Trump's Oil Price Outlook: Goldman Sachs' Assessment Of Public Posts

Table of Contents

Goldman Sachs' Methodology: Evaluating Trump's Tweets and Statements

Goldman Sachs, in assessing the impact of Trump's rhetoric on oil price analysis, likely employed a multifaceted methodology. This involved a comprehensive approach encompassing various data points and analytical techniques.

Data Sources

Goldman Sachs' data sources likely included a wide array of publicly available information:

- Tweets: Analyzing Trump's frequent Twitter pronouncements on energy policy and international relations, focusing on keywords related to oil and specific countries. For example, tweets mentioning sanctions against Iran or praising increased domestic oil production would have been key data points.

- Official Statements: Examining official White House press releases, speeches, and addresses to Congress for insights into administration policy on oil and gas.

- Press Conferences: Transcripts and recordings of press conferences offering further context and clarification on Trump's views on the energy sector.

- Interviews: Analyzing Trump's interviews with major news outlets for additional perspectives on his energy policies and potential impact on oil prices.

The inherent challenge here lies in the subjective nature of such qualitative data. Tweets, for instance, are often brief, informal, and susceptible to multiple interpretations.

Sentiment Analysis

Goldman Sachs likely employed sentiment analysis to quantify the emotional tone of Trump's statements regarding oil prices. This involved classifying statements as:

- Positive: Statements suggesting support for increased oil production, deregulation, or favorable trade deals could be classified as positive for oil prices. Example: "We will make America energy independent again!"

- Negative: Statements expressing disapproval of OPEC actions, criticism of specific oil companies, or threats of sanctions might indicate a negative sentiment towards prices. Example: "OPEC is ripping off the world!"

- Neutral: Statements focused on unrelated topics or providing factual information without expressing a clear positive or negative bias.

However, the accuracy of sentiment analysis in the context of political rhetoric is fraught with challenges. Algorithmic biases and the nuances of political language can lead to misinterpretations.

Market Reaction Analysis

To understand the market’s response, Goldman Sachs likely tracked several metrics:

- Immediate Price Fluctuations: Examining changes in oil futures prices and spot prices immediately following Trump's significant statements.

- Trading Volume Changes: Analyzing increased or decreased trading volume in oil markets after announcements, indicating heightened investor activity.

- Correlation Analysis: Establishing a statistical correlation between the sentiment of Trump's statements and subsequent changes in oil prices.

Goldman Sachs would have attempted to isolate the effect of Trump's statements from other market-moving factors, a challenging task given the complexity of the global oil market.

Key Findings: Goldman Sachs' Interpretation of Trump's Influence

Goldman Sachs' analysis likely revealed a complex interplay between Trump's actions and oil market dynamics.

Impact on OPEC and Global Production

Trump's administration actively engaged with OPEC, leading to potential shifts in global oil production:

- Sanctions: Sanctions on Iran, for example, significantly reduced Iranian oil exports, contributing to higher global oil prices.

- Negotiations: Attempts to negotiate with OPEC members to influence production levels.

Data points showing fluctuations in global oil production during the Trump administration would be crucial in assessing his influence.

Influence on US Domestic Production

Trump's policies aimed to boost US domestic oil production:

- Deregulation: Easing environmental regulations related to drilling and extraction.

- Support for Fossil Fuels: Financial incentives and policy support for oil and gas exploration.

Changes in US oil production throughout the Trump presidency would serve as a critical benchmark for evaluating the effectiveness of his policies.

The Role of Geopolitical Factors

Trump's foreign policy significantly impacted oil prices:

- Iran Sanctions: As mentioned earlier, sanctions on Iran affected global supply and prices.

- Relationships with Saudi Arabia: The nature of Trump's relationship with Saudi Arabia also played a role in oil market stability.

Goldman Sachs would have considered these geopolitical factors when evaluating the overall impact of Trump's actions on oil prices.

Predictive Modeling: Goldman Sachs' Forecasting Based on Trump's Rhetoric

Goldman Sachs might have incorporated Trump's statements into predictive models for oil prices.

Model Limitations

Predictive models incorporating political factors are inherently limited:

- Unpredictable Events: Geopolitical events and unexpected policy shifts make accurate forecasting extremely difficult.

- Unexpected Policy Changes: Trump's frequent policy changes made predicting long-term market trends especially challenging.

Accuracy of Predictions

Assessing the accuracy requires comparing Goldman Sachs' forecasts based on Trump's statements against actual oil price movements. This would likely involve analyzing the error margins of their models and determining the degree to which Trump's rhetoric influenced prediction accuracy.

Future Implications

Trump's legacy on the oil market will continue to influence future price predictions. Goldman Sachs' continued research into the impact of political rhetoric on commodity markets, including oil, is vital for understanding future price movements.

