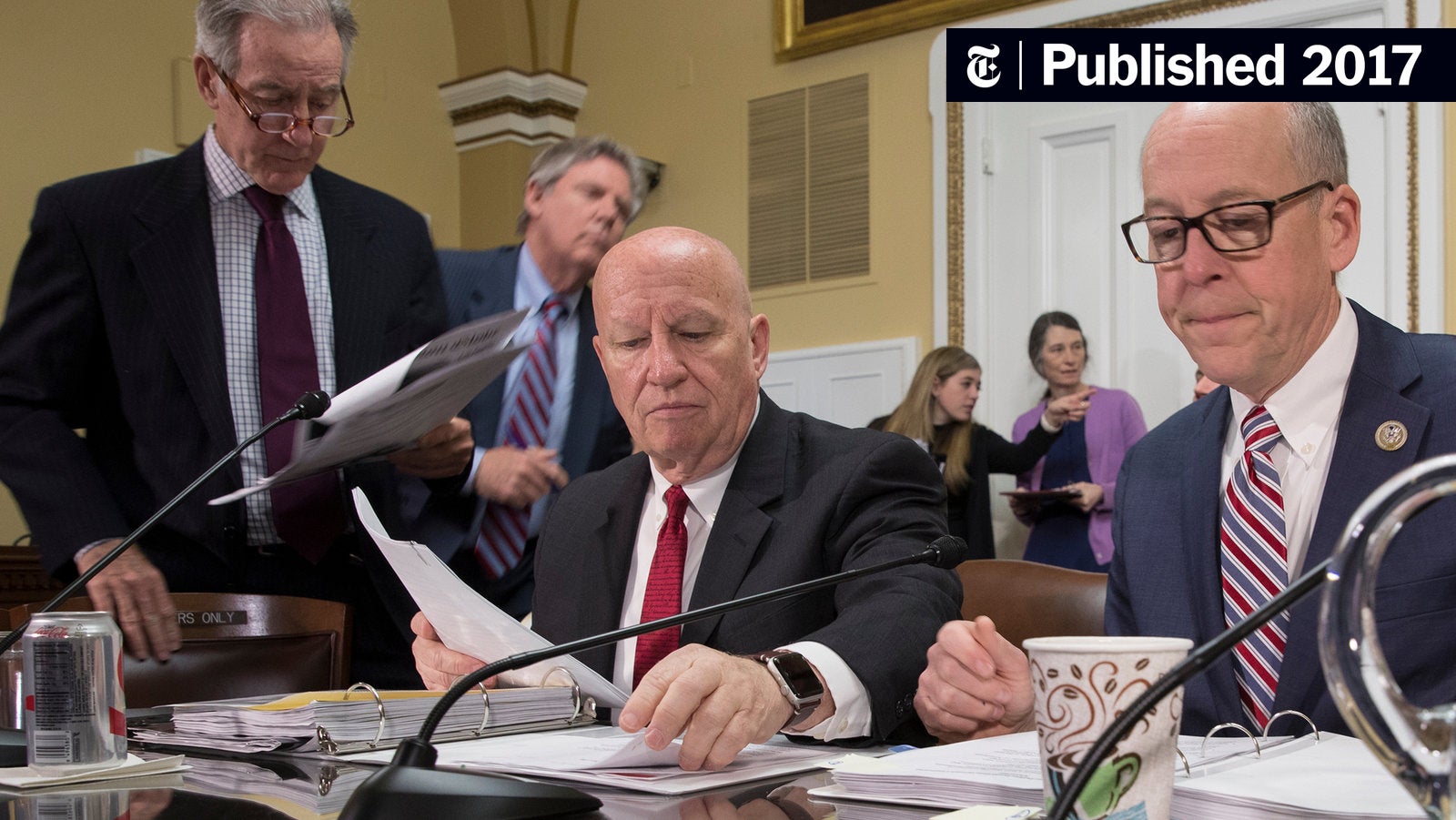

Trump's Tax Reform Faces Challenges From Within The GOP

Table of Contents

Internal GOP Divisions on Tax Reform's Effectiveness

The Republican party is far from unified on the effectiveness of Trump's tax reform. While proponents point to initial economic growth following the cuts, critics argue that the benefits were short-lived and unevenly distributed. The promised economic boom, fueled by increased investment and job creation, hasn't materialized to the extent predicted by some.

-

Differing Economic Impacts: Some economists argue that the tax cuts did stimulate short-term growth, citing increases in GDP in the immediate aftermath. However, others counter that this growth was unsustainable and masked underlying economic weaknesses. Studies by the Congressional Budget Office (CBO) and others offer conflicting data on the long-term impact. For instance, the CBO projected increased deficits as a result of the tax cuts, a point of contention within the GOP.

