Uber Stock Soars: Understanding April's Double-Digit Gains

Table of Contents

Key Factors Driving Uber Stock's April Surge

Several key factors contributed to the remarkable increase in the Uber stock price during April. Analyzing these elements provides valuable context for understanding the market's reaction and assessing future potential.

Improved Financial Performance

Uber's Q1 2024 earnings report (or the relevant quarter's report, depending on the actual date of writing) played a significant role in boosting investor confidence. The report showcased considerable improvements in key performance indicators, signaling a positive shift in the company's financial health.

- Increased revenue from ride-hailing services: A notable increase in ride bookings, particularly in key markets, contributed substantially to overall revenue growth. This suggests a recovery from the pandemic's impact and a strengthening demand for ride-sharing services.

- Strong growth in delivery and freight segments: Uber Eats and Uber Freight also experienced significant growth, diversifying the company's revenue streams and reducing reliance on ride-hailing alone. This diversification proved crucial in mitigating risks associated with fluctuations in the ride-sharing market.

- Improved operational efficiency: Uber implemented cost-cutting measures and streamlined its operations, leading to improved profitability (or a significant narrowing of losses). This demonstrates a focus on sustainable growth and enhanced operational management.

- Cost-cutting measures: Successful cost-cutting initiatives without sacrificing essential services significantly boosted profit margins, attracting the attention of investors seeking improved returns on their Uber investment.

Positive Market Sentiment and Investor Confidence

The April surge in Uber stock wasn't solely driven by internal factors. Positive market sentiment and renewed investor confidence also played a significant role.

- Positive analyst upgrades: Several leading financial analysts upgraded their Uber stock forecast, citing the improved financial performance and positive outlook for the company. This positive outlook influenced other investors and contributed to the increased demand.

- Increased institutional investment: Large institutional investors increased their holdings in Uber stock, signaling their confidence in the company's long-term growth potential. This influx of capital further drove up the price.

- Positive media coverage: Favorable media coverage highlighting the company's progress and positive financial results also contributed to a more optimistic market perception of Uber.

- Stronger-than-expected user growth: Exceeding expectations in user growth and engagement solidified the narrative of a company on a solid trajectory, reinforcing positive investor sentiment.

Strategic Initiatives and Innovation

Uber's ongoing commitment to innovation and strategic initiatives also contributed to the April stock price surge.

- Launch of new subscription service: The introduction of new subscription services offering discounted rides or deliveries attracted new users and increased engagement with existing customers. This is a critical step toward increased customer retention and loyalty.

- Expansion into new geographic markets: Expanding operations into new markets provided access to new customer bases, boosting revenue potential and overall market reach.

- Strategic partnerships with other companies: Partnerships with complementary businesses broadened Uber's service offerings and created new revenue opportunities, strengthening its competitive advantage.

- Technological advancements in autonomous vehicle technology: Continued investment and progress in autonomous vehicle technology showcases Uber's commitment to future innovation, further enhancing investor confidence in long-term prospects.

Analyzing the Risks and Potential Challenges

While April's results were undeniably positive, it's crucial to acknowledge the inherent risks and challenges facing Uber.

Competition and Market Saturation

The ride-sharing industry remains highly competitive, posing a significant challenge to Uber's sustained growth.

- Intense competition from established players: Competitors like Lyft continue to pose a substantial threat, vying for market share and customers. This competitive landscape necessitates ongoing innovation and strategic adaptations from Uber.

- Potential for new entrants to disrupt the market: The ride-sharing market is not immune to disruptive technologies or business models; the emergence of new competitors could significantly impact Uber's market share.

- Concerns about market saturation in key cities: In some major cities, the market may be approaching saturation, limiting future growth potential unless Uber expands into new, less saturated markets or develops new service offerings.

Regulatory and Legal Hurdles

Navigating the complex regulatory landscape presents significant hurdles for Uber's operations.

- Ongoing legal battles concerning driver classification: The ongoing debate surrounding the classification of Uber drivers as employees or independent contractors continues to pose legal and financial risks.

- Varying regulatory environments across different regions: Different regions impose varying regulatory requirements, increasing operational complexity and potential compliance costs.

- Potential for increased regulatory scrutiny: Increased scrutiny from regulatory bodies could lead to stricter regulations, impacting Uber's operations and profitability.

