The Power Of Simplicity: A Proven Approach To Dividend Investing

Table of Contents

Understanding the Basics of Dividend Investing

Dividend investing involves selecting and holding stocks of companies that regularly pay out a portion of their profits to shareholders as dividends. This strategy offers several key benefits:

- Passive Income Stream Generation: Receive regular cash payments, supplementing your income and potentially reducing your reliance on other income sources.

- Potential for Capital Appreciation: Besides dividend income, your investment can grow in value over time, leading to capital gains when you eventually sell your shares.

- Reduced Reliance on Market Fluctuations: While stock prices fluctuate, dividend income provides a degree of stability, especially during market downturns.

- Building Long-Term Wealth Steadily: The consistent income generation and potential for capital appreciation combine to build wealth over the long term.

The difference between dividend yield and dividend growth is crucial. Dividend yield represents the annual dividend payment relative to the stock price (a higher yield means a larger dividend relative to the price). Dividend growth, on the other hand, refers to the rate at which a company increases its dividend payments over time. Investors often seek a balance between a reasonable yield and a history of consistent dividend growth.

Selecting Dividend-Paying Stocks: A Simplified Approach

Instead of chasing high-yield, high-risk stocks, focus on quality over quantity. Look for established, financially stable companies with a proven track record of consistent dividend payments. This approach minimizes risk and maximizes the chances of receiving reliable dividend income.

- Prioritize companies with a long history of dividend payments: A long history of dividend payments suggests financial stability and a commitment to returning value to shareholders.

- Analyze dividend payout ratios to assess sustainability: The payout ratio indicates the percentage of earnings paid out as dividends. A sustainable payout ratio (generally below 70%) ensures the company can continue paying dividends even during challenging economic periods.

- Consider companies with strong balance sheets and consistent earnings growth: Solid financial fundamentals reduce the risk of dividend cuts or suspensions.

- Use free online resources like Finviz or Yahoo Finance for screening: These tools allow you to filter stocks based on criteria like dividend yield, payout ratio, and earnings growth, simplifying your search for suitable dividend-paying stocks.

Building a Diversified Dividend Portfolio: Less is More

Diversification is essential to mitigate risk, but it doesn't mean investing in hundreds of stocks. A smaller, well-researched portfolio of 10-20 high-quality dividend stocks is often more manageable and effective than a highly diversified portfolio that's difficult to track.

- Start with a small, diversified portfolio to minimize risk: Begin with a manageable number of stocks across different sectors.

- Choose companies from different sectors for better risk management: This reduces your vulnerability to sector-specific downturns. For example, having holdings in technology, healthcare, and consumer staples helps spread risk.

- Avoid over-diversification which can make tracking difficult: Focus your efforts on understanding a smaller number of companies.

- Regularly review and rebalance your portfolio: Periodically adjust your holdings to maintain your desired asset allocation and to take advantage of opportunities to improve your portfolio's performance.

The Power of Reinvestment: Compounding Your Gains

Dividend reinvestment plans (DRIPs) are a powerful tool for accelerating wealth building. By reinvesting your dividends to buy more shares, you harness the magic of compounding.

- Maximize returns by reinvesting dividends to buy more shares: This allows you to purchase additional shares at current market prices, increasing your holdings and future dividend income.

- Benefit from the power of compounding over the long term: The compounding effect of reinvesting dividends significantly boosts your returns over time.

- Take advantage of DRIPs offered by many companies: Many companies offer DRIPs, which allow you to automatically reinvest your dividends.

- Consider using a brokerage that automatically reinvests dividends: If your chosen company doesn't offer a DRIP, most brokerages provide options for automatic dividend reinvestment.

Maintaining Discipline and Patience: The Long Game

Successful dividend investing requires a long-term perspective. Short-term market fluctuations are inevitable, but they shouldn't deter a long-term investor focused on consistent dividend income and capital appreciation.

- Avoid panic selling during market downturns: Market corrections are normal. Holding onto your investments during downturns allows you to benefit from potential rebounds.

- Focus on the long-term growth potential of your investments: Dividend investing is a marathon, not a sprint. Patience is crucial for achieving long-term success.

- Regularly review your portfolio, but avoid making frequent changes: Periodic reviews help ensure your portfolio remains aligned with your goals. However, avoid impulsive trading based on short-term market noise.

- Stay disciplined and patient; the long game pays off: Consistent effort and a long-term perspective are key to successful dividend investing.

