Trump's Embrace Of Cheap Oil: Challenges And Consequences For The Energy Industry

Table of Contents

Boosted Domestic Oil Production and its Repercussions

The Trump administration's focus on energy independence fueled a boom in domestic oil production, particularly shale oil. However, this surge came with substantial repercussions.

The Shale Oil Boom and its Limitations

The shale oil boom, driven by advancements in hydraulic fracturing ("fracking"), significantly increased US oil production. However, this reliance on fracking brought its own set of challenges:

-

Environmental Impact: Fracking's high water usage and potential for methane emissions raised significant environmental concerns, impacting water resources and contributing to climate change. Studies have shown a correlation between increased fracking activity and localized water contamination incidents.

-

Economic Vulnerability: The shale oil industry proved vulnerable to price volatility. Its profitability hinges on sustained high oil prices, making it dependent on government subsidies and prone to economic downturns when global oil prices fall. Many smaller shale companies faced bankruptcy during periods of low oil prices.

-

Job Creation vs. Job Losses: While the shale oil boom created jobs in extraction and related industries, it also led to job losses in other energy sectors, particularly renewable energy, as investment shifted towards fossil fuels.

-

Specific Examples:

- US crude oil production increased from approximately 9 million barrels per day in 2016 to over 12 million barrels per day in 2019.

- The number of active oil and gas rigs in the US increased significantly during this period.

Impact on Global Oil Prices and Geopolitical Dynamics

The increased US oil production significantly impacted global oil prices, leading to a period of lower prices.

-

Global Price Impact: The influx of US oil into the global market exerted downward pressure on oil prices, benefiting consumers worldwide but challenging other oil-producing nations.

-

Impact on OPEC: OPEC, the Organization of the Petroleum Exporting Countries, faced reduced influence as US production lessened its dependence on OPEC oil. This led to strategic adjustments in OPEC's production policies.

-

Geopolitical Shifts: The shift in global energy dynamics influenced geopolitical alliances and tensions. Some nations saw reduced leverage due to decreased dependence on their oil exports.

-

Oil Price Comparison:

- Average Brent crude oil price in 2016: ~$45/barrel

- Average Brent crude oil price in 2019: ~$64/barrel (still relatively low compared to previous years)

Challenges for Renewable Energy Development

The focus on cheap oil under the Trump administration presented significant challenges to the growth of renewable energy.

Reduced Investment in Renewables

The lower oil prices reduced the competitiveness of renewable energy sources like solar and wind power, which often require government subsidies to be economically viable.

-

Decreased Investment: Investment in renewable energy technologies declined relative to investment in fossil fuels during this period. This was reflected in reduced funding for research and development and slower deployment of renewable energy projects.

-

Long-Term Energy Security & Climate Change: This reduced investment had implications for long-term energy security and the achievement of climate change goals. A greater reliance on fossil fuels hinders efforts to decarbonize the energy sector.

-

Investment Trends:

- A noticeable decrease in venture capital investment in renewable energy companies was observed during the period of low oil prices.

- Government funding for renewable energy research and development programs also experienced a slowdown.

Policy Implications and Subsidies

Government policies favoring cheap oil, including tax breaks and deregulation, created an uneven playing field for renewable energy.

-

Fossil Fuel vs. Renewable Subsidies: The Trump administration's policies favored fossil fuels with substantial subsidies, while support for renewable energy was comparatively less.

-

Impact on Development: This imbalance in support significantly hampered the development and deployment of renewable energy infrastructure.

-

Energy Independence: The long-term consequence of this policy imbalance is a continued dependence on fossil fuels, hindering true energy independence and resilience.

-

Key Policy Decisions:

- Rollbacks of environmental regulations aimed at reducing carbon emissions.

- Withdrawal from the Paris Agreement on climate change.

Long-Term Economic and Environmental Consequences

The Trump administration's embrace of cheap oil had profound long-term economic and environmental consequences.

Economic Instability Tied to Oil Price Fluctuations

Over-reliance on oil production created economic vulnerability to oil price shocks.

-

Economic Risks: The economy became susceptible to significant fluctuations based on global oil prices. Low prices were beneficial in the short term, but sharp increases could trigger economic instability.

-

Vulnerability to Shocks: Price volatility in the oil market presented a considerable risk to industries reliant on oil, such as transportation and manufacturing.

-

Economic Scenarios: A sharp increase in oil prices could lead to higher inflation, reduced consumer spending, and potential economic recession.

-

Potential Economic Scenarios:

- A sudden oil price spike could trigger inflation and reduce consumer confidence.

- Oil price volatility can lead to uncertainty in investment decisions and hinder economic growth.

Environmental Concerns and Climate Change

Increased oil production led to a rise in greenhouse gas emissions, worsening climate change.

