U.S. Dollar Performance Under Scrutiny: A Nixon-Era Parallel?

Table of Contents

The Nixon Shock and its Legacy

The Nixon shock of 1971 marked a pivotal moment in global monetary history. Understanding this historical event is crucial to interpreting the current challenges to U.S. dollar performance.

The End of Bretton Woods

The Bretton Woods system, established after World War II, pegged the value of most currencies to the U.S. dollar, which in turn was convertible to gold. This system provided a degree of stability to the global economy, but it became increasingly strained in the late 1960s due to the rising cost of the Vietnam War and increasing U.S. trade deficits. President Nixon's decision to unilaterally end the convertibility of the dollar to gold in August 1971 effectively ended the Bretton Woods system and ushered in an era of floating exchange rates.

- Devaluation of the dollar: The move immediately devalued the dollar, leading to increased uncertainty in global currency markets.

- Impact on international trade and investment: Fluctuating exchange rates made international trade and investment riskier, impacting businesses reliant on global markets.

- Rise of inflation: The decoupling of the dollar from gold contributed to a period of significant inflation globally.

- Long-term effects on global monetary policy: The Nixon shock fundamentally altered global monetary policy, leading to a more decentralized and volatile system.

Current Challenges to U.S. Dollar Dominance

The current challenges facing the U.S. dollar's performance share striking similarities with the conditions preceding the Nixon shock, albeit in a different global context.

Rising Inflation and Interest Rates

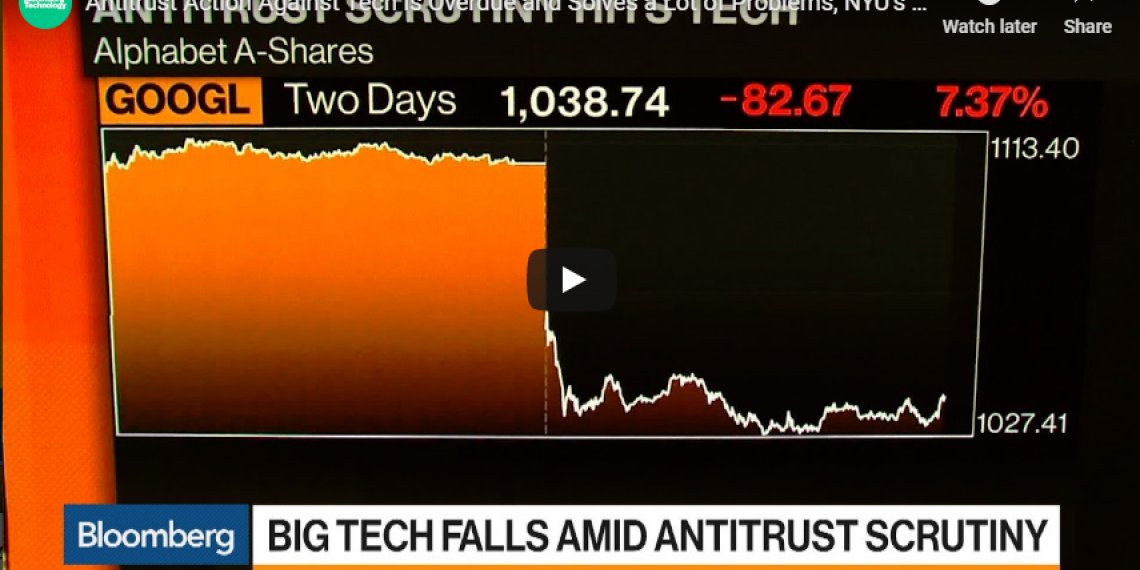

The U.S. is currently grappling with persistently high inflation, forcing the Federal Reserve to aggressively raise interest rates. This tightening monetary policy, while aimed at curbing inflation, has significant implications for the dollar's value and global capital flows.

- Inflation rates and interest rate hikes: Inflation soared to multi-decade highs in 2022, prompting the Fed to implement a series of substantial interest rate increases. (Insert relevant data on inflation and interest rates here).

