The U.S. Dollar And The Presidency: A Historical Comparison (Nixon To Present)

Table of Contents

The Nixon Shock and the End of Bretton Woods (1971-1974)

President Richard Nixon's decision to close the gold window in August 1971, a move now known as the "Nixon Shock," fundamentally altered the international monetary system and the relationship between the U.S. dollar and gold. This marked the end of the Bretton Woods system, established in 1944, which pegged the value of most currencies to the U.S. dollar, which in turn was convertible to gold at a fixed rate.

-

Details on the Bretton Woods system and its demise: The Bretton Woods system aimed to create a stable and predictable international monetary system after World War II. However, growing imbalances in international trade and persistent inflation in the United States ultimately undermined the system's stability. Nixon's decision was a response to these pressures and a bid to regain control over the U.S. economy.

-

Explanation of the gold standard and its abandonment: The gold standard, where currencies were backed by gold reserves, provided a sense of security and stability. Abandoning it meant the U.S. dollar became a fiat currency—its value determined by market forces rather than a fixed amount of gold.

-

Short-term and long-term consequences of the Nixon Shock on the U.S. dollar's value: The immediate impact was a devaluation of the U.S. dollar against other currencies. In the long term, the shift to a fiat currency increased the U.S. government’s flexibility in managing monetary policy but also introduced greater volatility into the exchange rate markets.

-

Impact on inflation and international trade: The Nixon Shock contributed to increased inflation in the U.S. and globally. The floating exchange rate regime that emerged after Bretton Woods made international trade more complex and exposed businesses to greater currency risk.

The Reagan Era and Supply-Side Economics (1981-1989)

The Reagan administration's economic policies, often referred to as "Reaganomics," focused on supply-side economics, emphasizing tax cuts and deregulation to stimulate economic growth. These policies had a profound impact on the U.S. dollar.

-

Explanation of supply-side economics and its intended effects: Supply-side economics argued that reducing taxes would incentivize investment, production, and employment, ultimately leading to higher economic growth.

-

The impact of Reaganomics on inflation and the value of the dollar: While Reaganomics initially contributed to a strong dollar, it also led to a significant increase in the national debt. The strong dollar made U.S. exports more expensive, impacting American businesses.

-

The role of the strong dollar in the 1980s and its implications for American businesses: The high value of the dollar during the 1980s made American goods less competitive in international markets, contributing to trade deficits.

-

Discussion of the national debt under Reagan: The combination of tax cuts and increased military spending resulted in a substantial rise in the national debt during the Reagan years, laying the groundwork for future economic challenges.

The Greenspan Years and the Dot-com Bubble (1987-2006)

Alan Greenspan's tenure as Federal Reserve Chairman (1987-2006) was a period of significant economic growth punctuated by the dot-com bubble and its subsequent burst. His approach to monetary policy profoundly impacted the U.S. dollar.

-

Greenspan's approach to interest rate management: Greenspan's focus was on maintaining price stability and avoiding inflation through careful management of interest rates. His actions often involved subtle adjustments to keep the economy on a steady course.

-

The role of the Federal Reserve in managing inflation and the dollar's value: The Federal Reserve's influence on interest rates directly impacts the value of the U.S. dollar, influencing investment flows and exchange rates.

-

Analysis of the dot-com bubble and its impact on the economy and the dollar: The rapid growth and subsequent collapse of the dot-com bubble showed the vulnerabilities of the economy and the challenges of managing rapid technological and economic change.

-

Discussion of the early stages of globalization and its effect on the U.S. dollar: Globalization intensified during Greenspan's tenure, leading to increased capital flows and greater interconnectedness of global financial markets, which increased the complexity of managing the U.S. dollar's value.

The 21st Century and Beyond: From the 2008 Financial Crisis to the Present

The 21st century has presented unprecedented challenges to the U.S. dollar, including the 2008 financial crisis and the rise of competing global currencies.

-

The role of the U.S. dollar in the global financial system: The U.S. dollar remains the world's dominant reserve currency, but its position is being challenged by the rise of other currencies like the Euro and the Chinese Yuan.

