Trump's Tariffs: Exclusive Strategic Guidance From Goldman Sachs

Table of Contents

Understanding the Impact of Trump's Tariffs

Sector-Specific Analysis

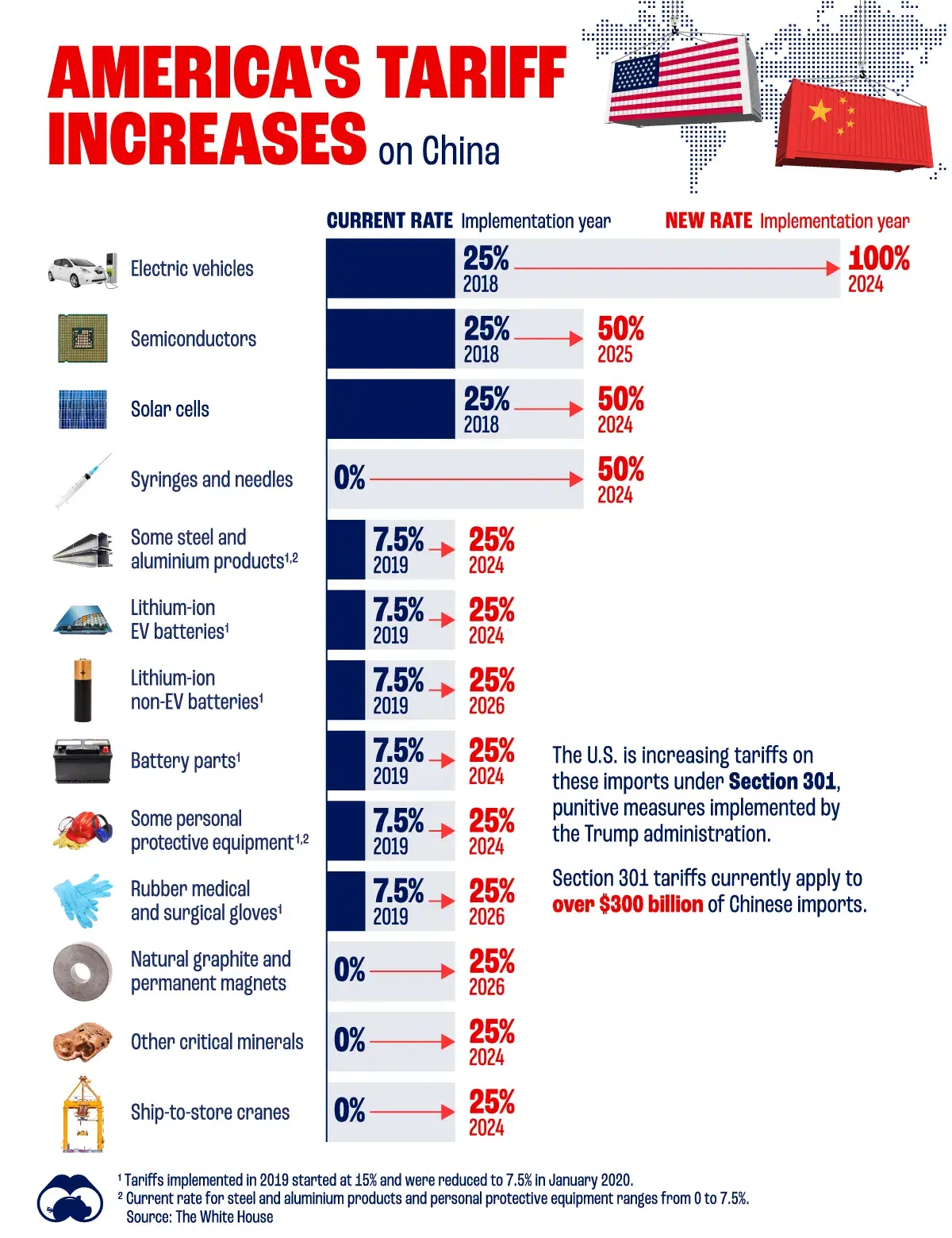

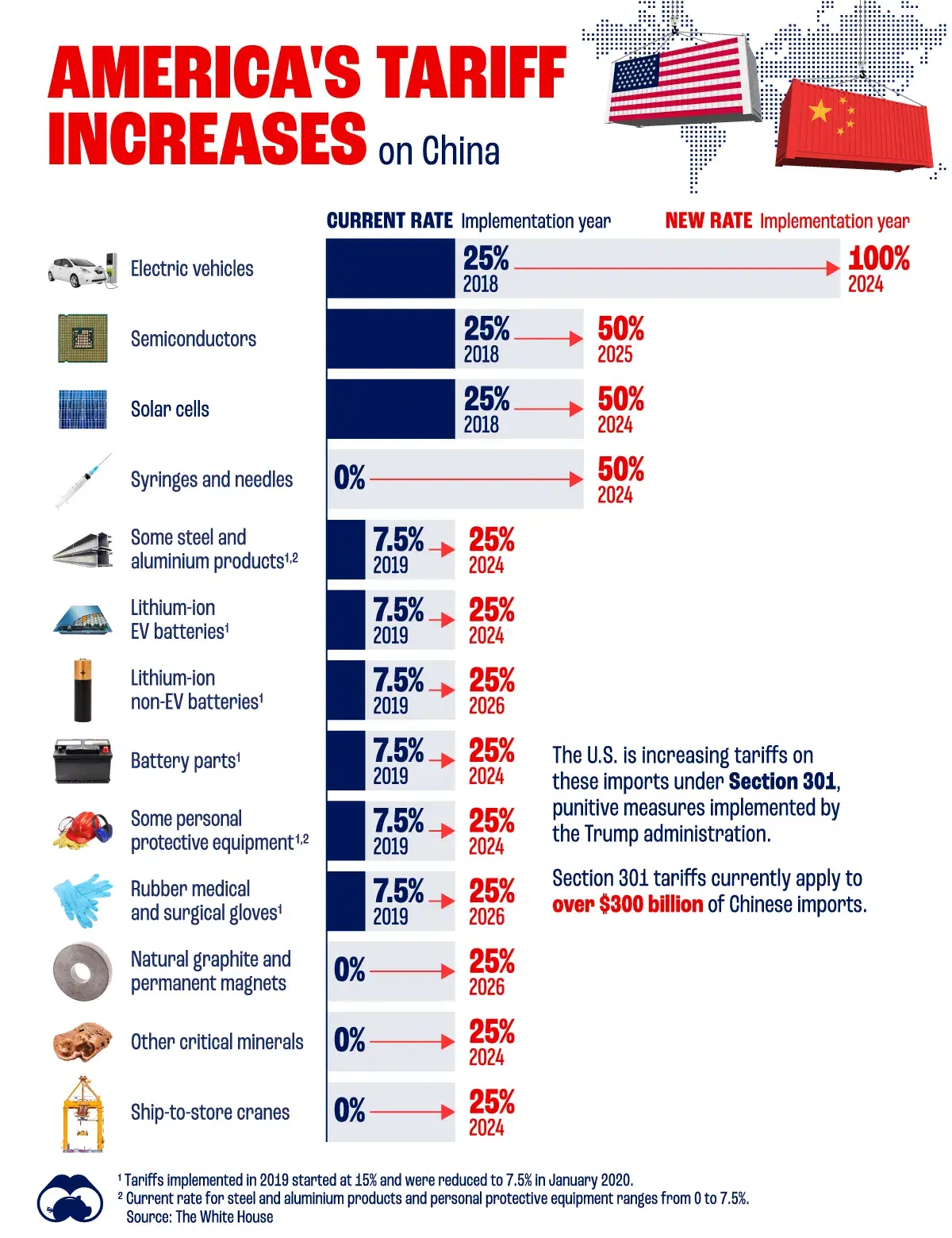

Trump's tariffs didn't impact all sectors equally. A detailed examination reveals winners and losers. Goldman Sachs's research highlighted significant variations in the tariff impact analysis across different industries.

