Uber (UBER) Investment: Potential And Risks

Table of Contents

The Potential of Investing in Uber (UBER)

Uber's potential as an investment hinges on its market dominance and continued technological innovation. The company's strong position in the ride-sharing and delivery sectors, coupled with ambitious expansion plans, presents significant growth opportunities.

Market Dominance and Growth Potential

Uber boasts a substantial market share in numerous global cities, making it a dominant player in the ride-sharing industry. This leadership position, coupled with its expansion into lucrative markets like food delivery (Uber Eats) and freight, positions it for continued growth. As the company matures and refines its operations, the potential for increased revenue and profitability is undeniable.

- Expanding into untapped global markets: Uber continues to penetrate new geographical areas, bringing its services to underserved populations and expanding its revenue streams.

- Increasing market penetration in existing markets: Through targeted marketing campaigns and strategic partnerships, Uber aims to further solidify its position within existing markets, attracting new users and increasing usage frequency.

- Successful integration of new technologies (e.g., autonomous driving): Uber's significant investment in autonomous vehicle technology could revolutionize its operational efficiency and reduce costs, significantly impacting its bottom line.

- Diversification into new business segments (e.g., logistics, subscription services): Expanding into complementary services offers opportunities for revenue diversification and reduced reliance on its core ride-sharing business.

Technological Innovation and Competitive Advantage

Uber's significant investment in technology is a key driver of its competitive advantage. Its user-friendly app, strong brand recognition, and advanced algorithms provide a powerful platform for continued growth.

- Advanced mapping and routing algorithms: These optimize routes, improve efficiency, and enhance the overall user experience.

- AI-powered driver and rider matching: Sophisticated algorithms efficiently connect riders with drivers, minimizing wait times and improving service quality.

- Development of autonomous vehicle technology: This has the potential to dramatically reduce operational costs and increase efficiency, providing a substantial competitive edge.

The Risks of Investing in Uber (UBER)

While the potential for growth is substantial, several significant risks must be considered before investing in UBER stock. These risks encompass regulatory hurdles, financial performance, and broader economic factors.

Regulatory and Legal Challenges

Uber faces ongoing regulatory and legal challenges globally, including disputes over driver classification, data privacy, and competition from government-backed transportation initiatives. These issues pose significant threats to profitability and operational stability.

- Labor laws and driver classification disputes: The classification of drivers as independent contractors versus employees varies across jurisdictions and continues to be a source of legal and financial uncertainty.

- Data privacy concerns and regulations: Uber handles vast amounts of user data, requiring strict adherence to evolving data privacy regulations and potentially leading to significant fines or lawsuits.

- Competition from government-backed transportation initiatives: Government-supported public transportation systems can pose a direct challenge to Uber's market share in certain areas.

