Trade War Unfazed: Canadian Investment In US Stocks Hits New Peak

Table of Contents

Record-Breaking Investment Figures

Canadian investment in US stocks has experienced a dramatic upswing, shattering previous records. Data from [Insert Source, e.g., Statistics Canada, a reputable financial news source] reveals a [Insert Specific Dollar Amount, e.g., $500 billion] increase in Canadian holdings of US equities in [Insert Time Period, e.g., the last quarter], representing a [Insert Percentage, e.g., 15%] jump compared to the same period last year.

- Specific Dollar Amounts: The total value of Canadian investment in US stocks now stands at approximately [Insert Total Amount, e.g., $2 trillion].

- Percentage Increase: This represents a significant increase of [Insert Percentage, e.g., 20%] compared to [Insert Comparison Period, e.g., five years ago].

- Attractive Sectors: Canadian investors have shown a particular interest in the US technology and energy sectors, which have seen disproportionately high inflows of capital. [Insert Supporting Data or Anecdote].

- Source Citations: [List all sources used, ensuring proper citation format].

Factors Driving the Investment Surge

Several factors converge to explain this remarkable surge in Canadian investment in US stocks. The robust performance of the US economy, despite trade uncertainties, plays a significant role. Attractive valuations of many US companies, particularly compared to some sectors within the Canadian market, also attract investors seeking higher returns.

- US Economic Strength: The resilience of the US economy, fueled by [mention specific economic indicators like consumer spending, job growth, etc.], continues to attract foreign investment.

- Attractive Valuations: Many US stocks offer valuations deemed more compelling compared to their Canadian counterparts, particularly in growth sectors.

- Diversification Strategies: Canadian investors are increasingly diversifying their portfolios to mitigate risks associated with relying solely on the Canadian market. US stocks provide valuable diversification.

- Low Interest Rates: The persistently low interest rate environment globally encourages investors to seek higher returns in the equity market, making US stocks an attractive option.

- Technological Advancements: The increased accessibility and ease of cross-border investment facilitated by technological advancements have also contributed to this trend.

The Impact of Trade Wars (or Lack Thereof)

Surprisingly, the ongoing trade tensions between the US and Canada (or other countries) have not significantly dampened Canadian investment in US stocks. This resilience suggests that other factors, as discussed above, outweigh the concerns surrounding trade disputes.

- Trade Tensions' Limited Impact: While some initial concerns existed, the actual impact of trade wars on investment decisions appears minimal. This points towards a longer-term view from investors who focus on fundamental economic indicators.

- USMCA Influence: The renegotiation and ratification of the USMCA (United States-Mexico-Canada Agreement) likely played a role in calming investor anxieties related to trade relations.

- Expert Opinions: [Include quotes from financial analysts or experts on the surprisingly strong cross-border investment, linking to their sources].

Implications for Canadian Investors and the US Market

This significant influx of Canadian capital into the US stock market has far-reaching implications. While offering opportunities for Canadian investors, it also presents certain risks.

- Potential Risks: Concentrating a significant portion of a portfolio in one market, even as strong as the US market, carries inherent risks. Diversification remains crucial.

- Opportunities for Canadian Investors: Canadian investors benefit from potential participation in the growth of US companies and the broader US economy.

- Impact on the US Market: The influx of Canadian capital adds to the overall liquidity and strength of the US stock market, potentially influencing prices and valuations.

- Future Scenarios: Continued strong performance of the US economy and attractive valuations could further fuel Canadian investment, while potential economic downturns or increased trade tensions could alter this trajectory.

Conclusion

Canadian investment in US stocks has reached unprecedented heights, defying expectations amidst economic uncertainty and ongoing trade discussions. This surge is driven by a combination of factors including the strength of the US economy, attractive valuations of US equities, diversification strategies, and the low-interest-rate environment. The relative lack of impact from trade wars further underscores the long-term perspective of Canadian investors. Considering a strategic increase in your own Canadian investment in US stocks? Consult a financial professional today to learn more about diversifying your portfolio effectively and making informed investment decisions regarding Canadian investment in US stocks.