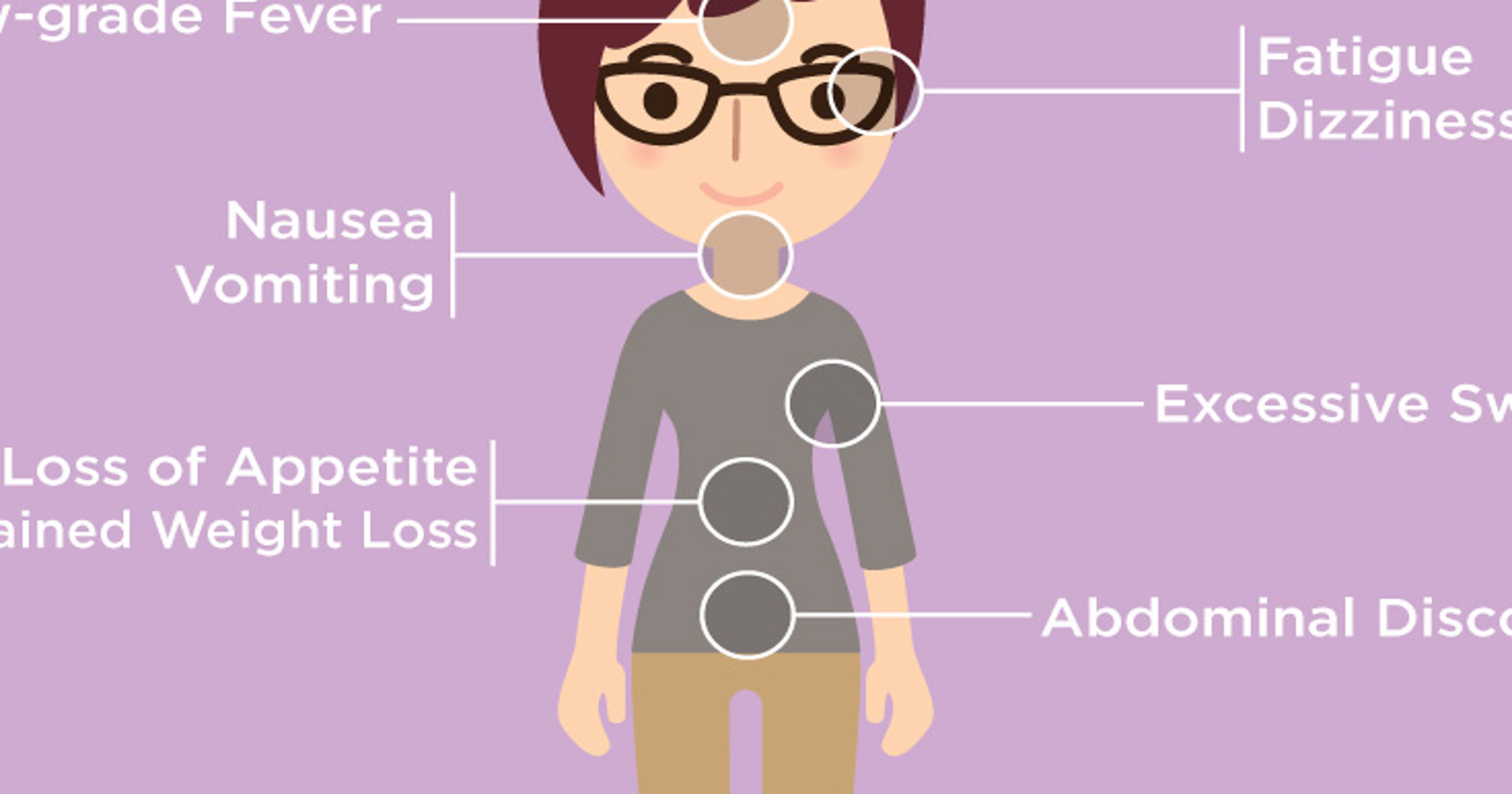

- Impact on consumer spending and business investment: Rising interest rates increase borrowing costs, dampening consumer spending and business investment, potentially leading to a slowdown or recession.

- Potential for a recession: The aggressive interest rate hikes increase the risk of a significant economic downturn in the U.S. and globally.