Conclusion

This simplified approach to dividend investing empowers you to build wealth steadily and sustainably. By focusing on quality companies, diversification, reinvestment, and patience, you can harness the power of simplicity to achieve your financial goals. Don't let complex strategies overwhelm you. Embrace the power of simplicity in your dividend investing journey and start building your wealth today! Learn more about simple and effective dividend investing strategies and start building a brighter financial future!

Featured Posts

-

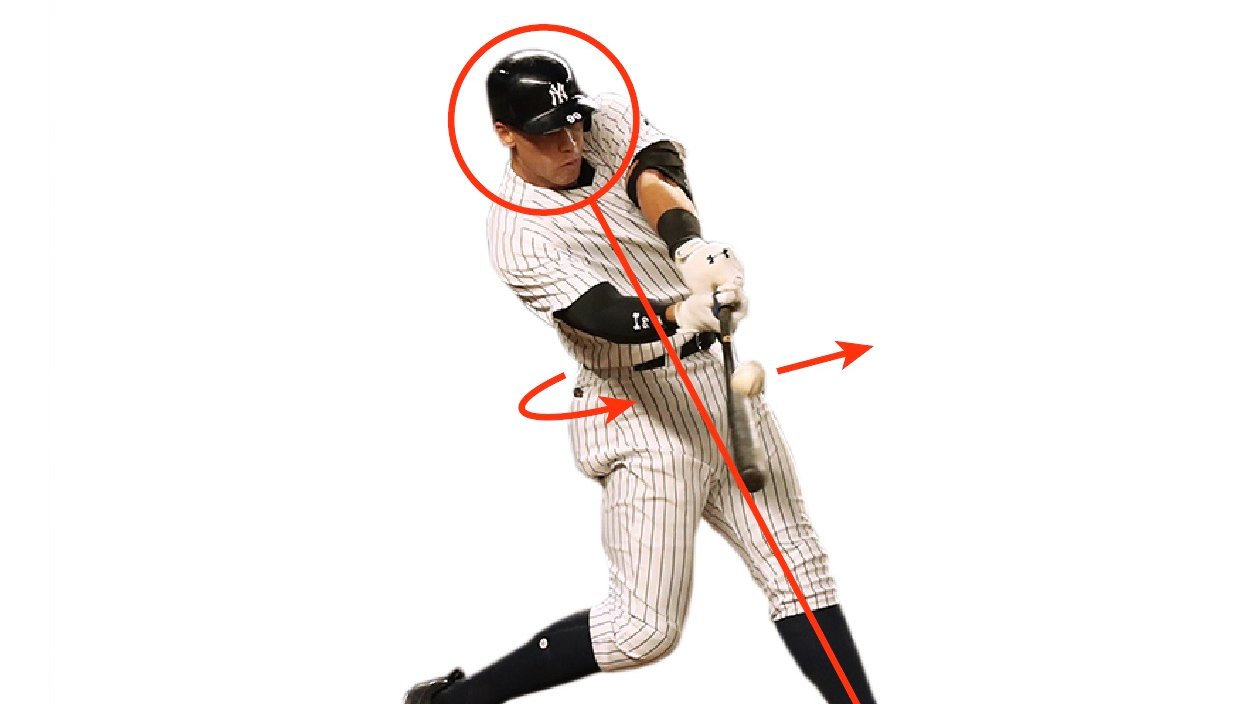

Why Did Aaron Judge Do 20 Push Ups A Look At His On Field Ambitions

May 11, 2025

Why Did Aaron Judge Do 20 Push Ups A Look At His On Field Ambitions

May 11, 2025 -

Bayern Munchen Celebreaza Cariera Lui Thomas Mueller Un Omagiu Emotionant

May 11, 2025

Bayern Munchen Celebreaza Cariera Lui Thomas Mueller Un Omagiu Emotionant

May 11, 2025 -

Ufc 315 Early Predictions Expert Picks And Potential Upsets

May 11, 2025

Ufc 315 Early Predictions Expert Picks And Potential Upsets

May 11, 2025 -

L Absence De Chantal Ladesou Dans Lol Les Coulisses De L Emission

May 11, 2025

L Absence De Chantal Ladesou Dans Lol Les Coulisses De L Emission

May 11, 2025 -

Highlander Reboot Henry Cavill To Star In Amazon Series

May 11, 2025

Highlander Reboot Henry Cavill To Star In Amazon Series

May 11, 2025