The Trump Trade War: Wall Street Bets' Perspective And The Current Economic Climate

Table of Contents

Wall Street's Initial Reactions to the Trump Trade War

The announcement and implementation of the Trump trade war policies sent shockwaves through Wall Street, creating a period of significant uncertainty and volatility.

Volatility and Uncertainty

The initial reaction to the trade war announcements was marked by increased market volatility. Uncertainty surrounding the long-term implications of tariffs led to market corrections across various sectors.

- Stock Market Dips: Specific sectors, such as agriculture and technology, experienced notable dips in stock prices as tariffs impacted their supply chains and market access.

- Increased Hedging Activities: Investors significantly increased their hedging activities to mitigate potential losses stemming from the increased market risk associated with the trade war. This involved strategies like purchasing put options and diversifying their portfolios geographically.

- Keywords: market volatility, market uncertainty, risk assessment, investment hedging

Sectoral Impacts

The Trump trade war didn't affect all sectors equally. Some industries thrived while others struggled, highlighting the complex and nuanced impact of the tariffs.

- Winners and Losers: While some domestic industries initially benefited from increased protection, others faced higher input costs due to increased tariffs on imported goods. The agricultural sector, for example, experienced significant challenges due to retaliatory tariffs imposed by China.

- Supply Chain Disruption: The trade war significantly disrupted global supply chains, forcing companies to reassess their sourcing strategies and leading to increased production costs for many businesses.

- Keywords: tariff impact, sectoral analysis, supply chain disruption, trade negotiations

Long-Term Economic Consequences of the Trump Trade War

The Trump trade war's long-term effects continue to ripple through the global economy, impacting inflation, global trade patterns, and geopolitical relations.

Inflationary Pressures

Tariffs directly increased the cost of imported goods, contributing to inflationary pressures.

- Increased Import Costs: Tariffs added directly to the price of imported goods, increasing the cost of production for businesses that relied on these imports.

- Supply Chain Disruptions: The disruptions to global supply chains added further inflationary pressure as businesses scrambled to find alternative sources of goods and materials.

- Keywords: inflation, consumer prices, import costs, supply chain resilience

Global Trade Realignment

The trade war accelerated a shift in global trade patterns, leading to the formation of new alliances and trade agreements.

- Rise of Regional Trade Blocs: Countries sought to reduce their reliance on trade with the US and China by strengthening regional trade agreements.

- Changes in Sourcing Strategies: Companies diversified their supply chains, seeking alternative sources of goods and materials to reduce their exposure to tariff risks.

- Keywords: global trade, trade agreements, regional trade blocs, trade diversification

Geopolitical Implications

The trade war had far-reaching geopolitical consequences, significantly impacting US-China relations and broader global stability.

- US-China Relations: The trade war exacerbated existing tensions between the US and China, contributing to a period of increased geopolitical uncertainty.

- Global Power Dynamics: The trade war highlighted the shifting global power dynamics, with emerging economies playing an increasingly important role in shaping international trade relations.

- Keywords: geopolitics, US-China relations, global power dynamics, international trade

Current Wall Street Strategies in the Post-Trade War Era

In the wake of the Trump trade war, Wall Street investment firms have adjusted their strategies to adapt to the altered economic landscape.

Adapting Investment Strategies

Investment firms have incorporated lessons learned from the trade war into their investment strategies.

- Diversification Strategies: Diversification is now more crucial than ever, with investors seeking to reduce their exposure to risks associated with specific countries or sectors.

- Risk Management Techniques: Sophisticated risk management techniques are employed to account for the increased volatility and uncertainty in the global marketplace.

- Keywords: investment strategies, risk management, portfolio diversification, long-term investment

Focus on Resilient Sectors

Wall Street is now focusing on sectors that have demonstrated resilience to economic shocks, showing strong performance despite the trade war's legacy.

- Identifying Resilient Sectors: Sectors less reliant on global trade or those offering essential goods and services are generally seen as more resilient.

