The Promise Of Driverless Cars: Evaluating Uber ETFs For Long-Term Growth

Table of Contents

The Potential of Driverless Cars

The autonomous vehicle market is poised for explosive growth. This technological leap promises to reshape transportation as we know it.

Market Disruption and Growth

The market for autonomous vehicles is projected to reach staggering heights. Reports from McKinsey & Company predict a market value exceeding trillions of dollars by the mid-2030s. This significant growth is fueled by several key factors:

- Increased efficiency: Self-driving vehicles can optimize routes, reducing travel time and fuel consumption.

- Reduced accidents: Autonomous driving systems have the potential to significantly decrease the number of accidents caused by human error.

- Improved logistics: Autonomous trucks and delivery vehicles can streamline supply chains and improve the efficiency of goods transportation.

- New mobility services: The rise of robo-taxis and autonomous ride-sharing services will create entirely new transportation models.

These factors will contribute to a massive expansion of the market, creating significant potential for investment returns for those who position themselves strategically.

Technological Advancements

The driverless car revolution is driven by groundbreaking advancements in several key areas:

- Sensor technology: LiDAR (Light Detection and Ranging), radar, and advanced camera systems provide the “eyes” for autonomous vehicles, enabling them to perceive their surroundings with high accuracy.

- AI and machine learning: Sophisticated algorithms and machine learning models are crucial for processing sensor data, making decisions, and navigating complex environments.

- Mapping and localization: Precise maps and advanced localization technologies are essential for autonomous vehicles to accurately determine their position and navigate effectively.

- Cybersecurity advancements: Robust cybersecurity measures are vital to protect autonomous vehicles from hacking and ensure their safe operation.

These advancements are constantly improving, reducing the risks associated with autonomous driving and paving the way for widespread adoption.

Analyzing Uber's Position in the Autonomous Vehicle Market

Uber, a major player in the ride-sharing industry, is actively involved in the development and deployment of autonomous vehicles.

Uber's Investments and Strategies

Uber's Advanced Technologies Group (ATG) is at the heart of its autonomous vehicle ambitions. They've invested heavily in research and development, forging strategic partnerships, and making key acquisitions to accelerate their progress.

- Uber ATG: This dedicated division focuses on developing self-driving technology for both passenger transportation and autonomous delivery services.

- Collaborations: Uber actively collaborates with other companies in the technology and automotive sectors to leverage expertise and resources.

- Expansion into autonomous delivery: Uber is expanding its services to encompass autonomous delivery of food, groceries, and other goods.

However, Uber faces significant competition from established automakers like Tesla, General Motors, and Waymo, as well as other tech giants. Its success will depend on its ability to innovate and overcome significant technological and regulatory hurdles.

Risks and Challenges

Despite the potential, several risks and challenges face Uber and the autonomous vehicle industry as a whole:

- Regulatory hurdles: The regulatory landscape for autonomous vehicles is still evolving, with varying regulations across different jurisdictions.

- Safety concerns: Ensuring the safety of autonomous vehicles is paramount, and any major accidents could severely impact public trust and investor confidence.

- Ethical considerations: Addressing ethical dilemmas related to accident scenarios and data privacy is crucial for the responsible development and deployment of self-driving technology.

- Technological limitations: Current autonomous driving technology is not yet perfect and still faces limitations in handling complex and unpredictable situations.

- Competition: Intense competition from established automakers and tech giants presents a significant challenge to Uber's market dominance aspirations.

These risks could negatively impact the performance of Uber ETFs, emphasizing the importance of a well-diversified investment strategy.

Investing in Uber ETFs: A Strategic Approach

Investing in the autonomous vehicle sector through Uber ETFs offers a way to participate in this growth market, but understanding the nuances of ETF investing is essential.

Understanding ETF Investment

ETFs (Exchange Traded Funds) are investment funds that trade on stock exchanges like individual stocks. They offer several advantages for investors:

- Diversification: ETFs typically hold a basket of different stocks, reducing the risk associated with investing in a single company.

- Lower costs: ETFs generally have lower expense ratios than mutual funds.

- Ease of trading: ETFs can be bought and sold throughout the trading day, just like individual stocks.

- Accessibility: ETFs are relatively accessible to most investors through brokerage accounts.

It's crucial to understand your own risk tolerance and investment goals before investing in any ETF.

