The Real Safe Bet: Investing In Stability

Table of Contents

Identifying Stable Investment Options

Building a portfolio focused on investment stability requires careful consideration of various asset classes. A key element is mitigating risk through smart diversification and selection of inherently stable investment vehicles.

Diversification: Spreading Your Risk Across Asset Classes

Diversification is the cornerstone of any robust investment strategy. It involves spreading your investments across different asset classes to reduce the impact of poor performance in any single area. A well-diversified portfolio reduces overall portfolio volatility and increases the likelihood of achieving consistent, long-term growth.

- Stocks: Include both blue-chip stocks (discussed below) and dividend stocks, offering a blend of potential capital appreciation and steady income.

- Bonds: Government bonds and high-quality corporate bonds offer a relatively low-risk, fixed-income stream. Consider a mix of maturities to manage interest rate risk.

- Real Estate: Rental properties or Real Estate Investment Trusts (REITs) can provide both rental income and potential capital appreciation, though they carry some liquidity risks.

- Precious Metals: Gold and silver are often considered safe haven assets, providing a hedge against inflation and market downturns. They are typically less volatile than other asset classes.

Keywords: diversified portfolio, asset allocation, risk diversification, portfolio diversification strategy.

Blue-Chip Stocks: The Pillars of Stability

Blue-chip stocks represent shares in large, well-established companies with a long history of profitability and consistent dividend payments. These companies are generally less volatile than smaller, growth-oriented companies.

- Characteristics: Established market leadership, strong financial performance, consistent dividend payouts, and a history of weathering economic downturns.

- Examples: Companies like Johnson & Johnson, Procter & Gamble, and Coca-Cola are often cited as examples of blue-chip stocks.

- Benefits: While not immune to market fluctuations, blue-chip stocks typically offer a balance of capital appreciation and dividend income, contributing to a more stable investment profile.

Keywords: blue chip stocks, dividend stocks, stable stocks, reliable investments.

Government Bonds: A Low-Risk, Steady Return

Government bonds, issued by national governments, are generally considered among the safest investments available. Their relative safety stems from the government's ability to tax and print money to repay its debts.

- Safety and Return: While offering lower returns than stocks, government bonds provide a relatively predictable stream of income and are less susceptible to market volatility.

- Yield and Interest Rates: Bond yields typically move inversely to interest rates. When interest rates rise, bond yields generally fall, and vice-versa.

- Maturity Dates: Consider diversifying your bond holdings across different maturity dates to manage interest rate risk.

Keywords: government bonds, fixed income investments, low-risk investments, bond yields.

Building a Stable Investment Portfolio

Creating a stable investment portfolio involves a deep understanding of your risk tolerance and the development of a sound, long-term investment plan.

Understanding Your Risk Tolerance

Before investing, it's crucial to understand your risk tolerance. This refers to your comfort level with the potential for investment losses.

- Risk Profiles: Conservative investors prioritize capital preservation and accept lower returns for reduced risk. Moderate investors balance risk and return, while aggressive investors are willing to accept higher risk for potentially greater returns.

- Determining Your Risk Tolerance: Use online questionnaires and resources to assess your risk tolerance before making investment decisions. [Link to a reputable resource for assessing risk tolerance].

Keywords: risk tolerance, investment strategy, personal finance, financial planning.

Developing a Long-Term Investment Plan

A long-term investment approach, typically spanning decades, allows you to ride out short-term market fluctuations and benefit from the power of compounding.

- Regular Contributions: Consistent contributions over time, even small amounts, significantly contribute to long-term growth.

