Thursday's Downturn In CoreWeave (CRWV): A Comprehensive Explanation

Table of Contents

Analyzing the Factors Contributing to the CRWV Stock Decline

Several interconnected factors likely contributed to the sharp decline in CoreWeave's stock price on Thursday. Let's examine the most significant ones:

Market-Wide Sentiment and the Tech Sector Sell-Off

Thursday's market downturn wasn't isolated to CoreWeave. The broader tech sector experienced a significant sell-off, with major market indices like the Nasdaq experiencing a [Insert Percentage]% decline. This negative market sentiment, driven by [Insert Reason for Broad Market Sell-off, e.g., rising interest rates, concerns about inflation], significantly impacted investor confidence and triggered widespread selling, including in the CRWV stock.

- Negative investor sentiment spilled over from the broader market.

- The Nasdaq and other tech-heavy indices experienced considerable losses.

- Concerns about [Specific Economic Factors] likely contributed to the overall market downturn.

Absence of Significant News or Earnings Announcements

The suddenness of the CRWV stock drop is notable, given the absence of any major negative news releases or earnings announcements from CoreWeave on Thursday. This absence suggests that the decline might have been influenced by factors beyond company-specific news. One possibility is the impact of algorithmic trading, where automated systems react to broader market trends, causing cascading sell-offs.

- No negative press releases or earnings reports preceded the drop.

- Algorithmic trading could have amplified the sell-off based on broader market movements.

- A lack of significant news contributed to the unexpected nature of the decline.

Potential Impact of Competitor Activity

While no specific news emerged regarding competitor actions, the competitive landscape of the cloud computing and AI infrastructure markets is intense. Aggressive pricing strategies, new product launches, or strategic partnerships by competitors like [Mention Specific Competitors, e.g., AWS, Google Cloud, Azure] could have indirectly pressured CRWV's stock price. Further investigation into competitor activities around the time of the drop is warranted.

- Increased competition in the cloud computing and AI infrastructure sector is a constant factor.

- Actions by major competitors could influence investor perception of CoreWeave's market share and future growth.

- Analyzing competitor strategies is crucial for understanding the context of the stock decline.

Technical Analysis of the CRWV Stock Chart

A technical analysis of the CRWV stock chart offers further insights into Thursday's downturn.

Chart Patterns and Indicators

Examining the CRWV stock chart reveals [Describe observable chart patterns, e.g., a bearish candlestick pattern, a break below a key support level]. Technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) may also show signs of oversold conditions or bearish momentum preceding the drop. Analyzing these indicators can help understand the technical factors contributing to the sell-off.

- [Specific Chart Pattern Observed] indicated potential selling pressure.

- RSI and MACD readings might have shown bearish signals before the drop.

- Support and resistance levels on the chart can provide context for the price movement.

Trading Volume and Volatility

The trading volume on Thursday compared to previous days is crucial. An unusually high volume accompanying the price decline would suggest significant selling pressure. Examining the stock's volatility relative to the broader market will help determine if the CRWV stock was disproportionately affected by the overall market downturn.

- High trading volume on Thursday would confirm significant selling pressure.

- Comparing CRWV's volatility to market volatility provides context.

- Unusual spikes in trading volume often accompany significant price movements.

Long-Term Implications for CoreWeave (CRWV)

Thursday's downturn raises questions about the long-term implications for CoreWeave.

Investor Confidence and Future Outlook

The impact of Thursday's drop on investor confidence is a key concern. While a short-term decline doesn't necessarily reflect the company's long-term potential, it could impact investor sentiment and future investment decisions. However, CoreWeave's strong positioning in the rapidly growing cloud computing and AI markets suggests significant growth potential.

- The short-term impact on investor confidence needs careful monitoring.

- CoreWeave’s long-term prospects in the cloud and AI markets remain promising.

- Further analysis of the company's financials and growth strategy is needed.

Potential Recovery Strategies

CoreWeave may need to implement strategies to regain investor trust and recover from the stock drop. These strategies could include enhancing investor relations, clarifying its growth strategy, and perhaps adjusting its financial guidance.

