The Trump-Powell Conflict: A Call For The Fed Chair's Termination

Table of Contents

Trump's Criticism of Powell's Monetary Policy

Trump consistently criticized Powell's monetary policy decisions, particularly his approach to interest rate adjustments. This formed a central pillar of the Trump-Powell Conflict.

Interest Rate Hikes and Economic Growth

Trump argued that Powell's interest rate hikes hampered economic growth and threatened his chances of re-election. He frequently voiced his displeasure on Twitter and in public statements.

- Analysis of Trump's tweets and public statements regarding interest rate hikes: Trump's statements often directly linked interest rate increases to slowing economic growth, portraying Powell's actions as deliberately undermining his administration's economic successes. These pronouncements created significant market uncertainty.

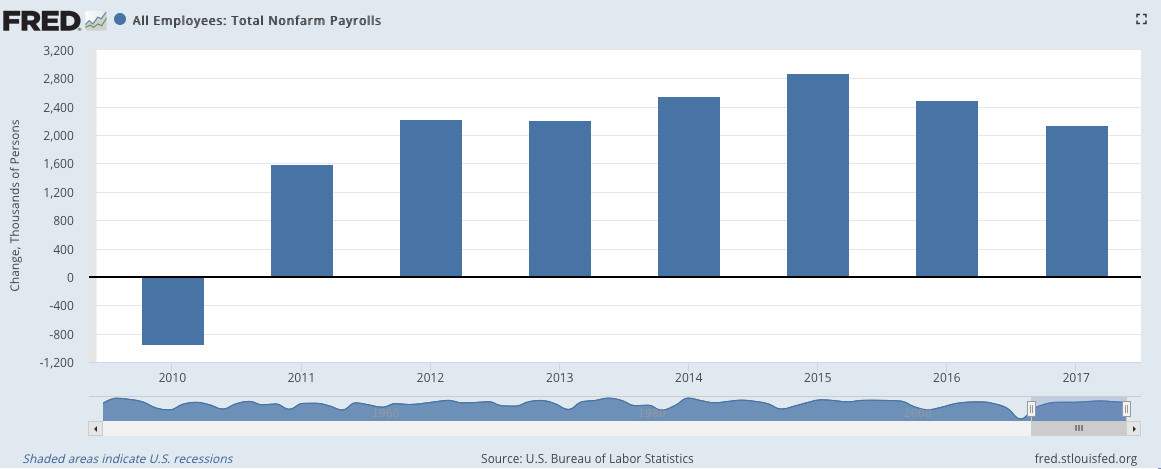

- Examination of the economic data during the period of rate increases: While the economy did experience slower growth during this period, attributing this solely to interest rate hikes is an oversimplification. Other factors, such as global trade tensions and slowing global growth, also played significant roles.

- Discussion of the potential impact of lower interest rates on inflation and economic growth: Trump advocated for lower interest rates to stimulate economic growth. However, lower rates could also fuel inflation, potentially leading to long-term economic instability. This was a central point of contention in the Trump-Powell Conflict.

The Independence of the Federal Reserve

Trump's attacks were widely perceived as an attempt to politicize the Federal Reserve, undermining its crucial independence. This aspect of the Trump-Powell Conflict sparked significant debate.

- Discussion of the historical importance of the Fed's independence: The Federal Reserve's independence from political influence is considered essential for maintaining its credibility and ability to make objective decisions based on economic data, rather than political expediency.

- Analysis of the potential consequences of political interference in monetary policy: Political interference in monetary policy could lead to short-sighted decisions driven by electoral considerations, rather than long-term economic stability. This was a key concern regarding the Fed Chair Termination calls.

- Exploration of legal frameworks protecting the Fed's independence: While the Fed operates with a degree of independence, it is ultimately accountable to Congress. The legal frameworks governing the Fed's autonomy were intensely debated during the Trump-Powell Conflict.

The Economic Consequences of the Conflict

The very public nature of the Trump-Powell Conflict had significant economic consequences.

Market Volatility and Uncertainty

The constant public criticism created uncertainty in the financial markets, leading to increased volatility.

- Analysis of market reactions to Trump's criticisms of Powell: Stock markets often reacted negatively to Trump's public attacks on Powell, reflecting investor concerns about the potential for political interference in monetary policy.

- Discussion of the impact of uncertainty on investor confidence: Uncertainty undermines investor confidence, potentially leading to reduced investment and slower economic growth. This was a direct consequence of the Trump-Powell Conflict.

- Exploration of the long-term economic effects of market volatility: Prolonged market volatility can damage long-term economic prospects by discouraging investment and hindering economic planning.

Impact on International Relations

Trump's attacks on Powell also had international implications, raising questions about the credibility of US economic policy.

- Discussion of how the conflict impacted international perceptions of the US economy: The conflict raised concerns among international investors and trading partners about the stability and predictability of US economic policy.

