Trump's China Trade Policy: 30% Tariffs To Persist Until Late 2025?

Table of Contents

The Legacy of Trump's Trade War with China

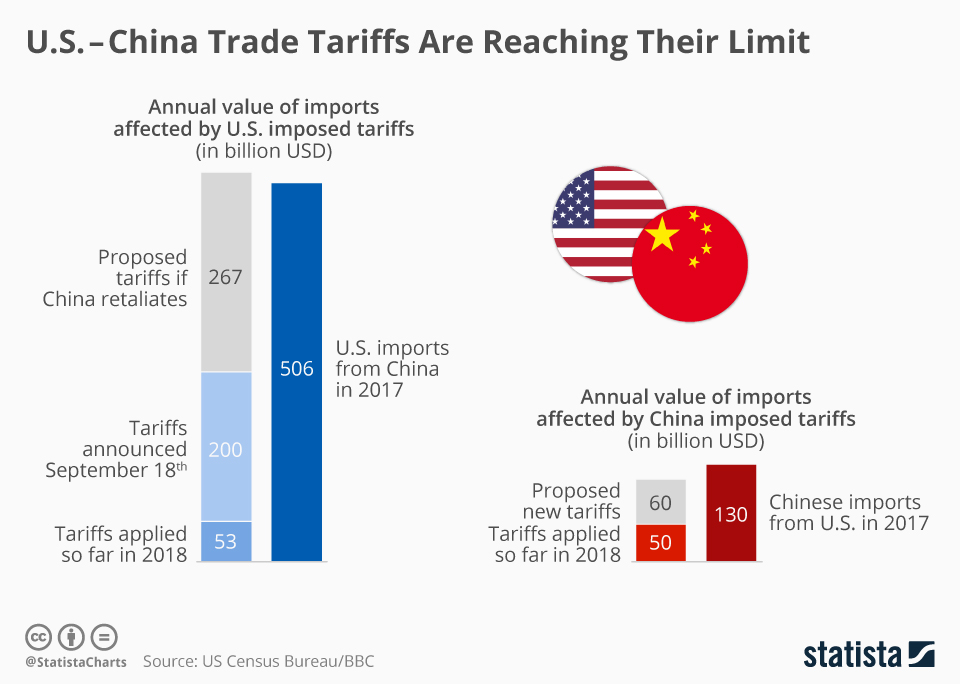

The Trump administration's trade war with China, initiated in 2018, significantly altered the global trade landscape. The stated goals were to address what the administration perceived as unfair trade practices by China, including intellectual property theft and forced technology transfer. This aggressive approach involved imposing tariffs on hundreds of billions of dollars worth of Chinese goods.

- Initial Tariff Imposition: The initial tariffs, ranging from 10% to 25%, targeted various sectors, escalating tensions and prompting retaliatory measures from China. The 30% tariff became a particularly significant point of contention.

- Key Players: The Office of the United States Trade Representative (USTR) played a central role in formulating and implementing the trade policy, negotiating with its Chinese counterpart.

- Retaliatory Tariffs: China responded with its own tariffs on US goods, impacting American farmers, manufacturers, and other businesses. This tit-for-tat exchange significantly disrupted global supply chains.

- Economic Impact: The trade war period saw increased uncertainty in global markets, impacting economic growth in both the US and China. Consumer prices increased due to higher import costs resulting from Trump's China tariffs.

30% Tariffs: A Continuing Burden on Businesses and Consumers?

The 30% tariffs, a key element of Trump's China trade policy, continue to significantly impact businesses and consumers. Their persistence raises concerns about long-term economic consequences.

- Impact on Specific Industries: Manufacturing, agriculture, and technology sectors have been disproportionately affected. Increased costs for imported raw materials and components have squeezed profit margins. Farmers, in particular, faced reduced export opportunities due to Chinese retaliatory tariffs.

- Increased Costs: The 30% tariff directly increases the price of imported goods, leading to higher prices for consumers. This inflationary pressure has broader economic consequences, impacting purchasing power and overall consumer confidence.

