The Uber (UBER) Investment Case: A Detailed Look

Table of Contents

The ride-sharing giant, Uber (UBER), has revolutionized transportation. But is investing in UBER stock a smart move? This detailed look analyzes the Uber investment case, weighing its potential for growth against inherent risks. We'll examine its financial performance, future prospects, and competitive landscape to help you decide if Uber is a worthwhile addition to your portfolio.

Uber's Business Model and Market Position

Dominance in Ride-Sharing

Uber's global reach and brand recognition are undeniable competitive advantages. Its network effect – the more users, the more valuable the service becomes – creates a significant barrier to entry for competitors.

- Market Share: While exact figures vary by region, Uber consistently holds a substantial market share in most major cities worldwide, often exceeding 70% in some areas.

- Geographic Reach: Uber operates in thousands of cities across numerous countries, providing extensive coverage and a vast user base.

- Brand Strength: Uber's branding is globally recognized, synonymous with convenient and readily available transportation. This strong brand recognition translates directly into customer loyalty and higher market penetration compared to rivals like Lyft.

Uber's scale allows for economies of scale, enabling it to negotiate favorable rates with drivers and offer competitive pricing to consumers. This competitive pricing strategy, coupled with its vast network, solidifies its position as a market leader.

Diversification Beyond Rides

Uber's strategy extends far beyond its core ride-sharing business. Uber Eats, its food delivery service, and Uber Freight, its logistics platform, are key diversification initiatives contributing significantly to revenue and growth potential.

- Revenue Breakdown: While ride-sharing remains the largest revenue generator, Uber Eats and Uber Freight are experiencing rapid growth, providing diversification and mitigating reliance on a single service.

- Segment Growth Rates: Both Uber Eats and Uber Freight show strong growth potential, tapping into large and expanding markets. The food delivery market, for instance, is experiencing explosive growth, while the freight market offers a significant opportunity for technological disruption and efficiency gains.

- Market Analysis: Uber Eats competes in a highly competitive food delivery market against established players like DoorDash and Grubhub. However, its existing user base and brand recognition offer a substantial competitive advantage. Uber Freight is positioned to disrupt the traditional trucking industry through technology-driven efficiency improvements.

This diversification is crucial for mitigating risk. If one segment experiences a downturn, others can help cushion the blow, leading to more stable financial performance for the UBER stock.

Financial Performance and Growth Prospects

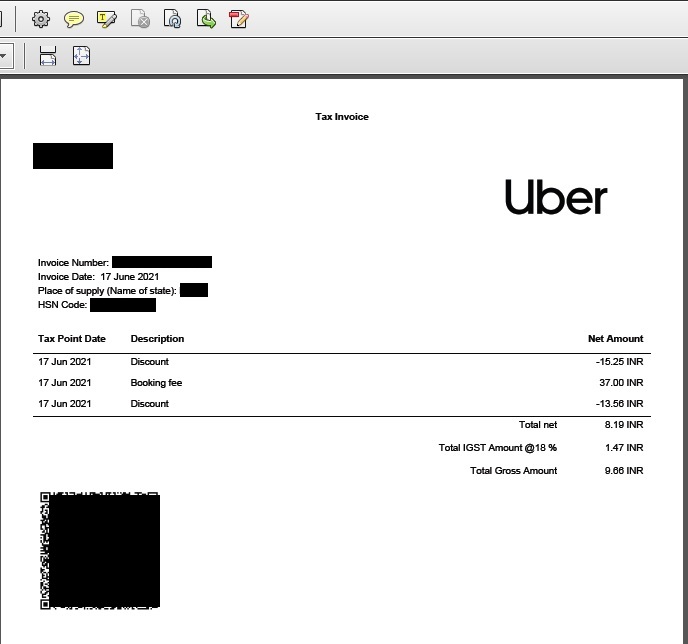

Revenue and Profitability

Analyzing Uber's financial statements reveals fluctuating profitability. While revenue has grown steadily, achieving profitability has been a challenge, particularly on a net income basis.

- Key Financial Data Points: Investors should examine key metrics such as total revenue, operating income, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), and net income. Closely monitoring debt levels is also crucial.

