The Rise Of Disaster Betting: Examining The Los Angeles Wildfire Example

Table of Contents

The Mechanics of Disaster Betting

Disaster betting encompasses various financial instruments designed to speculate on or mitigate the risk of catastrophic events. Unlike traditional gambling, it often involves complex financial derivatives and sophisticated risk assessment models. Several key mechanisms drive this market:

-

Prediction Markets: These platforms allow individuals to trade contracts based on the likelihood of a specific disaster occurring. In the context of wildfires, prediction markets could involve betting on the probability of a large-scale wildfire in a particular region, factoring in variables like drought conditions, wind speeds, and fuel load. These markets can provide valuable insights into collective risk perception.

-

Catastrophe Bonds (Cat Bonds): These are insurance-linked securities where investors provide capital to insurers in exchange for a return. If a specified disaster occurs (e.g., a wildfire exceeding a certain insured loss threshold), investors lose their principal, but receive a higher return if the disaster does not materialize. Cat bonds effectively transfer wildfire risk from insurance companies to investors.

-

Insurance Derivatives: These are contracts whose value depends on the payouts of insurance policies. They allow insurers to hedge against potential losses from major wildfire events by transferring a portion of their risk to other market participants.

Data and algorithms play a crucial role in assessing wildfire risk and setting betting odds. Sophisticated models analyze historical data, climate projections, and real-time environmental conditions to predict the probability and intensity of wildfires. However, the inherent unpredictability of wildfires means even the most advanced models can be inaccurate, leading to significant uncertainty and potential losses for those involved in disaster betting.

The Los Angeles Wildfire Context

Los Angeles has a long history of devastating wildfires, but their frequency and intensity have increased significantly in recent decades, fueled by climate change, urban sprawl encroaching on wildlands, and increasingly dry conditions. Examples include the 2007 Witch Fire, the 2009 Station Fire, and the 2018 Woolsey Fire. These fires have resulted in billions of dollars in property damage, significant loss of life, and widespread ecological destruction.

- Factors Contributing to Increased Wildfire Risk: Climate change (longer, hotter, drier summers), increased urbanization in fire-prone areas, inadequate forest management, and strong Santa Ana winds are all key factors.

- Economic Impact: The cost of fighting wildfires, rebuilding infrastructure, and compensating victims places a massive strain on both public and private resources.

Disaster betting could have played a significant role in both predicting and financially hedging against these events. However, the availability and accessibility of wildfire-specific betting markets remain limited, suggesting a nascent but potentially expanding market.

Ethical Considerations and Regulatory Challenges

The ethical implications of profiting from natural disasters are profound. Disaster betting raises concerns about:

- Market Manipulation: The potential for individuals or groups to manipulate markets by spreading misinformation or influencing risk assessments for personal gain.

- Social Impact: The perception that individuals are profiting from the suffering of others can erode public trust and create social division.

- Regulatory Challenges: The complexity of disaster betting markets makes it difficult to create effective regulations that balance innovation with responsible risk management.

Existing regulations are often fragmented and inadequate to address the specific challenges posed by disaster betting. Developing a robust regulatory framework that safeguards against market manipulation, protects vulnerable populations, and promotes responsible risk management is a crucial challenge for policymakers.

The Future of Disaster Betting

Technological advancements, particularly in artificial intelligence (AI) and machine learning, are likely to drive significant growth in disaster betting markets.

- AI and Machine Learning: These technologies can analyze vast datasets to improve the accuracy of disaster predictions, leading to more sophisticated and complex betting instruments.

- Increased Accuracy in Risk Assessment: More precise risk models can potentially lead to more efficient allocation of resources for disaster preparedness.

- Sophisticated Betting Instruments: We can expect the development of new and complex financial products designed to manage and transfer disaster risk more effectively.

The implications of this growth are significant for insurance companies, governments, and individuals. Increased investment in disaster preparedness, driven by more accurate risk assessments, could ultimately lead to more resilient communities. However, the potential for exploitation and market manipulation necessitates careful consideration of ethical and regulatory frameworks to harness the potential benefits while mitigating the risks.

Understanding and Managing the Rise of Disaster Betting

Disaster betting presents a complex and multifaceted challenge. Its relationship to events like the Los Angeles wildfires underscores the need for careful consideration of its ethical and societal implications. The potential for both positive and negative consequences necessitates a balanced approach that prioritizes responsible disaster betting and ethical considerations in disaster risk assessment. The future of disaster risk management hinges on our ability to navigate the complexities of this evolving market. We encourage further research and discussion on the topic, focusing on specific aspects like wildfire prediction markets and catastrophe bonds to foster better understanding and ensure the responsible development of this potentially powerful tool. Let's work towards a future where disaster risk assessment and management are ethically sound and effectively mitigate the potential for harm while harnessing the benefits of innovative financial tools.

