Trump's Trade War: A $174 Billion Blow To Global Billionaires' Net Worth

Table of Contents

The Impact on Specific Industries

The Trump trade war didn't impact all industries equally. Certain sectors, heavily reliant on global supply chains and international trade, bore the brunt of the economic fallout.

Technology Sector Losses

The technology sector, a cornerstone of the global economy, felt the sting of the tariffs acutely. Companies like Apple, with their extensive global supply chains, faced increased production costs and logistical challenges. The added tariffs on imported components significantly impacted profit margins. This ripple effect extended to related industries, such as semiconductor manufacturing, further exacerbating the losses. Specific tech billionaires experienced substantial reductions in their net worth, with the exact figures varying depending on their individual holdings and investment portfolios.

- Increased costs due to tariffs: Tariffs on imported components like screens and processors directly increased the cost of producing electronic devices.

- Reduced consumer demand: Higher prices for tech products due to tariffs led to a decrease in consumer demand, impacting sales and profitability.

- Disrupted supply chains: The trade war created uncertainty and disruptions in global supply chains, delaying product launches and increasing production costs.

Retail and Consumer Goods

The retail and consumer goods sector also experienced considerable hardship. Tariffs on imported clothing, furniture, and other goods led to price increases for consumers and reduced profit margins for retailers and manufacturers. Many companies struggled to absorb the increased costs, leading to reduced profits and impacting the net worth of billionaires invested in these industries.

- Increased import costs: Tariffs significantly increased the cost of importing raw materials and finished goods, impacting profitability.

- Reduced profit margins: Companies struggled to pass on the full increase in import costs to consumers, leading to squeezed margins and reduced profits.

- Decreased consumer spending: Higher prices for consumer goods led to a decline in consumer spending, further impacting the retail sector.

Automotive Industry Downturn

The automotive industry faced significant challenges, with tariffs impacting both car manufacturers and parts suppliers. Increased import duties on vehicles and parts resulted in higher prices for consumers, reduced sales, and, in some cases, plant closures and job losses. This downturn directly translated into losses for billionaires invested in the automotive sector.

- Higher import duties on vehicles and parts: Tariffs on imported vehicles and components raised prices, making them less competitive.

- Reduced sales: Higher prices and decreased consumer confidence led to a significant reduction in sales for many automotive companies.

- Plant closures and job losses: Some automotive companies were forced to close plants or lay off workers due to reduced demand and profitability.

Geographic Distribution of Losses

The impact of the Trump trade war wasn't confined to any single geographic region. Billionaires across the globe, particularly in regions heavily involved in international trade, experienced losses.

Impact on US Billionaires

While some might assume US billionaires were shielded from the impact, this wasn't entirely true. While some benefited from increased domestic production, others faced losses due to increased domestic production costs and the loss of export markets to retaliatory tariffs imposed by other countries. The effects were complex and varied significantly depending on the specific industry and business model.

- Increased domestic production costs: The trade war led to higher costs for raw materials and components, impacting domestic production.

- Loss of export markets: Retaliatory tariffs imposed by other countries reduced access to export markets for some US businesses.

Impact on Asian Billionaires

Asian billionaires, particularly in China, Japan, and South Korea, felt the impact severely. Retaliatory tariffs imposed by these countries in response to US tariffs significantly reduced their exports to the US, impacting revenues and ultimately their net worth.

- Reduced exports to the US: Retaliatory tariffs imposed by China, Japan, and South Korea significantly reduced their exports to the US.

- Increased production costs: Increased domestic production costs due to tariffs further impacted profitability.

European Billionaires' Exposure

European billionaires also faced repercussions from the trade war, primarily through disruptions in transatlantic trade and reduced access to the US market. The complexities of global supply chains meant that businesses with links to the US were significantly impacted.

- Disrupted supply chains: The trade war caused significant disruption to global supply chains, impacting businesses across Europe.