-

Industries that benefited: Certain domestic industries, particularly some segments of manufacturing, experienced increased demand due to reduced competition from foreign imports. This led to job creation and increased domestic production in specific sectors. For instance, Goldman Sachs noted a surge in domestic steel production following the imposition of tariffs on steel imports from China.

-

Industries that suffered: Conversely, sectors heavily reliant on imported materials or components, such as agriculture and some technology sub-sectors, experienced increased input costs, impacting profitability and competitiveness. The increase in the price of imported goods also led to inflationary pressure across the economy, as documented in Goldman Sachs's economic reports. The agricultural sector, for example, faced significant challenges due to retaliatory tariffs imposed by key trading partners.

-

Overall economic impact: The net economic impact of Trump's tariffs remains a subject of debate. While some sectors benefited, others suffered, leading to complex and often contradictory effects on overall economic growth and employment. Goldman Sachs's research suggests that while certain domestic industries saw gains, these were often offset by losses in other sectors and a rise in consumer prices due to increased import costs.

Global Trade Implications

Trump's tariffs triggered a wave of retaliatory measures, significantly impacting global trade relationships. This resulted in global trade wars and widespread supply chain disruptions.

-

Changes in trade relationships: The imposition of tariffs led to significant deterioration in trade relationships with China, the EU, and other key trading partners. Retaliatory tariffs from these countries further escalated tensions and disrupted established trade flows. Goldman Sachs's analyses highlight a significant increase in trade disputes and a decline in global trade volume during this period.

-

Supply chain disruptions: Companies struggled to adapt to the changing trade landscape, leading to disruptions in global supply chains. Businesses were forced to re-evaluate their sourcing strategies, incurring additional costs and delays. Goldman Sachs's reports emphasized the vulnerability of global supply chains to geopolitical events and trade protectionism.

Goldman Sachs's Strategic Recommendations for Businesses

Risk Mitigation Strategies

Navigating the complexities of Trump's tariffs required proactive risk management. Goldman Sachs provided crucial guidance on effective mitigation strategies.

-

Diversifying supply chains: Businesses were urged to reduce their reliance on single-source suppliers and diversify their sourcing geographically. This reduces vulnerability to tariff changes and geopolitical instability.

-

Exploring alternative sourcing options: Companies needed to actively explore alternative sourcing options, potentially shifting production to countries with more favorable trade relationships. This strategy often required significant investment in new facilities or partnerships.

-

Hedging against currency fluctuations: The volatility of exchange rates exacerbated the impact of tariffs. Goldman Sachs emphasized the importance of implementing hedging strategies to minimize currency risks.

-

Lobbying efforts: Engaging in effective lobbying efforts to influence trade policy became crucial. This involved actively participating in policy discussions and advocating for business interests.

Opportunity Identification and Exploitation

Despite the challenges, Trump's tariffs also created opportunities for businesses that adapted effectively.

-

Successful companies: Companies that successfully navigated the tariff landscape often exhibited agility, adaptability, and a proactive approach to risk management. They were able to adjust their strategies quickly and capitalize on emerging opportunities.

-

Potential investment opportunities: Some sectors, particularly those benefiting from reduced competition from imports, emerged as attractive investment opportunities. Goldman Sachs provided guidance on identifying and evaluating these opportunities.

-

Emerging markets: The shift in global trade flows created opportunities in new and emerging markets. Companies that could quickly adapt and penetrate these markets gained a competitive advantage.

The Long-Term Effects of Trump's Tariffs

Lasting Impacts on Global Trade

Trump's trade policies had far-reaching and lasting consequences for global trade patterns and international cooperation.