Choosing the Right Uber ETF

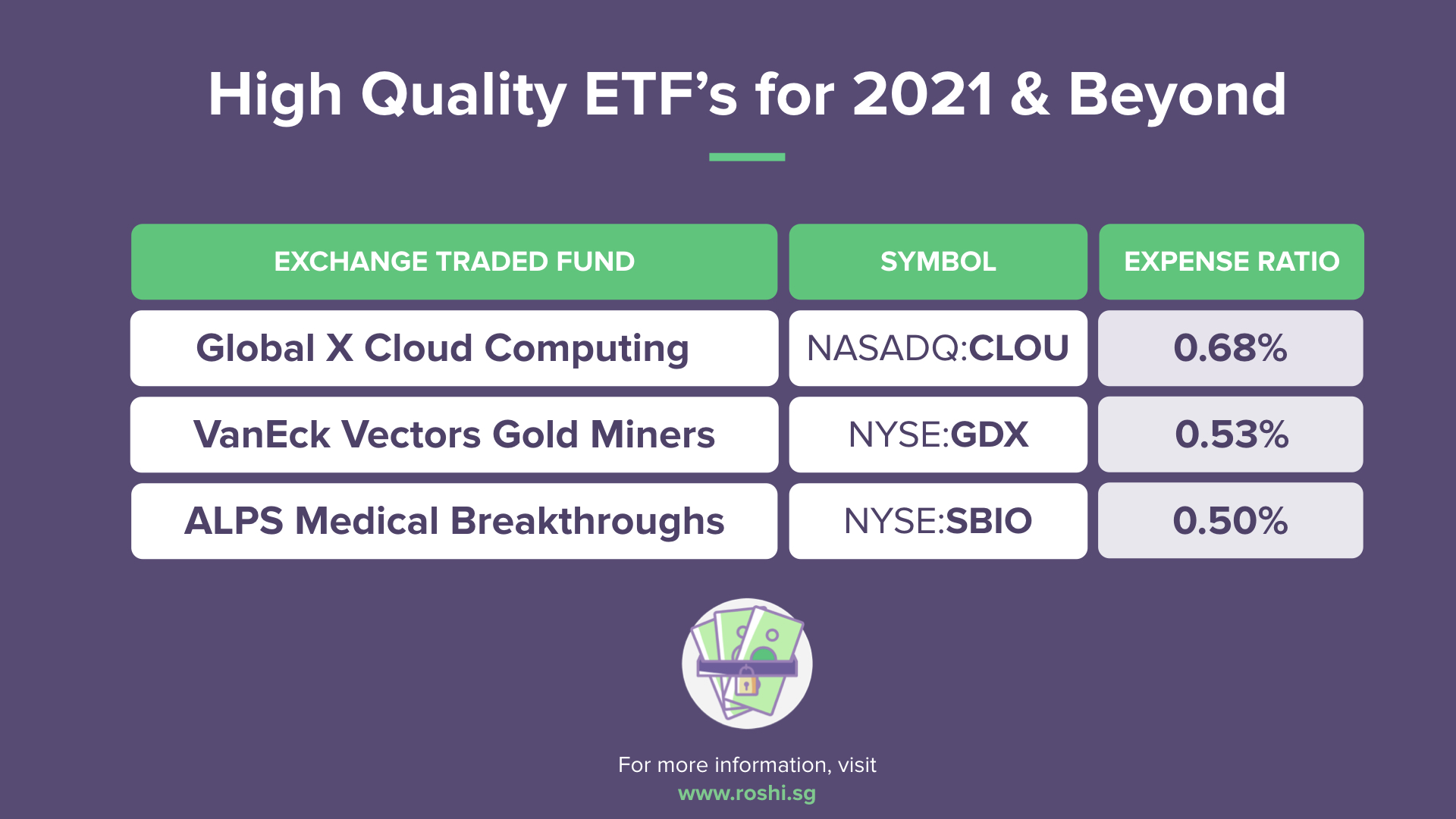

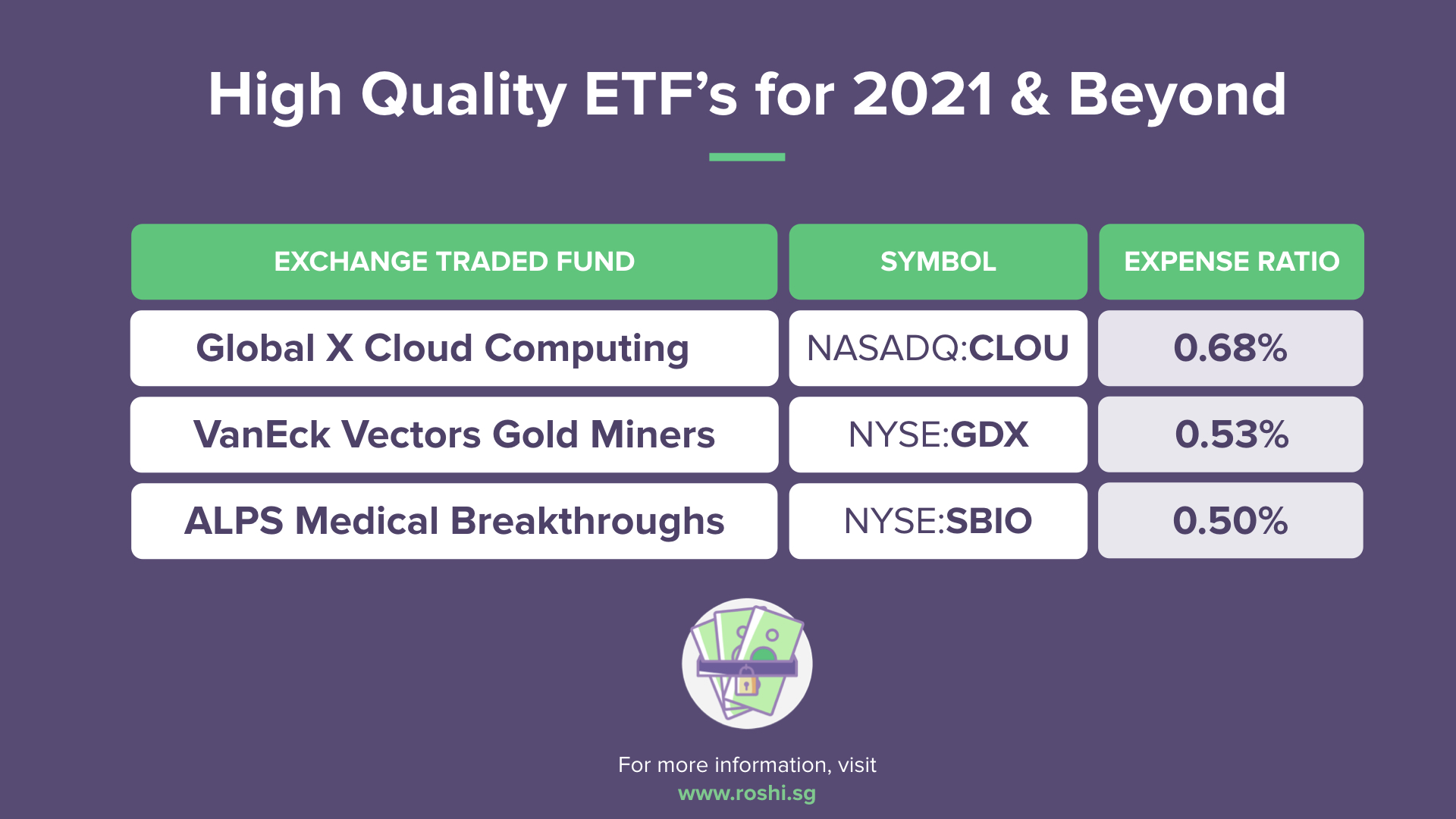

Selecting the right Uber ETF requires careful consideration of several factors:

- Expense ratios: Lower expense ratios translate to higher returns over time.

- Diversification within the ETF: Assess the ETF's holdings to ensure sufficient diversification within the autonomous vehicle and broader technology sectors.

- Underlying holdings: Review the specific companies held by the ETF to understand its investment strategy and potential risks.

- Past performance: Remember that past performance is not indicative of future results.

It is strongly recommended to seek professional financial advice to determine which ETF best aligns with your individual investment goals and risk tolerance.

Long-Term Investment Strategy

Investing in Uber ETFs or similar technology ETFs focused on driverless car technology requires a long-term perspective.

- Patience: The autonomous vehicle market is still developing, and short-term market fluctuations are to be expected.

- Diversification: Diversifying your investments across multiple asset classes reduces overall portfolio risk.

- Regular portfolio review: Regularly review your portfolio to ensure it continues to align with your long-term investment goals.

While short-term market volatility might occur, the potential for substantial long-term returns in this transformative industry is significant.

Conclusion