- Analysis of the potential for negative impacts on trade and investment: Uncertainty surrounding US economic policy could deter foreign investment and negatively impact trade relations. This threat was a significant consequence of the Trump-Powell Conflict.

- Comparison with similar instances of political interference in other countries' central banks: Historical examples of political interference in central banks highlight the potential for negative economic consequences, reinforcing the importance of central bank independence.

Arguments For and Against Powell's Termination

The Trump-Powell Conflict and the resulting Fed Chair Termination debate presented contrasting arguments.

Arguments in Favor of Termination

Some argued that Powell's policies were detrimental to the economy and that his removal was necessary to improve economic performance.

- Summarize arguments emphasizing economic performance: Proponents of termination often focused on the perceived negative impact of Powell's policies on economic growth and job creation.

- Consider arguments emphasizing political accountability: Some argued that Powell should be held accountable for what they considered poor economic performance.

Arguments Against Termination

Others vehemently opposed Powell's removal, emphasizing the importance of the Fed's independence.

- Summarize arguments emphasizing the independence of the Fed: Opponents stressed that removing Powell would severely damage the Fed's independence, setting a dangerous precedent for future administrations.

- Discuss the long-term consequences of political interference: They warned that political interference could lead to economically damaging, short-sighted policies.

Conclusion

The Trump-Powell Conflict serves as a crucial case study in the complex interplay between politics and economics. While Trump’s calls for the Fed Chair Termination raised questions about economic policy, the potential damage to the Fed's independence ultimately overshadowed these arguments. The episode underscores the vital role of an independent central bank in maintaining economic stability and the inherent dangers of political interference in monetary policy decisions. Understanding the intricacies of the Trump-Powell Conflict is essential for safeguarding the future of the Federal Reserve and fostering a healthy US economy. Further research into the long-term impacts of this conflict is needed to fully understand its implications. Let's continue the discussion on the crucial importance of an independent Federal Reserve and the dangers of the Fed Chair Termination debate.

Featured Posts

-

Why Papal Signet Rings Are Destroyed The Case Of Pope Francis

Apr 23, 2025

Why Papal Signet Rings Are Destroyed The Case Of Pope Francis

Apr 23, 2025 -

Christian Yelichs Spring Training Debut Following Back Surgery Recovery

Apr 23, 2025

Christian Yelichs Spring Training Debut Following Back Surgery Recovery

Apr 23, 2025 -

The Economic Data Doesnt Reflect Trumps Presence

Apr 23, 2025

The Economic Data Doesnt Reflect Trumps Presence

Apr 23, 2025 -

Ser Aldhhb Alywm Alathnyn 17 Fbrayr 2025 Sbykt 10 Jramat

Apr 23, 2025

Ser Aldhhb Alywm Alathnyn 17 Fbrayr 2025 Sbykt 10 Jramat

Apr 23, 2025 -

Rowdy Tellez Revenge Watch Him Dominate His Former Team

Apr 23, 2025

Rowdy Tellez Revenge Watch Him Dominate His Former Team

Apr 23, 2025

Latest Posts

-

43 Billion Gap Space X Now Exceeds Tesla In Musks Portfolio Value

May 10, 2025

43 Billion Gap Space X Now Exceeds Tesla In Musks Portfolio Value

May 10, 2025 -

Space X Valuation Soars 43 Billion Ahead Of Musks Tesla Investment

May 10, 2025

Space X Valuation Soars 43 Billion Ahead Of Musks Tesla Investment

May 10, 2025 -

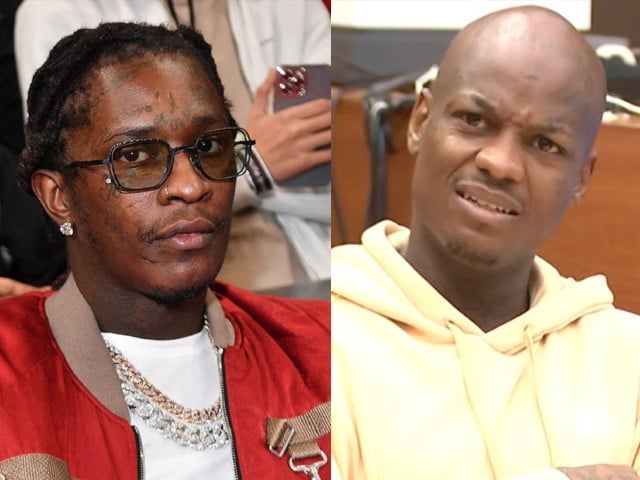

Blue Origin Young Thug Not Among Upcoming Passengers

May 10, 2025

Blue Origin Young Thug Not Among Upcoming Passengers

May 10, 2025 -

New Young Thug Music A Public Apology For Past Mistakes

May 10, 2025

New Young Thug Music A Public Apology For Past Mistakes

May 10, 2025 -

First Listen Mariah The Scientists Burning Blue

May 10, 2025

First Listen Mariah The Scientists Burning Blue

May 10, 2025