- Investment Opportunities: These resilient sectors present attractive investment opportunities for those seeking long-term growth in a complex global environment.

- Keywords: resilient sectors, economic growth, investment opportunities, market trends

Conclusion: Understanding the Trump Trade War's Enduring Legacy on Wall Street and the Economy

The Trump trade war's impact on Wall Street and the global economy is multifaceted and far-reaching. The initial market volatility, sectoral impacts, inflationary pressures, global trade realignment, and geopolitical consequences have all shaped the current economic climate. Wall Street has responded by adapting investment strategies, focusing on diversification, and prioritizing sectors demonstrating resilience. Understanding this complex legacy is crucial for navigating the current economic landscape and making informed investment decisions. Further research into the specific impacts on various sectors and the evolving global trade landscape is vital. Consider seeking professional financial advice to navigate the complexities of the post-trade war economic landscape and to make sound investment choices in this era shaped by the Trump trade war's lasting effects.

Featured Posts

-

Henry Cavills Favorite Fantasy Show Better Than The Witcher

May 29, 2025

Henry Cavills Favorite Fantasy Show Better Than The Witcher

May 29, 2025 -

Nokia Telefonok Ertekes Regi Modellek Es A Piaci Aruk

May 29, 2025

Nokia Telefonok Ertekes Regi Modellek Es A Piaci Aruk

May 29, 2025 -

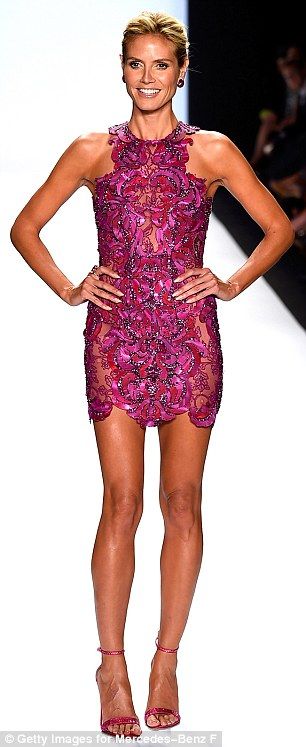

Red Hot Liberty Pooles Dazzling Mini Dress Look

May 29, 2025

Red Hot Liberty Pooles Dazzling Mini Dress Look

May 29, 2025 -

Post Match Analysis Barcelonas Thrilling 4 3 Win Against Real Madrid

May 29, 2025

Post Match Analysis Barcelonas Thrilling 4 3 Win Against Real Madrid

May 29, 2025 -

Eroeffnung Karl Weinbar Neue Weinbar An Der Venloer Strasse

May 29, 2025

Eroeffnung Karl Weinbar Neue Weinbar An Der Venloer Strasse

May 29, 2025

Latest Posts

-

Updates On Sanofis Respiratory Pipeline Asthma And Copd Clinical Trial Progress

May 31, 2025

Updates On Sanofis Respiratory Pipeline Asthma And Copd Clinical Trial Progress

May 31, 2025 -

Sanofis Respiratory Pipeline New Data And Future Clinical Studies For Asthma And Copd

May 31, 2025

Sanofis Respiratory Pipeline New Data And Future Clinical Studies For Asthma And Copd

May 31, 2025 -

Constanza Grave Incendio Forestal Causa Densa Humarada Y Afecta A La Poblacion

May 31, 2025

Constanza Grave Incendio Forestal Causa Densa Humarada Y Afecta A La Poblacion

May 31, 2025 -

Incendio En Constanza Bomberos Forestales Luchan Contra Las Llamas

May 31, 2025

Incendio En Constanza Bomberos Forestales Luchan Contra Las Llamas

May 31, 2025 -

Bomberos Forestales Combaten Incendio En Constanza Densa Humarada Afecta A Residentes

May 31, 2025

Bomberos Forestales Combaten Incendio En Constanza Densa Humarada Afecta A Residentes

May 31, 2025