The Trump Presidency And Cheap Oil: An Analysis Of Industry Impact

Table of Contents

The Trump Administration's Energy Policies and their Effect on Oil Prices

The Trump administration's energy policies significantly influenced oil prices and the global energy landscape. A core strategy was to boost domestic oil production, leading to a period of relatively cheap oil for consumers.

Increased Domestic Oil Production

The administration championed deregulation, aiming to unleash American energy potential. This support manifested in several key policy decisions that directly impacted shale oil production, a crucial component of the US energy boom. Relaxing environmental regulations and streamlining the permitting process for drilling on federal lands were key drivers of this increase. Data from the Energy Information Administration (EIA) shows a substantial rise in US crude oil production throughout the Trump presidency.

- Increased drilling permits on federal lands: The administration actively approved drilling permits on previously restricted areas, making more land available for oil and gas extraction.

- Easing of environmental impact assessments: The streamlining of environmental reviews sped up the approval process for new oil and gas projects, reducing bureaucratic hurdles.

- Support for pipeline projects (e.g., Keystone XL): The administration's backing of major pipeline projects, such as the Keystone XL pipeline, facilitated the transportation of oil, further boosting production and supply.

Impact on OPEC and Global Oil Supply

The surge in US oil production significantly impacted OPEC (Organization of the Petroleum Exporting Countries) strategies. Faced with increased competition from the US, OPEC's influence on global oil prices diminished. This led to periods of price volatility and even price wars, as OPEC members struggled to maintain market share.

- OPEC's response to increased US production: OPEC attempted to counter the increased US production through various strategies, including production cuts, but faced challenges in coordinating member nations.

- Price wars and their consequences: Periods of price wars ensued as OPEC members and other producers competed for market share, resulting in lower oil prices for consumers but also challenges for many oil-producing nations.

- Changes in global oil market share: The US significantly increased its share of the global oil market during the Trump presidency, challenging OPEC's traditional dominance.

Economic Consequences of Cheap Oil During the Trump Presidency

Cheap oil during the Trump presidency had profound economic consequences, impacting both consumers and the energy industry itself.

Benefits for Consumers

Lower gas prices directly translated into increased disposable income for many American consumers. This had a positive ripple effect across the economy, boosting consumer spending and contributing to economic growth.

- Lower transportation costs: Lower gas prices reduced transportation costs for businesses and individuals, stimulating economic activity.

- Increased disposable income: Consumers had more money to spend on other goods and services, stimulating other sectors of the economy.

- Stimulus to other sectors of the economy: The increased consumer spending fueled economic growth in sectors like retail, tourism, and hospitality.

Challenges for the Oil and Gas Industry

While consumers benefited from low oil prices, the energy industry itself faced significant challenges. Lower prices squeezed profit margins, leading to bankruptcies, layoffs, and reduced investment in exploration and production.

- Reduced profitability for oil producers: Lower oil prices significantly reduced the profitability of oil and gas companies, forcing some into bankruptcy.

- Job losses in the energy sector: The reduced profitability led to job losses in the oil and gas industry and related sectors such as oilfield services.

- Decreased investment in exploration and production: The uncertain price environment caused a decrease in investment in new exploration and production projects.

Geopolitical Implications of the Trump Administration's Oil Policies

The Trump administration's energy policies had significant geopolitical implications, altering the US's relationship with OPEC and other oil-producing nations and impacting global energy security.

Relationship with OPEC and other oil-producing nations

The Trump administration's focus on energy independence led to shifts in US foreign policy regarding oil-producing countries. The emphasis on domestic production lessened the US's reliance on foreign oil, potentially altering the dynamics of its relationships with OPEC and other key players in the global oil market.

- Changes in alliances and partnerships: The US reassessed its relationships with traditional allies and partners in the energy sector.

- Impact on US influence in global energy markets: The increased US energy independence potentially reduced its dependence on foreign energy sources and altered the country's influence in global energy markets.

- Negotiations and agreements with OPEC nations: The shift in US energy policy impacted negotiations and agreements with OPEC and other oil-producing nations.

Energy Security and National Interests

The administration's policies aimed to enhance US energy security by reducing reliance on foreign oil imports. However, this increased dependence on domestic production also created potential vulnerabilities, including a greater susceptibility to disruptions in the US energy market.

- Reduced reliance on foreign oil imports: Increased domestic production led to a reduction in the US's reliance on foreign oil imports, bolstering energy security.

- Impact on national security strategy: The shift towards energy independence influenced the nation's overall national security strategy.

- Potential vulnerabilities of increased domestic production: The dependence on domestic production created potential vulnerabilities to supply chain disruptions and environmental concerns.

