Trump Issues 10% Tariff Warning: Conditions For Exceptions

Table of Contents

The Initial Tariff Announcement and its Scope

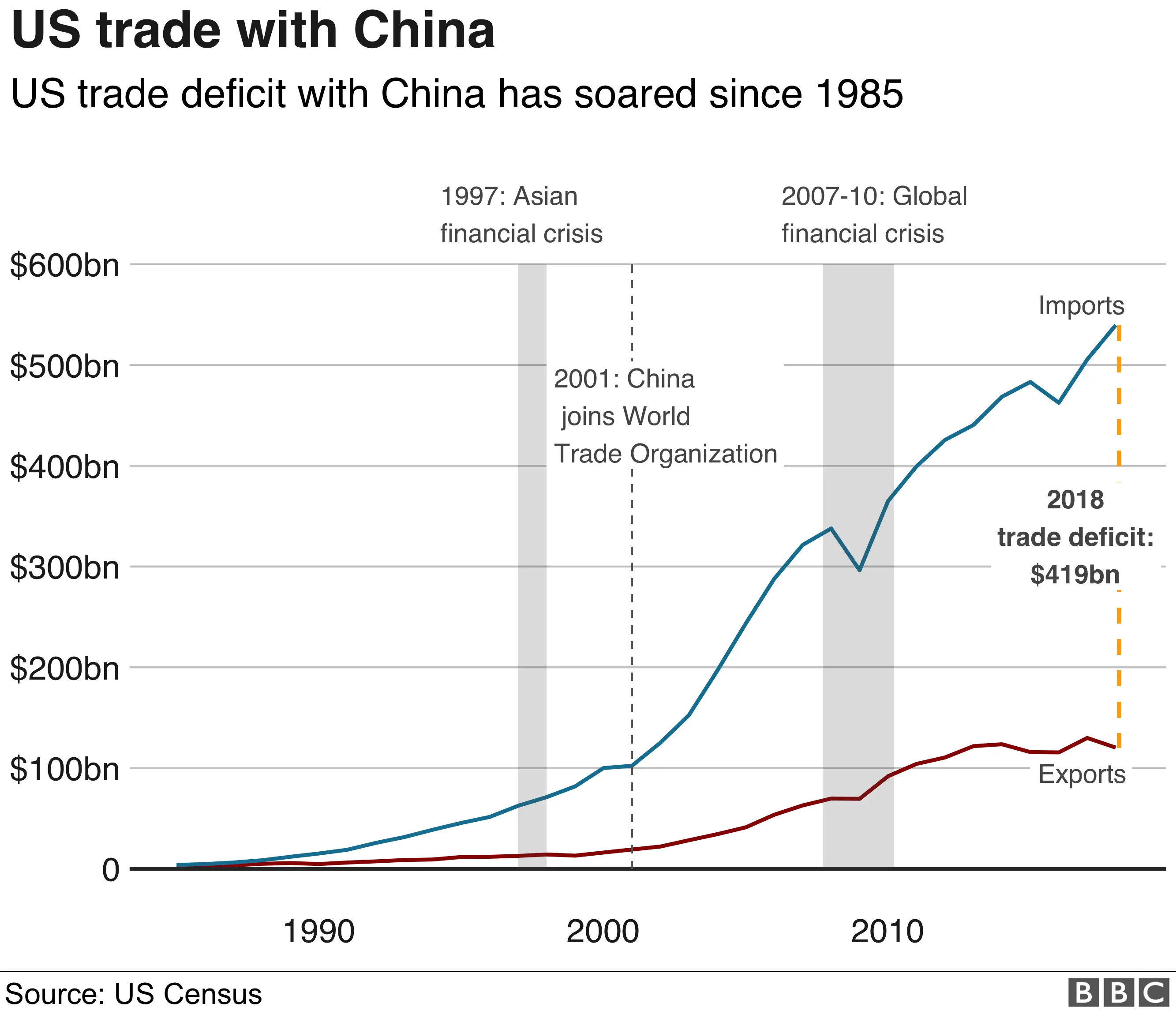

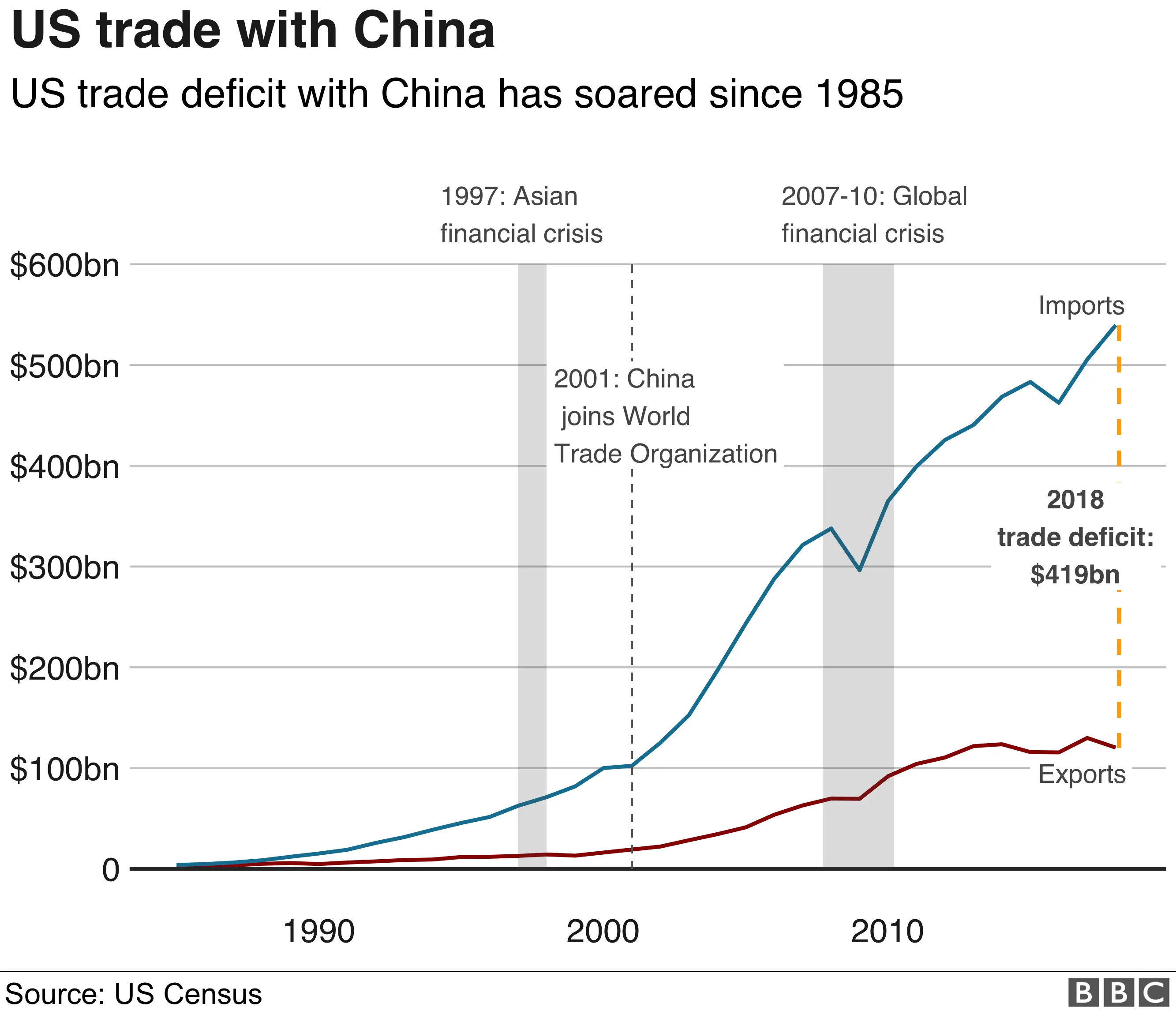

The initial tariff announcement, while ultimately not fully implemented in this specific form, targeted a wide range of goods from specific countries, aiming to address perceived trade imbalances and protect American industries. The stated rationale was to leverage tariffs as a negotiating tool to secure better trade deals. The potential economic consequences of these tariffs, if exceptions weren't granted, were significant.

-

Potential Economic Consequences:

- Reduced consumer spending due to increased prices.

- Increased production costs for businesses relying on imported goods.

- Potential job losses in industries heavily reliant on imports.

- Retaliatory tariffs from affected countries, further harming US exports.

-

Industries Most Affected: Industries like manufacturing, agriculture, and retail faced the most direct and immediate impact of the Trump tariff impact, with potential job losses varying significantly depending on the specific sector and reliance on imported goods. The Trump trade policy created uncertainty and volatility in these markets. The 10% tariff implications were particularly acute for smaller businesses with limited ability to absorb increased costs.