- Improved communication with investors can rebuild confidence.

- A clear and well-communicated growth strategy can attract investment.

- Potential adjustments to financial guidance might be necessary.

Conclusion: Understanding and Navigating Thursday's Downturn in CoreWeave (CRWV)

Thursday's decline in CoreWeave (CRWV) stock resulted from a confluence of factors: a broad tech sector sell-off fueled by negative market sentiment, the absence of company-specific negative news, potential competitive pressures, and technical indicators suggesting a bearish trend. Understanding these multifaceted influences is crucial for navigating market fluctuations. While the stock market inherently involves uncertainty and complexity, diligent analysis, including monitoring key technical indicators and staying informed about industry news, can help investors make informed decisions. To further your understanding, conduct thorough CoreWeave stock analysis using reputable financial news sources and technical analysis tools. Monitor CRWV closely for future developments and consider developing a robust CRWV investment strategy based on your risk tolerance and long-term goals.

Featured Posts

-

Invasive Zebra Mussels A Casper Boat Lift Infestation

May 22, 2025

Invasive Zebra Mussels A Casper Boat Lift Infestation

May 22, 2025 -

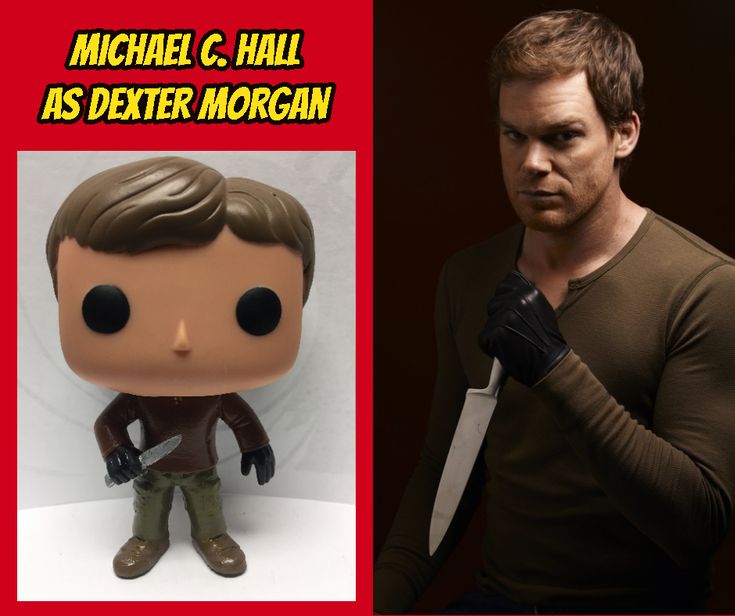

Funkos Dexter Pop Vinyl Figures First Look

May 22, 2025

Funkos Dexter Pop Vinyl Figures First Look

May 22, 2025 -

The Thames Water Executive Bonus Debate Facts And Figures

May 22, 2025

The Thames Water Executive Bonus Debate Facts And Figures

May 22, 2025 -

Dexter Resurrection De Terugkeer Van John Lithgow En Jimmy Smits

May 22, 2025

Dexter Resurrection De Terugkeer Van John Lithgow En Jimmy Smits

May 22, 2025 -

Find The Perfect Outdoor Patio A Guide To Manhattans Al Fresco Restaurants

May 22, 2025

Find The Perfect Outdoor Patio A Guide To Manhattans Al Fresco Restaurants

May 22, 2025

Latest Posts

-

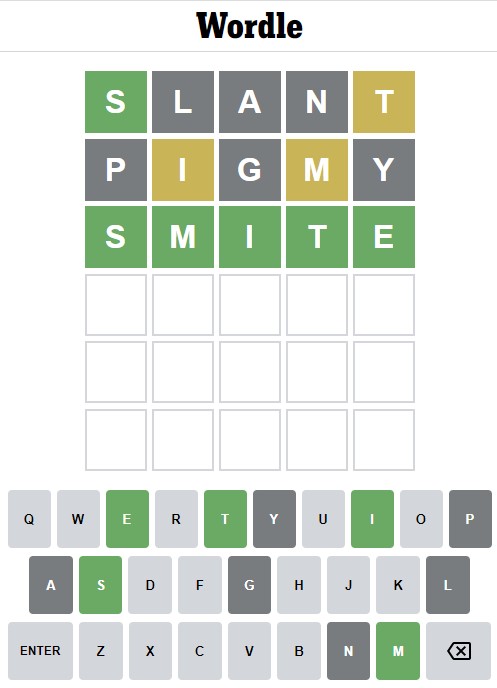

Wordle April 26 2025 Tips Clues And The Wordle Answer

May 22, 2025

Wordle April 26 2025 Tips Clues And The Wordle Answer

May 22, 2025 -

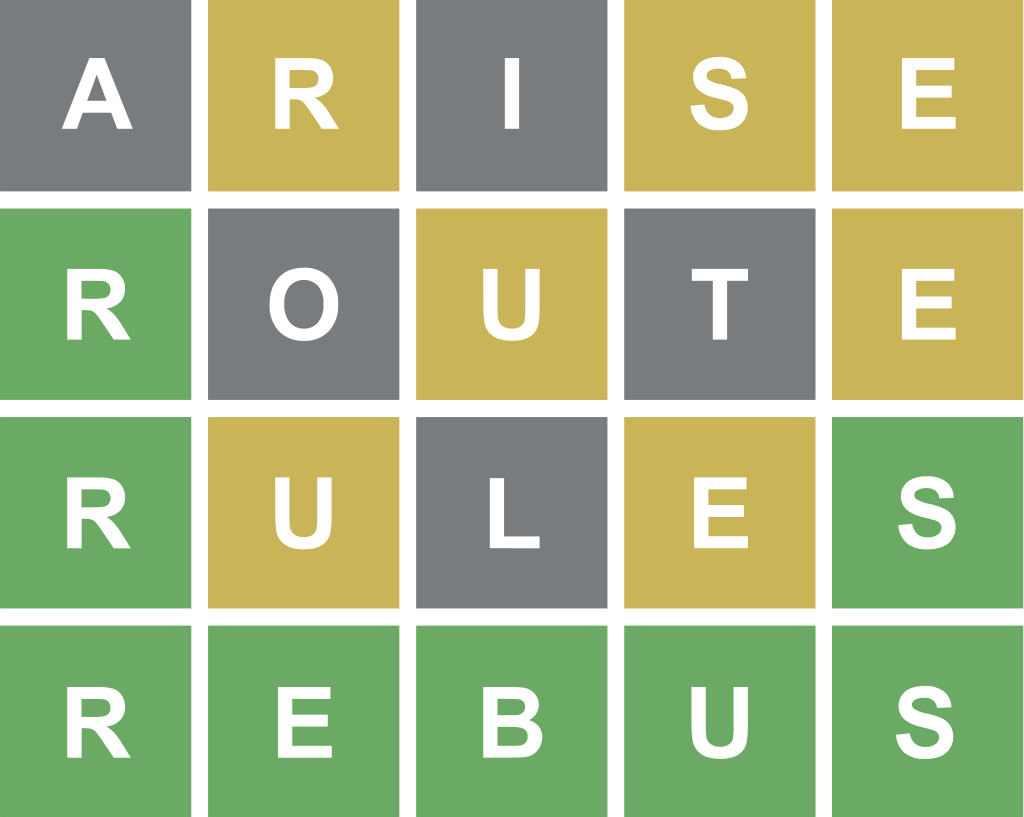

Wordle 370 March 20 Find The Answer With Our Hints And Clues

May 22, 2025

Wordle 370 March 20 Find The Answer With Our Hints And Clues

May 22, 2025 -

Wordle Hints And Answer March 20th 370

May 22, 2025

Wordle Hints And Answer March 20th 370

May 22, 2025 -

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025 -

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025