Trump Administration Rejects $3 Billion Sunnova Energy Loan

Table of Contents

Reasons Behind the Loan Rejection

The official reasons cited by the Trump administration for denying Sunnova's $3 billion loan application remain somewhat opaque. While no public statement explicitly detailed the rationale, several underlying factors likely contributed to the decision.

- Political Climate: The Trump administration's focus on fossil fuels and skepticism towards renewable energy initiatives created an unfavorable climate for Sunnova's application. The administration's broader energy policy, which prioritized coal and oil, arguably overshadowed the potential benefits of supporting a major solar energy company.

- Concerns about Financial Stability: It's possible that concerns regarding Sunnova's financial health or the inherent risks associated with the solar energy sector played a role. The administration may have perceived the loan as too risky, given the fluctuating nature of the renewable energy market.

- Prioritization of Other Energy Sectors: The administration may have prioritized funding for other energy sectors deemed more strategically important, leaving less room for renewable energy initiatives like Sunnova's.

Bullet points summarizing potential reasons:

- Lack of explicit public justification from the Trump administration.

- Potential bias towards fossil fuel energy sources.

- Concerns about the long-term viability and financial stability of the solar energy industry.

- Competition for limited government funding amongst various energy sectors.

Impact on Sunnova Energy

The rejection of the $3 billion loan dealt a significant blow to Sunnova Energy. The immediate impact included a drop in the company's stock price and a decrease in investor confidence. However, the long-term implications are potentially far-reaching.

- Operational Challenges: The lack of funding may necessitate a restructuring of Sunnova's business model, potentially leading to project delays and reduced expansion plans. This could affect its ability to compete effectively in the increasingly competitive solar market.

- Financial Restructuring: Sunnova might need to explore alternative financing options, such as private equity investment or issuing more debt, which could impact its long-term financial health and operational flexibility.

- Potential Job Losses: Depending on the scale of the restructuring, Sunnova might be forced to implement cost-cutting measures, including potential job losses or hiring freezes.

Bullet points summarizing the impact on Sunnova:

- Significant decrease in stock price and investor confidence.

- Potential delays or cancellations of solar projects.

- Need for alternative financing strategies.

- Possible job losses and reduced operational capacity.

Wider Implications for the Renewable Energy Sector

The Trump administration's decision extends beyond Sunnova, impacting the broader renewable energy sector. The rejection sends a chilling message to potential investors and developers in the solar industry.

- Decreased Investor Sentiment: The loan rejection could signal a lack of government support for solar energy, causing investors to reconsider their investments in renewable energy projects. This could lead to a slowdown in the growth of the industry.

- Hindered Project Development: The decreased availability of funding could lead to delays or cancellations of numerous solar energy projects, impacting the overall progress towards a cleaner energy future.

- Political Ramifications: The decision reflects the administration's energy policy priorities and may discourage future investments in green technologies. This could have far-reaching consequences for the global transition to a sustainable energy system.

Bullet points summarizing the wider impact:

- Negative impact on investor confidence in the renewable energy sector.

- Potential delays or cancellations of renewable energy projects.

- Political signaling against investment in green technologies.

Alternative Perspectives and Analysis

While the Trump administration's decision appears detrimental to Sunnova and the solar energy industry, some argue that the loan rejection might not be solely negative. Some analysts suggest that Sunnova could leverage this setback to explore more innovative financing models and strengthen its long-term resilience. Furthermore, the increased focus on private investment could stimulate competition and innovation within the sector.

Bullet points highlighting diverse perspectives:

- Some analysts suggest that the rejection could spur innovation and diversification in funding sources for Sunnova.

- The rejection might force the company to become more financially resilient and less reliant on government funding.

- Private investment could potentially fill the void left by government funding.

Conclusion: The Long-Term Effects of the Sunnova Energy Loan Rejection

The Trump administration's rejection of Sunnova Energy's $3 billion loan request had significant short-term and potentially long-term consequences. The decision highlighted the administration's energy policy priorities and sent a clear signal to the renewable energy sector. The impact on Sunnova's operations, the wider solar energy industry, and investor confidence is undeniable. Understanding the impact of the Sunnova Energy loan rejection is crucial for shaping the future of renewable energy. Share your thoughts and stay informed about crucial decisions affecting solar energy investment.

