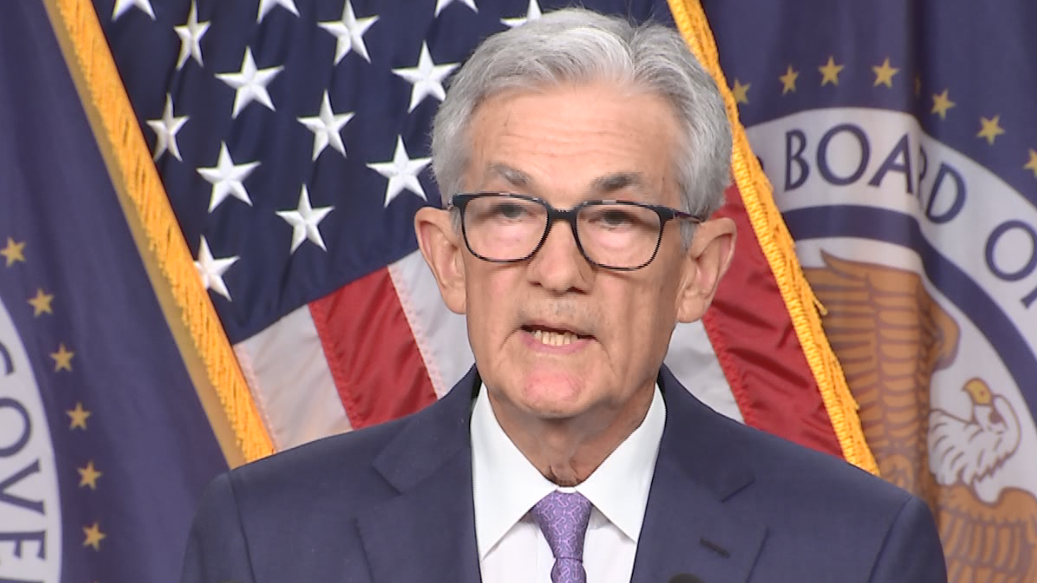

U.S. Federal Reserve Holds Steady: Rate Decision Amidst Growing Economic Pressures

Table of Contents

The Fed's Rationale for Holding Rates Steady

The Federal Open Market Committee (FOMC) justified its decision to hold rates steady by citing a complex interplay of economic indicators. Their official statement emphasized a cautious approach, acknowledging both progress in reducing inflation and persistent uncertainties. The committee's assessment of inflation suggests a slowdown, but it remains above the Fed's target, prompting a wait-and-see approach. The robust labor market, while positive, also contributes to inflationary pressures, adding another layer of complexity to the decision-making process.

- Specific inflation figures cited by the Fed: While the exact figures vary depending on the specific index used (CPI, PCE), the Fed likely referenced a continued decline in the rate of inflation, albeit from still-elevated levels.

- Unemployment rate and its trend: The unemployment rate remains historically low, indicating a strong labor market. However, this low unemployment also fuels wage growth, which can contribute to inflationary pressures.

- Mention of any specific economic indicators mentioned in the statement: The FOMC statement likely included assessments of consumer spending, GDP growth, and other key economic indicators to paint a complete picture of the current economic situation. These factors influence the Fed’s confidence (or lack thereof) in a sustained economic recovery.

Economic Pressures Facing the U.S. Economy

The U.S. economy currently faces a formidable challenge: taming inflation without triggering a recession. High inflation continues to erode purchasing power, impacting consumers and businesses alike. The fear of a recession looms large, fueled by persistent high inflation, rising interest rates in the past, and slowing economic growth in some sectors. The Fed is walking a tightrope, attempting to cool inflation without causing excessive economic slowdown. Furthermore, the global economic landscape adds another layer of complexity, with geopolitical instability and supply chain disruptions contributing to economic uncertainty.

- Current inflation rate and its comparison to the Fed's target: The current inflation rate remains above the Fed's target of 2%, though the pace of increase may be slowing. This discrepancy is a key factor in the Fed's decision-making.