-

Environmental Impact: Increased oil production and consumption contributed to higher carbon dioxide emissions, air pollution, and other environmental problems.

-

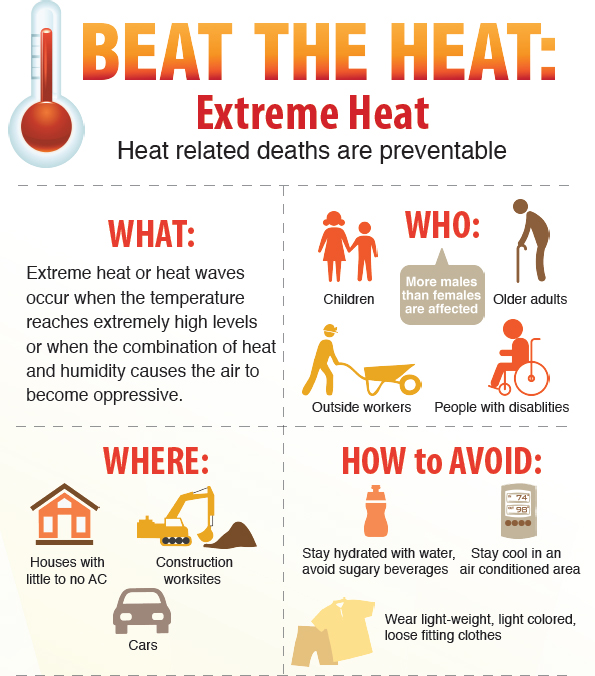

Climate Change Consequences: Continued reliance on fossil fuels accelerates climate change, leading to more frequent and severe extreme weather events.

-

Economic Growth vs. Sustainability: The pursuit of economic growth through cheap oil came at the expense of environmental sustainability. Balancing these two priorities is a major challenge.

-

Environmental Impact Data:

- Data from the Environmental Protection Agency (EPA) shows an increase in greenhouse gas emissions during this period.

- Studies have linked increased oil production to air and water pollution in affected areas.

Conclusion

Trump's embrace of cheap oil, while providing short-term economic benefits, presented significant challenges and unforeseen consequences for the energy industry. The overreliance on fossil fuels, particularly shale oil, created economic vulnerabilities, hindered renewable energy development, and exacerbated environmental concerns. The policy's impact on global energy markets and geopolitical relations also deserves further scrutiny. Understanding the long-term implications of policies focused on cheap oil is crucial for shaping future energy strategies. We need a balanced approach that prioritizes both economic growth and environmental sustainability to ensure a secure and sustainable energy future. Further research into the complexities of cheap oil policies and their impact on the energy sector is essential.

Featured Posts

-

10 John Wick Esque Action Movies You Should Watch

May 12, 2025

10 John Wick Esque Action Movies You Should Watch

May 12, 2025 -

Schoofs No Show Debate On Fabers Honours Veto Ignored

May 12, 2025

Schoofs No Show Debate On Fabers Honours Veto Ignored

May 12, 2025 -

Maxs Crazy Rich Asians Plans Executive Producer Jon M Chu

May 12, 2025

Maxs Crazy Rich Asians Plans Executive Producer Jon M Chu

May 12, 2025 -

Nine Possible Successors Examining The Future Of The Papacy After Pope Francis

May 12, 2025

Nine Possible Successors Examining The Future Of The Papacy After Pope Francis

May 12, 2025 -

The Teen Mom Effect Examining Farrah Abrahams Career Trajectory

May 12, 2025

The Teen Mom Effect Examining Farrah Abrahams Career Trajectory

May 12, 2025

Latest Posts

-

Southern Californias Record Breaking Heatwave La And Orange Counties Face Extreme Temperatures

May 13, 2025

Southern Californias Record Breaking Heatwave La And Orange Counties Face Extreme Temperatures

May 13, 2025 -

Record Heat Grips La And Orange Counties Impacts Warnings And Cooling Centers

May 13, 2025

Record Heat Grips La And Orange Counties Impacts Warnings And Cooling Centers

May 13, 2025 -

Extreme Heat In Indore 40 C Temperature Triggers Loo Warning

May 13, 2025

Extreme Heat In Indore 40 C Temperature Triggers Loo Warning

May 13, 2025 -

La And Orange Counties Sizzle Under Record Breaking Heat Extreme Temperatures And Safety Tips

May 13, 2025

La And Orange Counties Sizzle Under Record Breaking Heat Extreme Temperatures And Safety Tips

May 13, 2025 -

Record Breaking Temperatures Scorch La And Orange Counties Heatwave Emergency

May 13, 2025

Record Breaking Temperatures Scorch La And Orange Counties Heatwave Emergency

May 13, 2025