The Potential Of Low Mortgage Rates To Revitalize Canada's Housing Sector

Table of Contents

The Impact of Low Mortgage Rates on Affordability

Low mortgage rates in Canada directly influence housing affordability, making homeownership a more realistic goal for many. The primary effect is a reduction in monthly mortgage payments. This means that for a given house price, the required monthly outlay is significantly lower with a lower interest rate. This increased affordability has several important consequences:

- Increased accessibility for first-time homebuyers: Lower monthly payments reduce the financial barrier to entry, enabling more Canadians to achieve the dream of homeownership. This could lead to a substantial increase in homeownership rates, particularly among younger generations.

- Boosting affordability across provinces: While housing prices vary considerably across Canada – with Vancouver and Toronto traditionally being more expensive than other provinces – the impact of low mortgage rates is felt nationwide. Even in pricier markets, lower rates can make a noticeable difference in affordability. For example, a 1% reduction in interest rates could translate to hundreds of dollars in monthly savings, potentially opening up opportunities for those previously priced out of the market.

- Data-driven evidence: Studies consistently demonstrate a strong correlation between low mortgage rates and increased housing affordability. Historical data from periods of low interest rates in Canada show a clear rise in home purchases and homeownership rates, supporting this claim.

Increased Buyer Activity and Market Stimulation

Lower mortgage rates directly stimulate buyer activity in the Canadian real estate market. When borrowing becomes cheaper, more people are incentivized to enter the market, leading to several key effects:

- Increased real estate sales: A surge in demand fueled by low mortgage rates can lead to a significant increase in real estate sales across various segments, from condos in urban centers to detached homes in suburban areas.

- Heightened market competition: Increased buyer activity translates to higher competition among potential homebuyers, potentially driving up prices in certain markets. This competitive pressure can benefit sellers but can also intensify the challenges faced by first-time buyers.

- Market revitalization: The increased activity injects energy into the broader housing sector, stimulating related industries such as construction, renovation, and interior design. This ripple effect can contribute to overall economic growth.

- Historical precedent: Analysis of past periods of low interest rates in Canada reveals a consistently positive correlation between lower rates and increased housing market activity, providing a strong basis for forecasting future trends.

Potential Risks and Considerations Associated with Low Mortgage Rates

While low mortgage rates offer significant benefits, it's crucial to acknowledge the potential risks:

- The risk of a housing bubble: Prolonged periods of low interest rates can create an environment ripe for a housing bubble. Inflated demand, combined with readily available credit, can drive prices beyond their sustainable levels, creating a vulnerable market susceptible to a sharp correction.

- Increased household debt: Lower rates can incentivize individuals to borrow more, potentially leading to higher household debt levels. This increased debt burden can create financial vulnerability for borrowers, especially if interest rates rise unexpectedly.

- Inflationary pressures: Low interest rates can contribute to inflationary pressures. If the rate of inflation outpaces wage growth, the actual affordability gains from lower mortgage rates could be eroded.

- Responsible lending and financial literacy: It's crucial for both borrowers and lenders to adopt responsible lending practices and promote financial literacy among potential homebuyers to mitigate the risks associated with high debt levels.

Government Policies and their Influence on the Housing Market

Government policies play a significant role in shaping Canada's housing market dynamics. Several key areas of influence include:

- CMHC's role: The Canada Mortgage and Housing Corporation (CMHC) plays a critical role in insuring mortgages and influencing lending practices. Their policies directly affect the availability and affordability of mortgages.

- Housing incentives: Government incentives, such as grants or tax breaks for first-time homebuyers, can significantly influence market activity and affordability.

- Mortgage regulations: Government regulations on mortgage lending, such as stress tests, aim to ensure responsible borrowing and market stability. These regulations can impact the ease with which individuals can secure a mortgage.

- Impact analysis: A thorough analysis of current and proposed government policies is essential to understand their potential impact on the housing market and affordability.

Conclusion

Low mortgage rates present a significant opportunity to revitalize Canada's housing sector by boosting affordability and stimulating market activity. However, this potential comes with inherent risks, including the potential for a housing bubble and increased household debt. Careful consideration of these risks, coupled with responsible lending practices and informed government policies, is crucial to ensure a sustainable and healthy housing market. To make informed decisions regarding buying or selling, it's vital to monitor low mortgage rates, stay informed about Canadian housing market trends, and understand the impact of these rates on your financial future. Understanding the nuances of low mortgage rates and their effect on the Canadian housing market is key to navigating this dynamic environment effectively.