Conclusion: Understanding Trump's Lasting Influence on Oil Price Predictions

Goldman Sachs' analysis of Trump's oil price outlook likely highlighted a complex relationship between his public statements and oil market behavior. While sentiment analysis and market reaction analysis provided insights, the inherent limitations of predicting oil prices based solely on political rhetoric must be acknowledged. Multiple factors, including geopolitical events and traditional supply-demand dynamics, significantly influence oil price forecasts. To stay informed, continue researching Trump's oil price outlook and the broader impact of political rhetoric on commodity pricing, paying close attention to the continued analyses from Goldman Sachs and other key financial institutions in this vital field. Understanding the influence of political factors on energy markets remains crucial for investors and policymakers alike.

Featured Posts

-

Pinch Hit Magic Gurriels Rbi Single Lifts Padres Over Braves

May 15, 2025

Pinch Hit Magic Gurriels Rbi Single Lifts Padres Over Braves

May 15, 2025 -

Npo Toezichthouder En Bruins Gesprek Over Leeflang Noodzakelijk

May 15, 2025

Npo Toezichthouder En Bruins Gesprek Over Leeflang Noodzakelijk

May 15, 2025 -

Key Advisors Assist Xi In Securing Us Deal

May 15, 2025

Key Advisors Assist Xi In Securing Us Deal

May 15, 2025 -

Vertrouwen In De Npo De Rol Van Het College Van Omroepen

May 15, 2025

Vertrouwen In De Npo De Rol Van Het College Van Omroepen

May 15, 2025 -

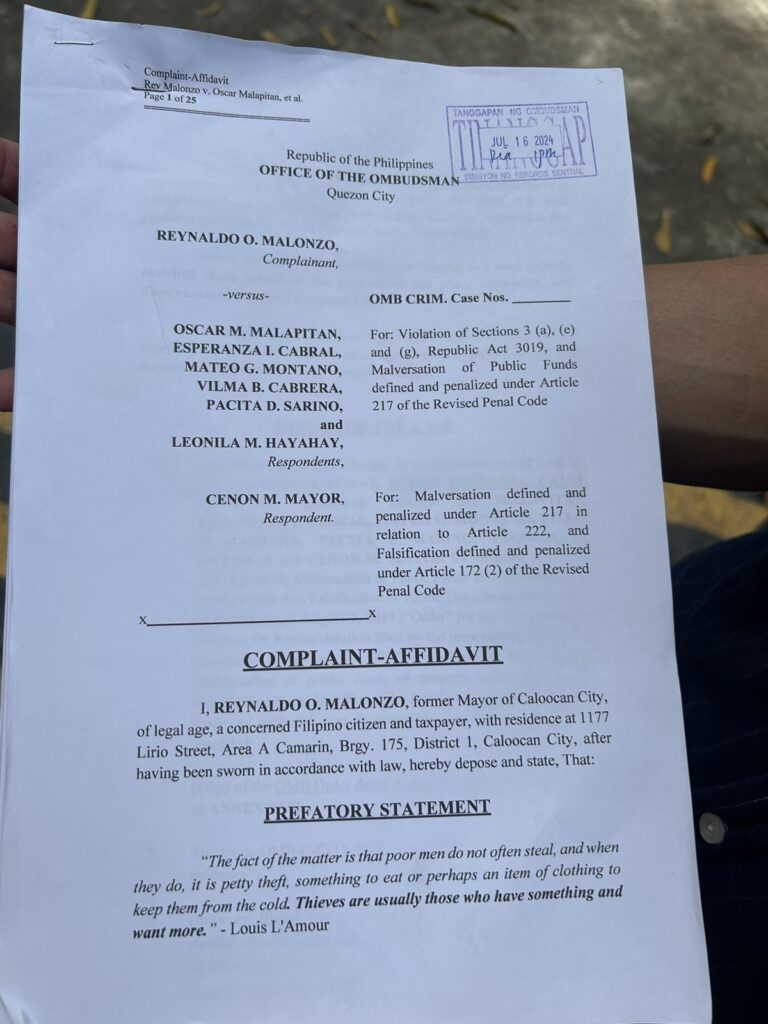

Latest Caloocan Election Results Malapitan Extends Lead Against Trillanes

May 15, 2025

Latest Caloocan Election Results Malapitan Extends Lead Against Trillanes

May 15, 2025

Latest Posts

-

How Liverpool Fc Influenced Paddy Pimbletts Ufc 314 Travel

May 15, 2025

How Liverpool Fc Influenced Paddy Pimbletts Ufc 314 Travel

May 15, 2025 -

Paddy Pimblett Vs Michael Chandler A Ufc Veterans Perspective

May 15, 2025

Paddy Pimblett Vs Michael Chandler A Ufc Veterans Perspective

May 15, 2025 -

Ufc Veteran Analyzes The Paddy Pimblett Vs Michael Chandler Fight

May 15, 2025

Ufc Veteran Analyzes The Paddy Pimblett Vs Michael Chandler Fight

May 15, 2025 -

Ufc 314 Pimbletts Path To A Championship Contender Spot

May 15, 2025

Ufc 314 Pimbletts Path To A Championship Contender Spot

May 15, 2025 -

Paddy Pimblett Prioritizes Liverpool Fc Ufc 314 Travel Plans Revealed

May 15, 2025

Paddy Pimblett Prioritizes Liverpool Fc Ufc 314 Travel Plans Revealed

May 15, 2025