasing power. The extent of this impact depends on the size and scope of the tariffs and the overall economic climate.

GDP Growth

The overall impact on GDP growth is uncertain and subject to various interacting factors. Reduced trade volumes and decreased consumer spending could negatively affect GDP growth. Conversely, increased domestic production in certain sectors could offer some offsetting positive effects.

Job Market

The net effect on the job market is difficult to predict. While some sectors may experience job losses due to reduced production or competitiveness, others could see increased demand for labor. The overall impact on employment will depend on the interplay of these competing forces.

Foreign Investment

The new tariff ruling could negatively affect foreign investment in Canada if investors perceive increased risks and uncertainties in the Canadian market. This uncertainty could deter investment and potentially hinder economic growth.

Government Response and Policy Implications

The Canadian government's response to the "Posthaste Effect" will be crucial in shaping the long-term economic consequences.

- Support programs: Targeted government support programs for affected industries, such as financial assistance or tax breaks, could help mitigate the negative impacts of the tariff ruling.

- Trade negotiations: The government will likely engage in negotiations with trading partners to minimize retaliatory tariffs and resolve trade disputes.

- Policy adjustments: Based on comprehensive economic impact assessments, the government may review and adjust the tariff policy to minimize negative economic consequences while maintaining its policy objectives.

- Public awareness campaigns: Clear communication to inform businesses and consumers about the implications of the new tariff ruling is crucial for effective adaptation and mitigation.

Conclusion

The "Posthaste Effect" of the new Canadian tariff ruling presents a complex economic challenge. While some sectors may benefit from increased domestic demand, many face significant hurdles due to higher import costs and decreased global competitiveness. The government's response, including support programs and trade negotiations, will be critical in determining the long-term economic consequences. Staying informed about the ongoing developments surrounding the Canadian Tariff Ruling Impact is essential for businesses and consumers alike. Understanding the potential effects on your specific industry or sector is critical for effective planning and mitigation strategies. Continue to monitor news and updates regarding the Canadian tariff ruling impact to make informed decisions for your business and financial well-being.

Featured Posts

-

40 Profit Jump For Bannatyne Group In Darlington

May 31, 2025

40 Profit Jump For Bannatyne Group In Darlington

May 31, 2025 -

Transgender Student At Center Of Trumps California Funding Threat What We Know

May 31, 2025

Transgender Student At Center Of Trumps California Funding Threat What We Know

May 31, 2025 -

Finding Your Good Life A Holistic Approach To Well Being

May 31, 2025

Finding Your Good Life A Holistic Approach To Well Being

May 31, 2025 -

New Covid 19 Variants Ba 1 And Lf 7 Detected In India What Does Insacog Data Reveal

May 31, 2025

New Covid 19 Variants Ba 1 And Lf 7 Detected In India What Does Insacog Data Reveal

May 31, 2025 -

Spain Blackout Fallout Iberdrolas Statement And The Ongoing Investigation

May 31, 2025

Spain Blackout Fallout Iberdrolas Statement And The Ongoing Investigation

May 31, 2025