Traders Pare Bets On BOE Cuts: Pound Strengthens After UK Inflation Data

Table of Contents

UK Inflation Data Surprises Markets

The latest UK inflation figures have defied analyst expectations, triggering a reassessment of the economic outlook and the likelihood of BOE rate cuts. The Consumer Price Index (CPI) for [Insert Month, Year] came in at [Insert CPI Percentage], significantly higher than the predicted [Insert Predicted CPI Percentage]. Similarly, the Retail Price Index (RPI) registered at [Insert RPI Percentage], exceeding forecasts. This unexpected surge suggests a more resilient economy than previously anticipated and raises questions about the inflationary pressures currently facing the UK.

- CPI: [Insert CPI Percentage] (vs. predicted [Insert Predicted CPI Percentage])

- RPI: [Insert RPI Percentage] (vs. predicted [Insert Predicted CPI Percentage])

- Previous Month's CPI: [Insert Previous Month's CPI Percentage]

- Analyst consensus before data release: Most analysts predicted a continued downward trend in inflation.

Impact on BOE Rate Cut Expectations

The higher-than-expected inflation data has significantly diminished market expectations for imminent BOE rate cuts. The relationship between inflation and interest rates is inverse; higher inflation typically prompts central banks to raise interest rates to curb price increases. Before the data release, market pricing suggested a [Insert Percentage]% probability of a BOE rate cut within the next [Insert Timeframe]. Following the release, this probability has dropped to approximately [Insert New Percentage]%, reflecting a notable shift in investor sentiment.

- Before data release: [Insert Percentage]% probability of a BOE rate cut.

- After data release: [Insert New Percentage]% probability of a BOE rate cut.

- Market analyst quote 1: "[Insert Quote from a Market Analyst about reduced BOE rate cut expectations]."

- Market analyst quote 2: "[Insert Quote from a different Market Analyst on the same topic]."

Pound Strengthens Against Major Currencies

In the wake of the unexpected inflation data, the pound has experienced a notable strengthening against major currencies. The GBP/USD exchange rate has risen from [Insert Previous Exchange Rate] to [Insert Current Exchange Rate], while the GBP/EUR exchange rate has moved from [Insert Previous Exchange Rate] to [Insert Current Exchange Rate]. This appreciation reflects increased investor confidence in the UK economy and reduced concerns about the need for further BOE monetary easing. However, a stronger pound could negatively impact UK exports, making them more expensive for international buyers.

- GBP/USD: [Insert Previous Exchange Rate] -> [Insert Current Exchange Rate]

- GBP/EUR: [Insert Previous Exchange Rate] -> [Insert Current Exchange Rate]

- Impact on exports: A stronger pound could hinder UK export competitiveness.

- Impact on imports: A stronger pound makes imports cheaper for UK consumers.

Further Implications and Market Outlook

The recent inflation data and the subsequent market reaction represent a significant shift in the UK economic narrative. Whether this trend will continue depends on several factors, including future inflation data releases, upcoming BOE monetary policy meetings, and the performance of other key economic indicators like employment figures and wage growth. A return to expectations of BOE rate cuts could be triggered by a renewed weakening in economic data or a significant change in the global economic landscape.

- Next inflation data release: [Insert Date of Next Release]

- Upcoming BOE meeting: [Insert Date of Next Meeting]

- Other key indicators: Employment figures, wage growth, consumer confidence.

Conclusion: Analyzing the Shift in BOE Rate Cut Probabilities and the Pound's Future

The unexpectedly high UK inflation figures have dramatically altered market expectations regarding BOE rate cuts, leading to a strengthening of the pound. The reduced likelihood of BOE easing reflects a reassessment of the UK's economic resilience. However, the situation remains dynamic, and future economic indicators and BOE policy decisions will continue to shape the trajectory of the pound and the probability of future BOE interest rate changes. To stay informed about BOE rate cut predictions, Bank of England policy, and pound sterling forecasts, subscribe to our newsletter, follow us on social media, and check back regularly for updates on BOE interest rates and their impact on the British economy.

