To Buy Or Not To Buy Palantir Stock Before May 5th?

Table of Contents

Palantir's Recent Financial Performance and Future Projections

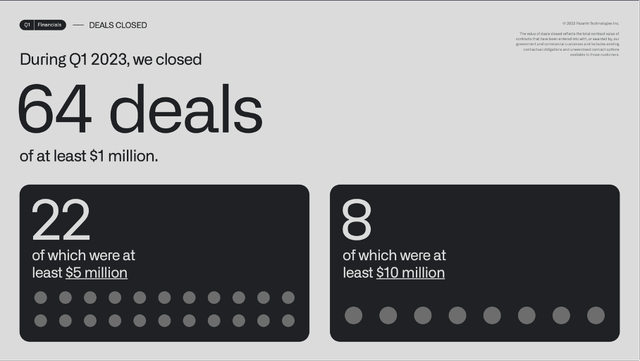

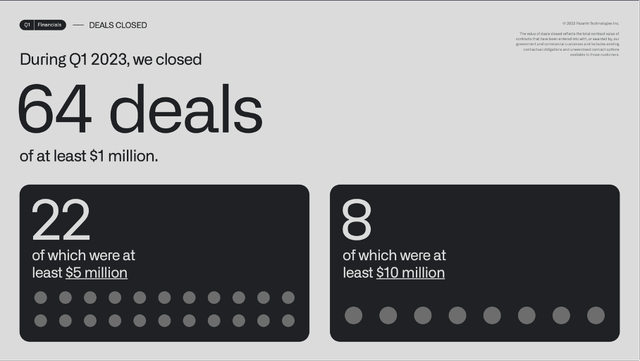

Palantir's recent financial reports offer a mixed bag. While the company consistently demonstrates strong revenue growth, fueled by its government and commercial contracts, profitability remains a key focus. Analyzing Palantir earnings is crucial for understanding its trajectory. Let's examine some key aspects:

-

Quarterly and Annual Earnings: Review Palantir's latest quarterly earnings reports for revenue figures, growth percentages, and net income (or loss). Look for trends in revenue growth, identifying periods of acceleration or deceleration. Compare this to previous years' performance for a comprehensive picture.

-

Key Performance Indicators (KPIs): Beyond revenue, focus on KPIs such as customer acquisition cost (CAC), average revenue per user (ARPU), and operating margins. A declining CAC signals increasing efficiency, while rising ARPU suggests higher customer value. Improving operating margins suggest better cost management.

-

Significant Contracts: Pay close attention to any major contracts won or lost. Government contracts, especially, can significantly influence Palantir's revenue stream and overall financial health. Note the size and duration of these contracts.

-

Analyst Predictions and Price Targets: Research analyst ratings and price targets for PLTR stock. While these predictions aren't guarantees, they offer insights into market sentiment and expected future performance. Consider the range of predictions to understand the potential variability.

Key Metrics to Watch:

- Revenue growth rate: A consistently high revenue growth rate indicates strong market demand and business expansion.

- Profit margins: Improving profit margins indicate better cost control and higher profitability.

- Customer acquisition cost: A decreasing CAC suggests efficient marketing and sales strategies.

- Debt-to-equity ratio: A healthy debt-to-equity ratio points to responsible financial management.

Market Trends and Industry Outlook for Palantir

The technology sector, particularly the big data analytics market, is highly competitive. Palantir's position within this landscape is a critical factor in assessing its stock's potential.

-

Technology Sector Outlook: Analyze the overall health of the technology sector. Economic downturns can negatively impact technology spending, while periods of growth often fuel increased investment in data analytics solutions.

-

Competitive Landscape: Identify Palantir's main competitors and evaluate their relative strengths and weaknesses. Consider their market share, innovation, and financial performance. This competitive analysis is crucial for understanding Palantir's position.

-

Geopolitical and Economic Factors: Geopolitical instability and economic slowdowns can impact government spending on technologies such as Palantir's, influencing its contracts and revenue streams.