- Geopolitical factors: The war in Ukraine and global supply chain disruptions have exacerbated inflationary pressures and complicated the Federal Reserve's policy response.

The Rise of Alternative Currencies

The U.S. dollar's long-held dominance in international trade and finance is being challenged by the rise of alternative currencies, especially the Euro and the Chinese Yuan. This shift reflects the changing global economic landscape and the increasing diversification of global financial markets.

- Growing role of the Euro and Yuan: The Euro has become a significant rival to the dollar, particularly within the European Union. China's growing economic influence has led to increased use of the Yuan in bilateral trade agreements.

- Impact of digital currencies and blockchain technology: The emergence of cryptocurrencies and other digital assets could further erode the dollar's dominance if they gain wider adoption.

- Potential for a multi-polar currency system: The future may see a more multi-polar currency system, with the dollar sharing influence with other major currencies.

- Implications for U.S. economic power: A decline in the dollar's dominance could diminish U.S. economic and political power on the global stage.

Geopolitical Risks and Uncertainty

Geopolitical instability significantly impacts U.S. dollar performance. The ongoing war in Ukraine, rising tensions with China, and other global conflicts inject considerable uncertainty into financial markets.

- Impact of sanctions and trade wars: Geopolitical tensions often lead to sanctions and trade wars, disrupting global trade and impacting currency values.

- Flight to safety phenomenon: During periods of uncertainty, investors often seek the perceived safety of the U.S. dollar, driving up its value. However, this effect can be temporary.

- Role of uncertainty in driving capital flows: Uncertainty drives capital flows, sometimes away from the dollar, leading to volatility.

- Potential for further weakening of the dollar: Continued geopolitical instability could contribute to a long-term weakening of the dollar's position.

Conclusion

The current challenges to U.S. dollar performance bear striking similarities to the circumstances that led to the Nixon shock, highlighting the inherent volatility of global monetary systems. While the details differ, the underlying themes of rising inflation, geopolitical tensions, and the emergence of competing currencies are strikingly similar. Key takeaways include the historical context of the Nixon shock, the current economic pressures on the dollar, and the growing influence of alternative currencies and geopolitical risks. Understanding the factors impacting U.S. dollar performance is crucial for navigating the complex global economic landscape. Stay informed about future developments and consider strategies to mitigate potential risks to your investments and financial well-being. Diversifying your portfolio in light of the current uncertainties regarding U.S. dollar performance is a prudent strategy.

Featured Posts

-

The Untapped Potential Of Middle Managers Driving Business Growth And Employee Engagement

Apr 29, 2025

The Untapped Potential Of Middle Managers Driving Business Growth And Employee Engagement

Apr 29, 2025 -

Get Capital Summertime Ball 2025 Tickets A Step By Step Guide

Apr 29, 2025

Get Capital Summertime Ball 2025 Tickets A Step By Step Guide

Apr 29, 2025 -

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers

Apr 29, 2025

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers

Apr 29, 2025 -

Willie Nelson New Album Release Overshadowed By Family Feud

Apr 29, 2025

Willie Nelson New Album Release Overshadowed By Family Feud

Apr 29, 2025 -

Adhd In Adults 8 Subtle Signs You Shouldnt Ignore

Apr 29, 2025

Adhd In Adults 8 Subtle Signs You Shouldnt Ignore

Apr 29, 2025

Latest Posts

-

Celtic Loanee Eyes Championship Glory

May 12, 2025

Celtic Loanee Eyes Championship Glory

May 12, 2025 -

Loanees Bid For Celtic Success

May 12, 2025

Loanees Bid For Celtic Success

May 12, 2025 -

Ipswich Town Women Gwalia Game To Decide League Position

May 12, 2025

Ipswich Town Women Gwalia Game To Decide League Position

May 12, 2025 -

Post Match Interview Sheehan On Ipswich Towns Performance

May 12, 2025

Post Match Interview Sheehan On Ipswich Towns Performance

May 12, 2025 -

Sheehans Reaction Ipswich Towns Focus Remains Strong

May 12, 2025

Sheehans Reaction Ipswich Towns Focus Remains Strong

May 12, 2025