-

Republican Voices of Concern: Several prominent Republicans, including [insert names of specific Republican politicians with differing views, citing sources], have voiced concerns about the tax cuts' long-term consequences. These concerns range from the ballooning national debt to the perceived inequitable distribution of benefits.

-

Debate on National Debt and Tax Benefits: The debate surrounding the national debt is central to the internal GOP divisions on Trump's Tax Reform. The tax cuts significantly increased the national deficit, prompting concerns about future fiscal responsibility. Furthermore, the distribution of tax benefits remains a point of contention. While corporations saw substantial reductions in their tax burden, many argue that the benefits for middle-class families were less significant. This has created a rift within the party regarding the fairness and overall effectiveness of the policy.

Rising Concerns over Income Inequality and Tax Reform

A significant challenge to the continued acceptance of Trump's Tax Reform is the growing concern about income inequality. Critics argue that the tax cuts disproportionately benefited the wealthy, exacerbating existing economic disparities. This issue resonates strongly within the GOP, as well as amongst the broader electorate.

-

Wealth Concentration Data: Data from organizations like the Economic Policy Institute (EPI) reveal a widening gap between the wealthiest Americans and the rest of the population following the implementation of the tax cuts. This has fueled criticism from within the GOP that the tax cuts weren't designed to benefit the average American.

-

Lack of Middle-Class Relief: Many Republicans now express concern that the tax cuts failed to deliver meaningful relief to middle-class families. The perceived focus on corporate tax cuts, rather than broader tax relief, has damaged the policy's image within segments of the party.

-

Political Implications of Inequality: The growing income inequality linked to Trump's Tax Reform has significant political ramifications. This disparity is increasingly becoming a key campaign issue, influencing public opinion and impacting the electoral prospects of the Republican party.

The Impact of Shifting Economic Priorities on Trump's Tax Reform

The ongoing costs associated with Trump's Tax Reform are clashing with emerging economic priorities, creating internal tension within the GOP. The desire for increased infrastructure spending, social security reform, and other initiatives places budgetary constraints on maintaining the current tax structure.

-

Budgetary Constraints: The significant reduction in government revenue due to the tax cuts has created a difficult budgetary situation. Funding competing priorities, such as infrastructure improvements, while sustaining the tax cuts, requires difficult political choices and compromises.

-

Political Trade-offs: Maintaining the tax cuts while simultaneously funding other vital initiatives requires a balancing act. This has created intense political infighting within the GOP, with different factions prioritizing different spending initiatives.

-

Future Policy Adjustments: As economic priorities shift, the future of Trump's Tax Reform is uncertain. There's growing pressure to explore potential adjustments to the tax code to address the budgetary constraints and better align with evolving political needs. This may involve repealing or modifying specific provisions.

The Role of the Next Election Cycle in Shaping the Future of Trump's Tax Reform

The upcoming election cycles will play a crucial role in shaping the future of Trump's Tax Reform. The outcome of these elections and the resulting shifts in power within the GOP could significantly impact the policy's trajectory.

-

Presidential Candidates' Stances: The positions taken by various presidential candidates on tax reform will heavily influence the debate. Some may advocate for maintaining the existing policy, while others may propose alterations or even complete repeal.

-

Potential Alterations or Repeals: Depending on election outcomes, the existing tax cuts are vulnerable to changes. Some Republicans may push for modifications to address concerns about income inequality or budgetary constraints, while others may advocate for complete repeal.

-

Public Opinion's Influence: Public opinion plays a pivotal role. As concerns regarding the tax cuts increase, particularly regarding income inequality, public pressure may force the GOP to reconsider its approach.

Conclusion

Trump's Tax Reform faces numerous challenges, stemming from internal GOP divisions regarding its effectiveness, growing concerns about income inequality, shifting economic priorities, and the upcoming election cycles. The ongoing debate within the GOP highlights the complexity of this crucial policy. The future of Trump's Tax Reform remains uncertain, contingent on political shifts, budgetary constraints, and the evolving public opinion. Stay informed on the evolving debate surrounding Trump's Tax Reform and its lasting impact on the American economy. Further research into the different perspectives within the GOP on this crucial policy is encouraged to understand the complexities involved in Trump's Tax Reform.