Featured Posts

-

Analyzing Paddy Pimblett Vs Michael Chandler Insights From A Ufc Veteran

May 15, 2025

Analyzing Paddy Pimblett Vs Michael Chandler Insights From A Ufc Veteran

May 15, 2025 -

Identifying The Countrys Top Business Growth Areas

May 15, 2025

Identifying The Countrys Top Business Growth Areas

May 15, 2025 -

Miami Heats Recruitment Challenges Lessons From Jimmy Butlers Golden State Connection

May 15, 2025

Miami Heats Recruitment Challenges Lessons From Jimmy Butlers Golden State Connection

May 15, 2025 -

Androids Design Language Evolution Whats New

May 15, 2025

Androids Design Language Evolution Whats New

May 15, 2025 -

Gender Euphoria Scale A Potential Tool For Improving Transgender Wellbeing

May 15, 2025

Gender Euphoria Scale A Potential Tool For Improving Transgender Wellbeing

May 15, 2025

Latest Posts

-

Analyzing The Performance Of Dodgers Prospects Kim Hope And Miller Plus Phillips

May 15, 2025

Analyzing The Performance Of Dodgers Prospects Kim Hope And Miller Plus Phillips

May 15, 2025 -

Top Dodgers Minor Leaguers Kim Hope Miller And Phillips Progress

May 15, 2025

Top Dodgers Minor Leaguers Kim Hope Miller And Phillips Progress

May 15, 2025 -

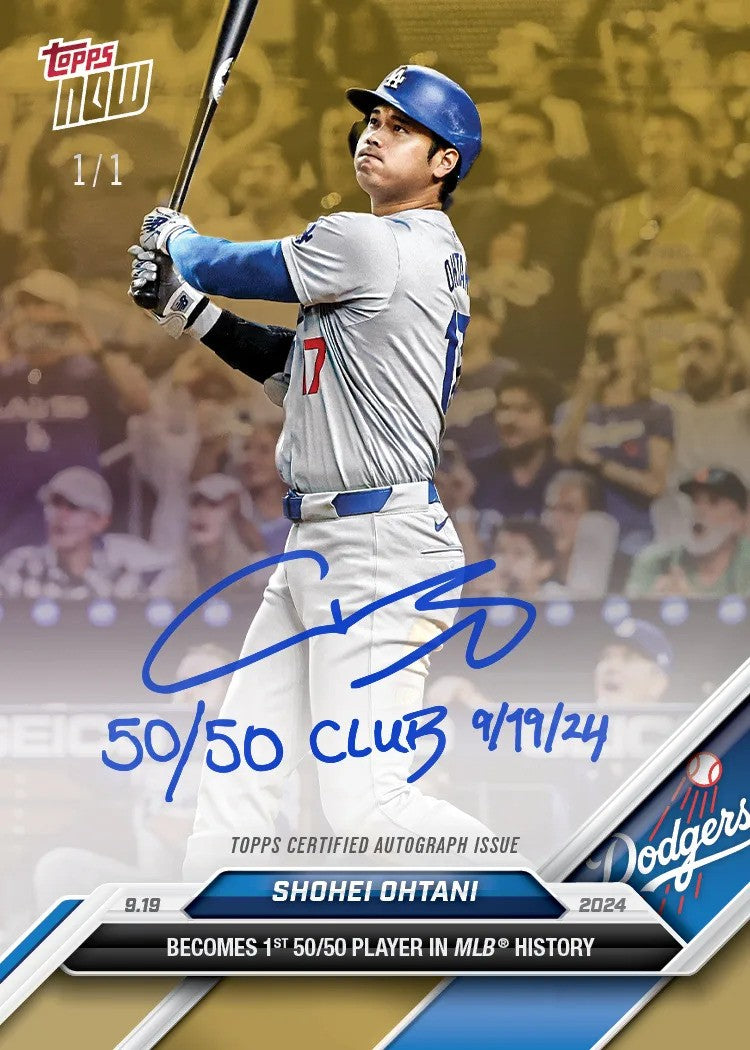

Ohtanis Humble Home Run Celebration A Gesture Of Support For A Teammate

May 15, 2025

Ohtanis Humble Home Run Celebration A Gesture Of Support For A Teammate

May 15, 2025 -

Dodgers Prospects Tracking Kim Hope Miller And Phillips Development

May 15, 2025

Dodgers Prospects Tracking Kim Hope Miller And Phillips Development

May 15, 2025 -

Shohei Ohtani Home Run Celebration Highlights Teamwork And Camaraderie

May 15, 2025

Shohei Ohtani Home Run Celebration Highlights Teamwork And Camaraderie

May 15, 2025