Trump's Economic Agenda: Can He Unite The GOP For Tax Reform?

Table of Contents

Key Components of Trump's Economic Agenda

Trump's economic platform rested on three major pillars: tax cuts, deregulation, and increased infrastructure spending. These policies aimed to stimulate economic growth and job creation, but their implementation faced considerable political resistance.

Tax Cuts: The Heart of the Matter

The proposed tax cuts were substantial, targeting both individual and corporate taxpayers. For individuals, the plan involved significant reductions in tax brackets, aiming to simplify the tax code and boost disposable income. For corporations, the plan proposed a dramatic decrease in the corporate tax rate, from 35% to 21%.

- Proposed Individual Tax Cuts: Lowered tax rates across all brackets, with the biggest cuts benefiting higher-income earners. This led to criticism that the plan disproportionately benefitted the wealthy.

- Proposed Corporate Tax Cuts: A reduction from 35% to 21%, intended to boost business investment and create jobs. Critics argued that this could exacerbate income inequality and increase the national debt.

- Projected Economic Effects: Supporters predicted increased economic growth, job creation, and higher wages. Opponents countered with concerns about rising income inequality, increased national debt, and minimal impact on job creation. Independent analyses produced varied results, highlighting the complexity of predicting the actual economic effects.

Deregulation: Unleashing the Market

Trump's administration pursued an aggressive deregulation agenda, aiming to reduce the burden of government regulations on businesses. The stated goal was to foster economic growth and job creation by reducing compliance costs and streamlining business operations.

- Examples of Deregulation: Rollbacks of environmental regulations, financial regulations, and labor regulations were prominent features. Specific examples included easing restrictions on emissions, reducing banking oversight, and weakening worker protection laws.

- Potential Benefits and Drawbacks: Supporters argued that deregulation would stimulate investment, create jobs, and boost competitiveness. Critics, however, voiced concerns about potential negative impacts on the environment, worker safety, and financial stability. The long-term consequences of these deregulatory actions remain a subject of debate.

Infrastructure Spending: A Promise Unfulfilled

Trump's economic agenda also included a substantial investment in infrastructure development. The proposed plan focused on repairing and upgrading America's aging infrastructure, with promises of creating millions of jobs and boosting economic growth.

- Proposed Infrastructure Projects: The plan encompassed a wide range of projects, including road and bridge repairs, improvements to public transportation, and upgrades to energy grids.

- Funding Mechanisms and Economic Benefits: Funding sources remained unclear, with debates surrounding the use of public funds versus private investment. Proponents emphasized the potential economic stimulus and job creation through these projects, while critics raised concerns about cost overruns and potential corruption.

Divisions Within the GOP on Tax Reform

Despite the Republican Party's unified control of the government during part of Trump’s presidency, significant internal divisions hampered the passage and implementation of his economic agenda, particularly regarding tax reform.

Conservative vs. Moderate Factions: A Deep Divide

The GOP contains a spectrum of views on fiscal policy, creating significant internal friction. Conservative Republicans favored deeper and broader tax cuts, prioritizing lower taxes regardless of the fiscal impact. Moderate Republicans, however, expressed concerns about the potential increase in the national debt and favored more targeted tax cuts.

- Disagreements on Tax Rates and Loopholes: Disagreements centered on the optimal tax rates for individuals and corporations, as well as how to handle various tax loopholes and deductions. This led to lengthy negotiations and compromises that diluted the initial scope of the tax cuts.

- Prominent Republican Figures and Their Stances: Figures like Paul Ryan initially championed the tax cuts, but even within the Republican leadership, differing opinions on the fiscal implications existed.

Concerns about the National Debt: A Looming Threat

The projected increase in the national debt due to the proposed tax cuts generated significant concern within the GOP, especially amongst fiscally conservative members. The long-term consequences of increasing the national debt fueled internal debates and opposition to certain aspects of the tax plan.

- Arguments Against Tax Cuts Based on Fiscal Consequences: Critics argued that the tax cuts would exacerbate the national debt, potentially leading to higher interest rates, reduced government spending in other areas, and long-term economic instability.

- Data on Current Debt Levels and Projected Increases: The already high national debt levels, coupled with projections of further increases due to the tax cuts, provided a powerful argument for opponents of the plan.

Opposition from Specific Interest Groups: Lobbying and Influence

Specific interest groups and lobbyists exerted significant influence on the shaping of the tax plan. Some business groups advocated for certain tax breaks or exemptions, while others opposed parts of the plan that they deemed detrimental to their interests.

- Examples of Groups Opposing Parts of the Plan: Various industry groups and trade associations lobbied to influence the final tax legislation, leading to compromises and modifications to the initial proposal.

Potential Outcomes and Their Implications

The success or failure of Trump's tax reform had significant implications for the US economy and the political landscape.

Successful Tax Reform: Economic Boom or Bust?

If Trump had successfully unified the GOP and passed his comprehensive tax plan, the potential benefits included:

- Economic Growth: Supporters projected a significant increase in GDP growth due to increased investment, consumer spending, and business activity.

