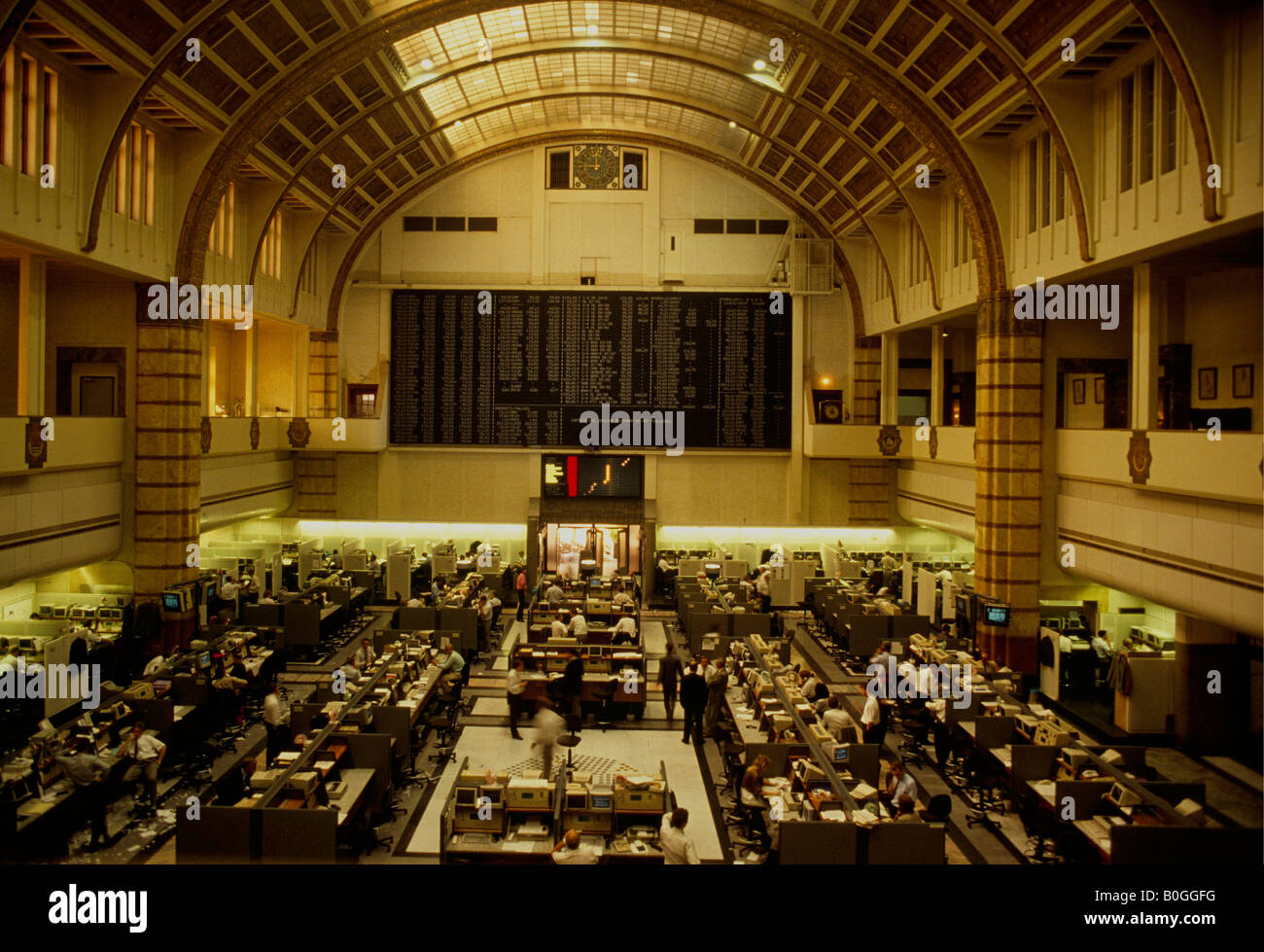

Trade War Intensifies: Amsterdam Stock Market Opens Down 7%

Table of Contents

Causes of the Amsterdam Stock Market Decline

The sharp decline in the Amsterdam Stock Market is a multifaceted issue stemming from a confluence of factors, primarily the intensifying global trade war, broader market uncertainty, and underlying geopolitical factors.

Impact of Increased Tariffs

Increased tariffs imposed on Dutch exports are significantly impacting the AEX index. These tariffs directly affect the profit margins of numerous companies listed on the Amsterdam exchange, leading to decreased investor confidence and a sell-off.

- Affected Sectors: The agricultural sector, a cornerstone of the Dutch economy, is severely impacted, along with technology companies reliant on global supply chains. Specific examples include dairy farmers facing reduced export opportunities to key markets and tech firms encountering higher costs for imported components.

- Companies Experiencing Losses: Several prominent companies listed on the AEX have reported significant losses, directly attributable to the tariff impact on their operations. Analysis of their financial reports reveals a clear correlation between the escalating trade war and decreased profitability. This decreased profitability translates into lower stock valuations.

- Tariff Impact on Profit Margins: The increased costs associated with tariffs are eroding profit margins for many Dutch businesses. This reduction in profitability makes them less attractive to investors, contributing to the overall market decline. The ongoing tariff war negatively impacts the Dutch exports and AEX index.

