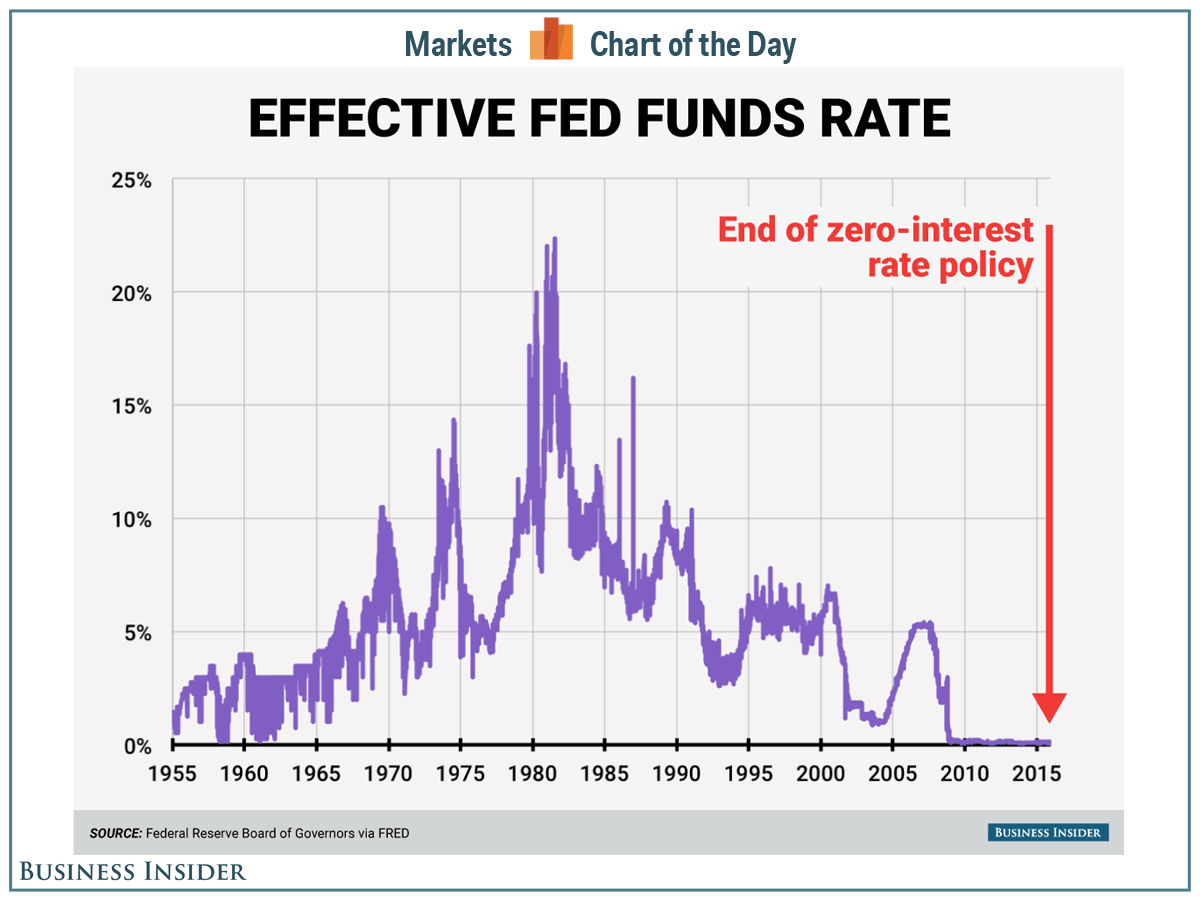

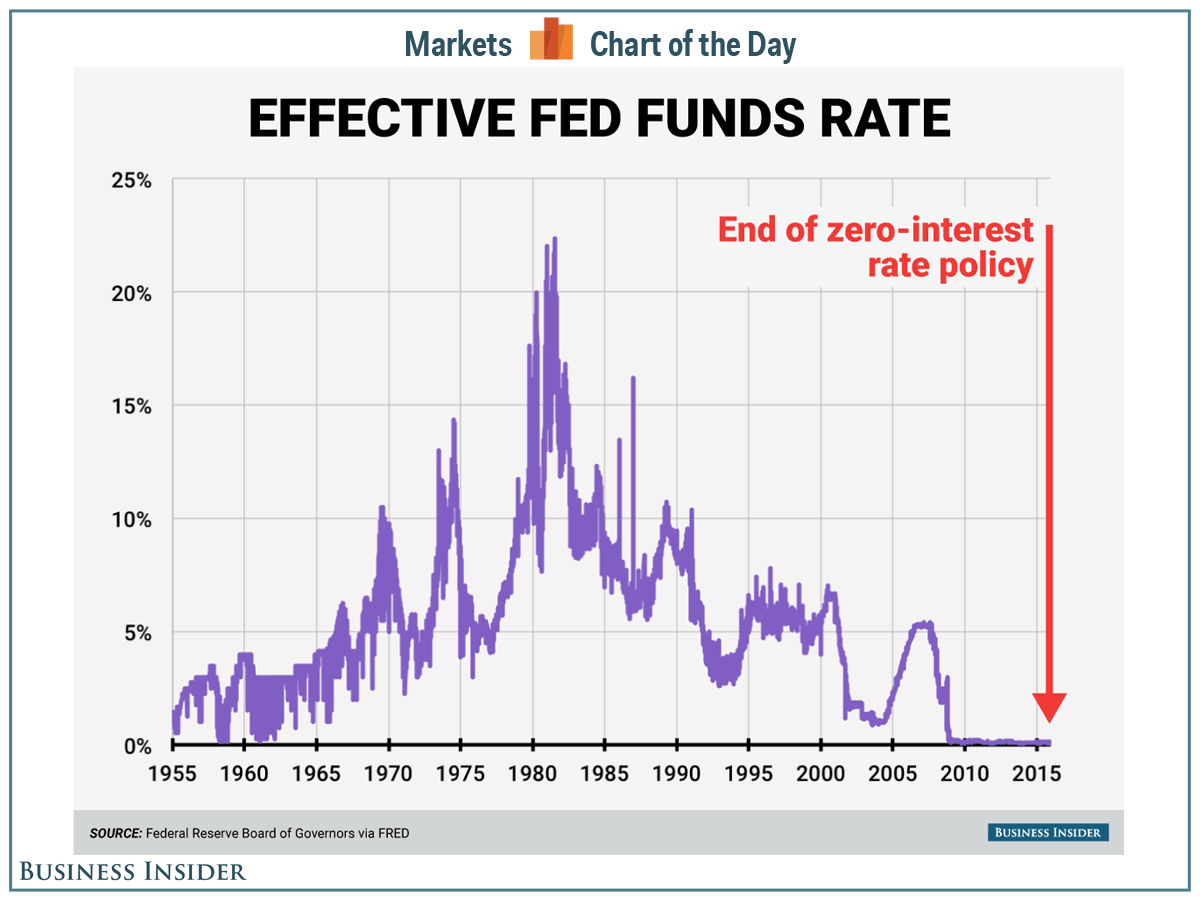

U.S. Federal Reserve Decision: Interest Rates Unchanged Due To Economic Uncertainty

Table of Contents

Economic Uncertainty: The Driving Force Behind the Fed's Decision

The Federal Reserve's decision to maintain interest rates was primarily driven by considerable economic uncertainty. Several key factors contributed to this cautious approach:

Inflationary Pressures: A Persistent Concern

Inflation remains a significant concern for the Federal Reserve. While recent data suggests a slight cooling in inflation, it is still above the Fed's target of 2%.

- Recent Inflation Data: The Consumer Price Index (CPI) and Producer Price Index (PPI) continue to show elevated levels, although the rate of increase has slowed in recent months.

- The Fed's Dual Mandate: The Federal Reserve operates under a dual mandate: maintaining price stability and maximizing employment. High inflation directly conflicts with the price stability goal, necessitating careful consideration of monetary policy adjustments.

Labor Market Dynamics: A Mixed Bag

The U.S. job market presents a mixed picture, further complicating the Fed's decision-making process.

- Unemployment Rates: While unemployment remains relatively low, indicating a strong labor market, it's not yet at a level that would warrant aggressive interest rate hikes.

- Wage Growth: Strong wage growth, although positive for workers, contributes to inflationary pressures, requiring careful monitoring by the Federal Reserve.

- Job Growth: While job growth has been robust, it's moderating and the Fed is closely watching to see if this continues or reverses.

Geopolitical Risks and Global Economic Slowdown: A Looming Threat

Global events significantly impact the U.S. economy, influencing the Federal Reserve's monetary policy decisions.