- Job Creation: Lower corporate taxes were expected to incentivize businesses to invest, expand, and hire more workers.

- Investment: The tax cuts were meant to stimulate both domestic and foreign investment.

Failure to Pass Tax Reform: Stagnation and Political Fallout

The failure to pass significant tax reform could have led to:

- Economic Stagnation: The lack of stimulus through tax cuts could have resulted in slower economic growth and fewer job opportunities.

- Political Gridlock: The inability to pass a key element of the president's agenda would have exacerbated political divisions and gridlock.

- Election Consequences: The failure to deliver on promised economic benefits could have had significant negative consequences for the Republican Party in subsequent elections.

Conclusion: Can Trump Unite the GOP on Tax Reform? A Critical Assessment

Trump's economic agenda, particularly his ambitious tax reform proposals, faced significant challenges due to deep divisions within the Republican Party itself. While the tax cuts were eventually passed, the internal conflicts, concerns about the national debt, and lobbying efforts significantly shaped the final legislation. The long-term consequences of these policies remain a subject of ongoing debate and analysis. To better understand the complexities of Trump's economic legacy and the impact of his tax policies, further research is crucial. Delve deeper into the "Trump economic policy analysis," explore the nuances of the "GOP tax reform debate," and examine the lasting effects of "Trump's economic legacy" to form your own informed opinion.

Featured Posts

-

At And T Exposes Extreme V Mware Price Hike In Broadcoms Acquisition Plan

May 22, 2025

At And T Exposes Extreme V Mware Price Hike In Broadcoms Acquisition Plan

May 22, 2025 -

Le Charme Suisse De Stephane Seduit Paris

May 22, 2025

Le Charme Suisse De Stephane Seduit Paris

May 22, 2025 -

Groeiend Autobezit Drijft Occasionverkopen Bij Abn Amro Omhoog

May 22, 2025

Groeiend Autobezit Drijft Occasionverkopen Bij Abn Amro Omhoog

May 22, 2025 -

Cau Duong Binh Duong Tay Ninh Huong Dan And Ban Do

May 22, 2025

Cau Duong Binh Duong Tay Ninh Huong Dan And Ban Do

May 22, 2025 -

Stolen Antiques Antiques Roadshow Appearance Ends In Arrest

May 22, 2025

Stolen Antiques Antiques Roadshow Appearance Ends In Arrest

May 22, 2025

Latest Posts

-

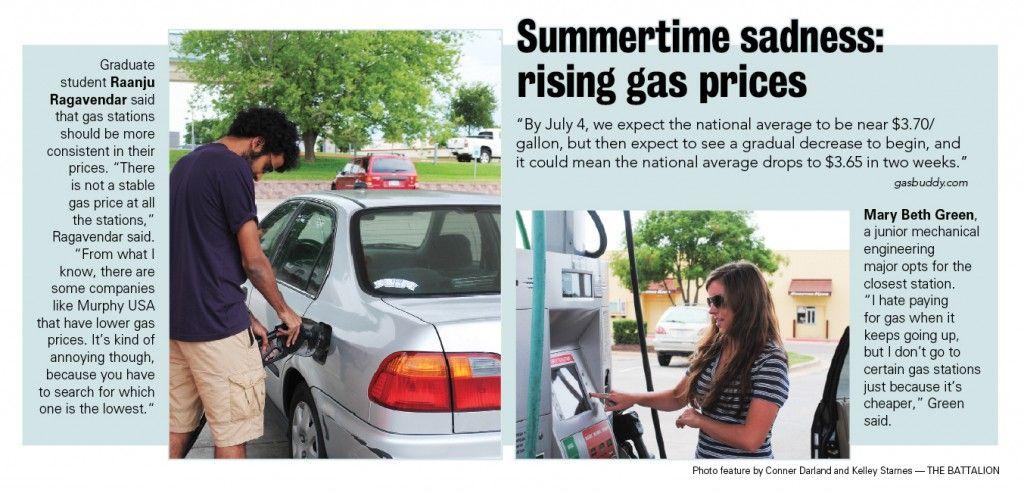

Virginia Gasoline Prices Week Over Week Decrease Gas Buddy

May 22, 2025

Virginia Gasoline Prices Week Over Week Decrease Gas Buddy

May 22, 2025 -

Gas Price Hike Impacts Mid Hudson Valley Residents

May 22, 2025

Gas Price Hike Impacts Mid Hudson Valley Residents

May 22, 2025 -

Investigation Launched After Franklin County Chicken Barn Fire

May 22, 2025

Investigation Launched After Franklin County Chicken Barn Fire

May 22, 2025 -

Large Scale Chicken Barn Fire In Franklin County Pa

May 22, 2025

Large Scale Chicken Barn Fire In Franklin County Pa

May 22, 2025 -

Rising Gas Prices Hit Mid Hudson Valley Hard

May 22, 2025

Rising Gas Prices Hit Mid Hudson Valley Hard

May 22, 2025