Three More Bank Of Canada Rate Cuts Predicted By Desjardins

Table of Contents

Desjardins' Rationale Behind the Prediction

Desjardins' prediction of three further Bank of Canada rate cuts rests on several key economic indicators and factors. Their analysis suggests a more cautious approach is needed to navigate the current economic climate.

-

Inflationary Pressures and Their Projected Trajectory: While inflation has begun to ease, Desjardins believes the current rate remains stubbornly high, necessitating further monetary easing. They project a slower-than-anticipated decline in inflation over the coming months.

-

Current Economic Growth and Forecasts: Desjardins' economists foresee slower economic growth in the near term than previously anticipated. This sluggish growth, combined with persistent inflationary pressures, justifies their call for further rate cuts.

-

Employment Data and Trends: While the unemployment rate remains relatively low, Desjardins points to softening employment data as a signal of potential economic weakness, supporting the need for stimulus through lower interest rates.

-

Comparison with Other Central Banks' Actions: Desjardins' analysis incorporates a comparison with the monetary policies of other major central banks globally. The actions (or inaction) of these institutions influence their assessment of the appropriate path for the Bank of Canada.

-

Potential Risks and Uncertainties Affecting the Canadian Economy: Geopolitical instability, global supply chain disruptions, and the lingering effects of the pandemic all contribute to the uncertainty in Desjardins' economic outlook, making further rate cuts a prudent measure to mitigate risk.

Potential Impact of Further Bank of Canada Rate Cuts on the Canadian Economy

Further Bank of Canada rate cuts could have a multifaceted impact on the Canadian economy, presenting both opportunities and challenges.

-

Stimulating Economic Growth and Consumer Spending: Lower interest rates typically lead to cheaper borrowing costs, encouraging businesses to invest and consumers to spend, thereby boosting economic activity.

-

Impact on Borrowing Costs for Businesses and Individuals (Mortgages, Loans): Reduced interest rates translate to lower mortgage payments for homeowners and lower borrowing costs for businesses seeking loans for expansion or investment. This could be a significant boon for those with existing debt.

-

Potential for Increased Inflation if Cuts are Too Aggressive: The risk of further rate cuts lies in the potential to fuel inflation. If the cuts are too significant or implemented too rapidly, it could lead to a resurgence of price increases.

-

Effects on the Canadian Dollar Exchange Rate: Lower interest rates can weaken the Canadian dollar relative to other currencies, potentially impacting import and export prices.

-

Implications for Investment Strategies: Lower interest rates influence investment strategies, making certain assets more attractive than others. Investors may need to re-evaluate their portfolios to adapt to the changing environment.

Impact on Mortgages and Housing Market

Lower interest rates are generally expected to stimulate the housing market. Reduced mortgage rates can make homes more affordable, potentially increasing demand and driving up prices. However, the extent of this effect will depend on other market factors, such as supply and government regulations.

Impact on Savings and Investments

Lower interest rates directly impact returns on savings accounts and bonds. Savers may see a reduction in the interest earned on their deposits. Conversely, lower rates may make certain investments, such as equities, relatively more attractive. Diversification of investments becomes even more crucial in a low-interest-rate environment to mitigate risk and potentially capture growth opportunities.

Alternative Perspectives and Potential Risks

While Desjardins predicts three more Bank of Canada rate cuts, it's essential to consider alternative viewpoints and potential risks.

-

Arguments Against Further Rate Cuts: Some economists argue that further rate cuts could exacerbate inflation and potentially destabilize the economy. They might favor a more cautious approach, waiting for clearer signs of economic weakness before implementing further monetary easing.

-

Risks Associated with Lower Interest Rates: Lower rates carry the risk of fueling excessive borrowing, potentially leading to asset bubbles and financial instability. The risk of inflation resurgence is also a significant concern.

-

Potential for Unexpected Economic Shifts: Unforeseen economic events, both domestic and international, could significantly impact the effectiveness of further rate cuts and the overall economic outlook.

-

Other Financial Experts' Opinions and Forecasts: It’s important to note that not all financial experts agree with Desjardins' forecast. Comparing different perspectives is vital for a comprehensive understanding.

Conclusion

Desjardins' prediction of three more Bank of Canada rate cuts highlights the complexities of the current economic landscape. While lower interest rates offer the potential for stimulating economic growth and boosting consumer spending, they also carry risks, including increased inflation and potential financial instability. Understanding the potential consequences of these Bank of Canada rate cuts is crucial for both businesses and individuals. The impact on mortgages, savings, and investments warrants careful consideration.

To navigate this uncertain terrain effectively, we strongly recommend consulting with a qualified financial advisor to discuss how these potential Bank of Canada rate cuts might specifically affect your personal financial situation and investment strategies. Stay informed about further developments by researching Bank of Canada rate cut predictions and their impact, and consider subscribing to our newsletter or following our social media for updates on this evolving situation.