- Supply Chain Disruptions: The tariffs disrupted global supply chains, forcing businesses to seek alternative sources of goods, often at higher costs and with longer lead times. This complexity continues to affect production schedules and overall efficiency.

- Statistical Evidence: Numerous economic studies have shown a correlation between the imposition of Trump's China tariffs and increased prices for consumers and businesses. The exact quantifiable impact continues to be a topic of ongoing debate and research.

Political and Economic Factors Influencing the Tariff Timeline

The removal or continuation of the 30% tariffs hinges on a complex interplay of political and economic considerations, making any prediction challenging.

- Future Administrations: The political landscape significantly influences trade policy. Future administrations may choose to renegotiate or eliminate the tariffs altogether, depending on their priorities and diplomatic strategies.

- Lobbying Efforts: Affected industries heavily lobby the government to influence trade policy decisions. These efforts exert considerable pressure on policymakers, who must balance competing interests.

- Domestic Political Agendas: Domestic political agendas, including concerns about job security and economic competitiveness, significantly factor into decisions regarding tariffs. The desire to protect domestic industries often competes with the benefits of free trade.

- Economic Impact of Removal: Removing the tariffs could lead to lower prices for consumers and increased economic activity, but it also raises concerns about the potential impact on domestic industries that have adapted to the changed market conditions.

Predictions and Scenarios for the Future of Trump's China Tariffs

Predicting the future of Trump's China tariffs, particularly the 30% tariffs, remains challenging. Several scenarios are plausible:

- Tariff Removal Before Late 2025: A future administration might prioritize de-escalation of trade tensions, leading to a quicker removal of the tariffs than anticipated. This could be driven by domestic economic concerns or a desire for improved relations with China.

- Continued Tariffs Beyond 2025: Alternatively, the tariffs might persist beyond 2025, especially if geopolitical tensions remain high or if the perceived unfair trade practices by China continue.

- Negotiations and Agreements: Negotiations between the US and China could lead to a phased removal of the tariffs in exchange for concessions on trade practices. This would likely involve a complex set of agreements on various trade issues.

- Global Economic Implications: Each scenario has significant implications for the global economy. The removal of tariffs would likely stimulate global trade, while their continued existence will likely cause continued economic uncertainty.

Conclusion

Trump's China tariffs, specifically the 30% tariffs, continue to cast a long shadow over global trade. While the initial goals of the trade war remain debated, the ongoing impact on businesses and consumers is undeniable. The timeline for tariff removal remains uncertain, influenced by a complex interplay of political and economic factors. Predictions vary, with scenarios ranging from early removal to extended persistence.

Call to Action: Stay informed about the evolving situation surrounding Trump's China tariffs and their potential long-term consequences. Further research into the impact of these tariffs on specific industries and global trade is essential for understanding the full ramifications of this complex trade policy. Understanding the intricacies of Trump's China Tariffs is crucial for navigating the current global economic landscape. Monitor updates on US-China trade relations to effectively manage risks and opportunities associated with these tariffs.

Featured Posts

-

Een Op De Zes Nederlanders Blijft Vuurwerk Kopen Ondanks Dreigend Landelijk Verbod

May 18, 2025

Een Op De Zes Nederlanders Blijft Vuurwerk Kopen Ondanks Dreigend Landelijk Verbod

May 18, 2025 -

Kalanick The Decision To Drop Specific Project Decision Was A Huge Error

May 18, 2025

Kalanick The Decision To Drop Specific Project Decision Was A Huge Error

May 18, 2025 -

Best Online Casinos Canada 7 Bit Casino Review And Top Picks

May 18, 2025

Best Online Casinos Canada 7 Bit Casino Review And Top Picks

May 18, 2025 -

No Deposit Bonus Codes April 2025 Updated List

May 18, 2025

No Deposit Bonus Codes April 2025 Updated List

May 18, 2025 -

Netflix Top 10 Shakeup Romance Drama Loses To True Crime Docuseries

May 18, 2025

Netflix Top 10 Shakeup Romance Drama Loses To True Crime Docuseries

May 18, 2025