Economic Uncertainty and Inflation

Macroeconomic factors also influence Uber's performance and pose considerable risk.

- Impact of inflation on consumer spending: Inflationary pressures can reduce consumer spending on discretionary services like ride-sharing and food delivery, potentially impacting Uber's revenue.

- Sensitivity to changes in fuel prices: Fluctuations in fuel prices directly impact operational costs, impacting profitability and potentially affecting pricing strategies.

- Potential for reduced demand during economic downturns: During economic downturns, consumer demand for non-essential services like ride-sharing often decreases, posing a significant challenge to Uber's revenue generation.

Conclusion

April's double-digit gains in Uber stock reflect the company's improved financial performance, positive investor sentiment, and successful strategic initiatives. The strong growth in various segments and operational efficiencies are clear positives. However, investors must carefully consider the potential risks, including intense competition, ongoing regulatory hurdles, and the impact of macroeconomic factors. Thorough research and a comprehensive understanding of the factors influencing Uber stock are vital for informed investment decisions. Before investing in Uber stock or any other stock, always consult with a financial advisor. Stay informed about future developments and consider the long-term implications before making any investment choices related to Uber stock performance.

Featured Posts

-

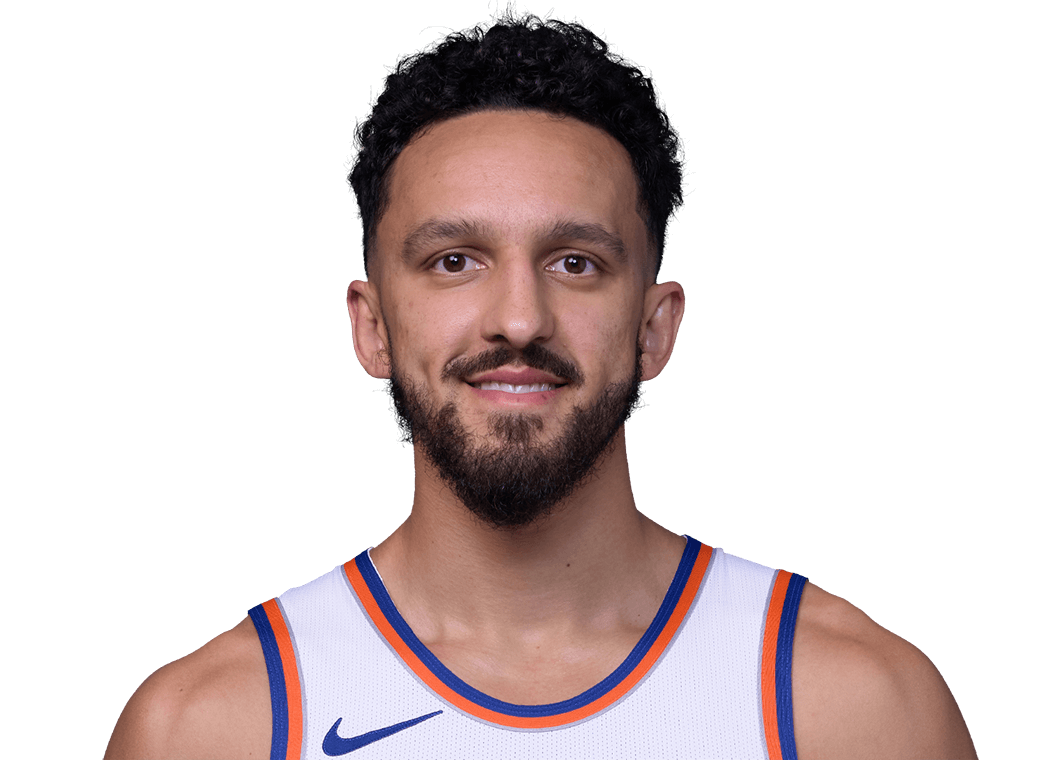

New York Knicks How To Handle The Landry Shamet Question

