TSX Composite Index: Record High Intraday

Table of Contents

Factors Contributing to the TSX Composite Index Record High

Several interconnected factors contributed to the TSX Composite Index reaching its record intraday high. Let's examine the most significant contributors:

Strong Performance of Key Sectors

The robust performance of several key sectors played a crucial role in propelling the TSX Composite Index to new heights.

-

Energy Sector: The energy sector experienced a remarkable surge, driven by rising oil and gas prices fueled by [Specific reasons, e.g., global demand, geopolitical instability]. Major players like [Company Name 1] and [Company Name 2] saw significant stock price increases, directly impacting the overall index. This strong performance highlights the importance of the energy sector in the Canadian economy and its contribution to the TSX's overall health. Keywords: Energy sector, oil prices, gas prices, sector performance, energy stocks.

-

Technology Stocks: The technology sector also contributed significantly, with companies benefiting from [Specific reasons, e.g., innovation in AI, increased digital adoption]. Growth in [Specific sub-sector, e.g., software, e-commerce] led to substantial gains for leading Canadian tech companies. This demonstrates the increasing importance of technology in driving economic growth within the Canadian stock market. Keywords: Technology stocks, tech sector, software companies, e-commerce, technological innovation.

-

Financial Institutions: Strong performance from major Canadian financial institutions further boosted the index. Increased lending activity and positive financial results contributed to their stock price appreciation. The stability and strength of the financial sector remain crucial for the overall health of the TSX Composite Index and the broader Canadian economy. Keywords: Financial institutions, banking sector, financial performance, lending activity.

Positive Economic Indicators

Positive economic indicators significantly influenced investor confidence and contributed to the rise in the TSX Composite Index.

-

GDP Growth: Stronger-than-expected GDP growth figures signaled a healthy Canadian economy, boosting investor optimism. The [Specific GDP growth percentage] reported in [Quarter/Month] exceeded analyst predictions. Keywords: GDP growth, economic growth, economic indicators.

-

Employment Rate: A robust employment rate, with [Specific employment figures], indicated a strong labor market. This positive data reinforced investor confidence in the economy's resilience and future growth potential. Keywords: Employment rate, job growth, labor market.

-

Inflation Figures: While inflation remained a concern, the recent [Specific inflation figures] indicated a potential slowdown, easing investor anxieties about aggressive interest rate hikes. Keywords: Inflation, interest rates, monetary policy.

-

Government Policies: Supportive government policies, such as [Specific example, e.g., tax incentives for specific industries], fostered a positive environment for investment. Keywords: Government policy, fiscal policy, economic stimulus.

Global Market Influences

Global market trends and events also played a part in the TSX Composite Index's record high.

-

US Stock Market Performance: The positive performance of the US stock market, a significant trading partner, generally creates a positive spillover effect on the Canadian market. Keywords: US stock market, global market trends, international trade.

-

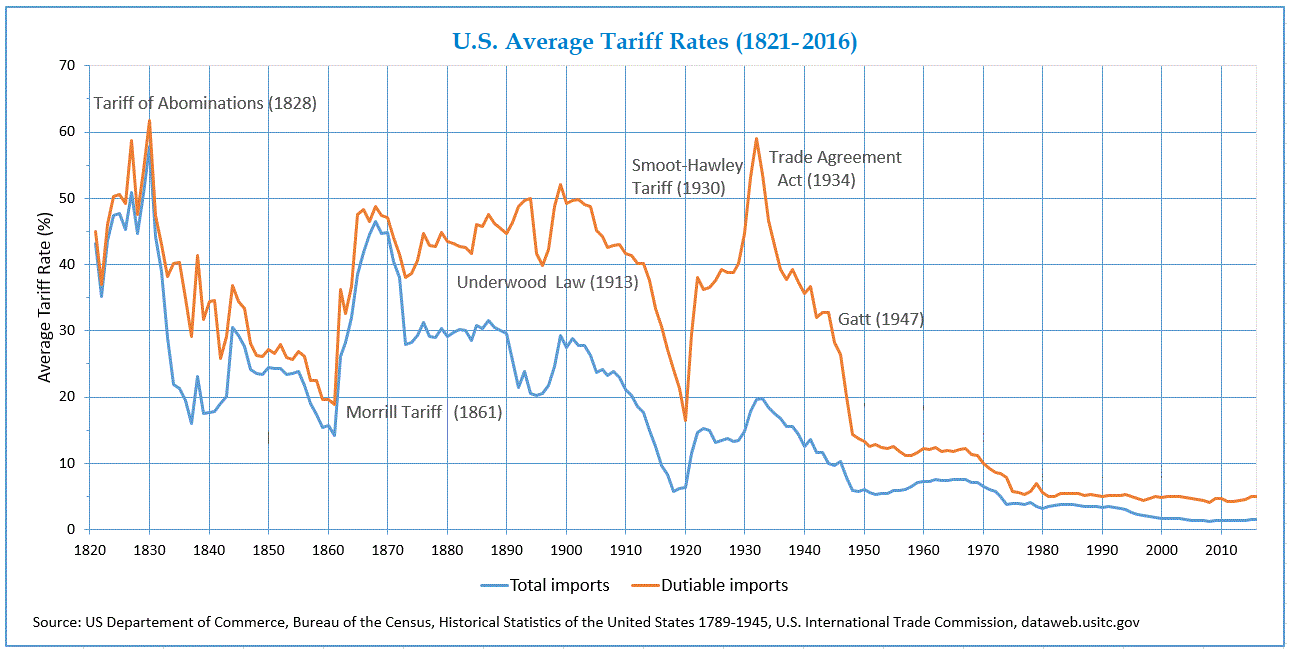

International Trade: Positive developments in international trade, particularly [Specific example, e.g., new trade agreements], contributed to increased investor confidence. Keywords: International trade, trade agreements, global economy.

