$TRUMP Coin Short Seller Scores White House Dinner: The Inside Story

Table of Contents

The $TRUMP Coin Controversy

The $TRUMP Coin, a cryptocurrency launched [insert launch date, if known] with the stated aim of capitalizing on the popularity of former President Donald Trump, has been shrouded in controversy from its inception. Its price history is a rollercoaster of dramatic spikes and plunges, reflecting the highly speculative nature of the investment. This volatility, combined with a lack of transparency around its development and management, has attracted both investors seeking quick profits and regulatory scrutiny. The coin's legitimacy has been questioned repeatedly, with allegations of pump-and-dump schemes designed to artificially inflate the price and then profit from the subsequent crash.

- Launch and initial price surge: The coin experienced a rapid price increase immediately following its launch, driven largely by hype and speculation.

- Regulatory scrutiny and warnings: Several regulatory bodies have issued warnings about the risks associated with investing in $TRUMP Coin, citing concerns about its volatility and potential for fraud.

- Allegations of pump-and-dump schemes: Numerous reports have emerged alleging coordinated efforts to manipulate the $TRUMP Coin price, benefiting a select group of early investors at the expense of others.

- High level of speculative investment: The significant price swings demonstrate the highly speculative nature of the investment, attracting individuals more interested in short-term gains than long-term value.

The Short Seller's Strategy

The unnamed short seller, reportedly operating through a major hedge fund [if known, otherwise omit], employed a sophisticated strategy to profit from the predicted decline of the $TRUMP Coin. Short selling involves borrowing and selling a cryptocurrency, hoping to buy it back later at a lower price and return the borrowed coins, pocketing the difference. This is a high-risk, high-reward strategy, particularly with a volatile asset like $TRUMP Coin. The potential for massive profits is balanced by the equally significant risk of substantial losses if the price rises unexpectedly.

- Identifying vulnerabilities in the $TRUMP Coin market: The short seller likely identified weaknesses in the coin's underlying fundamentals, such as regulatory uncertainty and the potential for market manipulation.

- Executing the short sale strategy: The short sale would have involved borrowing a significant quantity of $TRUMP Coin and selling it on the market at the prevailing price.

- Hedging against potential losses: Sophisticated risk management techniques would have been employed to mitigate the potential for significant losses if the price moved against their prediction.

- Timing of the short sell relative to White House Dinner invite: The proximity of the short sale to the White House dinner invitation raises serious questions about potential insider information or undue influence.

The White House Dinner Invitation: Coincidence or Conspiracy?

The short seller's invitation to a White House dinner raises profound ethical and legal concerns. The circumstances surrounding the invitation must be meticulously investigated to determine whether there was any improper influence or potential breach of ethics. Did the short seller receive insider information that influenced their trading decisions? Was the invitation a reward for supporting a particular political agenda? The answers to these questions are crucial.

- Guest list analysis and the short seller's presence: A careful examination of the guest list is necessary to identify any potential connections between the short seller and individuals involved in granting the invitation.

- The nature of the White House dinner and its attendees: Understanding the purpose and attendees of the dinner will help determine the context of the short seller's invitation and any potential conflicts of interest.

- Potential links between the short seller and administration officials: Any links between the short seller, their firm, or their associates and individuals within the current or previous administrations warrant thorough investigation.

- Investigation possibilities and calls for transparency: A full and transparent investigation is imperative to ascertain whether any laws were broken and to restore public trust in the integrity of the financial markets and political processes.

The Ripple Effect on the Cryptocurrency Market

This extraordinary event has sent shockwaves through the cryptocurrency market. Investor confidence, already fragile due to past volatility and regulatory uncertainty, has been further shaken. The incident has amplified calls for increased regulatory oversight of cryptocurrencies, especially those with perceived political connections. The potential consequences include stricter regulations, increased scrutiny of cryptocurrency exchanges, and heightened awareness among investors of the risks associated with politically-linked digital assets.

- Short-term and long-term effects on $TRUMP Coin price: The immediate impact has been a further decline in $TRUMP Coin's price, but the long-term consequences are still unfolding.