Featured Posts

-

Analyse Des Resultats Fdj Le 17 Fevrier Une Date Cle Pour L Action

Apr 23, 2025

Analyse Des Resultats Fdj Le 17 Fevrier Une Date Cle Pour L Action

Apr 23, 2025 -

Les Informations Cles De Bfm Bourse 17 02 15h 16h

Apr 23, 2025

Les Informations Cles De Bfm Bourse 17 02 15h 16h

Apr 23, 2025 -

Finding The Best And Worst Diy Stores In The Uk

Apr 23, 2025

Finding The Best And Worst Diy Stores In The Uk

Apr 23, 2025 -

Ftc Appeals Activision Blizzard Acquisition Decision

Apr 23, 2025

Ftc Appeals Activision Blizzard Acquisition Decision

Apr 23, 2025 -

Updated Fan Graphs Power Rankings March 27 To April 6

Apr 23, 2025

Updated Fan Graphs Power Rankings March 27 To April 6

Apr 23, 2025

Latest Posts

-

Investigation Into Lingering Toxic Chemicals From Ohio Train Derailment

May 10, 2025

Investigation Into Lingering Toxic Chemicals From Ohio Train Derailment

May 10, 2025 -

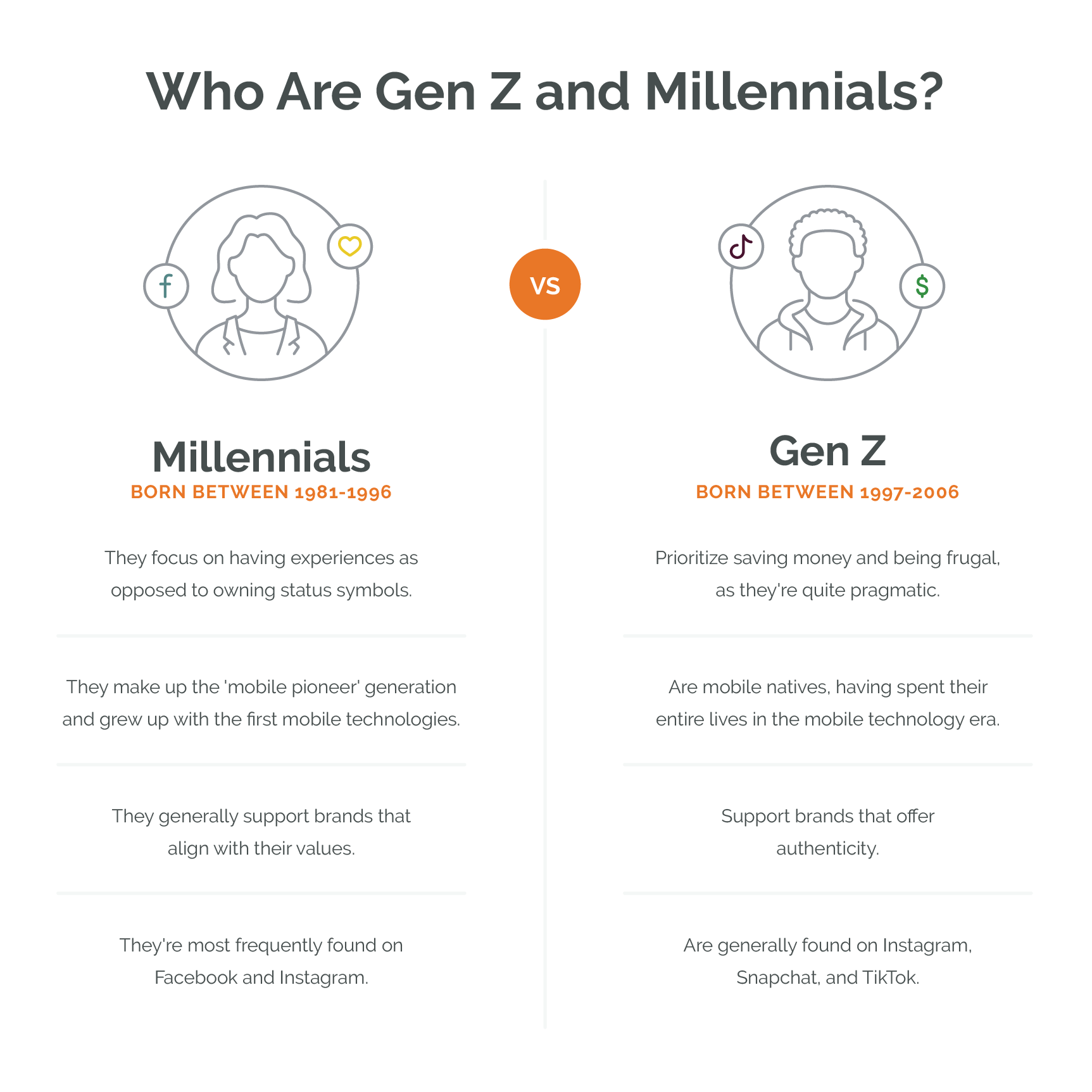

Does Androids Design Update Move The Needle With Gen Z

May 10, 2025

Does Androids Design Update Move The Needle With Gen Z

May 10, 2025 -

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

May 10, 2025

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

May 10, 2025 -

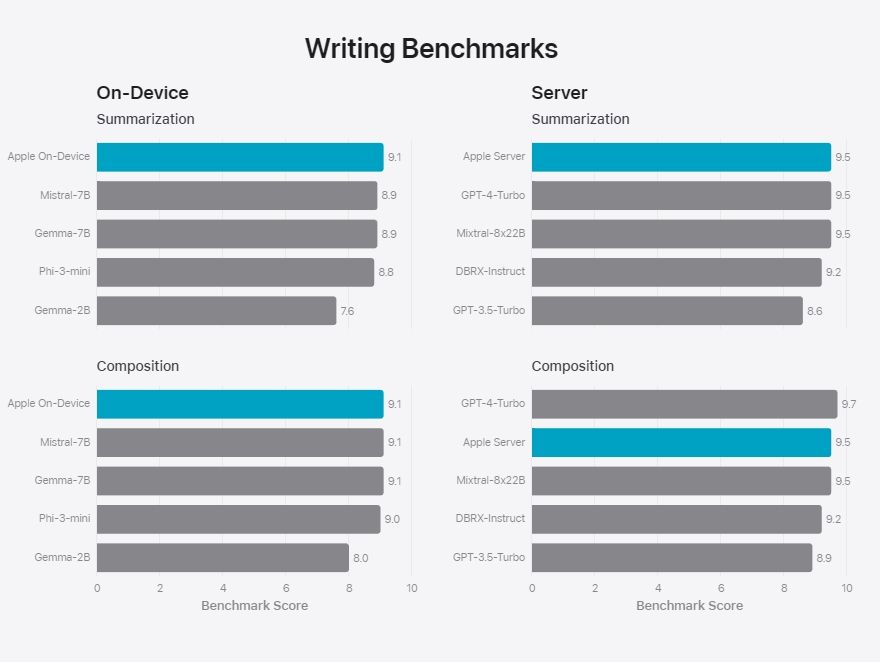

Analyzing Apples Ai Strengths And Weaknesses

May 10, 2025

Analyzing Apples Ai Strengths And Weaknesses

May 10, 2025 -

The Effectiveness Of Androids New Design In Attracting Gen Z

May 10, 2025

The Effectiveness Of Androids New Design In Attracting Gen Z

May 10, 2025