Featured Posts

-

San Diego Water Authority Selling Surplus Water Cost Reduction Strategy

May 30, 2025

San Diego Water Authority Selling Surplus Water Cost Reduction Strategy

May 30, 2025 -

Des Moines Crash Vehicle Ends Up On Its Side

May 30, 2025

Des Moines Crash Vehicle Ends Up On Its Side

May 30, 2025 -

Instagram Die Stars Denen Steffi Graf Folgt

May 30, 2025

Instagram Die Stars Denen Steffi Graf Folgt

May 30, 2025 -

Finalists Compete In Amman For 24th Chinese Bridge Competition

May 30, 2025

Finalists Compete In Amman For 24th Chinese Bridge Competition

May 30, 2025 -

Monte Carlo Victory For Alcaraz Musettis Injury Ends His Run

May 30, 2025

Monte Carlo Victory For Alcaraz Musettis Injury Ends His Run

May 30, 2025

Latest Posts

-

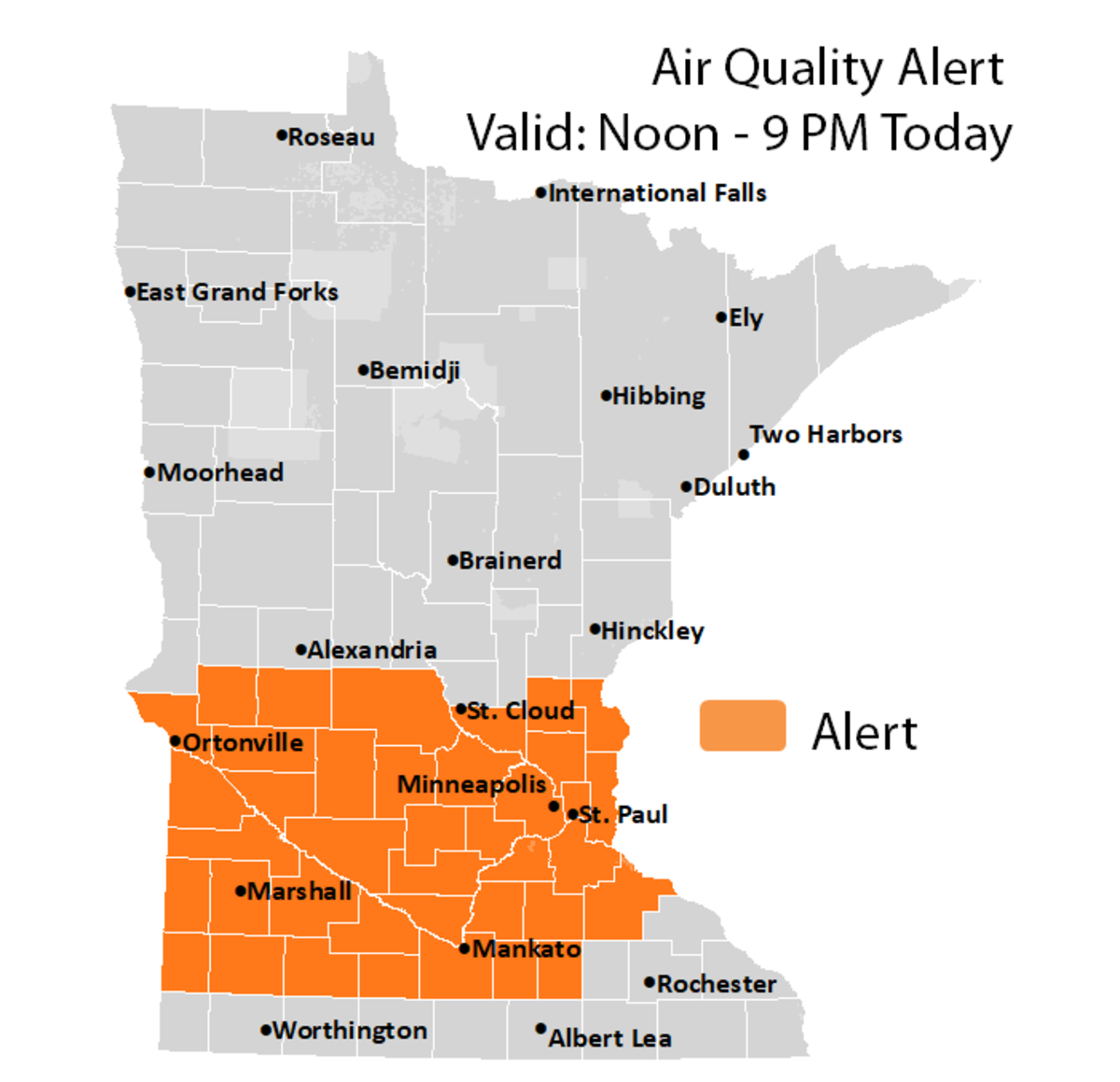

Canadian Wildfires Cause Dangerous Air In Minnesota

May 31, 2025

Canadian Wildfires Cause Dangerous Air In Minnesota

May 31, 2025 -

Eastern Manitoba Wildfires Rage Crews Struggle For Control

May 31, 2025

Eastern Manitoba Wildfires Rage Crews Struggle For Control

May 31, 2025 -

Homes Lost Lives Disrupted The Newfoundland Wildfire Crisis

May 31, 2025

Homes Lost Lives Disrupted The Newfoundland Wildfire Crisis

May 31, 2025 -

Air Quality Alert Minnesota Suffers From Canadian Wildfire Smoke

May 31, 2025

Air Quality Alert Minnesota Suffers From Canadian Wildfire Smoke

May 31, 2025 -

Manitoba Wildfires Crews Fight Deadly Spreading Blazes

May 31, 2025

Manitoba Wildfires Crews Fight Deadly Spreading Blazes

May 31, 2025