U.S. Customs Duties Hit Record High: $16.3 Billion In April

Table of Contents

Reasons Behind the Record High U.S. Customs Duties

Several factors contributed to the record-high U.S. customs duties in April 2024.

Increased Import Volume

The sheer volume of goods imported into the U.S. in April likely played a significant role.

- Strong consumer demand: Robust consumer spending fueled a high demand for imported goods.

- Restocking of inventories: Businesses replenished inventories depleted during previous supply chain disruptions.

- Increased reliance on imports: Many businesses continue to rely heavily on imports to meet consumer demand.

Analysis of specific import categories reveals significant increases in electronics, apparel, and automotive parts, all contributing to the overall rise in customs duties paid.

Higher Tariff Rates on Certain Goods

Existing tariffs and newly imposed duties on specific products significantly impacted the total customs duty revenue.

- Steel and aluminum tariffs: Tariffs on steel and aluminum imports, implemented in previous years, continue to add to import costs.

- Section 301 tariffs: Tariffs imposed under Section 301 of the Trade Act of 1974 on goods from China remain in effect, increasing import duties.

- Other trade disputes: Ongoing trade disputes with other countries may have led to the implementation of additional tariffs, impacting specific product categories.

The impact of these specific tariffs is a direct increase in import costs, often passed on to consumers in the form of higher prices.

Enforcement and Increased Audits

Stricter customs enforcement and increased audits contributed to higher duty assessments.

- Increased scrutiny of import documentation: Customs and Border Protection (CBP) is rigorously examining import documentation for accuracy and compliance.

- Stricter valuation methods: More stringent valuation methods are leading to higher assessed values and consequently higher duties.

- Penalties for misclassification: Businesses face increased penalties for misclassifying imported goods, resulting in substantial additional costs.

These stricter enforcement measures have increased compliance costs for businesses, demanding more resources for accurate documentation and expert advice.

Impact of Record High Duties on the U.S. Economy

The record-high U.S. customs duties have far-reaching consequences for the U.S. economy.

Inflationary Pressures

Increased import costs directly contribute to inflationary pressures.

- Higher consumer prices: Increased import costs are often passed on to consumers in the form of higher prices for goods.

- Reduced consumer spending: Higher prices can reduce consumer spending and potentially slow economic growth.

- Impact on business investment: Businesses may postpone investment plans due to uncertainty and increased costs.

Inflation data for April 2024 and subsequent economic forecasts will provide a clearer picture of the overall impact on the economy.

Impact on Businesses

Higher customs duties significantly impact business profitability and competitiveness.

- Increased costs for importers: Businesses face higher operational costs due to increased customs duties.

- Potential price increases for consumers: Importers may pass on increased costs to consumers, leading to higher prices.

- Decreased competitiveness for domestic businesses: Higher import costs may make imported goods less competitive compared to domestically produced alternatives.

Industries heavily reliant on imports, such as manufacturing and retail, are particularly vulnerable. Many are exploring strategies to mitigate the impact, such as price adjustments and sourcing diversification.

Shifting Global Trade Dynamics

The high customs duties may lead to companies reconsidering their sourcing strategies and supply chains.

- Shifting sourcing to countries with lower tariffs: Businesses may explore sourcing goods from countries with more favorable trade agreements or lower tariffs.

- Increased domestic production: Some businesses may consider increasing domestic production to reduce reliance on imports and avoid high duties.

- Restructuring of global supply chains: Businesses are likely to restructure their global supply chains to mitigate risk and minimize the impact of high tariffs.

These shifting trade dynamics have significant geopolitical implications, affecting international trade relationships and economic alliances.

Strategies for Businesses to Navigate High U.S. Customs Duties

Businesses can employ several strategies to mitigate the impact of high U.S. customs duties.

Accurate Classification and Valuation

Precise classification and valuation are crucial for minimizing duty payments.

- Seek professional advice from customs brokers: Customs brokers possess expertise in navigating complex customs regulations.

- Ensure accurate documentation: Maintain detailed and accurate import documentation to avoid penalties.

- Utilize tariff databases: Access up-to-date tariff information to ensure accurate classification of imported goods.

Accurate Harmonized System (HS) codes are essential for determining the correct duty rates.

Supply Chain Optimization

Re-evaluating supply chains can help minimize costs and potential delays.

- Explore alternative sourcing locations: Diversifying sourcing to countries with lower tariffs can help reduce overall costs.

- Optimize inventory management: Efficient inventory management can minimize storage costs and reduce the risk of duty increases.

- Improve logistics efficiency: Streamlining logistics processes can reduce delays and associated costs.

Diversifying supply chains reduces reliance on single-source countries and mitigates the risk of disruptions.

Duty Drawback Programs

Utilize available government programs to reduce or recover duties paid.

- Understand eligibility requirements: Determine eligibility for duty drawback programs based on specific import and export activities.

- Complete the application process: Follow the necessary procedures and documentation requirements for duty drawback applications.

- Seek professional assistance: Consult with customs experts to ensure compliance with all regulations.

Duty drawback programs can significantly reduce the financial burden of high import tariffs, offering a vital tool for businesses.

Conclusion

The record-high U.S. customs duties of $16.3 billion in April highlight the complexities of international trade. Understanding the contributing factors, economic impact, and available mitigation strategies is crucial for businesses. By proactively addressing customs compliance, optimizing supply chains, and exploring government programs, businesses can navigate this challenging environment and maintain profitability. Stay informed about changes in U.S. Customs Duties and their implications for your business. Effective planning and proactive management are key to minimizing the impact of these high import tariffs.

