Trump's Tariffs: $174 Billion Wipeout For Top 10 Billionaires

Table of Contents

The Billionaires Most Affected by Trump's Tariffs

Estimating the precise financial impact of Trump's tariffs on individual billionaires is complex, as their vast portfolios are diversified. However, analyses suggest significant losses for those heavily invested in sectors targeted by the tariffs. While precise figures are difficult to definitively attribute solely to tariffs, studies indicate substantial impacts. For example, consider the following (note: these figures are illustrative and based on estimations from various sources; precise attribution to tariffs alone is difficult):

-

Jeff Bezos (Amazon): Estimated losses stemming from increased import costs and potential decreased consumer spending. The tariffs affected various product categories sold on Amazon's platform, impacting both sellers and the company itself.

-

Elon Musk (Tesla): Tariffs on imported components for Tesla vehicles, particularly batteries, likely increased production costs and affected profit margins.

-

Mark Zuckerberg (Meta): While Meta's impact may be less direct compared to manufacturers, increased costs throughout the supply chain and decreased global trade could have indirectly affected advertising revenue.

-

Warren Buffett (Berkshire Hathaway): Berkshire Hathaway's diverse holdings were impacted across multiple sectors, including manufacturing and retail, leading to overall losses within the portfolio.

-

Bill Gates (Microsoft): Increased costs in the tech sector supply chain, potentially through higher prices for components, might have had a minor indirect effect.

Bullet Points:

- Increased input costs: Tariffs increased the cost of imported raw materials and components, squeezing profit margins for many businesses.

- Reduced consumer spending: Higher prices due to tariffs led to reduced consumer demand, impacting sales for various businesses.

- Supply chain disruptions: The tariff wars disrupted global supply chains, leading to delays and increased costs for companies.

- Retaliatory tariffs: Other countries imposed retaliatory tariffs on US exports, hurting American businesses and farmers.

Sectors Heavily Impacted by the Tariff Wars

Several sectors felt the brunt of Trump's tariff policies. The impact wasn't uniform, with some industries suffering more than others.

-

Retail: Increased prices on imported goods significantly reduced consumer purchasing power and impacted profit margins for retailers. Many retailers passed on higher costs to consumers, potentially slowing sales growth.

-

Technology: The tech sector faced increased costs for imported components, leading to higher prices for electronic devices and impacting profitability for tech companies.

-

Agriculture: Farmers faced retaliatory tariffs from other countries, severely impacting exports and leading to significant financial losses. This sector provides a clear example of the repercussions of global trade wars.

-

Manufacturing: The manufacturing sector faced both increased input costs and reduced export opportunities due to retaliatory tariffs.

Bullet Points:

- Increased consumer prices: The tariffs led to a significant increase in consumer prices across various sectors, impacting household budgets.

- Reduced business profitability: Higher costs and reduced demand led to lower profit margins for many businesses.

- Job losses: The economic downturn caused by the tariffs led to job losses in multiple sectors, particularly manufacturing and agriculture.

The Ripple Effect: Impact on Jobs and the Economy

The impact of Trump's tariffs extended far beyond the wealthiest individuals. The ripple effect on the broader economy was substantial.

-

Job losses: Decreased consumer spending and business closures led to job losses, particularly in sectors heavily reliant on international trade.

-

Inflation: The increased prices caused by the tariffs contributed to inflation, eroding consumer purchasing power.

-

International trade relations: The tariff wars damaged US relationships with key trading partners, hindering future economic cooperation.

Arguments For and Against Trump's Tariffs

The economic rationale behind Trump's tariffs remains highly contested.

Arguments For:

- Protecting domestic industries: Proponents argued that tariffs protected American industries from unfair foreign competition.

- Creating jobs: It was claimed that tariffs would boost domestic manufacturing and create jobs in the US.

Arguments Against:

- Increased prices for consumers: Critics argued that the tariffs led to higher prices for consumers, reducing their purchasing power.

- Trade wars: The tariffs sparked retaliatory tariffs from other countries, leading to trade wars that hurt both US and foreign businesses.

- Negative impact on global economy: The tariffs were seen as detrimental to the global economy, disrupting international trade and slowing economic growth.

Long-Term Consequences of Trump's Trade Policies

The long-term economic and geopolitical consequences of Trump's tariffs are still unfolding.

-

Impact on US competitiveness: The tariffs might have hindered US competitiveness in the global market by increasing the cost of American-made goods.

-

Future trade disputes: The tariff wars set a precedent for future trade disputes and created uncertainties in the global trading system.

-

Economic recovery: Assessing the overall economic recovery following the period of tariffs requires further analysis and long-term data.