-

The impact of quantitative easing on the dollar's value and inflation: Quantitative easing (QE), a monetary policy tool used to stimulate the economy after the 2008 crisis, involved the Federal Reserve injecting vast sums of money into the financial system. This had implications for the dollar's value and the potential for future inflation.

-

The rise of other global currencies and the changing global economic landscape: The emergence of new economic powers like China and the increasing use of alternative payment systems are reshaping the global economic landscape and the role of the U.S. dollar.

-

Analysis of current economic policies and their potential impact on the future of the U.S. dollar: Current economic policies, including fiscal and monetary policies, will continue to shape the future value and role of the U.S. dollar in the global economy.

The Impact of Presidential Decisions on Monetary Policy

The relationship between the Presidency and monetary policy is crucial in understanding the fluctuations of the U.S. dollar. Presidential administrations, through their appointments to the Federal Reserve Board and their overall economic philosophies, significantly influence the course of monetary policy.

-

Examples of how different presidential administrations prioritized economic growth, inflation control, or other goals: Different presidents have prioritized different economic goals, leading to varying monetary policies and their consequential impact on the U.S. dollar's value. For example, some administrations have focused on controlling inflation, even at the cost of slower economic growth, while others have prioritized job creation, even if it meant risking higher inflation.

-

How these priorities shaped the actions of the Federal Reserve and other economic bodies: The Federal Reserve, while independent, operates within the broader economic context set by the administration. Presidential appointments to the Federal Reserve Board reflect the administration's economic priorities.

-

The resulting impacts on interest rates, exchange rates, and the overall health of the U.S. economy: These decisions have far-reaching implications for interest rates, exchange rates, inflation, employment, and the overall health of the U.S. economy.

Conclusion

The history of the U.S. dollar is inextricably linked to the decisions and policies of successive presidencies. From Nixon's shock to the complexities of the 21st-century global economy, understanding this relationship is crucial. Each presidency has faced unique challenges and implemented distinct approaches to managing the U.S. dollar, resulting in both periods of prosperity and instability. This historical analysis highlights the critical interplay between presidential leadership and the health of the U.S. dollar, demonstrating that its future remains dependent on well-informed and effective economic policies. Further research into the specific economic decisions made by each administration can provide a deeper understanding of the intricacies of the U.S. dollar and its trajectory under different presidencies. Continue your exploration of the U.S. dollar's impact on American history and the global economy. Understanding the U.S. dollar's past is key to navigating its future.