Criteria for Tariff Exceptions

Securing a Trump tariff waiver requires demonstrating that your situation meets specific criteria outlined by the administration. These criteria were generally interpreted broadly, leaving room for interpretation and requiring strong justification.

National Security Concerns

Businesses could argue that a particular imported good is essential for national security, a high bar requiring substantial evidence. This might involve demonstrating reliance on the imported good for critical infrastructure, defense systems, or essential services. Examples could include specialized components for military equipment or critical technologies.

Unavailability of Goods Domestically

Demonstrating that the imported good is not readily available within the US requires thorough market research and evidence. This involves proving that domestic alternatives are either non-existent, insufficient in quantity, or significantly inferior in quality.

Economic Hardship

Proving significant economic hardship due to the tariffs requires concrete financial data. This could include demonstrating substantial losses in revenue, market share, or employment due to the tariffs. Detailed financial statements, market analysis reports, and economic impact assessments would be necessary.

- Documentation Needed:

- Detailed financial statements

- Market research reports

- Supply chain analysis

- Statements from industry experts

- Letters of support from relevant stakeholders

The Application Process for Tariff Exceptions

The application process for a tariff exemption request was often complex and bureaucratic.

Identifying the Relevant Agency

The specific government agency responsible for processing these applications varied depending on the type of good and the nature of the exception requested. Thorough research was vital to ensure the application reached the correct department.

Preparing the Necessary Documentation

A comprehensive application required meticulous preparation. A checklist of essential documents might have included:

- Completed application forms

- Detailed explanation of the need for the exception

- Supporting documentation (financial statements, market analysis, etc.)

- Letters of support from industry stakeholders

Submitting the Application

Applications were typically submitted through an online portal or by mail, depending on the agency involved. Strict deadlines usually applied, highlighting the importance of timely submission.

- Timeline and Potential Delays: The processing time for these applications varied greatly and significant delays were not uncommon.

Challenges and Potential Roadblocks in Obtaining Exceptions

Securing a Trump tariff relief was not guaranteed. Several challenges could hinder the process:

Bureaucracy and Administrative Hurdles

Navigating the complex government regulations and bureaucratic processes was a significant challenge for many businesses. The sheer volume of paperwork and the specialized knowledge required posed significant hurdles.

Lack of Transparency in the Decision-Making Process

The decision-making process for tariff exceptions often lacked transparency, leading to uncertainty and unpredictability. The criteria for granting exceptions weren't always clearly defined, making it difficult for businesses to gauge their chances of success.

Political Considerations

Political factors undoubtedly played a role in the decision-making process. The outcome of an application could be influenced by various political considerations, making the process even more unpredictable.

- Common Reasons for Application Rejection:

- Insufficient evidence to support the claimed need for an exception.

- Failure to meet the specific criteria outlined by the administration.

- Incomplete or poorly prepared applications.

Conclusion

Navigating the complexities of Trump Tariffs Exceptions required a deep understanding of the specific criteria for obtaining an exemption, a thorough understanding of the application process, and careful preparation of the necessary documentation. The potential challenges, including bureaucratic hurdles, lack of transparency, and political considerations, were substantial. Don't let these trade barriers hinder your business. Learn more about securing a tariff exemption today! Research the specific criteria carefully and prepare a comprehensive application to maximize your chances of success. Seeking professional guidance is strongly recommended to navigate this challenging process effectively.

Featured Posts

-

Muellers Future Uncertain Assessing The Impact Of A Potential Bayern Departure

May 11, 2025

Muellers Future Uncertain Assessing The Impact Of A Potential Bayern Departure

May 11, 2025 -

Jessica Simpsons Heartbreak Reflecting On Her Marriage

May 11, 2025

Jessica Simpsons Heartbreak Reflecting On Her Marriage

May 11, 2025 -

The Impossibility Of John Wicks Return In John Wick 5 Debunking The Theories

May 11, 2025

The Impossibility Of John Wicks Return In John Wick 5 Debunking The Theories

May 11, 2025 -

Controversy Erupts As Asylum Minister Sidesteps Legal Review

May 11, 2025

Controversy Erupts As Asylum Minister Sidesteps Legal Review

May 11, 2025 -

Manon Fiorots Journey Overcoming Early Setback For Unmatched Success

May 11, 2025

Manon Fiorots Journey Overcoming Early Setback For Unmatched Success

May 11, 2025