Trump's EU Threats Send Gold Prices Climbing

Table of Contents

The Impact of Trump's Trade Policies on Global Markets

President Trump's trade policies, characterized by aggressive tariffs and threats of trade wars, have significantly impacted global markets. His actions toward the EU, including the imposition of tariffs on various goods and services, have injected a considerable level of uncertainty into the international economic landscape. These unpredictable trade policies create a climate of fear among businesses and investors, leading to decreased investment and overall economic slowdown.

- Specific examples: The imposition of steel and aluminum tariffs, threats of further tariffs on automobiles, and ongoing disputes over agricultural products have all contributed to market volatility.

- Uncertainty: The unpredictable nature of Trump's trade pronouncements makes it difficult for businesses to plan for the future, hindering investment and growth.

- Investor confidence: The lack of clarity and stability in trade relations significantly erodes investor confidence, leading to capital flight and a search for safer assets. This global uncertainty fuels the demand for safe-haven assets like gold.

Gold as a Safe-Haven Asset During Times of Uncertainty

Gold has historically served as a reliable safe-haven asset during periods of economic and political instability. Its inherent value and lack of correlation with other asset classes make it an attractive investment option when market volatility is high. When uncertainty grips financial markets, investors often engage in a "flight to safety," seeking assets perceived as less risky.

- Flight to safety: This phenomenon explains the surge in gold demand during times of political turmoil or economic downturns. Investors move their capital from riskier assets to safer ones, driving up the price of gold.

- Lack of correlation: Unlike stocks and bonds, gold often moves independently of other asset classes, providing diversification benefits to investors' portfolios.

- Tangible nature: Gold's physical existence provides an additional layer of security and comfort for investors who value tangible assets in uncertain times.

Analyzing the Recent Gold Price Surge

The recent increase in gold prices is directly correlated with the escalating trade tensions stemming from Trump's EU threats. Data from reputable sources like Bloomberg and Kitco show a significant price surge in gold since the latest pronouncements.

- Price points and percentage increases: (Insert specific data and charts showing the recent gold price increase. Mention percentage increases and specific price points reached).

- Correlation with news events: Clearly link the timing of specific price increases to announcements or actions related to Trump's EU trade policies. For instance, a specific tariff announcement and subsequent price jump can be highlighted.

- Potential for further increases: Based on the ongoing geopolitical uncertainty and the potential for further escalations in trade tensions, the potential for continued gold price increases remains high.

Alternative Investment Options During Times of Uncertainty

While gold is a popular safe-haven asset, investors may also consider other options during periods of market uncertainty. Government bonds, often considered low-risk investments, can provide a degree of stability. Other precious metals, such as silver and platinum, can also offer diversification benefits within a portfolio designed to withstand market volatility. A well-diversified investment strategy is crucial during such times.

Conclusion: Understanding the Link Between Trump's EU Threats and Gold Prices

In summary, the recent surge in gold prices is strongly linked to the increased market uncertainty caused by Trump's threats towards the EU and his unpredictable trade policies. Trump's EU threats have created a climate of global uncertainty, driving investors to seek the security of gold as a safe-haven asset. Gold's historical role as a safe haven, its lack of correlation with other assets, and its tangible nature reinforce its appeal during such turbulent times.

Stay informed about the latest developments regarding Trump's EU policies and consider adding gold to your investment strategy to mitigate risk during these uncertain times. Understanding how Trump's EU threats impact gold prices can be key to navigating the market and building a resilient investment portfolio. Consider diversifying your investments with gold and other precious metals to safeguard your financial future.

Featured Posts

-

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 25, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 25, 2025 -

France Debates Harsher Penalties For Juvenile Offenders

May 25, 2025

France Debates Harsher Penalties For Juvenile Offenders

May 25, 2025 -

Hsv Im Hoehenflug Aufstieg In Die Bundesliga Perfekt

May 25, 2025

Hsv Im Hoehenflug Aufstieg In Die Bundesliga Perfekt

May 25, 2025 -

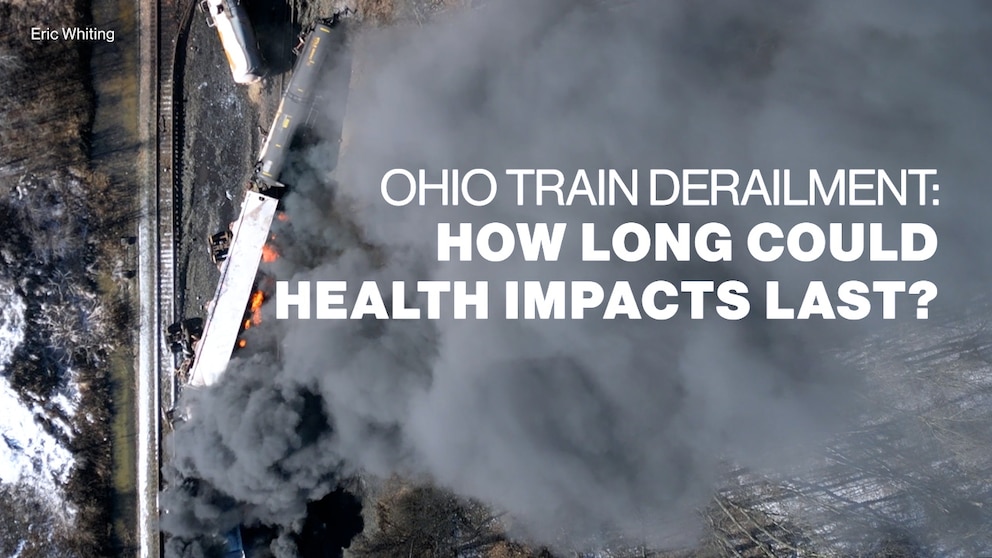

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

May 25, 2025

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

May 25, 2025 -

Avoid Memorial Day Travel Delays Best And Worst Flight Days 2025

May 25, 2025

Avoid Memorial Day Travel Delays Best And Worst Flight Days 2025

May 25, 2025