Trump Tariffs Weigh On Infineon (IFX) Sales: A Detailed Analysis

Table of Contents

Direct Impact of Tariffs on Infineon's Sales

The Trump tariffs presented a multifaceted challenge to Infineon's operations, impacting its sales through increased costs, reduced demand, and supply chain disruptions.

Increased Costs of Goods Sold

Tariffs on imported components directly increased Infineon's production costs. These tariffs affected various essential inputs, impacting the overall cost of manufacturing semiconductors.

- Raw Materials: Tariffs on raw materials like certain metals and chemicals used in semiconductor production added significantly to Infineon's expenses.

- Manufactured Parts: Import duties on pre-fabricated parts and components sourced from China and other affected countries further escalated production costs.

- Percentage Increase: While precise figures are difficult to isolate due to the complex nature of Infineon's cost structure, industry reports suggest that tariff-related cost increases for semiconductor manufacturers ranged from several percentage points to double digits in some cases, depending on the component.

- Price Increases: To offset some of these increased costs, Infineon likely passed on a portion of the price increase to its customers, potentially affecting sales volume in price-sensitive markets.

Reduced Demand Due to Trade Uncertainty

The US-China trade war, fueled by the Trump tariffs, created significant uncertainty in the global market. This uncertainty dampened overall demand for semiconductors, impacting Infineon's sales volume.

- Decreased Sales Volumes: The trade war negatively impacted several key sectors that rely heavily on semiconductors, leading to reduced orders from Infineon's key customers.

- Investment Hesitation: The uncertain trade environment led to cautious investment strategies among businesses, delaying or canceling planned capital expenditures, which in turn reduced demand for semiconductor components.

- Regional Impacts: Regions heavily involved in industries affected by the trade war, such as automotive manufacturing, experienced decreased demand for Infineon’s products.

Supply Chain Disruptions

The tariffs disrupted Infineon's supply chain, leading to bottlenecks and delays in production.

- Sourcing from China: Infineon, like many semiconductor companies, relies on extensive supply chains that include sourcing from China. The tariffs created obstacles to smooth and efficient supply chain operations.

- Production Delays: Delays in receiving essential components led to disruptions in Infineon's production schedules and affected its ability to meet customer demand.

- Increased Lead Times: The uncertainty and logistical challenges associated with navigating the tariff regime added to lead times, impacting overall production efficiency.

Infineon's Response to the Tariffs

Infineon implemented several strategies to mitigate the negative effects of the Trump tariffs.

Strategic Adjustments

Infineon responded to the challenges by diversifying its supply chains, implementing cost-cutting measures, and adjusting pricing strategies.

- Supply Chain Diversification: The company likely shifted sourcing of certain components away from countries affected by high tariffs to mitigate supply chain risks and reduce dependence on specific regions.

- Cost-Cutting Measures: Infineon likely implemented cost-cutting initiatives across various aspects of its operations to offset increased costs.

- Price Adjustments: The company attempted to balance price increases with maintaining market competitiveness in the face of reduced demand. The effectiveness of these strategies varied depending on market conditions and the specific components involved.

Lobbying Efforts

Infineon, along with other semiconductor companies, likely engaged in lobbying efforts to advocate for modifications or a repeal of the tariffs that negatively impacted the industry. These efforts involved working with industry associations and directly engaging with policymakers to convey the industry’s concerns and suggest more favorable trade policies.

Financial Performance and Stock Market Impact

The Trump tariffs noticeably impacted Infineon's financial performance and its stock market valuation.

Analysis of Financial Statements

A detailed analysis of Infineon's financial statements during the period of the tariffs reveals the financial impact:

- Revenue: While overall revenue might have continued to grow, the rate of growth likely slowed compared to pre-tariff periods, reflecting decreased demand and increased costs.

- Profit Margins: Profit margins probably compressed due to the increased costs of goods sold, especially if price increases were insufficient to fully offset them.

- Data Visualization: Charts and graphs comparing key financial metrics (revenue, gross margin, operating income, etc.) from before, during, and after the tariff period would visually demonstrate the impact.

Stock Market Reaction

The stock market reacted to Infineon's financial performance, reflecting investors' assessment of the tariff impact and the company's response strategies.

- Stock Price Fluctuations: Infineon's stock price likely experienced some volatility, possibly declining during periods of heightened trade tensions and improving when there were signs of tariff relief.

- Investor Sentiment: Investor sentiment towards Infineon would have been affected by the uncertainty surrounding the trade war and its impact on the company's financial prospects.

- Rating Agency Updates: Rating agencies might have adjusted their credit ratings for Infineon, reflecting the increased financial risks due to the trade war.

Conclusion

The Trump tariffs presented a significant challenge to Infineon (IFX), impacting its sales through increased costs, reduced demand, and supply chain disruptions. Infineon responded with strategic adjustments, including supply chain diversification and cost-cutting measures, but the overall financial impact was evident in its financial statements and stock market performance. Understanding the complex interplay between trade policies and corporate performance is critical for investors and industry analysts. Further research into the long-term effects of these tariffs on Infineon and similar companies is warranted. Stay informed about the latest developments concerning Infineon (IFX) and the impact of future trade policies on the semiconductor industry and the global economy. Continue to monitor the evolving global trade landscape and its effects on semiconductor sales.

Featured Posts

-

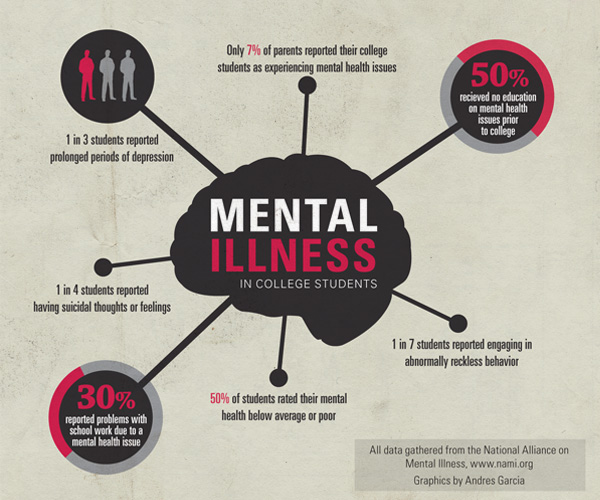

Reframing The Narrative Mental Illness And Violent Crime

May 10, 2025

Reframing The Narrative Mental Illness And Violent Crime

May 10, 2025 -

From Wolves Reject To European Champion The Rise Of A Football Star

May 10, 2025

From Wolves Reject To European Champion The Rise Of A Football Star

May 10, 2025 -

Jeanine Pirro A Closer Look At The Fox News Personality

May 10, 2025

Jeanine Pirro A Closer Look At The Fox News Personality

May 10, 2025 -

How Us Politics And Economics Shape Elon Musks Net Worth

May 10, 2025

How Us Politics And Economics Shape Elon Musks Net Worth

May 10, 2025 -

Dakota Johnson Pedro Pascal Kai Chris Evans Stin Tainia Materialists

May 10, 2025

Dakota Johnson Pedro Pascal Kai Chris Evans Stin Tainia Materialists

May 10, 2025