Featured Posts

-

Local Obituaries Saying Goodbye To Our Community Members

May 13, 2025

Local Obituaries Saying Goodbye To Our Community Members

May 13, 2025 -

Liga Hannover Drohkulisse Statt Derby Stimmung Im Abstiegskampf

May 13, 2025

Liga Hannover Drohkulisse Statt Derby Stimmung Im Abstiegskampf

May 13, 2025 -

Kyle Tucker Trade Rumors Leave Cubs Fans Frustrated

May 13, 2025

Kyle Tucker Trade Rumors Leave Cubs Fans Frustrated

May 13, 2025 -

Herthas Decline A Head To Head Analysis Of Boateng And Kruses Views

May 13, 2025

Herthas Decline A Head To Head Analysis Of Boateng And Kruses Views

May 13, 2025 -

Funeral Services For Teenager Killed In School Stabbing

May 13, 2025

Funeral Services For Teenager Killed In School Stabbing

May 13, 2025

Latest Posts

-

Transfer Race Heats Up Tottenham And Crystal Palace Target Top Young English Player

May 14, 2025

Transfer Race Heats Up Tottenham And Crystal Palace Target Top Young English Player

May 14, 2025 -

The Presence Of Banned Candles On Canadian Online Marketplaces

May 14, 2025

The Presence Of Banned Candles On Canadian Online Marketplaces

May 14, 2025 -

Premier League Rivals Chase Promising English Prospect Tottenham Vs Crystal Palace

May 14, 2025

Premier League Rivals Chase Promising English Prospect Tottenham Vs Crystal Palace

May 14, 2025 -

Banned Candle Sales On Etsy Walmart And Amazon A Canadian Perspective

May 14, 2025

Banned Candle Sales On Etsy Walmart And Amazon A Canadian Perspective

May 14, 2025 -

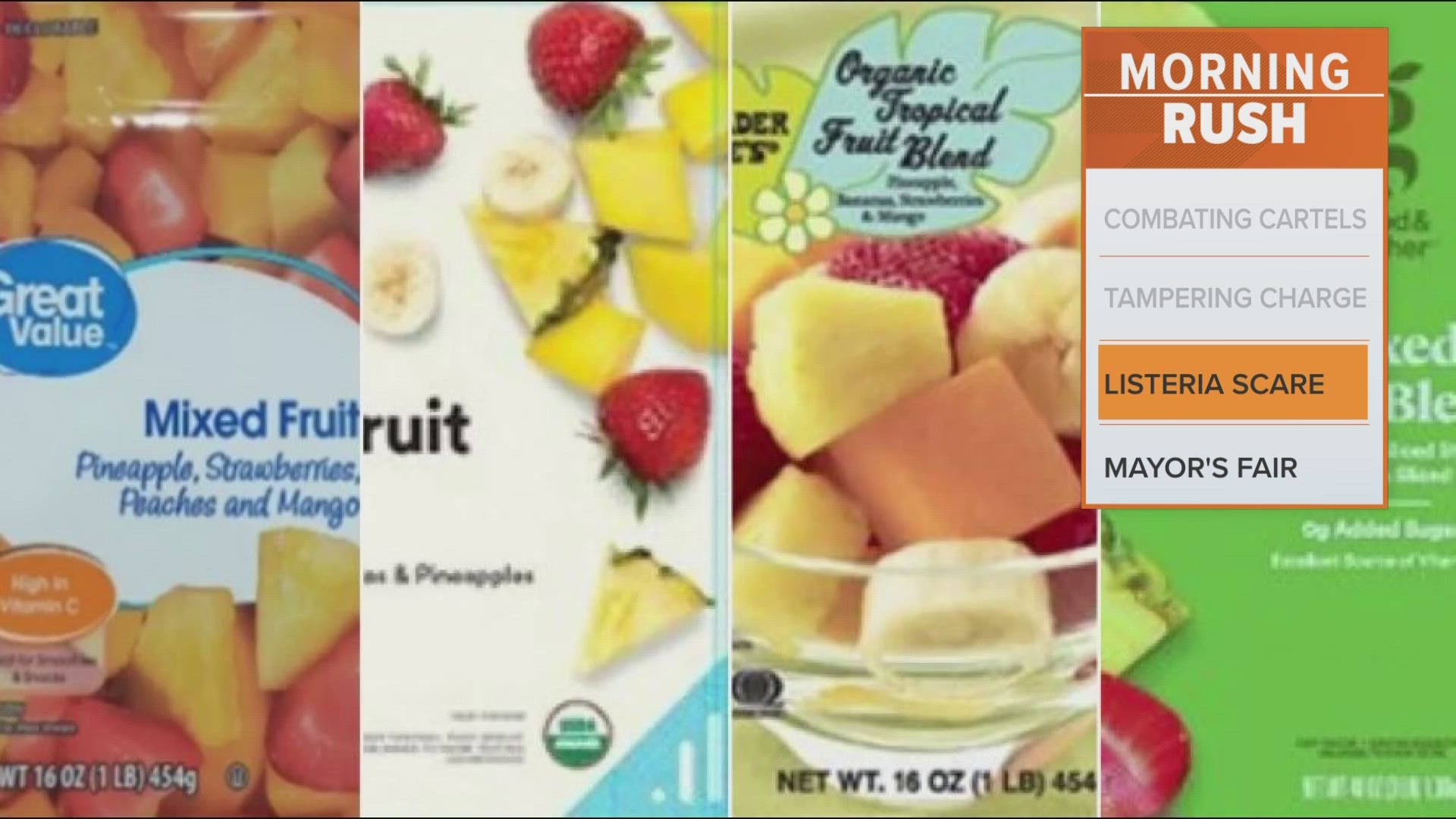

Urgent Recall Alert Great Value Item Pulled From Michigan Shelves

May 14, 2025

Urgent Recall Alert Great Value Item Pulled From Michigan Shelves

May 14, 2025