The Trump Tax Cut Bill: A Breakdown Of The House Republican Proposal

Table of Contents

Individual Income Tax Changes

Lowering Individual Income Tax Rates

The Trump Tax Cut Bill proposed a significant reduction in individual income tax rates. This involved altering the existing tax brackets and lowering the marginal tax rates for various income levels.

- Tax Bracket Changes: The bill significantly reduced the number of tax brackets and lowered the rates within each bracket. For example, the highest tax bracket was reduced, resulting in substantial savings for high-income earners.

- Comparison to Previous Rates: These changes represented a dramatic shift from prior tax rates, resulting in substantial tax cuts for many individuals. The magnitude of the reduction varied depending on income level.

- Potential Savings for Individuals: The reduction in rates translated to considerable tax savings for individuals across various income brackets, although the amount varied depending on individual circumstances and income. Taxpayers could expect to see a noticeable decrease in their annual tax liability. Related keywords: Tax brackets, marginal tax rates, tax cuts, individual taxpayers.

Standard Deduction and Child Tax Credit

The bill also included adjustments to the standard deduction and the child tax credit, impacting families and individuals differently.

- Increased Standard Deduction: The standard deduction amount was significantly increased, benefiting many taxpayers who previously itemized their deductions. This simplification reduced the complexity of tax filing for many.

- Expanded Child Tax Credit: The child tax credit was either increased or expanded to include more families. This provided substantial tax relief for families with children.

- Impact on Families: The changes to both the standard deduction and child tax credit provided considerable financial relief to many families, particularly those with multiple children. Related keywords: Standard deduction, child tax credit, family tax benefits, dependent care.

Elimination or Modification of Tax Deductions

Several itemized deductions were either eliminated or modified under the Trump Tax Cut Bill.

- State and Local Tax (SALT) Deduction: The SALT deduction, which allowed taxpayers to deduct state and local taxes from their federal income tax, was limited, impacting high-tax states disproportionately.

- Mortgage Interest Deduction: While the mortgage interest deduction remained, certain limitations were put in place.

- Impact on Homeowners and Charitable Givers: These changes significantly impacted homeowners and charitable givers, altering their tax strategies and reducing potential deductions. Related keywords: Itemized deductions, mortgage interest deduction, state and local tax deductions, charitable deductions.

Corporate Tax Rate Reductions

Lowering the Corporate Tax Rate

A central feature of the Trump Tax Cut Bill was a substantial reduction in the corporate tax rate.

- Proposed Rate Reduction: The corporate tax rate was significantly lowered, making the United States more competitive with other countries.

- Comparison to Previous Rates: The change represented a major shift in corporate taxation policy, moving from one of the highest rates in the developed world to a significantly lower one.

- Potential Impact on Business: This reduction was intended to stimulate business investment, job creation, and overall economic growth. Related keywords: Corporate tax rate, business tax cuts, investment incentives, job growth.

Impact on Corporate Profits and Investment

The lower corporate tax rate had a considerable impact on corporate profits and investment decisions.

- Increased Investment: Many businesses used the tax savings to increase investments in capital equipment, research and development, and expansion.

- Potential for Increased Wages: Some businesses used the savings to increase employee wages and benefits.

- Potential Downsides: However, critics argued that some corporations used the savings to increase shareholder payouts rather than investing in the business or employees. Related keywords: Corporate profits, capital investment, economic growth, foreign investment.

Economic Consequences and Long-Term Effects

Projected Budgetary Impact

The Trump Tax Cut Bill had a significant impact on the federal budget.

- Increased Deficit: The substantial tax cuts led to a projected increase in the national debt and the federal budget deficit.

- Long-Term Concerns: Concerns were raised about the long-term sustainability of this approach, with potential consequences for future generations. Related keywords: National debt, federal budget deficit, fiscal responsibility.

Potential Economic Growth and Job Creation

Proponents of the bill argued that the tax cuts would stimulate economic growth and job creation.

- Stimulus Effect: The tax cuts were intended to act as an economic stimulus, encouraging businesses to invest and hire more workers.

