Uber (UBER) Stock: A Thorough Investment Assessment

Table of Contents

The ride-sharing giant, Uber (UBER), has experienced significant volatility in its stock price recently. News of increased competition, fluctuating fuel costs, and ongoing regulatory challenges have all contributed to this uncertainty. This article aims to provide a thorough investment assessment of Uber stock, analyzing its strengths, weaknesses, opportunities, and threats (SWOT analysis) to help you better understand the potential of UBER stock price movements and whether it's a suitable addition to your investment portfolio. We will delve into key aspects, including UBER stock price history, Uber investment strategies, an Uber stock analysis, and an Uber stock forecast based on available data.

H2: Uber's Business Model and Market Position

H3: Ride-Sharing Dominance: Uber's global reach and market share in the ride-sharing industry are undeniable. Its brand recognition and extensive network of drivers provide a significant competitive advantage. However, the competitive landscape is far from static.

- Market Capitalization: Uber boasts a substantial market capitalization (check current figures for accuracy).

- Key Competitors: Lyft remains a significant competitor in the US, while various local players and traditional taxi services continue to compete in different regions.

- Global Expansion Strategy: Uber's global expansion is a key driver of growth, but success varies across different markets due to local regulations and competition.

- Market Penetration: Uber enjoys strong market penetration in major metropolitan areas worldwide, but penetration rates differ significantly across regions.

The "ride-sharing market" is fiercely competitive, and Uber's ability to maintain its dominant market share will depend on its ability to adapt to changing consumer preferences and technological advancements. Maintaining its "Uber market share" requires ongoing innovation and investment. Understanding the "competitive landscape" is crucial for any Uber investment.

H3: Diversification Beyond Rides: Uber's diversification strategy extends beyond its core ride-sharing business. Uber Eats, its food delivery service, has experienced significant growth, while Uber Freight targets the logistics sector. The company is also investing heavily in emerging technologies such as autonomous vehicles.

- Revenue Breakdown: A significant portion of Uber's revenue now comes from Uber Eats and other segments (check current figures for accuracy).

- Growth Potential: The potential for growth in these diverse segments is substantial, offering opportunities for increased revenue and profitability.

- Market Competition: Each segment faces its own competitive pressures – DoorDash and Grubhub rival Uber Eats, while established players dominate the freight market.

- Profitability Analysis: Analyzing the profitability of each segment is crucial to assessing the overall financial health and "diversification strategy" of Uber. The potential of "autonomous vehicles" to significantly reduce costs and improve efficiency is also a significant long-term factor.

H2: Financial Performance and Growth Prospects

H3: Revenue and Profitability: Analyzing Uber's financial statements reveals a complex picture. While revenue growth has been substantial, achieving consistent profitability remains a challenge.

- Revenue Figures: Year-over-year revenue growth (check current figures for accuracy) indicates the company's scale and market position but needs to be considered in the context of profitability.

- Net Income/Loss: Uber has historically reported net losses (check current figures for accuracy), although this is common for rapidly expanding companies.

- EBITDA & Free Cash Flow: Monitoring EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and free cash flow provides insights into the company's operational efficiency and cash generation abilities.

- Debt Levels: Understanding Uber's debt levels and its ability to manage its financial obligations is crucial for any "Uber financials" assessment.

Investors need to carefully analyze these "Uber financials" to understand the "revenue growth" trajectory and the path towards sustained "profitability."

H3: Future Growth Potential: Uber's future growth prospects depend on several factors, including its ability to execute its expansion plans and navigate regulatory challenges.

- Expansion Plans: Further global expansion into new markets remains a key growth driver.

- Technological Advancements: Investing in autonomous vehicle technology could drastically alter cost structures and competitive positioning.

- Regulatory Changes: Regulatory hurdles and changes in licensing requirements pose ongoing challenges.

- Macroeconomic Factors: Macroeconomic factors such as inflation, economic downturns, and fuel price fluctuations significantly impact Uber's operations.

The "growth forecast" for Uber relies on effectively managing these "market opportunities" and mitigating the "regulatory risks."

H2: Risk Assessment and Valuation

H3: Key Risks: Investing in Uber stock involves considerable risk. Understanding these risks is vital for any informed investment decision.

- Competitive Threats: Intense competition from existing and emerging players poses a significant threat.

- Regulatory Risks: Navigating ever-changing regulatory landscapes concerning licensing, safety regulations, and labor laws is crucial.

- Economic Sensitivity: Uber's business is sensitive to macroeconomic factors such as economic downturns and fuel price volatility.

- Technological Disruption: Rapid technological advancements could render existing business models obsolete.

These "investment risks," particularly the "regulatory risks" and "competitive risks," should be carefully weighed against the potential rewards.

H3: Stock Valuation: Evaluating Uber's stock valuation requires a multi-faceted approach.

- P/E Ratio: The price-to-earnings ratio (check current figures for accuracy) needs to be analyzed in the context of its growth prospects and compared to industry peers.

- Price-to-Sales Ratio: The price-to-sales ratio (check current figures for accuracy) provides another perspective on valuation.