-

Shifts in global power dynamics: The trade disputes triggered by Trump's tariffs impacted the balance of power in the global economy. They contributed to a more fragmented and less cooperative international trade environment.

-

Changes in supply chains: The disruptions caused by Trump's tariffs accelerated the trend towards regionalization and diversification of supply chains. Businesses increasingly prioritized supply chain resilience over cost optimization.

-

Evolution of trade agreements: The experience of Trump's tariffs highlighted the limitations of existing trade agreements and fueled debates about the need for more robust and adaptable mechanisms for managing global trade.

Lessons Learned and Future Implications

The Trump tariff experience provides valuable lessons for businesses and policymakers alike.

-

Proactive risk management: The importance of proactive risk management in navigating trade uncertainty cannot be overstated. This includes carefully monitoring trade policy developments, diversifying supply chains, and implementing hedging strategies.

-

Adaptability in global markets: Businesses must cultivate agility and adaptability to respond effectively to sudden changes in the global trading environment. This requires a flexible organizational structure, responsive strategies, and the ability to make quick decisions.

-

Potential future trade conflicts: The Trump administration's trade policies serve as a warning of the potential for future trade conflicts. Businesses must be prepared for further volatility and unexpected disruptions in the global trade system.

Conclusion:

This analysis of Trump's tariffs, drawing on exclusive insights from Goldman Sachs, highlights the significant impact of these policies on global trade and the strategic choices faced by businesses. By understanding the complex interplay of risks and opportunities presented by Trump's tariffs, businesses can develop effective strategies to navigate this challenging landscape. For in-depth analysis and customized strategic guidance on mitigating the risks and capitalizing on the opportunities presented by Trump's tariffs, contact Goldman Sachs today.

Featured Posts

-

Convicted Cardinals Right To Vote In Papal Conclave Questioned

Apr 29, 2025

Convicted Cardinals Right To Vote In Papal Conclave Questioned

Apr 29, 2025 -

Will A Convicted Cardinal Influence The Next Papal Election

Apr 29, 2025

Will A Convicted Cardinal Influence The Next Papal Election

Apr 29, 2025 -

Understanding Chicagos Zombie Office Buildings And Their Implications

Apr 29, 2025

Understanding Chicagos Zombie Office Buildings And Their Implications

Apr 29, 2025 -

The Evolution Of Jeff Goldblum His Most Memorable Roles

Apr 29, 2025

The Evolution Of Jeff Goldblum His Most Memorable Roles

Apr 29, 2025 -

Missing British Paralympian Las Vegas Police Launch Investigation

Apr 29, 2025

Missing British Paralympian Las Vegas Police Launch Investigation

Apr 29, 2025

Latest Posts

-

Visita Familiar De Boris Johnson En Texas Termina Con Inesperado Ataque De Avestruz

May 12, 2025

Visita Familiar De Boris Johnson En Texas Termina Con Inesperado Ataque De Avestruz

May 12, 2025 -

Voyna I Mir Dzhonson I Tramp Raskhodyatsya V Strategiyakh Uregulirovaniya

May 12, 2025

Voyna I Mir Dzhonson I Tramp Raskhodyatsya V Strategiyakh Uregulirovaniya

May 12, 2025 -

Ataque De Avestruz A Boris Johnson En Texas La Reaccion Del Exprimer Ministro

May 12, 2025

Ataque De Avestruz A Boris Johnson En Texas La Reaccion Del Exprimer Ministro

May 12, 2025 -

El Avestruz Y Boris Johnson Un Encuentro Inesperado En Texas

May 12, 2025

El Avestruz Y Boris Johnson Un Encuentro Inesperado En Texas

May 12, 2025 -

Boris Johnson Y El Incidente Con El Avestruz En Texas Detalles De La Visita Familiar

May 12, 2025

Boris Johnson Y El Incidente Con El Avestruz En Texas Detalles De La Visita Familiar

May 12, 2025