Featured Posts

-

Captured In Gaza The Enduring Strength Of Idf Soldiers

May 26, 2025

Captured In Gaza The Enduring Strength Of Idf Soldiers

May 26, 2025 -

Sunday Memorial Service Remembering Craig Mc Ilquham Of The Hells Angels

May 26, 2025

Sunday Memorial Service Remembering Craig Mc Ilquham Of The Hells Angels

May 26, 2025 -

Panne Technique A La Rtbf Impact Sur Les Programmes Et Solutions

May 26, 2025

Panne Technique A La Rtbf Impact Sur Les Programmes Et Solutions

May 26, 2025 -

Accentures 50 000 Employee Promotion Six Month Delay Explained

May 26, 2025

Accentures 50 000 Employee Promotion Six Month Delay Explained

May 26, 2025 -

F1 Fashion How Racing Drivers Are Defining Style

May 26, 2025

F1 Fashion How Racing Drivers Are Defining Style

May 26, 2025

Latest Posts

-

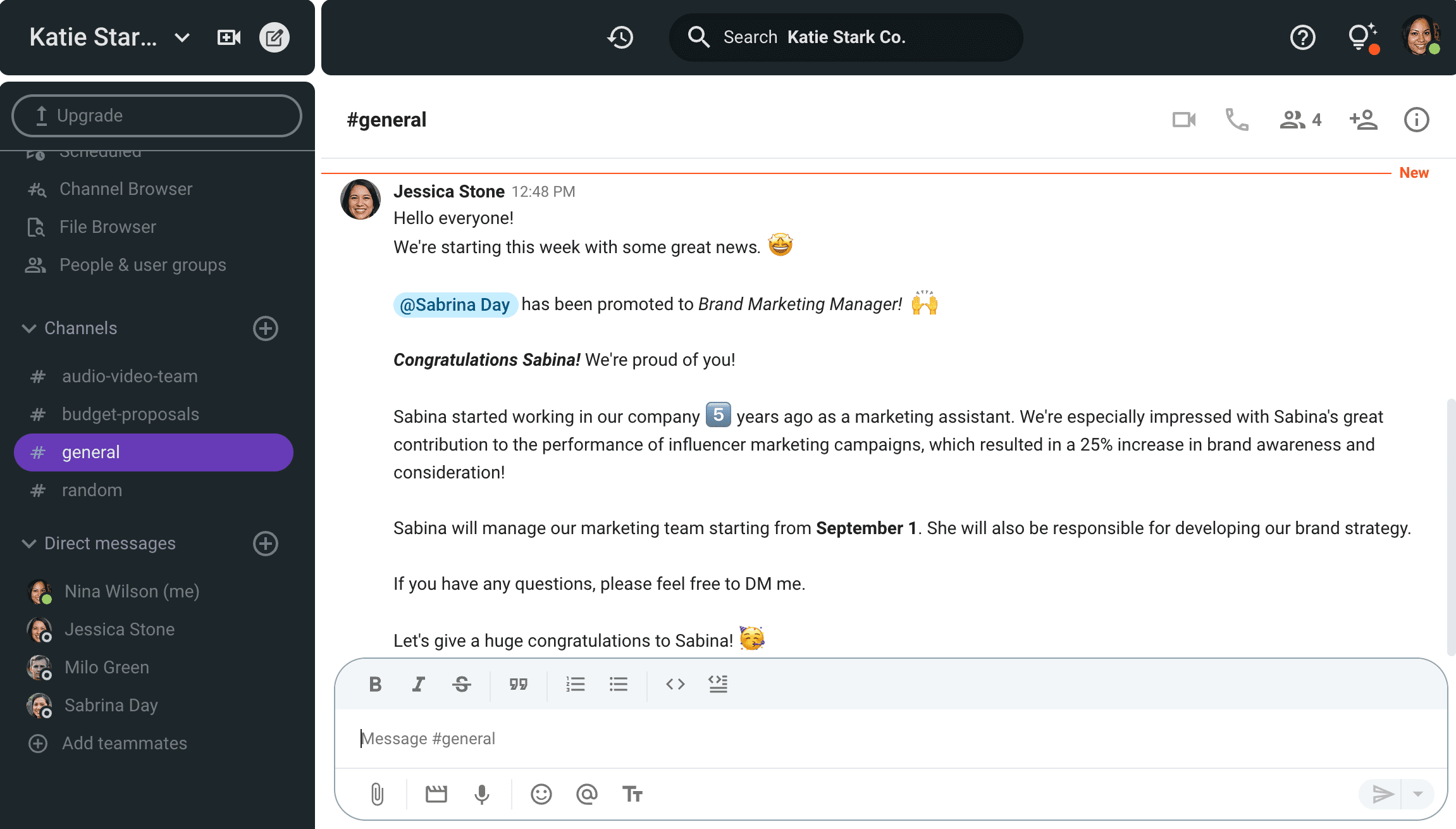

Aamir Khans Daughter Ira Reveals Details Of Andre Agassi Meeting

May 30, 2025

Aamir Khans Daughter Ira Reveals Details Of Andre Agassi Meeting

May 30, 2025 -

La Rivalidad Agassi Rios Un Duelo Memorable En La Historia Del Tenis

May 30, 2025

La Rivalidad Agassi Rios Un Duelo Memorable En La Historia Del Tenis

May 30, 2025 -

Ira Khans Shocking Revelation After Meeting Andre Agassi

May 30, 2025

Ira Khans Shocking Revelation After Meeting Andre Agassi

May 30, 2025 -

El Recuerdo De Agassi Rios Una Bestia Sudamericana En La Cancha

May 30, 2025

El Recuerdo De Agassi Rios Una Bestia Sudamericana En La Cancha

May 30, 2025 -

Steffi Graf Neuer Sport Ehe Mit Agassi Und Ihre Spezielle Regel

May 30, 2025

Steffi Graf Neuer Sport Ehe Mit Agassi Und Ihre Spezielle Regel

May 30, 2025