- Wider market reaction and investor sentiment: The entire cryptocurrency market has experienced a downturn in confidence following the revelation, prompting many to re-evaluate their investments.

- Potential for new regulations in the cryptocurrency space: This incident underscores the need for stricter regulations to prevent market manipulation and ensure transparency within the cryptocurrency sector.

Conclusion

The story of the $TRUMP Coin short seller and their White House dinner invitation is a remarkable and deeply unsettling one. It highlights the complex and potentially problematic intersection of high-stakes finance, political influence, and the volatile world of cryptocurrencies. The ethical and legal implications are far-reaching, demanding thorough investigation and potentially significant regulatory reforms. The incident underscores the need for transparency and accountability in all financial markets, and the serious risks inherent in investing in politically-charged cryptocurrencies like $TRUMP Coin.

The story of the $TRUMP Coin short seller raises serious questions about the intersection of finance and politics. Stay informed about the evolving situation and the ongoing investigation by following our updates on the $TRUMP Coin and other politically-charged cryptocurrencies. Learn more about the risks and rewards of $TRUMP Coin investments and the importance of ethical considerations in financial markets.

Featured Posts

-

Space X Moves Starship To Test Site Ahead Of Flight 9

May 29, 2025

Space X Moves Starship To Test Site Ahead Of Flight 9

May 29, 2025 -

Hujan Di Denpasar Ramalan Cuaca Bali Untuk Besok

May 29, 2025

Hujan Di Denpasar Ramalan Cuaca Bali Untuk Besok

May 29, 2025 -

Update Marini Hospitalized After Serious Testing Crash

May 29, 2025

Update Marini Hospitalized After Serious Testing Crash

May 29, 2025 -

Hollywood Shutdown Actors And Writers On Strike What It Means For The Industry

May 29, 2025

Hollywood Shutdown Actors And Writers On Strike What It Means For The Industry

May 29, 2025 -

Marinis Hospitalization Follows Testing Facility Crash

May 29, 2025

Marinis Hospitalization Follows Testing Facility Crash

May 29, 2025

Latest Posts

-

Exploring Bernard Keriks Family Hala Matli And His Children

May 31, 2025

Exploring Bernard Keriks Family Hala Matli And His Children

May 31, 2025 -

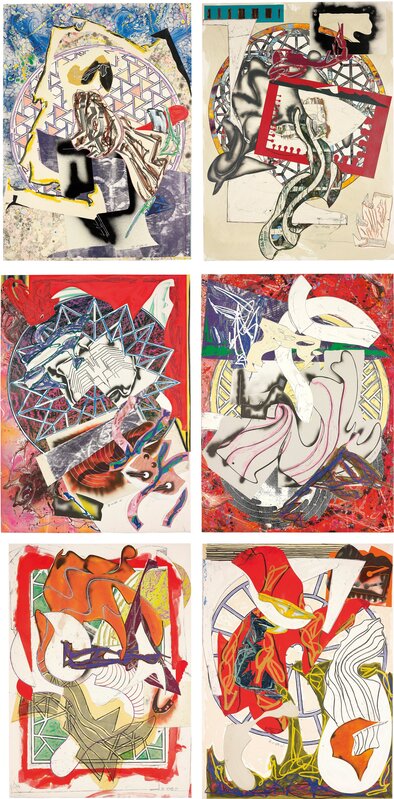

A Banksy Bonanza Six Screenprints And A Handmade Tool A Collectors Dream

May 31, 2025

A Banksy Bonanza Six Screenprints And A Handmade Tool A Collectors Dream

May 31, 2025 -

Remembering Bernard Kerik Former Nypd Commissioner 69

May 31, 2025

Remembering Bernard Kerik Former Nypd Commissioner 69

May 31, 2025 -

Remembering Bernard Kerik A Look At His Career And Conviction

May 31, 2025

Remembering Bernard Kerik A Look At His Career And Conviction

May 31, 2025 -

9 11s Nypd Commissioner Bernard Kerik Dies At 69

May 31, 2025

9 11s Nypd Commissioner Bernard Kerik Dies At 69

May 31, 2025