Factors Influencing Palantir's Stock Price:

- Overall market sentiment: Positive market sentiment generally boosts stock prices, while negative sentiment can lead to declines.

- News and announcements: Major announcements from Palantir, such as new product launches or partnerships, can significantly impact investor sentiment and the stock price.

- Analyst ratings and upgrades/downgrades: Positive ratings and upgrades can drive up the stock price, while negative ratings and downgrades can lead to declines.

- Competitor activity: The actions of Palantir's competitors can indirectly affect its stock price.

Upcoming Events and Their Potential Impact on Palantir Stock

Upcoming events, such as earnings calls and product launches, can significantly influence investor sentiment and stock price volatility. Identifying these events and their potential impact is crucial.

-

Earnings Calls: Palantir's earnings calls provide updates on the company's financial performance and future outlook. These calls often lead to increased stock price volatility.

-

Product Launches and Partnerships: New product launches and partnerships can signal innovation and growth potential, positively impacting investor sentiment.

-

Potential Surprises: Be prepared for potential positive or negative surprises that could cause sudden shifts in the stock price.

Key Events to Consider Before May 5th:

- Identify any scheduled earnings calls, product launches, or significant partnership announcements before May 5th.

- Assess the potential positive or negative impact of each event on investor sentiment and the stock price.

Risk Assessment and Investment Strategies

Investing in Palantir stock carries inherent risks. Understanding these risks and developing a suitable investment strategy are crucial for mitigating potential losses.

-

Volatility: PLTR stock is known for its volatility. Be prepared for significant price fluctuations.

-

Competition: The competitive nature of the big data analytics market presents a risk.

-

Regulatory Risks: Government regulations could impact Palantir's business operations.

-

Long-Term vs. Short-Term Investments: Consider your investment horizon. A long-term investment strategy might be better suited to handle the volatility of Palantir's stock.

Mitigation Strategies:

- Dollar-cost averaging: Invest a fixed amount of money at regular intervals, reducing the impact of price fluctuations.

- Diversifying your portfolio: Don't put all your eggs in one basket. Spread your investments across different asset classes to reduce overall risk.

- Setting stop-loss orders: Set a price at which you're willing to sell your shares to limit potential losses.

Conclusion: Should You Buy Palantir Stock Before May 5th?

Based on our analysis of Palantir's financial performance, market trends, upcoming events, and inherent risks, the decision to buy Palantir stock before May 5th is complex and depends on your individual risk tolerance and investment strategy. While Palantir exhibits strong revenue growth and operates in a growing market, its profitability and stock price volatility remain concerns. Consider the potential impact of upcoming events before making a decision.

Remember, this analysis is for informational purposes only and does not constitute financial advice. Conduct your own thorough research and consider consulting a financial advisor before making any investment decisions. Make an informed decision about your Palantir investment. Is Palantir stock right for your portfolio? Learn more about investing in Palantir and consider your investment strategy regarding Palantir stock before May 5th.

Featured Posts

-

Hertls Historic Night Two Hat Tricks In One Month

May 09, 2025

Hertls Historic Night Two Hat Tricks In One Month

May 09, 2025 -

Indian Stock Market Sensex And Nifty Current Levels And Days Trading Summary

May 09, 2025

Indian Stock Market Sensex And Nifty Current Levels And Days Trading Summary

May 09, 2025 -

Daycare Vs Babysitter A Cost Comparison Following A 3 000 Babysitting Bill

May 09, 2025

Daycare Vs Babysitter A Cost Comparison Following A 3 000 Babysitting Bill

May 09, 2025 -

3e Ligne De Tram A Dijon La Concertation Citoyenne Adoptee Par Le Conseil Metropolitain

May 09, 2025

3e Ligne De Tram A Dijon La Concertation Citoyenne Adoptee Par Le Conseil Metropolitain

May 09, 2025 -

Chinas Canola Imports A Diversification Strategy

May 09, 2025

Chinas Canola Imports A Diversification Strategy

May 09, 2025