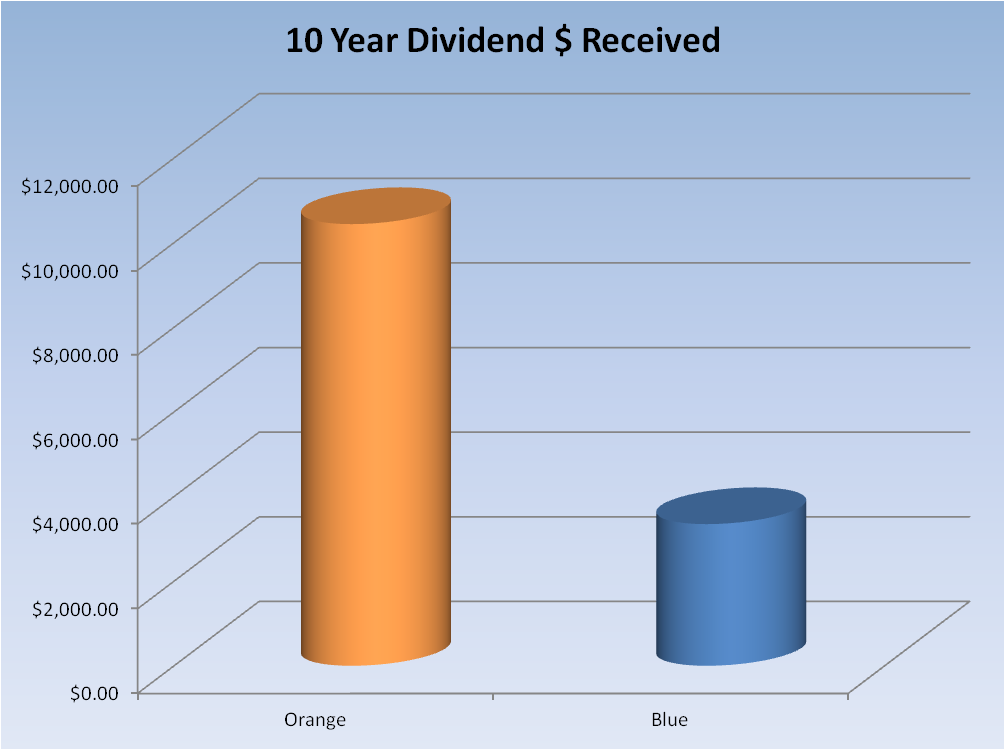

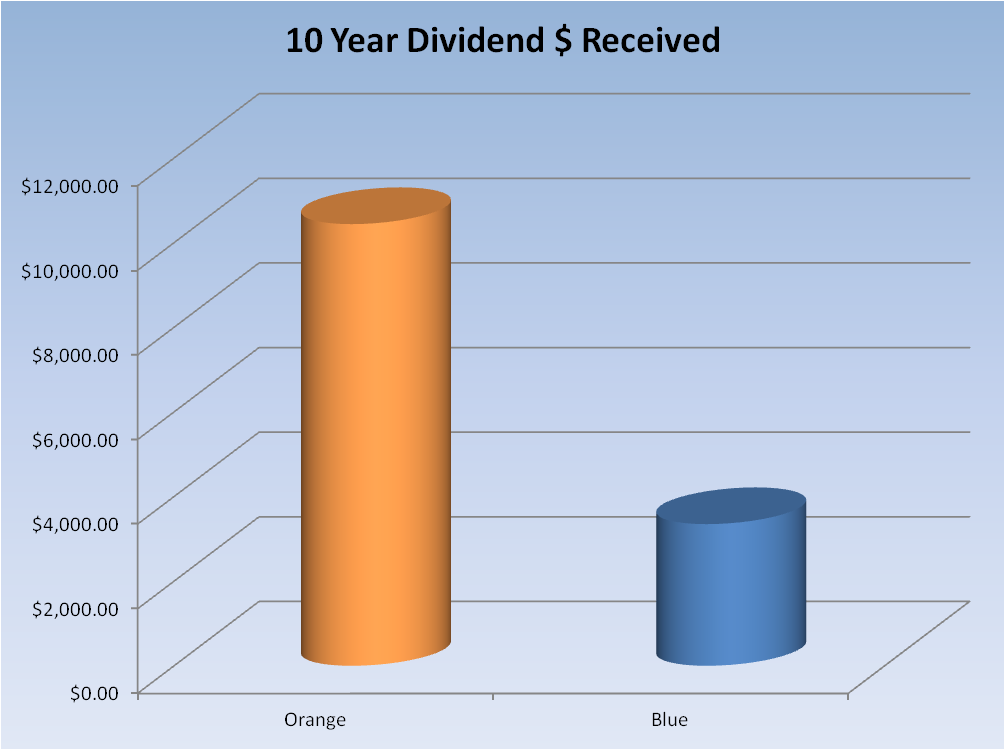

- Reinvesting Returns: Reinvesting dividends and capital gains accelerates growth through compounding. Compounding allows your earnings to generate further earnings.

- Time Horizon: The longer your time horizon, the more effectively you can mitigate short-term market risks.

Keywords: long-term investment, investment planning, retirement planning, compounding interest.

Seeking Professional Advice

Consulting a financial advisor provides invaluable support in creating a personalized investment strategy.

- Personalized Strategies: A financial advisor can help you create an investment strategy that aligns with your specific goals, risk tolerance, and time horizon.

- Expertise and Guidance: They offer expert advice on diversification, asset allocation, and risk management, providing ongoing support throughout your investment journey.

Keywords: financial advisor, investment advice, wealth management, financial planning services.

Conclusion: Secure Your Future with Stable Investments

Prioritizing stability in your investment portfolio offers significant advantages, including reduced volatility, consistent returns, and greater peace of mind. By diversifying your investments, developing a long-term investment plan, and seeking professional guidance, you can build a secure financial future. Start building your portfolio of stable investments today. Consult a financial advisor to learn more about creating a personalized investment stability strategy that aligns with your long-term goals. Remember, consistent, safe investments are the foundation of lasting financial security.

Featured Posts

-

Mind The Gap Wheelchair Accessibility On The Elizabeth Line

May 09, 2025

Mind The Gap Wheelchair Accessibility On The Elizabeth Line

May 09, 2025 -

Madeleine Mc Cann Disappearance A 23 Year Olds Dna Test And Its Implications

May 09, 2025

Madeleine Mc Cann Disappearance A 23 Year Olds Dna Test And Its Implications

May 09, 2025 -

A New Theory On Davids High Potential Unveiling Morgans Greatest Flaw

May 09, 2025

A New Theory On Davids High Potential Unveiling Morgans Greatest Flaw

May 09, 2025 -

New France Poland Friendship Treaty Signing Scheduled For Next Month

May 09, 2025

New France Poland Friendship Treaty Signing Scheduled For Next Month

May 09, 2025 -

168 Million Verdict Against Meta The Impact On Whats App Security

May 09, 2025

168 Million Verdict Against Meta The Impact On Whats App Security

May 09, 2025