Featured Posts

-

Erik Ten Hag Leverkusens Second Choice Latest Man Utd Manager News

May 23, 2025

Erik Ten Hag Leverkusens Second Choice Latest Man Utd Manager News

May 23, 2025 -

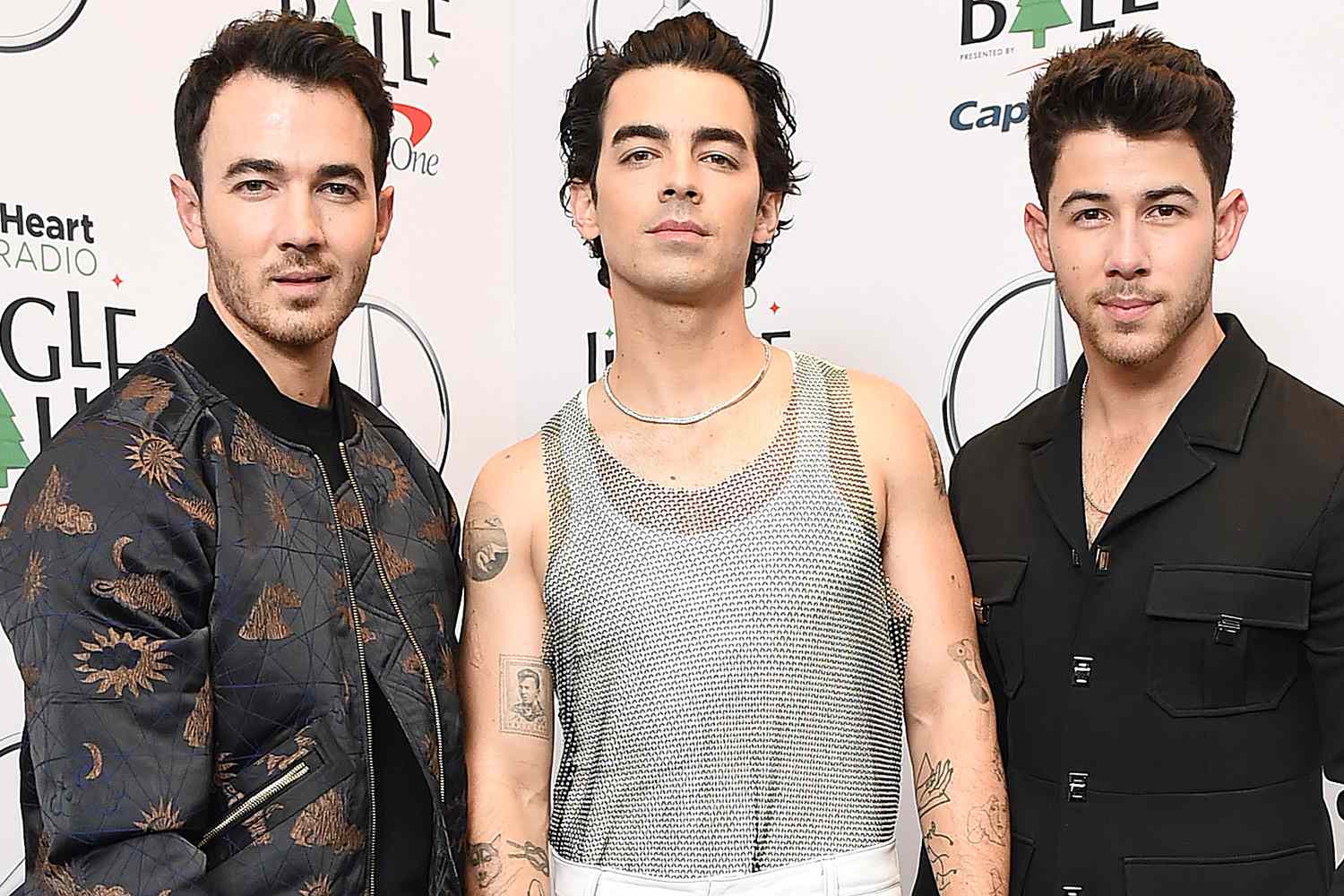

The Jonas Brothers Joe Jonas His Response To A Marital Dispute

May 23, 2025

The Jonas Brothers Joe Jonas His Response To A Marital Dispute

May 23, 2025 -

Confirmed Englands Playing Xi Vs Zimbabwe

May 23, 2025

Confirmed Englands Playing Xi Vs Zimbabwe

May 23, 2025 -

Emissary Alleges Hamas Duplicity The Witkoff Story

May 23, 2025

Emissary Alleges Hamas Duplicity The Witkoff Story

May 23, 2025 -

Mort D Un Motard A Seoul Suite A L Effondrement D Une Route Photos

May 23, 2025

Mort D Un Motard A Seoul Suite A L Effondrement D Une Route Photos

May 23, 2025

Latest Posts

-

Find The Answers Nyt Mini Crossword Hints Sunday April 19th

May 23, 2025

Find The Answers Nyt Mini Crossword Hints Sunday April 19th

May 23, 2025 -

Investigation Launched Into Sexist Abuse Of Female Referee

May 23, 2025

Investigation Launched Into Sexist Abuse Of Female Referee

May 23, 2025 -

March 12 2025 Nyt Mini Crossword Complete Answers And Clues

May 23, 2025

March 12 2025 Nyt Mini Crossword Complete Answers And Clues

May 23, 2025 -

Sexist Chants Aimed At Female Referee Spark Investigation

May 23, 2025

Sexist Chants Aimed At Female Referee Spark Investigation

May 23, 2025 -

Nrw Eis Trend Diese Sorte Liegt Vorn

May 23, 2025

Nrw Eis Trend Diese Sorte Liegt Vorn

May 23, 2025