Featured Posts

-

Community Gathers To Remember 15 Year Old Stabbing Victim

May 13, 2025

Community Gathers To Remember 15 Year Old Stabbing Victim

May 13, 2025 -

Stream Pl Retro High Definition Sky Sports Premier League Classics

May 13, 2025

Stream Pl Retro High Definition Sky Sports Premier League Classics

May 13, 2025 -

Mosque Under Scrutiny Police Raid Linked To Controversial Muslim Mega City Project

May 13, 2025

Mosque Under Scrutiny Police Raid Linked To Controversial Muslim Mega City Project

May 13, 2025 -

Marinika Tepi I Antiromski Rasizam Shta Kazhe Uni A Roma Srbi E

May 13, 2025

Marinika Tepi I Antiromski Rasizam Shta Kazhe Uni A Roma Srbi E

May 13, 2025 -

Derbito Go Reshi Se Barnli I Lids Povtorno Vo Premier Ligata

May 13, 2025

Derbito Go Reshi Se Barnli I Lids Povtorno Vo Premier Ligata

May 13, 2025

Latest Posts

-

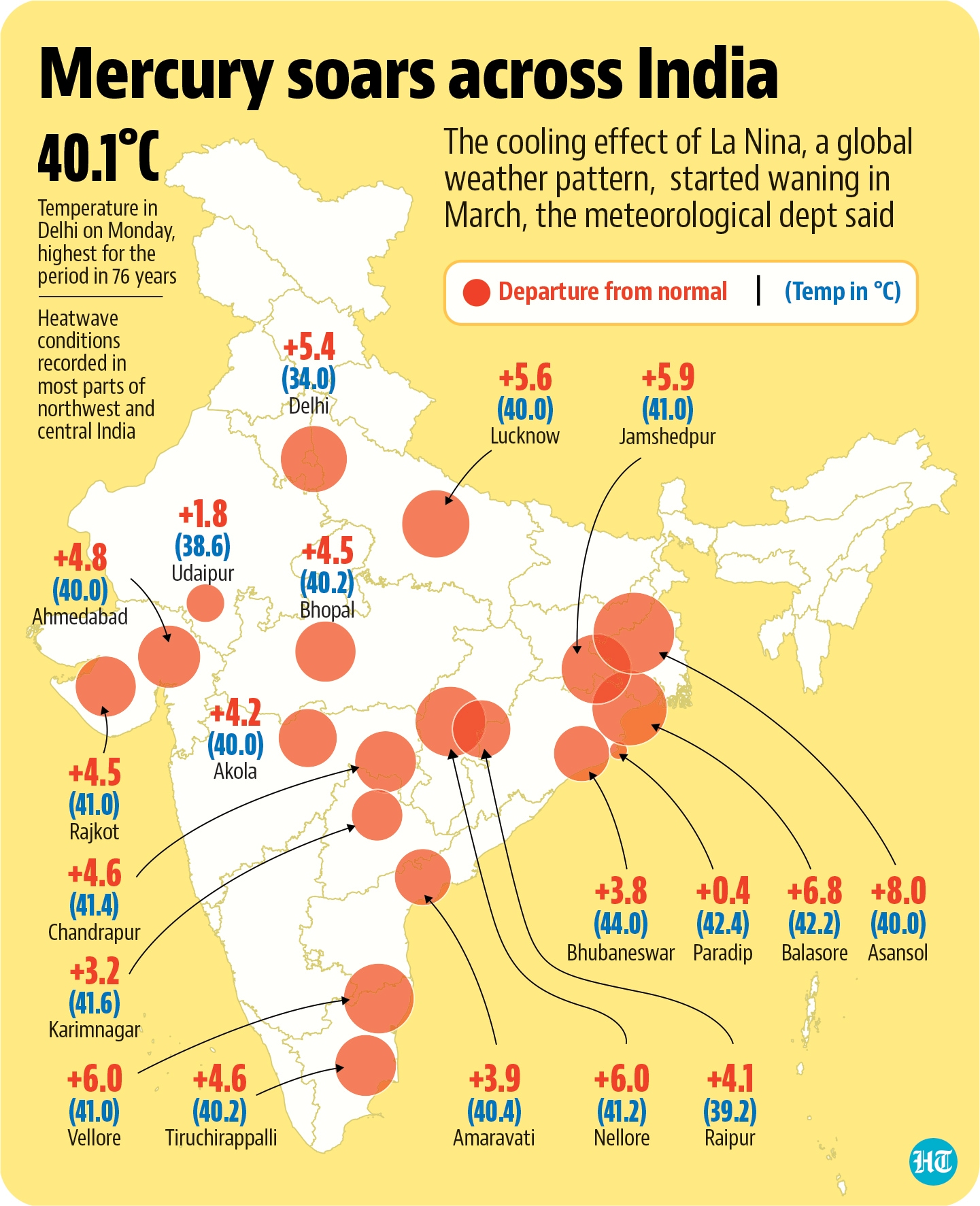

India Heatwave Central Government Issues State Level Advisory

May 13, 2025

India Heatwave Central Government Issues State Level Advisory

May 13, 2025 -

Heatwave Alert Centre Advises States On Precautions

May 13, 2025

Heatwave Alert Centre Advises States On Precautions

May 13, 2025 -

La And Orange Counties Sizzle Under Record Breaking Heat Extreme Temperatures And Safety Measures

May 13, 2025

La And Orange Counties Sizzle Under Record Breaking Heat Extreme Temperatures And Safety Measures

May 13, 2025 -

Centre Urges States To Prepare For Heatwave Bhubaneswar And Beyond

May 13, 2025

Centre Urges States To Prepare For Heatwave Bhubaneswar And Beyond

May 13, 2025 -

Record Breaking Temperatures Scorch La And Orange Counties Heatwave Impacts

May 13, 2025

Record Breaking Temperatures Scorch La And Orange Counties Heatwave Impacts

May 13, 2025