The Significance Of U.S.-China Tariff Rollbacks For American Businesses

Table of Contents

Reduced Import Costs and Increased Profitability

The most immediate impact of U.S.-China tariff rollbacks is the reduction in import costs for American businesses. This has several cascading effects, ultimately boosting profitability and competitiveness.

Lower Prices for Consumers

Lower tariffs translate directly to lower prices for consumers. This increased purchasing power stimulates demand, potentially mitigating inflationary pressures and boosting overall consumer spending.

- Examples: Reduced prices on electronics, clothing, and furniture imported from China are already being observed.

- Impact on Inflation: Lower import prices can help to ease inflationary pressures, contributing to a healthier macroeconomic environment.

- Increased Consumer Spending: With more disposable income, consumers are likely to increase spending, benefiting the broader economy.

Enhanced Competitiveness for American Businesses

Lower import costs significantly enhance the competitiveness of American businesses, particularly those that rely on imported goods as inputs in their production processes. This is especially relevant for manufacturing and technology sectors heavily reliant on Chinese components.

- Case Studies: Companies in the electronics and apparel industries are already reporting improved margins due to decreased input costs.

- Examples: Manufacturers can now offer more competitively priced products, gaining market share both domestically and internationally.

Increased Profit Margins

The direct impact of lower input costs is a substantial increase in business profit margins. This creates opportunities for reinvestment and job creation.

- Financial Projections: Analysts predict significant profit margin improvements across various sectors due to U.S.-China tariff rollbacks.

- Examples: Several companies have already announced plans to reinvest savings from reduced import costs into research and development, expansion, and hiring.

- Potential for Reinvestment and Job Creation: Increased profits can fuel further investment, leading to job creation and economic growth.

Restored Supply Chain Stability

The U.S.-China trade war severely disrupted global supply chains. The tariff rollbacks are contributing significantly to restoring stability and predictability.

Mitigation of Supply Chain Disruptions

Reduced tariffs lessen the incentive to seek alternative, often more expensive and less reliable, suppliers outside China. This leads to smoother and more efficient supply chains.

- Examples: Companies are reporting reduced lead times and improved logistics as relationships with Chinese suppliers are re-established.

- Reduced Lead Times: Faster delivery times translate to quicker production cycles and increased responsiveness to market demands.

- Improved Logistics: Streamlined processes and reduced complexity in the supply chain enhance efficiency and reduce costs.

Reduced Uncertainty and Improved Planning

The reduced uncertainty in the trade landscape allows businesses to engage in more effective long-term planning and strategic decision-making.

- Improved Business Forecasting: Companies can now make more accurate forecasts, reducing risk and improving investment decisions.

- Increased Investment in Domestic Production: Some businesses may choose to increase domestic production, taking advantage of lower input costs.

- Reduced Reliance on Alternative Suppliers: The decreased need to source goods from alternative suppliers reduces costs and complexity.

Strengthened Business Relationships with Chinese Suppliers

Easing trade tensions allows for renewed collaboration and strengthened business relationships with Chinese suppliers. This opens doors for joint ventures and innovation.

- Examples: Companies are reporting renewed partnerships and increased communication with their Chinese counterparts.

- Potential for Joint Ventures and Innovation: The improved relationship creates fertile ground for collaborative projects and technological advancements.

Broader Economic Impacts and Opportunities

The positive effects of U.S.-China tariff rollbacks extend beyond individual businesses, impacting the broader U.S. economy.

Positive Effects on GDP Growth

Reduced import costs and increased business profitability contribute to overall U.S. GDP growth.

- Economic Modeling Predictions: Economic models suggest that tariff rollbacks will contribute positively to GDP growth.

- Increased Investment and Employment: Increased business investment leads to job creation and economic expansion.

- Impact on Consumer Confidence: Lower prices and increased economic activity boost consumer confidence, fueling further spending.

Renewed Focus on Innovation and Investment

Reduced trade uncertainty encourages innovation and investment. Companies are more willing to invest in research and development, expansion, and new ventures.

- Examples: Several companies have announced increased R&D spending and plans for expansion into new markets.

- New Business Ventures: Lower input costs and improved market conditions foster the creation of new businesses.