Conclusion

Trump's tariffs resulted in a significant potential financial impact, potentially wiping out $174 billion for the top ten billionaires, highlighting the far-reaching consequences of these trade policies. The analysis revealed significant losses across multiple sectors, including retail, technology, and agriculture. The ripple effects on jobs, inflation, and international relations cannot be overlooked. Understanding the complexities of these tariffs and their lasting impact is crucial for informed economic policy discussions. Further research into the long-term effects of these trade policies, including their impact on different income brackets, is needed. Learn more about the economic consequences of Trump's tariffs and the ongoing debate surrounding them. Continue exploring the effects of these policies by visiting [link to relevant resources or further reading].

Featured Posts

-

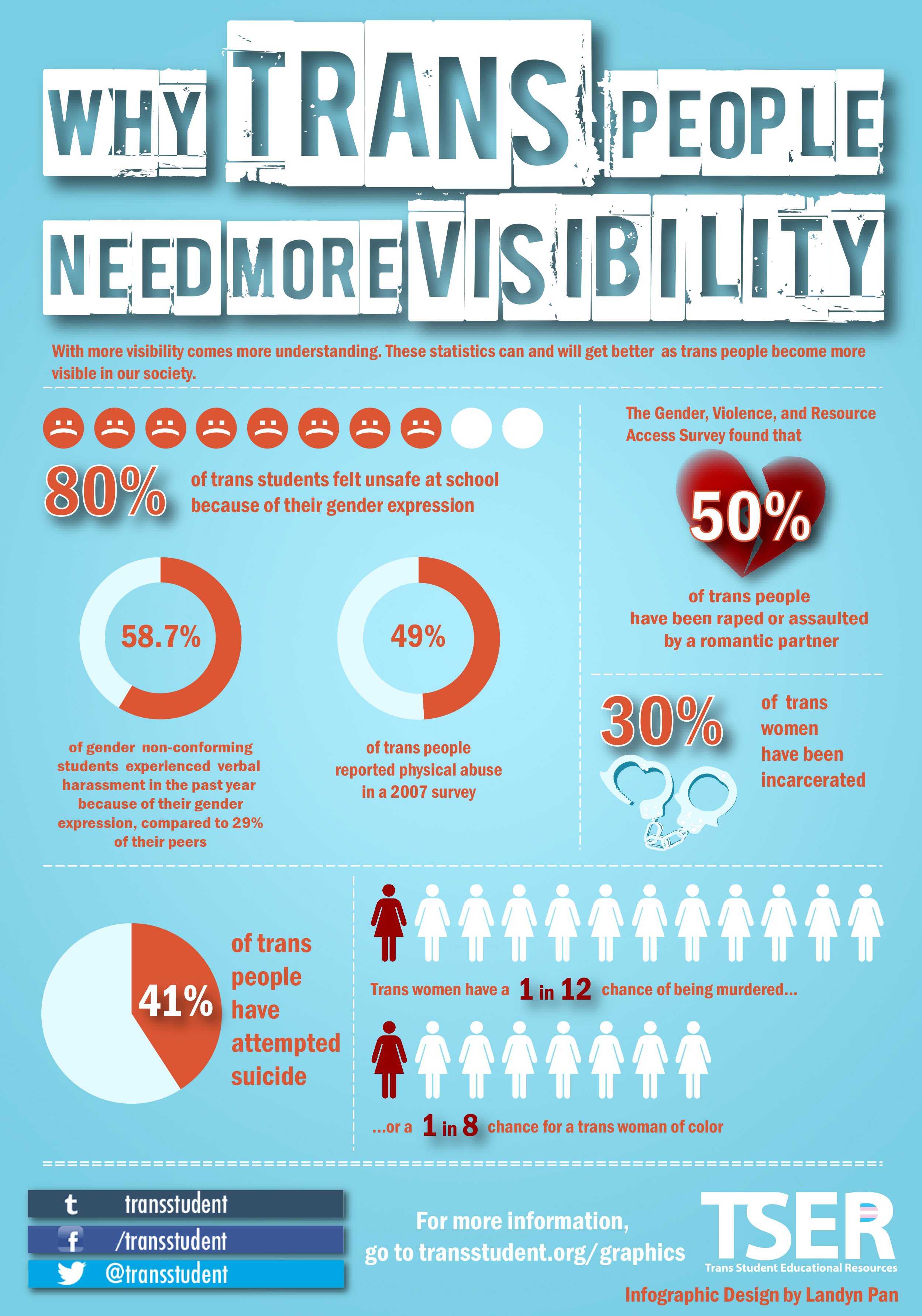

International Transgender Day Of Visibility Becoming A Stronger Ally

May 10, 2025

International Transgender Day Of Visibility Becoming A Stronger Ally

May 10, 2025 -

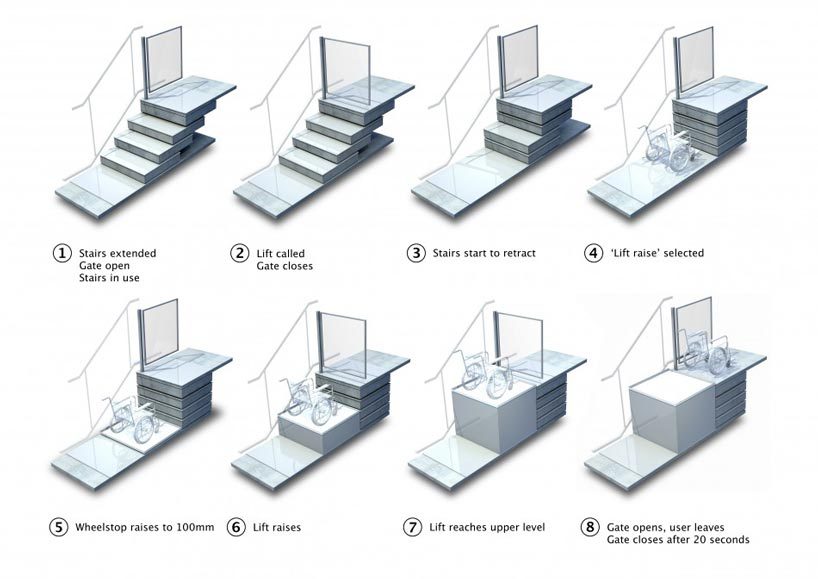

Tf Ls Commitment To Wheelchair Accessibility Navigating The Elizabeth Line

May 10, 2025

Tf Ls Commitment To Wheelchair Accessibility Navigating The Elizabeth Line

May 10, 2025 -

Unlocking The Nyt Strands April 9 2025 Puzzle With Clues And Spangram

May 10, 2025

Unlocking The Nyt Strands April 9 2025 Puzzle With Clues And Spangram

May 10, 2025 -

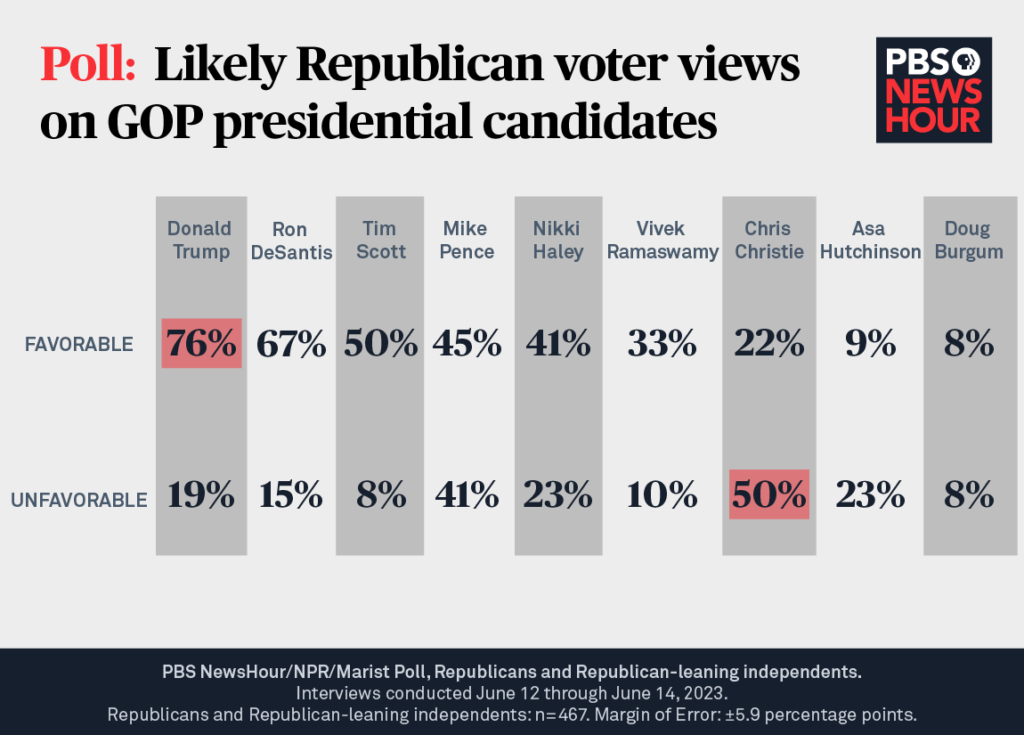

2023 Nl Federal Election Candidate Comparison

May 10, 2025

2023 Nl Federal Election Candidate Comparison

May 10, 2025 -

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025