- Year-over-Year Comparison: Comparing these metrics year-over-year will help illustrate growth trends and identify any significant changes in financial performance. Benchmarking against industry peers provides valuable context.

- Profitability Trends: Understanding the factors influencing profitability, such as operating expenses, marketing costs, and driver compensation, is essential for making informed investment decisions.

Understanding these trends and their underlying drivers is crucial to assessing the long-term viability of the UBER stock.

Future Growth Drivers

Several factors could drive future growth for Uber:

- New Market Expansion: Expanding into underserved regions and developing countries presents significant growth opportunities.

- Technological Innovation: Investments in autonomous vehicles and other technological advancements could revolutionize the transportation and logistics industries, offering substantial long-term advantages.

- Increased Service Adoption: Further penetration into existing markets, particularly for Uber Eats and Uber Freight, will contribute to revenue growth.

These factors could significantly impact the company's financial performance and valuation, making a detailed analysis critical before considering an Uber (UBER) investment.

Risks and Challenges Facing Uber

Regulatory Hurdles

The ride-sharing industry faces significant regulatory challenges globally. These regulations can impact Uber's operations and profitability.

- Regional Variations: Regulatory environments differ significantly across various regions, leading to varying operational costs and compliance burdens.

- Potential Changes: Future changes in regulations could introduce new costs or restrictions, potentially impacting Uber's profitability and growth.

- Impact on Operational Costs: Compliance with regulations, including licensing fees and background checks, can significantly impact operating costs.

Navigating these regulatory hurdles effectively is crucial for Uber's continued success.

Competition and Market Saturation

The ride-sharing market is highly competitive, with existing and potential competitors constantly vying for market share.

- Key Competitors: Lyft is a major competitor in the US, while other regional players exist globally.

- Competitive Strategies: Analyzing the competitive strategies employed by rivals is essential in assessing Uber's market position and future growth.

- Market Saturation: The potential for market saturation in established markets presents a significant challenge for continued growth.

Intense competition can put pressure on pricing, impacting Uber's profitability and market share.

Driver Relations and Labor Costs

The relationship between Uber and its drivers is a critical factor influencing its operating costs and public perception.

- Driver Compensation Models: The compensation model for drivers significantly impacts Uber's operating costs and driver satisfaction.

- Independent Contractor Classification: The classification of drivers as independent contractors is a point of ongoing legal and regulatory scrutiny.

- Potential for Unionization: The potential for driver unionization could significantly impact labor costs and operational dynamics.

Maintaining a positive relationship with drivers is vital for Uber's long-term sustainability.

Conclusion

The Uber (UBER) investment case presents a multifaceted picture. While Uber dominates ride-sharing and is diversifying successfully, regulatory hurdles, competition, and labor relations pose substantial challenges. A thorough analysis of its financial performance, growth prospects, and risks is paramount before investing in UBER stock. Remember to conduct your own thorough due diligence and consult with a financial advisor before making any investment decisions. Is the Uber (UBER) investment ride right for your portfolio? Only careful consideration of the factors discussed above can help you decide.

Featured Posts

-

Vitor Kley Homenagem Comovente Ao Pai Ivan Kley

May 19, 2025

Vitor Kley Homenagem Comovente Ao Pai Ivan Kley

May 19, 2025 -

The Resurrection Of Lazarus In Jerusalem A Biblical Account And Its Impact

May 19, 2025

The Resurrection Of Lazarus In Jerusalem A Biblical Account And Its Impact

May 19, 2025 -

Eurovision 2025 United Kingdoms 19th Place Finish

May 19, 2025

Eurovision 2025 United Kingdoms 19th Place Finish

May 19, 2025 -

Czy Eurowizja Jest Zagrozona Trudnosci Justyny Steczkowskiej

May 19, 2025

Czy Eurowizja Jest Zagrozona Trudnosci Justyny Steczkowskiej

May 19, 2025 -

Stefanos Stefanu Kibris Sorununda Oenemli Bir Rol

May 19, 2025

Stefanos Stefanu Kibris Sorununda Oenemli Bir Rol

May 19, 2025