Featured Posts

-

Capital Summertime Ball 2025 Tickets The Ultimate Guide To Purchase

Apr 29, 2025

Capital Summertime Ball 2025 Tickets The Ultimate Guide To Purchase

Apr 29, 2025 -

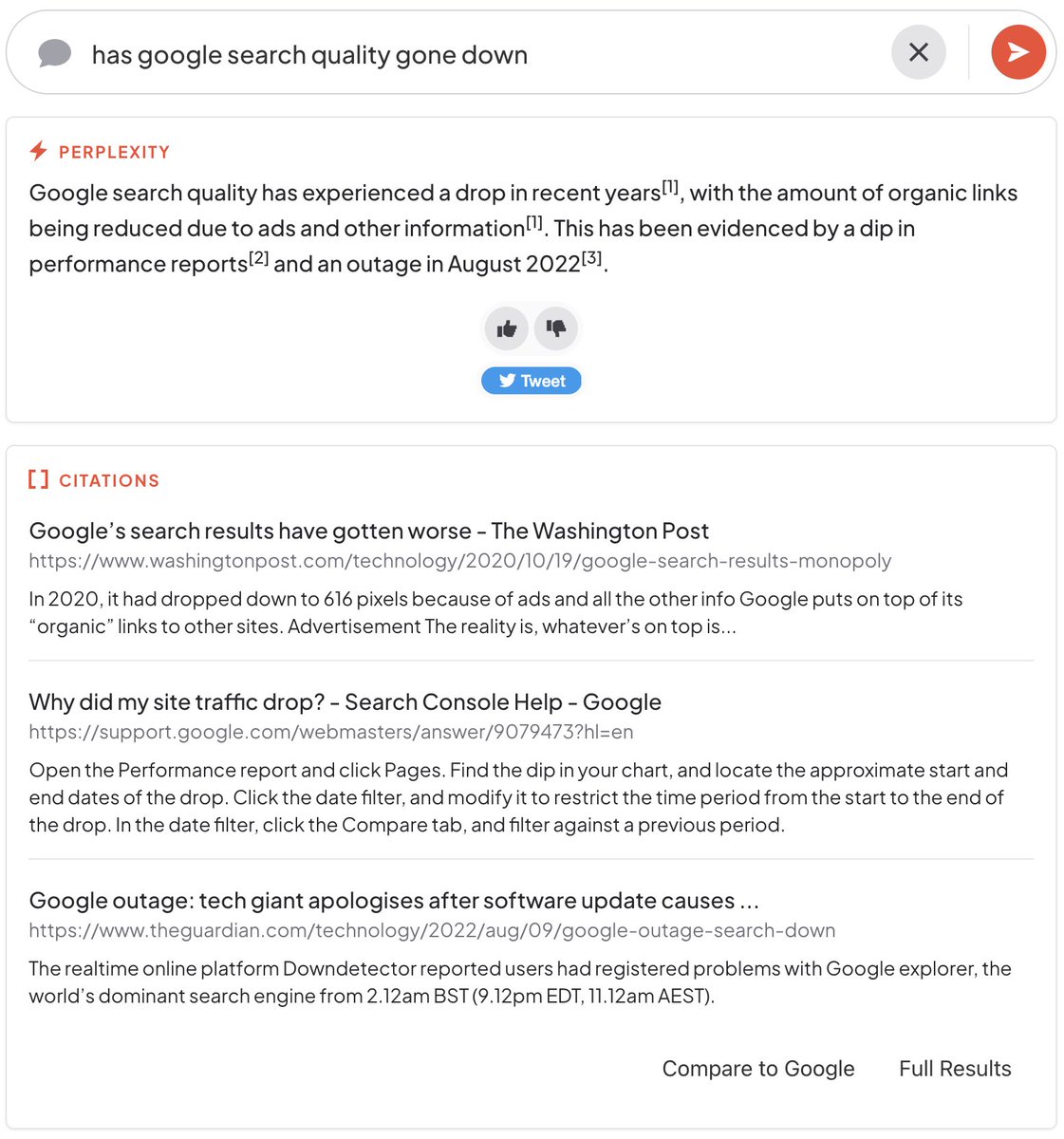

Perplexity Ceo On Disrupting Google In The Emerging Ai Browser Market

Apr 29, 2025

Perplexity Ceo On Disrupting Google In The Emerging Ai Browser Market

Apr 29, 2025 -

Dows Alberta Megaproject Tariff Delays And Economic Consequences

Apr 29, 2025

Dows Alberta Megaproject Tariff Delays And Economic Consequences

Apr 29, 2025 -

Adhd Medisinering Og Skole Funn Fra Ny Fhi Rapport

Apr 29, 2025

Adhd Medisinering Og Skole Funn Fra Ny Fhi Rapport

Apr 29, 2025 -

The China Factor Assessing Risks And Opportunities For Global Automakers

Apr 29, 2025

The China Factor Assessing Risks And Opportunities For Global Automakers

Apr 29, 2025

Latest Posts

-

The Truth Behind Jessica Simpsons Snake Sperm Statement

May 12, 2025

The Truth Behind Jessica Simpsons Snake Sperm Statement

May 12, 2025 -

Remembering A Fallen Hero Fremont Firefighter Honored

May 12, 2025

Remembering A Fallen Hero Fremont Firefighter Honored

May 12, 2025 -

National Fallen Firefighters Memorial A Fremont Hero Remembered

May 12, 2025

National Fallen Firefighters Memorial A Fremont Hero Remembered

May 12, 2025 -

The Jessica Simpson Jeremy Renner Connection A Timeline Of Events

May 12, 2025

The Jessica Simpson Jeremy Renner Connection A Timeline Of Events

May 12, 2025 -

I Foni Tis Tzesika Simpson Mythos I Pragmatikotita I Methodos Me To Fidisio Sperma

May 12, 2025

I Foni Tis Tzesika Simpson Mythos I Pragmatikotita I Methodos Me To Fidisio Sperma

May 12, 2025