Conclusion

The Trump presidency's impact on oil prices and the energy industry was multifaceted and far-reaching. The administration's policies significantly boosted domestic oil production, leading to periods of relatively cheap oil for consumers but also challenges for the oil and gas industry. The changes had significant economic and geopolitical ramifications, reshaping the global energy landscape. Further research and discussion on the long-term implications of the "Trump Presidency and Cheap Oil" are crucial. A deeper understanding of this complex interplay between politics and the energy market is essential for informed policy-making and strategic planning in the energy sector. Consider exploring further readings on energy policy, geopolitical analysis, and the economics of the oil and gas industry to gain a more complete picture.

Featured Posts

-

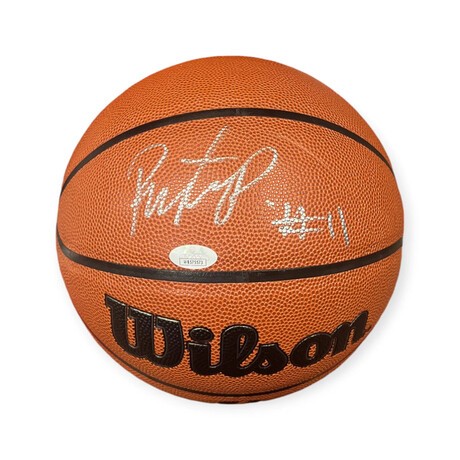

Payton Pritchard Analyzing His Breakout Nba Season And Sixth Man Award Chances

May 12, 2025

Payton Pritchard Analyzing His Breakout Nba Season And Sixth Man Award Chances

May 12, 2025 -

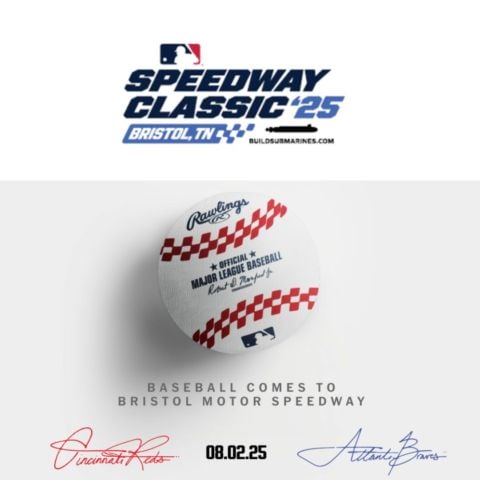

Mlb Speedway Classic In Bristol Manfreds Predictions For Fan Attendance

May 12, 2025

Mlb Speedway Classic In Bristol Manfreds Predictions For Fan Attendance

May 12, 2025 -

Rethinking John Wick 5 Exploring Alternatives For The Franchise

May 12, 2025

Rethinking John Wick 5 Exploring Alternatives For The Franchise

May 12, 2025 -

Time To Call It Quits A Discussion About A Potential John Wick 5

May 12, 2025

Time To Call It Quits A Discussion About A Potential John Wick 5

May 12, 2025 -

Yankees Confident Aaron Judge Is A Future Hall Of Famer After 1 000 Games

May 12, 2025

Yankees Confident Aaron Judge Is A Future Hall Of Famer After 1 000 Games

May 12, 2025

Latest Posts

-

Hikmah Dari Sby Menangani Konflik Myanmar Tanpa Intervensi Berlebihan

May 13, 2025

Hikmah Dari Sby Menangani Konflik Myanmar Tanpa Intervensi Berlebihan

May 13, 2025 -

Myanmar Prioritas Penindakan Tegas Judi Online Dan Penipuan Telekomunikasi

May 13, 2025

Myanmar Prioritas Penindakan Tegas Judi Online Dan Penipuan Telekomunikasi

May 13, 2025 -

Delovoy Forum Rossiya Myanma V Moskve Novye Vozmozhnosti Dlya Sotrudnichestva

May 13, 2025

Delovoy Forum Rossiya Myanma V Moskve Novye Vozmozhnosti Dlya Sotrudnichestva

May 13, 2025 -

Menilik Strategi Sby Resolusi Konflik Myanmar Yang Damai

May 13, 2025

Menilik Strategi Sby Resolusi Konflik Myanmar Yang Damai

May 13, 2025 -

Rossiysko Myanmanskiy Delovoy Forum V Moskve Daty Uchastniki I Povestka Dnya

May 13, 2025

Rossiysko Myanmanskiy Delovoy Forum V Moskve Daty Uchastniki I Povestka Dnya

May 13, 2025