May 17, 2025

New York Knicks How To Handle The Landry Shamet Question

May 17, 2025 -

Landing The Fountain City Classic Scholarship Mastering The Midday Interview

May 17, 2025

Landing The Fountain City Classic Scholarship Mastering The Midday Interview

May 17, 2025 -

Angel Reese And Mom Angel Webb Reese Stunning Photos Revealed

May 17, 2025

Angel Reese And Mom Angel Webb Reese Stunning Photos Revealed

May 17, 2025 -

The Studio Seth Rogens Film Earns A Perfect Score On Rotten Tomatoes

May 17, 2025

The Studio Seth Rogens Film Earns A Perfect Score On Rotten Tomatoes

May 17, 2025 -

High Salary Limited Options A Practical Guide To Career Transition

May 17, 2025

High Salary Limited Options A Practical Guide To Career Transition

May 17, 2025

Latest Posts

-

Rune Dominira Protiv Povredenog Alkarasa U Finalu Barselone

May 17, 2025

Rune Dominira Protiv Povredenog Alkarasa U Finalu Barselone

May 17, 2025 -

Rune Bolji Od Povredenog Alkarasa U Finalu Barselone

May 17, 2025

Rune Bolji Od Povredenog Alkarasa U Finalu Barselone

May 17, 2025 -

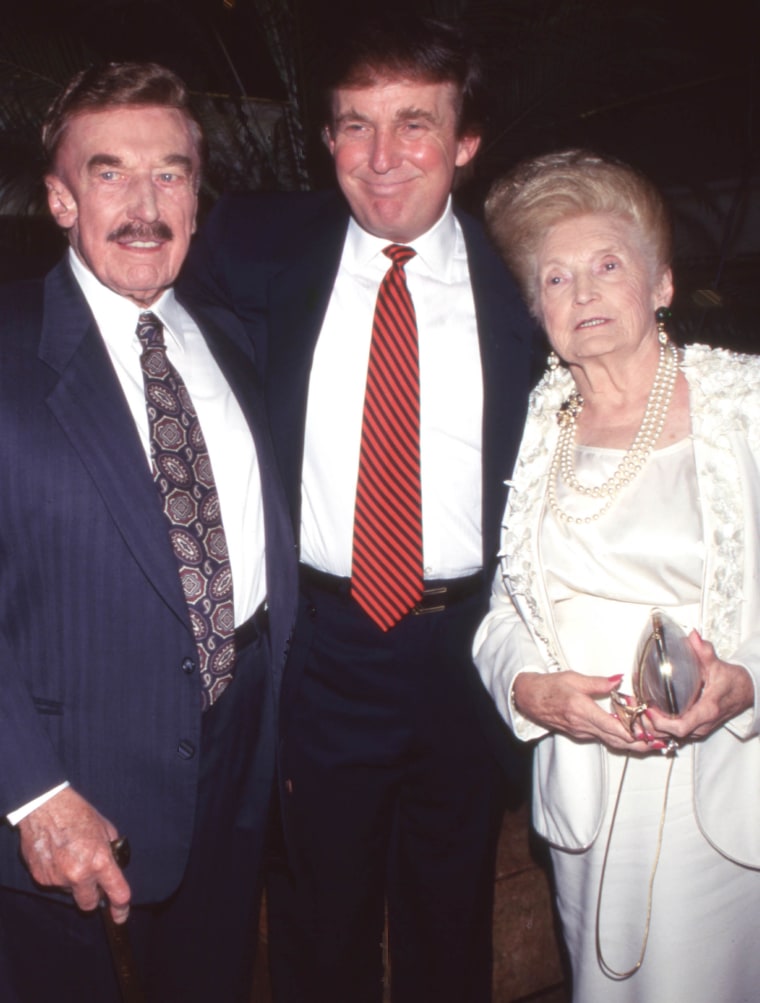

Exploring The Trump Family Tree The Arrival Of Alexander Boulos

May 17, 2025

Exploring The Trump Family Tree The Arrival Of Alexander Boulos

May 17, 2025 -

Donald Trumps Family Tree Grows Tiffanys Son Alexander Joins The Lineage

May 17, 2025

Donald Trumps Family Tree Grows Tiffanys Son Alexander Joins The Lineage

May 17, 2025 -

A New Addition To The Trump Family Alexander Arrives Examining The Family Tree

May 17, 2025

A New Addition To The Trump Family Alexander Arrives Examining The Family Tree

May 17, 2025