Featured Posts

-

Cassidy Hutchinsons Upcoming Memoir Insights Into The January 6th Hearings

Apr 29, 2025

Cassidy Hutchinsons Upcoming Memoir Insights Into The January 6th Hearings

Apr 29, 2025 -

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025 -

Rent Growth Eases In Metro Vancouver Yet Housing Remains Expensive

Apr 29, 2025

Rent Growth Eases In Metro Vancouver Yet Housing Remains Expensive

Apr 29, 2025 -

Israels Gaza Aid Ban Fuel Food And Water Shortages Deepen

Apr 29, 2025

Israels Gaza Aid Ban Fuel Food And Water Shortages Deepen

Apr 29, 2025 -

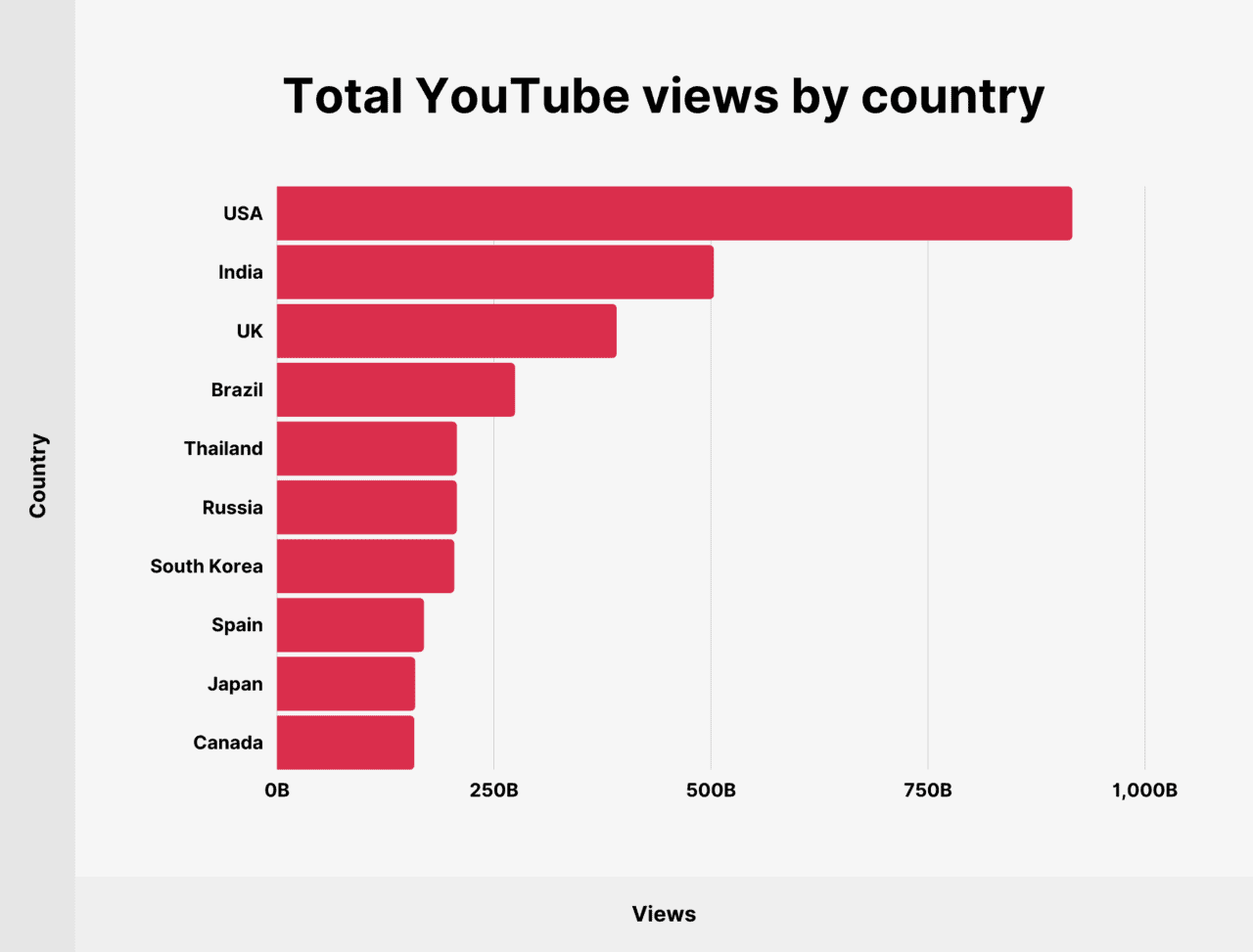

You Tubes Growing Senior Audience Demographics And Engagement

Apr 29, 2025

You Tubes Growing Senior Audience Demographics And Engagement

Apr 29, 2025

Latest Posts

-

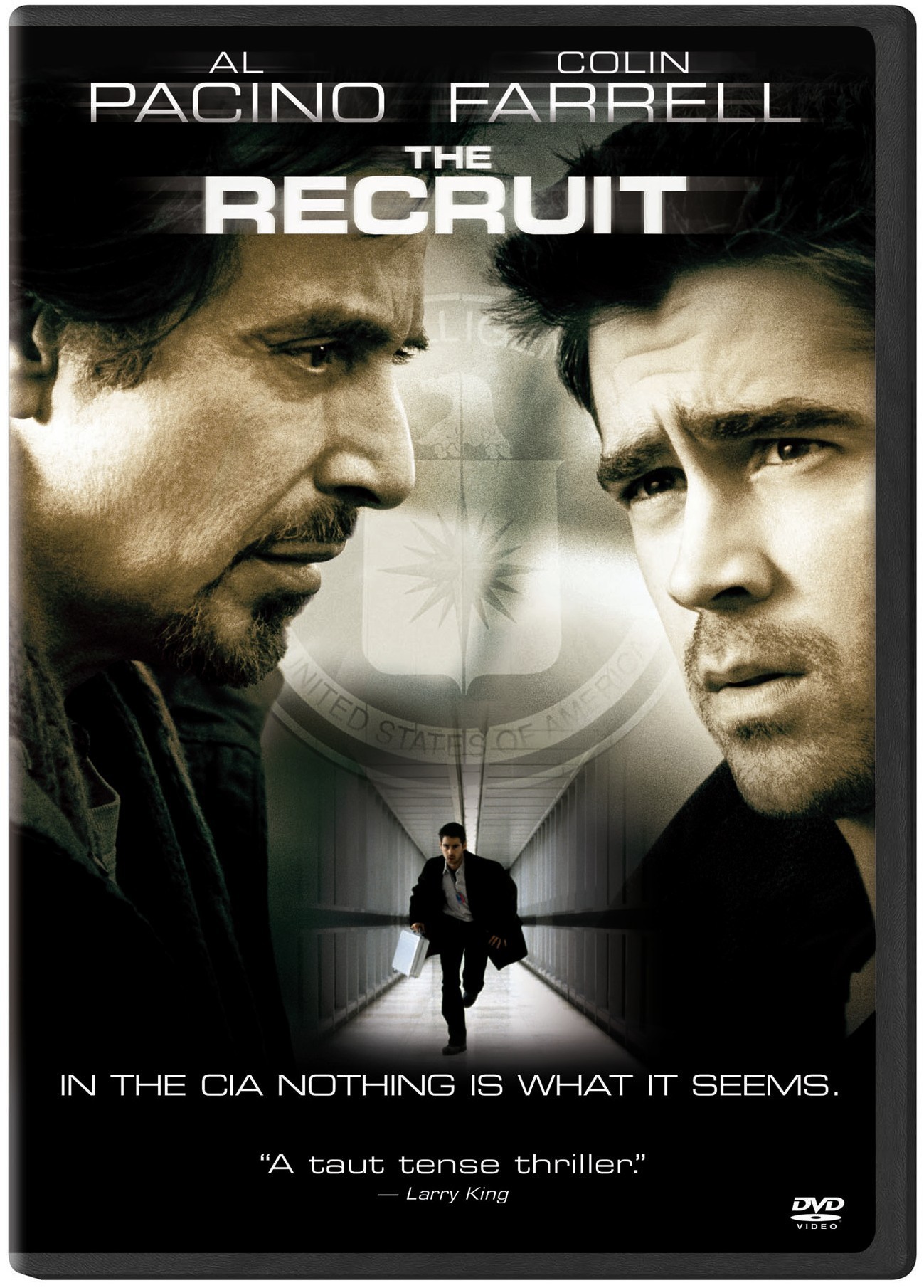

Kelly Graves Latest Recruit A Rising Star From Down Under

May 13, 2025

Kelly Graves Latest Recruit A Rising Star From Down Under

May 13, 2025 -

University Of Oregon Womens Basketball New Recruit From Australia

May 13, 2025

University Of Oregon Womens Basketball New Recruit From Australia

May 13, 2025 -

Oregon Ducks Womens Basketball Graves Adds Top Australian Talent

May 13, 2025

Oregon Ducks Womens Basketball Graves Adds Top Australian Talent

May 13, 2025 -

Kelly Graves Lands Australian Star A Recruiting Coup For Oregon Ducks

May 13, 2025

Kelly Graves Lands Australian Star A Recruiting Coup For Oregon Ducks

May 13, 2025 -

From Social Media Influencer To Political Candidate A Gen Z Perspective

May 13, 2025

From Social Media Influencer To Political Candidate A Gen Z Perspective

May 13, 2025