The Thriving Venture Capital Secondary Market: Trends And Insights

Table of Contents

A venture capital secondary market is a marketplace where limited partners (LPs), general partners (GPs), and specialized secondary buyers trade existing venture capital fund interests. LPs, typically institutional investors like pension funds and endowments, often seek liquidity before the traditional exit events (IPO or acquisition) of their underlying portfolio companies. GPs may also participate, potentially selling portions of their funds to manage capital calls or pursue other investment opportunities. Secondary buyers, a growing group encompassing dedicated secondary funds, family offices, and other sophisticated investors, provide the liquidity and demand that fuels this market.

Increased Liquidity and Portfolio Diversification in the Venture Capital Secondary Market

The venture capital secondary market provides LPs with crucial liquidity options, allowing them to access capital well before the typical exit events of their portfolio companies. This is particularly beneficial for LPs with long-term investment horizons and a need for flexible capital management.

Furthermore, the secondary market facilitates portfolio diversification. By selling less-performing or less-strategic investments, LPs can rebalance their portfolios and reduce their overall concentration risk. This proactive approach to portfolio management enhances the overall stability and resilience of the LP's venture capital allocation.

- Reduced concentration risk for LPs: Diversification reduces reliance on a small number of investments.

- Faster capital repatriation: Access to capital earlier than originally anticipated.

- Opportunities to reinvest in promising new funds: Freed-up capital can be deployed into more attractive opportunities.

- Improved LP reporting and transparency: Secondary transactions enhance reporting and provide better visibility into portfolio performance.

Key Drivers Shaping the Venture Capital Secondary Market

Several factors are propelling the significant growth observed in the venture capital secondary market:

- Increased fund size and longer fund lifecycles in the primary market: Larger funds necessitate more sophisticated liquidity solutions.

- Rising demand for liquidity from LPs: Increased pressure for quicker returns and capital flexibility.

- Sophisticated secondary market buyers (e.g., specialized funds, family offices): A growing pool of capital dedicated to secondary market investments.

- Technological advancements improving market efficiency and transparency: Improved data analysis and streamlined transaction processes.

- Growth of the fund-of-funds industry: Fund-of-funds often utilize the secondary market for portfolio rebalancing and optimizing performance.

Strategies and Valuation in the Venture Capital Secondary Market

Buyers and sellers employ various strategies within the secondary market. These include:

- Stapled secondary transactions: Simultaneous sale of existing interests alongside new capital commitments to the fund.

- Direct secondary transactions: Direct sale of limited partnership interests without involving the general partner.

Valuing illiquid assets in the venture capital secondary market presents unique challenges. Methods employed include:

- Discounted Cash Flow (DCF) analysis: Projects future cash flows based on projections of the underlying portfolio companies.

- Precedent transactions: Comparing the sale price of similar assets in recent transactions.

- Market multiples: Using valuation multiples derived from publicly traded comparable companies.

Economic conditions and market sentiment significantly impact valuations in this market.

Regulatory Landscape and Future Outlook for the Venture Capital Secondary Market

The regulatory environment plays a vital role in shaping the venture capital secondary market. Increased regulatory scrutiny is expected to continue.

Future trends and challenges include:

- Increased regulatory scrutiny: Greater transparency and oversight of secondary market transactions.

- Impact of global economic uncertainty: Market fluctuations influence investor sentiment and valuation.

- Technological innovations further enhancing market efficiency: Data analytics and automation will continue to transform the market.

- Potential for increased competition among buyers: Increased competition could drive up prices.

- The rise of data-driven valuation models: Sophisticated models will improve valuation accuracy.

Navigating the Opportunities in the Venture Capital Secondary Market

The venture capital secondary market offers significant opportunities for both buyers and sellers, providing liquidity, diversification, and access to unique investment strategies. However, navigating this market requires a deep understanding of its complexities, including valuation methodologies and regulatory considerations. This market is characterized by its illiquidity, which requires careful due diligence and a long-term perspective. The future looks bright, with technology and increased participation driving further growth. To fully capitalize on the potential of the venture capital secondary market, it's essential to stay informed about current trends and developments. Explore the opportunities available in secondary market investments and venture capital secondary transactions to optimize your portfolio and enhance liquidity in the venture capital market.