- Discounted Cash Flow Analysis (DCF): A discounted cash flow analysis can provide a more comprehensive valuation, but it relies on assumptions about future cash flows.

- Peer Comparison: Comparing Uber's valuation metrics to its competitors helps determine whether it is overvalued or undervalued. A thorough "peer comparison" within the "stock valuation" process is recommended.

Conclusion:

This Uber (UBER) stock analysis reveals a company with significant strengths, such as a dominant position in the ride-sharing market and a promising diversification strategy. However, significant risks remain, including intense competition, regulatory challenges, and economic sensitivity. Uber (UBER) stock presents both exciting opportunities and significant risks. Further due diligence is recommended before making any investment decisions. Thorough due diligence on Uber (UBER) stock is vital. Continue your Uber (UBER) stock research, carefully considering all aspects of its business model, financial performance, and future prospects before making any investment decisions. Learn more about investing in Uber (UBER) stock by consulting reputable financial resources and seeking professional investment advice.

Featured Posts

-

Photos Jennifer Lawrence And Husband Take A Relaxing Walk

May 19, 2025

Photos Jennifer Lawrence And Husband Take A Relaxing Walk

May 19, 2025 -

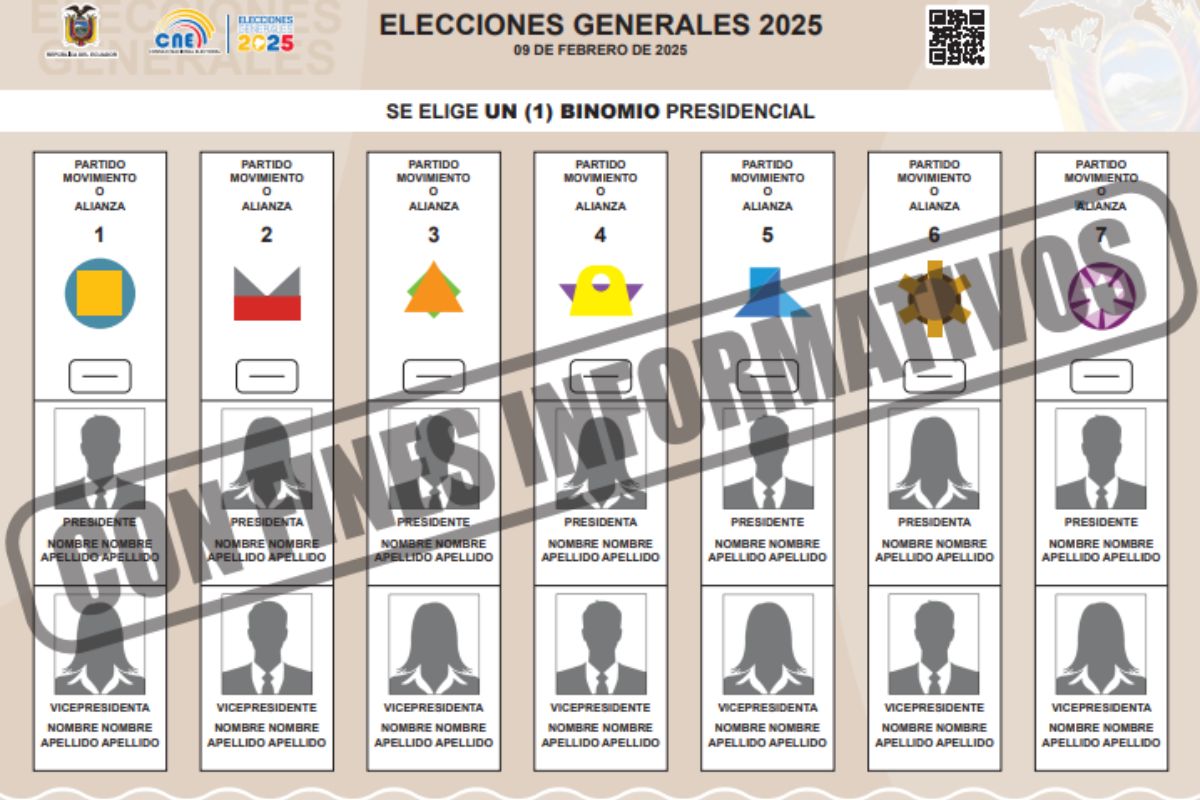

Cne Preparativos Para Las Primarias De 2025

May 19, 2025

Cne Preparativos Para Las Primarias De 2025

May 19, 2025 -

Amputee Athlete Makes History Parker Byrds College Baseball Milestone

May 19, 2025

Amputee Athlete Makes History Parker Byrds College Baseball Milestone

May 19, 2025 -

Ana Paola Hall Declaratoria Gracias Al Apoyo De La Ciudadania

May 19, 2025

Ana Paola Hall Declaratoria Gracias Al Apoyo De La Ciudadania

May 19, 2025 -

Poitiers Nouveau Projet Immobilier 46 Appartements Dans L Ancien Palais De Justice Et Tribunal De Commerce

May 19, 2025

Poitiers Nouveau Projet Immobilier 46 Appartements Dans L Ancien Palais De Justice Et Tribunal De Commerce

May 19, 2025