Global Market Uncertainty

The decline in the Amsterdam Stock Market is not an isolated incident. It's part of a broader pattern of global market instability fueled by escalating trade tensions. This uncertainty is driving investor anxiety and prompting a flight to safety.

- Other Major Stock Market Declines: Similar declines have been observed in major stock markets worldwide, reflecting a global loss of investor confidence. The interconnected nature of global finance means that instability in one market quickly propagates to others.

- Investor Sentiment and Fear: The prevailing sentiment among investors is one of fear and uncertainty. The unpredictable nature of the trade war and its potential long-term consequences are causing investors to reduce their risk exposure.

- Flight to Safety Assets: Investors are increasingly seeking refuge in traditionally "safe" assets such as gold, which is seen as a hedge against market volatility and economic uncertainty. This shift away from riskier assets further contributes to the market downturn. The global market volatility is impacting the Amsterdam Stock market and investor confidence.

Geopolitical Factors

Geopolitical events and instabilities further exacerbate the situation, adding another layer of complexity to the already volatile market conditions. These external factors significantly impact market sentiment and investor behavior.

- International Conflicts and Political Instability: Ongoing international conflicts and political instability in various regions of the world contribute to the overall sense of uncertainty. This uncertainty makes investors hesitant to commit capital to riskier assets.

- Indirect Impact on Market Sentiment: Even events seemingly unrelated to trade directly affect market sentiment. News of political turmoil or international conflicts can trigger sell-offs as investors seek to protect their investments. Geopolitical risk adds to the overall market uncertainty.

Potential Consequences of the Market Drop

The 7% drop in the Amsterdam Stock Market carries significant potential consequences for the Netherlands, the broader European Union, and individual investors.

Economic Impact on the Netherlands

The market decline poses serious risks to the Dutch economy, potentially impacting GDP growth, unemployment, and consumer spending.

- Potential Job Losses: Decreased economic activity resulting from the market downturn could lead to significant job losses across various sectors, impacting the overall employment rate and consumer confidence.

- Decreased Consumer Confidence: As the market continues to decline, consumers might postpone purchases, further slowing down economic growth. The uncertainty surrounding future economic prospects impacts spending behaviors.

- Impact on Specific Sectors: Sectors heavily reliant on exports, such as agriculture and technology, will be disproportionately affected. The tourism sector could also see a decline as a result of decreased consumer spending and uncertainty. The Netherlands economy is facing a potential downturn.

Implications for European Markets

The impact extends beyond the Netherlands, creating a ripple effect across European markets and the EU economy as a whole.

- Potential Contagion Effects: The interconnectedness of European financial markets means that a significant decline in one market can easily trigger a similar decline in others. This contagion effect could lead to a broader crisis in the Eurozone.

- Interconnectedness of European Markets: The economies of European nations are deeply intertwined, making them vulnerable to shocks originating in one specific region or market. The decline in the Amsterdam Stock market indicates the interconnection of European markets.

- Response from the European Central Bank: The European Central Bank (ECB) may need to intervene to mitigate the impact of the market downturn and prevent a wider crisis. The response of the ECB will significantly influence the overall trajectory of the Eurozone economy.

Impact on Individual Investors

Individual investors need to carefully manage their portfolios and adopt appropriate strategies to navigate this volatile market.

- Risk Management Strategies: Investors should reassess their risk tolerance and adjust their portfolios accordingly. Diversification is crucial to minimize potential losses.

- Portfolio Diversification: Diversifying investments across different asset classes and geographies is vital to reduce risk. This helps cushion against losses in any one particular sector or market.

- Potential Investment Opportunities Amidst the Downturn: While the market presents challenges, it also presents opportunities. Long-term investors might see this as a buying opportunity in certain undervalued sectors. Thorough research and a well-defined investment strategy are essential. This is an opportunity to rethink your investment strategies and navigate through the volatility.

Conclusion

The 7% drop in the Amsterdam Stock Market is a serious development reflecting the intensifying global trade war, heightened market uncertainty, and underlying geopolitical risks. The consequences could be far-reaching, impacting the Netherlands' economy, the broader European Union, and individual investors. The interconnectedness of global markets underscores the need for vigilance and proactive risk management.

Call to Action: Stay informed about the evolving trade war and its impact on the Amsterdam Stock Market. Monitor market developments closely and adjust your investment strategy accordingly to mitigate potential risks. Understand the implications of the trade war on your investments and consider seeking professional financial advice to navigate this volatile market. Learn more about mitigating risks associated with Amsterdam Stock Market fluctuations and building a resilient investment portfolio.

Featured Posts

-

Woody Allen And Dylan Farrow Sean Penn Weighs In On The Accusations

May 25, 2025

Woody Allen And Dylan Farrow Sean Penn Weighs In On The Accusations

May 25, 2025 -

Under 1 Million Dream Homes Found In Escape To The Country

May 25, 2025

Under 1 Million Dream Homes Found In Escape To The Country

May 25, 2025 -

A Realistic Escape To The Country What To Expect And How To Prepare

May 25, 2025

A Realistic Escape To The Country What To Expect And How To Prepare

May 25, 2025 -

Escape To The Countryside Finding Tranquility And Community

May 25, 2025

Escape To The Countryside Finding Tranquility And Community

May 25, 2025 -

The Closure Of Anchor Brewing Impact On The Craft Beer Industry

May 25, 2025

The Closure Of Anchor Brewing Impact On The Craft Beer Industry

May 25, 2025