Featured Posts

-

Examining The Russian Military Europes Security Concerns

Apr 29, 2025

Examining The Russian Military Europes Security Concerns

Apr 29, 2025 -

Auto Legendas F1 Motorral Szerelt Porsche Koezuti Verzio

Apr 29, 2025

Auto Legendas F1 Motorral Szerelt Porsche Koezuti Verzio

Apr 29, 2025 -

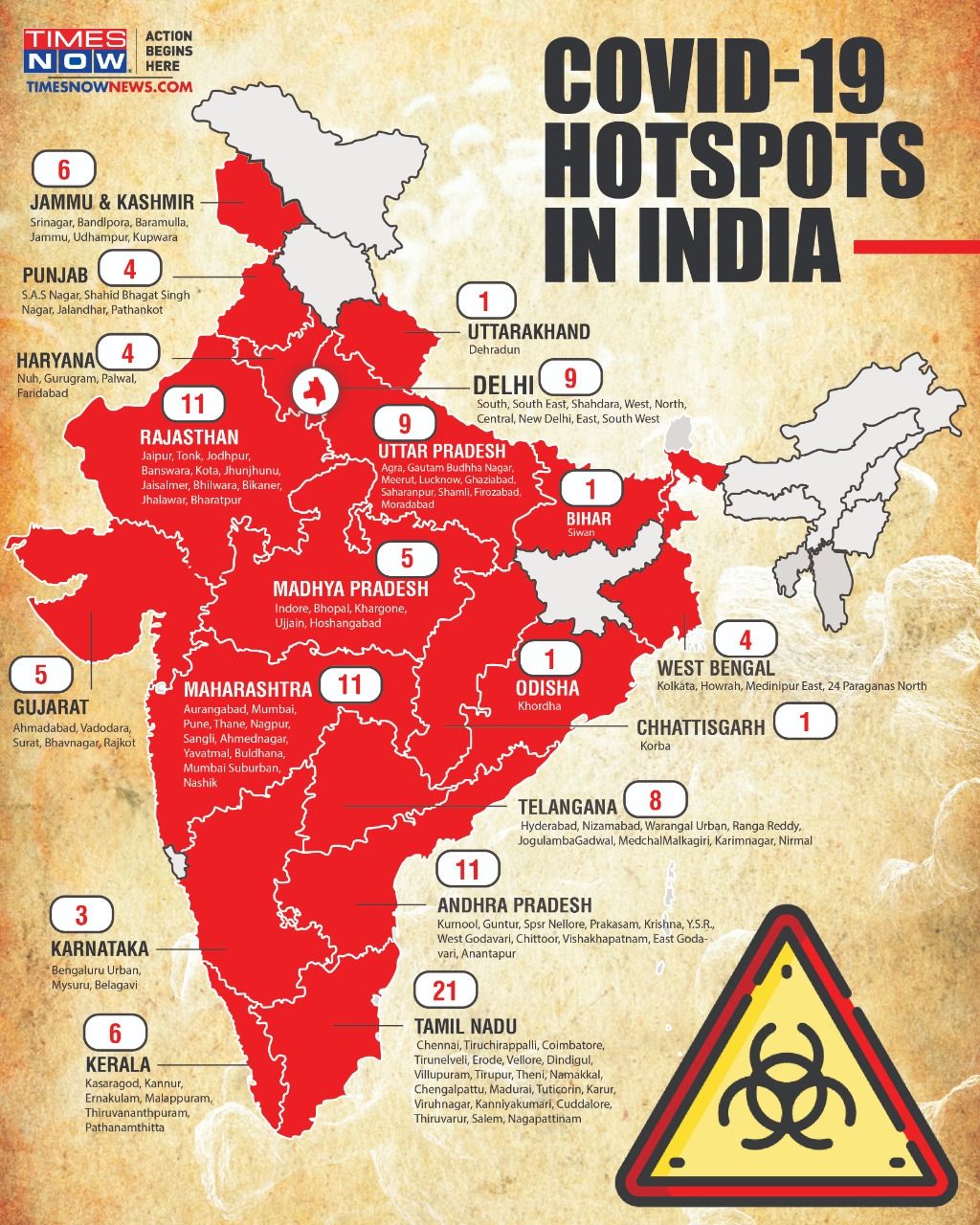

New Business Hotspots Across The Country A Comprehensive Map And Analysis

Apr 29, 2025

New Business Hotspots Across The Country A Comprehensive Map And Analysis

Apr 29, 2025 -

Descifrando El Exito Goleador El Caso De Alberto Ardila Olivares

Apr 29, 2025

Descifrando El Exito Goleador El Caso De Alberto Ardila Olivares

Apr 29, 2025 -

Is Australia Missing Out Examining Porsches Global Popularity

Apr 29, 2025

Is Australia Missing Out Examining Porsches Global Popularity

Apr 29, 2025

Latest Posts

-

Debate Ignites Fabers Decision On Coa Volunteer Honours

May 12, 2025

Debate Ignites Fabers Decision On Coa Volunteer Honours

May 12, 2025 -

The Unexpected Duo How Sylvester Stallone And Michael Caine Found Success In Diverse Genres

May 12, 2025

The Unexpected Duo How Sylvester Stallone And Michael Caine Found Success In Diverse Genres

May 12, 2025 -

The Life And Times Of Debbie Elliott

May 12, 2025

The Life And Times Of Debbie Elliott

May 12, 2025 -

Exploring The Life And Work Of Debbie Elliott

May 12, 2025

Exploring The Life And Work Of Debbie Elliott

May 12, 2025 -

Stallone And Caine From Action To Comedy Exploring Their Unexpected Film Pairings

May 12, 2025

Stallone And Caine From Action To Comedy Exploring Their Unexpected Film Pairings

May 12, 2025