- War in Ukraine: The ongoing conflict in Ukraine continues to disrupt global supply chains, contributing to inflationary pressures and economic uncertainty.

- Supply Chain Disruptions: Lingering supply chain disruptions stemming from the pandemic and geopolitical factors add complexity to the economic outlook.

- Global Economic Forecasts: Many global economic forecasts predict a slowdown in growth, potentially impacting the U.S. economy and influencing the Fed's decisions.

Analysis of the Fed's Statement and Potential Future Actions

The Federal Reserve's statement following its meeting provided valuable insights into its current thinking and potential future actions.

Key Takeaways from the Fed's Press Conference

The Fed chair's press conference highlighted the following key points:

- A continued commitment to bringing inflation down to the 2% target.

- A data-dependent approach to future interest rate decisions.

- Acknowledgement of the uncertainties surrounding the economic outlook.

Future Interest Rate Projections: A Cautious Approach

The Federal Reserve's forward guidance suggests a cautious approach to future interest rate adjustments.

- Potential Scenarios: Future scenarios include holding rates steady, further rate hikes, or even potential rate cuts depending on incoming economic data.

- Triggering Factors: Factors that would likely trigger rate hikes include persistent inflation or unexpectedly strong economic growth. Conversely, slower-than-expected growth or signs of significant economic weakness might lead to rate cuts.

Impact on Financial Markets: Navigating Volatility

The Fed's decision to hold rates steady had an immediate impact on financial markets.

- Market Reactions: Stock markets initially reacted positively to the news, while bond yields remained relatively stable.

- Investor Sentiment: Investor sentiment remains cautious, reflecting the prevailing economic uncertainty.

- Potential Volatility: Future market volatility is likely as investors continue to monitor economic data and the Federal Reserve's future actions.

Impact on Consumers and Businesses

The decision to hold interest rates has significant implications for consumers and businesses alike.

Implications for Borrowing Costs: A Mixed Bag

Unchanged interest rates have a mixed effect on borrowing costs.

- Mortgage Rates: Mortgage rates will likely remain relatively stable, which could benefit potential homebuyers.

- Loan Interest Rates: Interest rates on other types of loans, such as auto loans and personal loans, are also likely to remain relatively unchanged.

- Business Investment: Businesses may be more inclined to invest given the low borrowing costs, depending on their future outlook.

Effects on Consumer Spending and Economic Growth: Uncertain Outlook

The Fed's decision on interest rates will undoubtedly influence consumer spending and economic growth.

- Consumer Confidence: Consumer confidence could remain stable or even improve slightly, depending on the overall economic environment.

- Spending Patterns: Consumer spending patterns will be largely influenced by inflation rates and overall economic conditions.

Conclusion: Navigating Economic Uncertainty: The Federal Reserve's Ongoing Role

The Federal Reserve's decision to hold interest rates steady reflects the significant economic uncertainty facing the U.S. economy. Factors such as persistent inflation, labor market dynamics, and geopolitical risks all played a role in this decision. The future path of interest rates remains data-dependent, and the Federal Reserve's ongoing role in managing the U.S. economy is crucial. Stay informed about future U.S. Federal Reserve interest rate decisions and their impact on the economy by subscribing to our newsletter for regular updates. Understanding the Federal Reserve's actions is key to navigating the complexities of the current economic climate.

Featured Posts

-

Zayavi Stivena Kinga Pro Trampa Ta Maska Reaktsiya Svitu

May 09, 2025

Zayavi Stivena Kinga Pro Trampa Ta Maska Reaktsiya Svitu

May 09, 2025 -

The Next Ovechkin 9 Nhl Players With Potential To Break His Record

May 09, 2025

The Next Ovechkin 9 Nhl Players With Potential To Break His Record

May 09, 2025 -

Indias Stock Market Today Sensex Nifty 50 Close Flat Amidst Uncertainty

May 09, 2025

Indias Stock Market Today Sensex Nifty 50 Close Flat Amidst Uncertainty

May 09, 2025 -

A Comprehensive Look At Celebrity Antiques Road Trip

May 09, 2025

A Comprehensive Look At Celebrity Antiques Road Trip

May 09, 2025 -

Donner Ses Cheveux A Dijon Un Geste Solidaire

May 09, 2025

Donner Ses Cheveux A Dijon Un Geste Solidaire

May 09, 2025