Geopolitical Implications

The easing of trade tensions between the U.S. and China has broader geopolitical implications, potentially leading to improved bilateral relations and increased global trade stability.

- Improved Bilateral Relations: Reduced trade friction can create a more positive atmosphere for broader diplomatic engagement.

- Potential for Future Trade Agreements: This could pave the way for more comprehensive trade agreements between the two nations.

- Impact on Global Trade: A more stable U.S.-China trade relationship contributes to a healthier and more predictable global trading environment.

Conclusion

U.S.-China tariff rollbacks offer significant benefits for American businesses. Reduced import costs directly translate to increased profitability, restored supply chain stability, and broader economic opportunities. These changes create a more favorable environment for growth and competitiveness. American businesses should proactively assess the implications of these changes for their specific operations and leverage the opportunities created by the U.S.-China tariff rollbacks to optimize their strategies and achieve greater success. Understanding the nuances of U.S.-China tariff rollbacks and staying informed about future developments in this dynamic trade relationship is crucial for navigating the evolving global economic landscape.

Featured Posts

-

Skarlett Yokhansson Istoriya Otkaza Ot Selfi S Poklonnikom

May 13, 2025

Skarlett Yokhansson Istoriya Otkaza Ot Selfi S Poklonnikom

May 13, 2025 -

1035 The Beat Tory Lanez And 50 Cent On Megan Thee Stallions Potential Conviction

May 13, 2025

1035 The Beat Tory Lanez And 50 Cent On Megan Thee Stallions Potential Conviction

May 13, 2025 -

Nba Draft 2025 Whos Best Positioned To Land Cooper Flagg

May 13, 2025

Nba Draft 2025 Whos Best Positioned To Land Cooper Flagg

May 13, 2025 -

Navigating Tariff Turbulence Abi Researchs Insights Into The Tech Sectors Trade War Experience

May 13, 2025

Navigating Tariff Turbulence Abi Researchs Insights Into The Tech Sectors Trade War Experience

May 13, 2025 -

Is A Black Widow Mcu Return Possible Scarlett Johansson Weighs In

May 13, 2025

Is A Black Widow Mcu Return Possible Scarlett Johansson Weighs In

May 13, 2025

Latest Posts

-

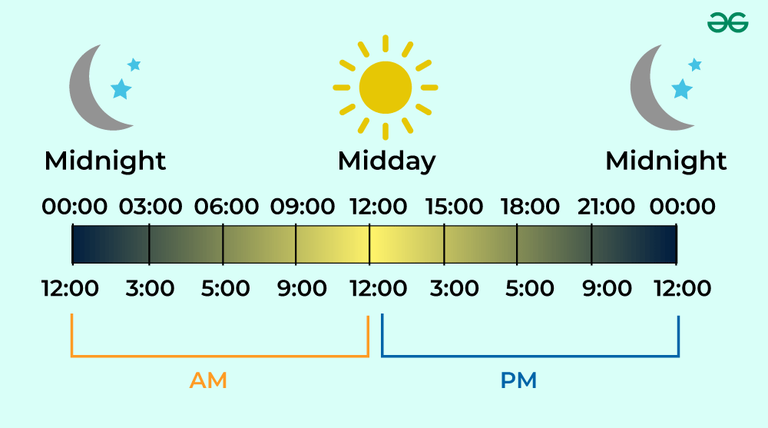

Mondays Top Business News Highlights 1 Am Et

May 14, 2025

Mondays Top Business News Highlights 1 Am Et

May 14, 2025 -

Tennis Star Raducanu And Coach End Partnership Early

May 14, 2025

Tennis Star Raducanu And Coach End Partnership Early

May 14, 2025 -

Raducanu Parts Ways With Coach Following Short Trial Period

May 14, 2025

Raducanu Parts Ways With Coach Following Short Trial Period

May 14, 2025 -

Company News Highlights Full Report Friday At 7 Pm Et

May 14, 2025

Company News Highlights Full Report Friday At 7 Pm Et

May 14, 2025 -

Friday 7 Pm Et Your Daily Dose Of Company News Highlights

May 14, 2025

Friday 7 Pm Et Your Daily Dose Of Company News Highlights

May 14, 2025