The potential of driverless cars to revolutionize transportation is undeniable, and Uber is a key player in this exciting sector. While investing in Uber ETFs offers a way to participate in this growth, careful consideration of the risks and challenges is essential. A long-term investment perspective, thorough research, and potentially consulting with a financial advisor are crucial for making informed investment decisions. Investing in the future of transportation presents exciting opportunities. Research and carefully consider the various Uber ETFs available to determine if they align with your long-term investment goals and risk tolerance. Begin your journey into the world of driverless car technology and explore the potential of Uber ETFs today!

Featured Posts

-

Senate Education Cuts Spark University Lawsuit Threat

May 19, 2025

Senate Education Cuts Spark University Lawsuit Threat

May 19, 2025 -

Jennifer Lawrence And Cooke Maroney Spotted Together After Baby No 2 Reports

May 19, 2025

Jennifer Lawrence And Cooke Maroney Spotted Together After Baby No 2 Reports

May 19, 2025 -

Reaccion De Alfonso Arus A La Eleccion De Melody Para Eurovision 2025 En Arusero

May 19, 2025

Reaccion De Alfonso Arus A La Eleccion De Melody Para Eurovision 2025 En Arusero

May 19, 2025 -

Zheneva Stanet Ploschadkoy Dlya Obsuzhdeniya Kipra Pod Rukovodstvom Genseka Oon

May 19, 2025

Zheneva Stanet Ploschadkoy Dlya Obsuzhdeniya Kipra Pod Rukovodstvom Genseka Oon

May 19, 2025 -

Colin Jost And Scarlett Johanssons Income Discrepancy Public Reaction And Analysis

May 19, 2025

Colin Jost And Scarlett Johanssons Income Discrepancy Public Reaction And Analysis

May 19, 2025