-

Geopolitical Events: While geopolitical uncertainty always exists, the absence of major negative geopolitical shocks contributed to a more stable investment environment. Keywords: Geopolitical events, global stability, risk assessment.

Increased Investor Sentiment

Improved investor sentiment played a critical role in driving the TSX Composite Index higher.

-

Positive Corporate Earnings: Strong corporate earnings reports from Canadian companies fueled investor confidence and increased demand for Canadian equities. Keywords: Corporate earnings, company performance, stock valuations.

-

Reduced Uncertainty: Decreased market volatility, following a period of uncertainty, allowed investors to adopt a more optimistic outlook. Keywords: Market volatility, investor confidence, risk tolerance.

-

Investment Strategies: Shifting investor strategies towards Canadian equities, perhaps due to [Specific reasons, e.g., perceived undervaluation, diversification strategies], increased demand and pushed the index higher. Keywords: Investment strategies, portfolio diversification, equity markets.

Implications of the TSX Composite Index Record High

The record intraday high of the TSX Composite Index carries both short-term and long-term implications:

Short-Term Implications

-

Increased Consumer Spending: The positive market sentiment could lead to increased consumer confidence and spending. Keywords: Consumer spending, economic growth, consumer confidence.

-

Business Investment: Businesses may be more inclined to invest due to improved market conditions. Keywords: Business investment, capital expenditure, economic expansion.

-

Market Corrections: The potential for short-term market corrections or increased volatility remains. Investors should be prepared for potential fluctuations. Keywords: Market corrections, market volatility, risk management.

Long-Term Implications

-

Sustainable Growth: The record high could signal a period of sustainable economic growth for Canada. Keywords: Sustainable growth, economic development, long-term outlook.

-

Job Creation: A strong economy often leads to job creation and improved employment opportunities. Keywords: Job creation, employment opportunities, economic impact.

-

Further Growth or Stagnation: Whether this marks the beginning of sustained growth or a temporary peak remains uncertain and dependent on various economic and global factors. Keywords: Economic growth, long-term outlook, economic forecasting.

Analyzing the TSX Composite Index Record High and its Future Trajectory

The TSX Composite Index reaching a record intraday high is a significant event driven by a combination of strong sectoral performance, positive economic indicators, favorable global market influences, and improved investor sentiment. While this suggests potential for continued growth, it is crucial to remember that markets are inherently volatile. The short-term outlook includes the possibility of market corrections, and the long-term trajectory depends on many intertwined economic and geopolitical factors. To make informed decisions about investments related to the TSX Composite Index and Canadian equities, stay informed by regularly checking reliable financial news sources and consider consulting with a qualified financial advisor. Understanding the dynamics of the TSX index and the Canadian stock market is key to navigating the complexities of investing in Canadian equities.

Featured Posts

-

Trumps China Tariffs Projected Impact Through 2025

May 17, 2025

Trumps China Tariffs Projected Impact Through 2025

May 17, 2025 -

Investigation Reveals Fatal Details In Bayesian Superyacht Incident

May 17, 2025

Investigation Reveals Fatal Details In Bayesian Superyacht Incident

May 17, 2025 -

Verifying The Authenticity Of Angel Reese Quotes

May 17, 2025

Verifying The Authenticity Of Angel Reese Quotes

May 17, 2025 -

The Impact Of False Angel Reese Quotes On Public Perception

May 17, 2025

The Impact Of False Angel Reese Quotes On Public Perception

May 17, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6th Hearing Witness To Detail Events This Fall

May 17, 2025

Cassidy Hutchinsons Memoir Key Jan 6th Hearing Witness To Detail Events This Fall

May 17, 2025

Latest Posts

-

Josh Cavallo Breaking Barriers After Coming Out

May 17, 2025

Josh Cavallo Breaking Barriers After Coming Out

May 17, 2025 -

Should Jalen Brunson End His Podcast Perkins Weighs In

May 17, 2025

Should Jalen Brunson End His Podcast Perkins Weighs In

May 17, 2025 -

Brunson Podcast Kendrick Perkins Strong Recommendation

May 17, 2025

Brunson Podcast Kendrick Perkins Strong Recommendation

May 17, 2025 -

Knicks Beat Pistons Crew Chief Acknowledges Missed Call On Hardaway Jr Shot

May 17, 2025

Knicks Beat Pistons Crew Chief Acknowledges Missed Call On Hardaway Jr Shot

May 17, 2025 -

Nba Analyst Perkins Advises Brunson Against Podcast

May 17, 2025

Nba Analyst Perkins Advises Brunson Against Podcast

May 17, 2025