- Potential recession indicators: Indicators like an inverted yield curve (where short-term interest rates exceed long-term rates), slowing GDP growth, and declining consumer confidence all raise concerns about a potential recession.

- Key global economic factors affecting the U.S.: Global economic slowdown, geopolitical tensions, and energy price volatility all exert pressure on the U.S. economy, influencing the Fed's decisions.

Market Reactions to the Fed's Decision

The markets responded to the Fed's decision with a mix of reactions. While some interpreted the decision as a sign of confidence in the economy's resilience, others viewed it as a sign of uncertainty. The immediate market response saw a degree of volatility, with stock market indices experiencing fluctuations depending on investor sentiment. Bond yields also reacted, reflecting changes in expectations for future interest rate movements. Financial analysts and economists offered varying interpretations, highlighting the complexity of the economic situation and the challenges facing the Fed.

- Changes in major stock indices following the announcement: The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all showed some degree of movement following the announcement, reflecting investor sentiment and expectations.

- Movement in bond yields: Bond yields reacted to the news, potentially reflecting changes in investor expectations for future inflation and interest rate policies.

- Quotes from financial analysts and economists: Expert opinions varied, with some praising the Fed's cautious approach, while others criticized it for not acting decisively enough to combat inflation.

Future Outlook and Potential Implications

The path ahead remains uncertain. While the Fed has held rates steady this time, the possibility of future interest rate hikes or cuts remains very much on the table. The Fed's future decisions will heavily depend on incoming economic data, particularly inflation figures and the strength of the labor market. This decision's impact on various sectors of the U.S. economy, such as housing and consumer spending, is likely to be significant, with potential consequences for job creation, investment, and overall economic growth.

- Prediction for the next FOMC meeting: Analysts will closely monitor economic indicators to forecast the likelihood of a rate hike or further holds at the next FOMC meeting.

- Potential scenarios for economic growth: Different scenarios could play out depending on the pace of inflation reduction, the strength of the labor market, and the global economic environment.

- Risks associated with inflation and recession: The primary risks remain managing inflation without triggering a recession. The Fed will strive to strike a delicate balance between these competing risks.

Conclusion: Analyzing the U.S. Federal Reserve's Hold on Rates

The U.S. Federal Reserve's decision to hold interest rates steady reflects the complex economic challenges facing the nation. The decision weighs carefully considered factors including persistent inflation, a strong labor market, and global economic uncertainties. The market's reaction highlights the significant impact of the Fed's actions on investor sentiment and overall economic expectations. The future outlook remains uncertain, requiring continued monitoring of key economic indicators and the Fed's future policy decisions. To stay informed about future developments concerning the U.S. Federal Reserve holds steady, and future interest rate decisions, subscribe to our newsletter or follow reputable financial news sources. Further reading on monetary policy and economic forecasting is recommended for a deeper understanding of these complex issues.

Featured Posts

-

Indian Stock Market Update Sensex Gains Niftys Positive Trend

May 10, 2025

Indian Stock Market Update Sensex Gains Niftys Positive Trend

May 10, 2025 -

Analyzing Abcs Decision Why Re Air High Potential Shows In March 2025

May 10, 2025

Analyzing Abcs Decision Why Re Air High Potential Shows In March 2025

May 10, 2025 -

Strictly Come Dancing Wynne Evans Addresses Speculation Over Return

May 10, 2025

Strictly Come Dancing Wynne Evans Addresses Speculation Over Return

May 10, 2025 -

Predstoyasch Rimeyk Na Stivn King Ot Netflix Kakvo Znaem Dosega

May 10, 2025

Predstoyasch Rimeyk Na Stivn King Ot Netflix Kakvo Znaem Dosega

May 10, 2025 -

Noi Mosdo Hasznalata Transznemu Not Tartoztattak Le Floridaban

May 10, 2025

Noi Mosdo Hasznalata Transznemu Not Tartoztattak Le Floridaban

May 10, 2025