- Reduced access to the US market: Retaliatory tariffs and decreased consumer demand in the US reduced access for European businesses to the American market.

Long-Term Economic Consequences

The Trump trade war's long-term effects continue to ripple through the global economy. Increased uncertainty, reduced global trade, and damage to international relations are just some of the lingering consequences. The impact on foreign investment and the overall pace of global economic growth remain areas of concern.

- Increased uncertainty: The trade war created uncertainty and volatility in global markets, impacting investment and economic growth.

- Reduced global trade: Tariffs and trade barriers hindered global trade, reducing economic efficiency and growth.

- Damage to international relations: The trade war strained relationships between countries, harming international cooperation and collaboration.

Conclusion

Trump's trade war, with its aggressive tariff policies, undeniably inflicted a significant $174 billion blow to the net worth of global billionaires. The impact spanned diverse industries – technology, retail, and automotive – and impacted billionaires across geographical regions, demonstrating the interconnectedness of the global economy. The long-term economic consequences, including increased uncertainty and damaged international relations, serve as a cautionary tale about the risks associated with protectionist trade policies. Understanding the ramifications of this pivotal economic event is crucial for navigating future global economic challenges. Further research into the lasting impact of the Trump trade war is essential to understanding the complex dynamics of global finance and trade.

Featured Posts

-

Viral Podcast Ignites Daycare Debate Psychologists Claims And Counterarguments

May 09, 2025

Viral Podcast Ignites Daycare Debate Psychologists Claims And Counterarguments

May 09, 2025 -

Totalitarian Threat Lais Ve Day Address Underscores Taiwans Security Concerns

May 09, 2025

Totalitarian Threat Lais Ve Day Address Underscores Taiwans Security Concerns

May 09, 2025 -

Air India Responds To Lisa Rays Complaint Actors Claims Unfounded

May 09, 2025

Air India Responds To Lisa Rays Complaint Actors Claims Unfounded

May 09, 2025 -

Starmer Makron Merts Tusk Propustyat Kievskie Torzhestva 9 Maya

May 09, 2025

Starmer Makron Merts Tusk Propustyat Kievskie Torzhestva 9 Maya

May 09, 2025 -

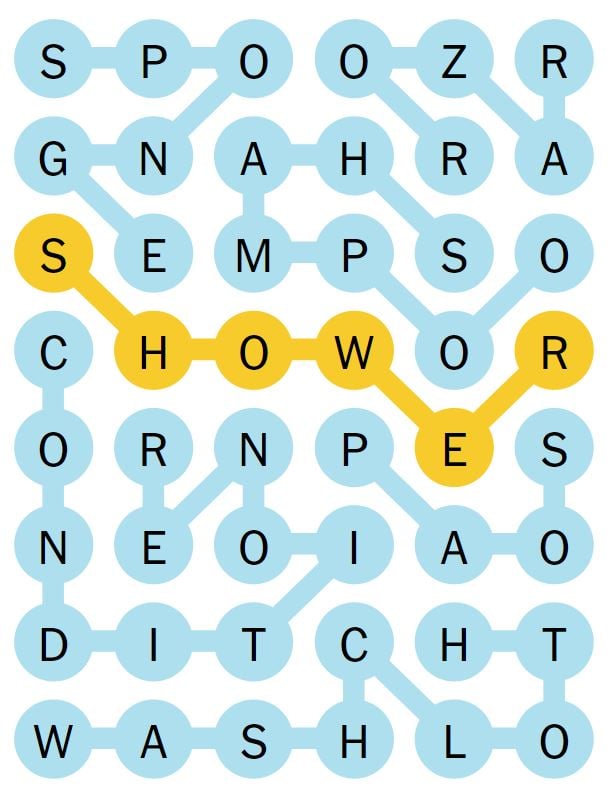

Help With Nyt Strands Puzzle 354 February 20th

May 09, 2025

Help With Nyt Strands Puzzle 354 February 20th

May 09, 2025