- Economic Models: Various economic models were used to project the potential impact on GDP growth and employment. These models, however, yielded varied results.

- Debate on Effectiveness: The actual effectiveness of the tax cuts in stimulating economic growth remains a subject of ongoing debate. Related keywords: Economic growth, job creation, wage growth, economic stimulus.

Income Inequality and Distributional Effects

The Trump Tax Cut Bill raised concerns about its impact on income inequality.

- Beneficial to Higher-Income Earners: Critics argued that a disproportionate share of the tax benefits went to higher-income individuals and corporations.

- Worsening Inequality: This could potentially exacerbate existing income inequality, raising concerns about fairness and social equity. Related keywords: Income inequality, wealth distribution, tax fairness.

Conclusion

The Trump Tax Cut Bill represented a major overhaul of the American tax code, significantly altering individual and corporate tax rates, deductions, and credits. While proponents touted its potential to stimulate economic growth and job creation, critics raised concerns about its impact on the national debt, income inequality, and long-term fiscal sustainability. Understanding the Trump Tax Cut Bill and its implications requires careful consideration of its various provisions and potential long-term effects. Research the Trump Tax Cut Bill to make informed decisions about its impact on your finances and the economy as a whole. Learn more about the complexities of the Trump Tax Cut Bill and its lasting legacy on the American tax system.

Featured Posts

-

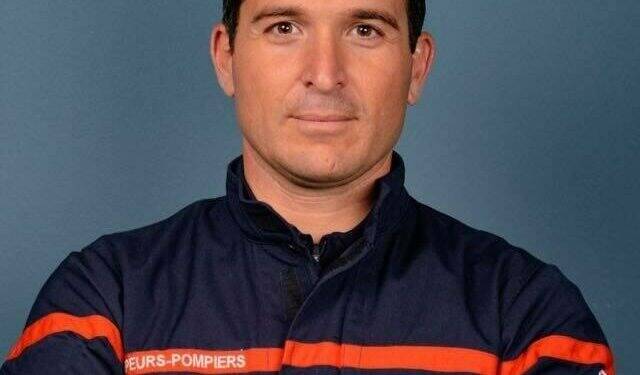

Ameliorer La Protection Civile Allemande Investissements Et Reformes Necessaires

May 13, 2025

Ameliorer La Protection Civile Allemande Investissements Et Reformes Necessaires

May 13, 2025 -

Performa Apik Jay Idzes Untuk Venezia Implikasi Bagi Timnas Indonesia

May 13, 2025

Performa Apik Jay Idzes Untuk Venezia Implikasi Bagi Timnas Indonesia

May 13, 2025 -

L Allemagne Renforce Sa Protection Civile Un Besoin Urgent Apres Des Annees De Negligence

May 13, 2025

L Allemagne Renforce Sa Protection Civile Un Besoin Urgent Apres Des Annees De Negligence

May 13, 2025 -

Chinas Byd Challenges Fords Fading Presence In Brazils Ev Market

May 13, 2025

Chinas Byd Challenges Fords Fading Presence In Brazils Ev Market

May 13, 2025 -

Prekmurski Romi Muzikanti Glasba In Identiteta

May 13, 2025

Prekmurski Romi Muzikanti Glasba In Identiteta

May 13, 2025

Latest Posts

-

Stream Snow White 2023 Live Action Your Guide To Viewing Options

May 14, 2025

Stream Snow White 2023 Live Action Your Guide To Viewing Options

May 14, 2025 -

Could There Be A Tommy Boy Sequel With David Spade

May 14, 2025

Could There Be A Tommy Boy Sequel With David Spade

May 14, 2025 -

Disneys Snow White Live Action Streaming Options And Availability

May 14, 2025

Disneys Snow White Live Action Streaming Options And Availability

May 14, 2025 -

Snow Whites Digital Debut 2025 Disney Streaming Release Information

May 14, 2025

Snow Whites Digital Debut 2025 Disney Streaming Release Information

May 14, 2025 -

David Spades Tommy Boy Sequel Idea Will It Happen

May 14, 2025

David Spades Tommy Boy Sequel Idea Will It Happen

May 14, 2025