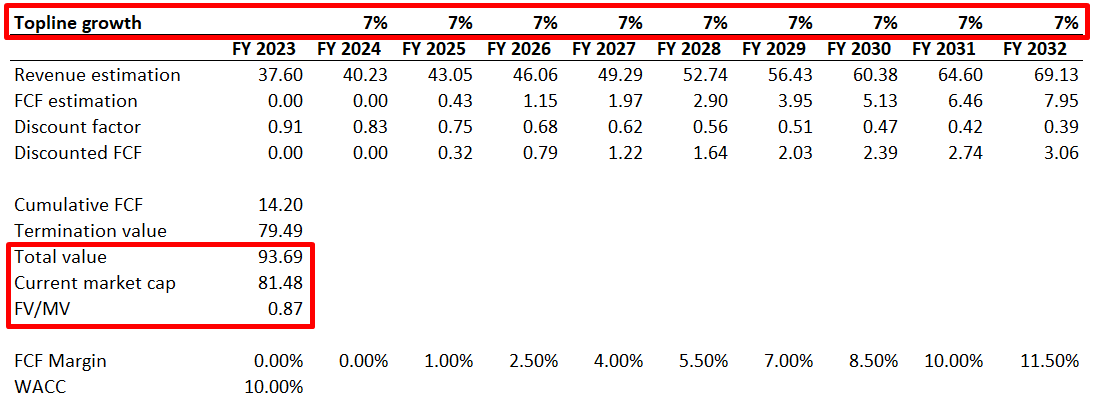

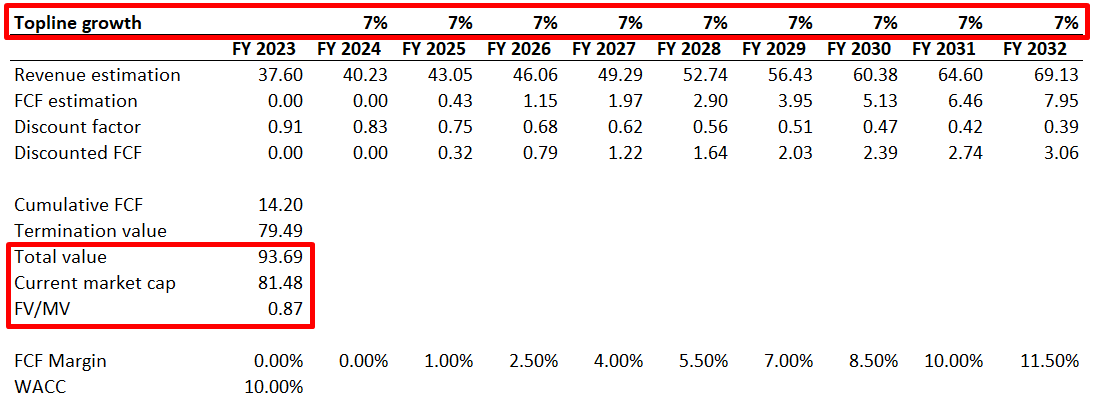

Financial Performance and Profitability

Uber's historical and projected financial performance requires careful scrutiny. While revenue growth has been impressive, profitability remains a challenge due to high operating costs and intense competition.

- High operating costs and ongoing losses: Maintaining a large driver network and managing operational expenses contribute to substantial costs, potentially hindering profitability.

- Dependence on high growth rates to maintain valuation: Uber's current valuation is partly dependent on maintaining high growth rates, making it susceptible to slower-than-expected expansion.

- Intense competition and pricing pressures: The ride-sharing and delivery markets are highly competitive, leading to price wars and pressure on profit margins.

Economic and Market Risks

Uber's business is sensitive to macroeconomic factors like economic downturns, fuel price fluctuations, and changes in consumer spending. Emerging transportation technologies also pose a potential threat.

- Economic recessions and reduced consumer spending: During economic downturns, consumer demand for ride-sharing and delivery services may decrease, impacting revenue.

- Fluctuations in fuel prices and inflation: Rising fuel costs directly impact driver earnings and operational expenses, affecting profitability.

- Disruptive technologies and increased competition: The emergence of new transportation technologies or business models could disrupt Uber's market position.

Conclusion

Investing in Uber (UBER) presents both exciting opportunities and substantial risks. The company's market dominance and technological innovation offer significant growth potential, while regulatory challenges, financial performance concerns, and macroeconomic risks pose significant headwinds. A thorough Uber (UBER) investment analysis is essential before making any investment decisions. Conduct thorough due diligence, carefully weigh the potential benefits against the risks, and consult a financial advisor before committing capital to UBER stock or comparable ride-sharing investments. Learn more about developing a robust Uber (UBER) investment strategy today.

Featured Posts

-

Nyt Mini Crossword Answers Today March 16 2025 Hints And Clues

May 19, 2025

Nyt Mini Crossword Answers Today March 16 2025 Hints And Clues

May 19, 2025 -

Dallas Wings Rookie Jersey Where To Find Paige Bueckers

May 19, 2025

Dallas Wings Rookie Jersey Where To Find Paige Bueckers

May 19, 2025 -

Cohep Participa En La Observacion Del Proceso Electoral Garantizando La Transparencia

May 19, 2025

Cohep Participa En La Observacion Del Proceso Electoral Garantizando La Transparencia

May 19, 2025 -

Starving For Less When A Wife Earns Less Than Her A List Husband

May 19, 2025

Starving For Less When A Wife Earns Less Than Her A List Husband

May 19, 2025 -

Analysts Forecast Trump Era 30 China Tariffs To Extend To Late 2025

May 19, 2025

Analysts Forecast Trump Era 30 China Tariffs To Extend To Late 2025

May 19, 2025