The Real Safe Bet: Diversification And Risk Management

Table of Contents

Understanding Diversification: Spreading Your Risk

Diversification is a cornerstone of sound investment strategy. It involves spreading your investments across different asset classes (stocks, bonds, real estate, commodities, etc.) to minimize losses if one area underperforms. This reduces the impact of market fluctuations on your overall investment portfolio, creating a more resilient and stable financial foundation. Effective portfolio diversification is about mitigating risk, not eliminating it entirely.

-

Don't put all your eggs in one basket: This classic adage perfectly encapsulates the core principle of diversification. Concentrating your investments in a single asset class or sector exposes you to significant risk if that area experiences a downturn.

-

Asset classes: Explore various asset classes, each offering a unique risk-return profile. Stocks generally offer higher potential returns but greater volatility than bonds, which are considered lower-risk, fixed-income securities. Real estate provides another avenue for diversification, offering potential for both income and capital appreciation. Commodities like gold can act as a hedge against inflation.

-

Geographic diversification: Investing in different countries helps mitigate country-specific risks. A downturn in one nation's economy won't necessarily impact your entire portfolio if you have investments spread globally. This is a key aspect of international diversification.

-

Sector diversification: Investing across various industries reduces reliance on a single sector's performance. For instance, if the technology sector underperforms, a diversified portfolio with investments in healthcare, energy, or consumer staples might still perform relatively well.

Implementing Effective Risk Management Strategies

Risk management is an ongoing process, not a one-time event. It involves identifying, assessing, and mitigating potential threats to your investment portfolio. Understanding your own risk tolerance is crucial for developing an appropriate investment strategy. Your risk tolerance depends on factors like your age, financial goals, and comfort level with potential losses.

-

Determine your risk tolerance: Are you a conservative investor prioritizing capital preservation, a moderate investor seeking a balance between risk and return, or an aggressive investor willing to accept higher risk for potentially higher rewards? Knowing your risk tolerance is paramount.

-

Set realistic investment goals: Clearly define your financial objectives – short-term (e.g., down payment on a house), mid-term (e.g., child's education), or long-term (e.g., retirement). Your investment strategy should align with these goals.

-

Regular portfolio reviews: Periodically monitor your investments and rebalance your portfolio to maintain your desired asset allocation and risk level. Market fluctuations can shift your asset allocation over time.

-

Diversify your investment strategies: Consider different investment approaches such as value investing (finding undervalued companies), growth investing (focusing on companies with high growth potential), or index fund investing (tracking a specific market index).

The Role of Asset Allocation in Diversification

Asset allocation is the cornerstone of diversification. It refers to the percentage of your investment portfolio allocated to each asset class. Strategic asset allocation is a long-term plan, typically based on your risk tolerance and investment goals. Tactical asset allocation involves short-term adjustments based on market conditions and your investment outlook.

-

Consider your time horizon: Longer time horizons generally allow for greater risk tolerance, as you have more time to recover from potential market downturns.

-

Seek professional advice: A financial advisor can help determine the optimal asset allocation for your individual needs and risk profile, offering personalized investment advice.

-

Rebalancing your portfolio: Periodically adjust your asset allocation to maintain your desired risk level. This involves selling some assets that have grown beyond their target allocation and buying others that have fallen below.

The Benefits of a Diversified Approach

Diversification and robust risk management aren't just about limiting losses; they're about maximizing returns and achieving long-term financial security. A well-structured approach fosters consistent growth and peace of mind.

-

Reduced portfolio volatility: Diversification cushions the impact of market downturns, leading to a smoother investment journey.

-

Improved risk-adjusted returns: You can potentially achieve higher returns for a given level of risk compared to a concentrated portfolio.

-

Enhanced long-term growth: A well-diversified portfolio is better positioned for sustained, long-term growth, enabling you to achieve your financial goals.

-

Increased peace of mind: Knowing you have a well-structured investment strategy provides valuable peace of mind, reducing financial anxiety.

Conclusion

Diversification and risk management are not optional extras; they are essential components of a sound investment strategy. By spreading your investments across different asset classes and actively managing risk through careful asset allocation and portfolio diversification, you significantly increase your chances of achieving your financial goals and building a secure financial future. Don't gamble with your financial well-being; make diversification and risk management your real safe bet. Start planning your diversified investment strategy today!

Featured Posts

-

Broadcoms Extreme V Mware Price Hike At And T Reports A 1 050 Jump

May 10, 2025

Broadcoms Extreme V Mware Price Hike At And T Reports A 1 050 Jump

May 10, 2025 -

Quick Binge Top Stephen King Show Under 5 Hours

May 10, 2025

Quick Binge Top Stephen King Show Under 5 Hours

May 10, 2025 -

Uk Immigration New Visa Policies Target Nigerians And Other High Risk Groups

May 10, 2025

Uk Immigration New Visa Policies Target Nigerians And Other High Risk Groups

May 10, 2025 -

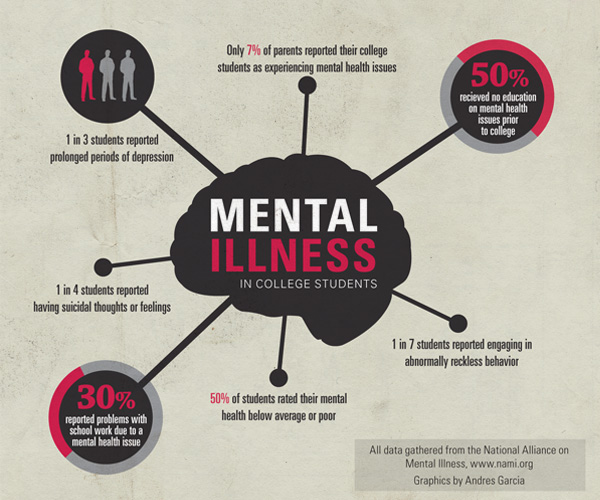

Reframing The Narrative Mental Illness And Violent Crime

May 10, 2025

Reframing The Narrative Mental Illness And Violent Crime

May 10, 2025 -

Thailands Central Bank Governor Search Navigating Tariff Challenges

May 10, 2025

Thailands Central Bank Governor Search Navigating Tariff Challenges

May 10, 2025