Uber's Foodpanda Taiwan Deal Falls Through Amid Regulatory Challenges

Table of Contents

Antitrust Concerns and Regulatory Scrutiny

The Taiwanese Fair Trade Commission (FTC) played a pivotal role in the deal's demise. Their concerns centered around potential monopolistic practices and a significant reduction in competition within the already consolidating Taiwanese food delivery market. The FTC's investigation highlighted several key areas of concern:

-

Detailed explanation of the FTC's investigation process: The FTC initiated a thorough investigation, scrutinizing market share data, pricing strategies, and potential anti-competitive behaviors. This included analyzing the combined market power of Uber Eats and Foodpanda, should the merger have been successful. The process involved reviewing internal documents, conducting interviews, and evaluating the potential impact on consumers.

-

Specific concerns raised by the FTC regarding market share and potential price increases: The FTC expressed serious concerns that a merger between Uber Eats and Foodpanda, already two of the largest players in the Taiwanese food delivery market, would lead to a significant reduction in competition, potentially resulting in higher prices for consumers and less choice in service providers. Their analysis suggested that the combined entity would hold a dominant market share, stifling innovation and potentially harming consumer welfare.

-

Mention any previous antitrust cases involving food delivery companies in Taiwan: While this case is particularly significant, the FTC's actions are consistent with its broader approach to regulating monopolies and promoting fair competition across various sectors in Taiwan. Previous cases involving other industries served as precedent for the rigorous scrutiny applied to the Uber-Foodpanda merger.

-

Discussion on the FTC's power and influence in such mergers: The FTC holds significant power in reviewing and approving or rejecting mergers and acquisitions in Taiwan. Their decision in this case sends a strong message to other companies considering similar mergers, emphasizing the importance of considering potential antitrust implications thoroughly before proceeding.

The Impact on Competition in Taiwan's Food Delivery Market

The failed acquisition significantly impacts the competitive landscape of Taiwan's already dynamic food delivery market. Before the attempted merger, both Foodpanda and Uber Eats held substantial market share, competing fiercely with other players like Deliveroo and local Taiwanese companies.

-

Comparison of Foodpanda's and Uber Eats' market shares in Taiwan: While precise figures aren't always publicly available, both companies held significant market share, meaning the merger would have dramatically altered the balance of power. The FTC's concern was that the combined entity would become overly dominant.

-

Analysis of other major players in the Taiwanese food delivery market: The remaining players, including smaller local competitors, will likely benefit from the continued existence of independent Foodpanda and Uber Eats. This prevents a situation of near-monopoly control, fostering a more competitive environment.

-

Discussion on the potential for increased prices or reduced service quality due to less competition: The FTC's concern was that a lack of competition could lead to higher delivery fees, reduced service quality, and less innovation within the industry. The failed merger potentially prevents these negative outcomes for consumers.

-

Assessment of consumer sentiment regarding the failed acquisition: While specific consumer sentiment data following the failed acquisition may not be immediately available, it's reasonable to assume that many consumers would prefer a more competitive market with lower prices and a greater variety of service providers.

Potential Alternatives and Future Strategies for Uber and Foodpanda

With the acquisition off the table, both Uber and Foodpanda must now adapt their strategies. Several alternatives exist:

-

Potential partnerships or collaborations: Instead of a full acquisition, Uber and Foodpanda could explore strategic partnerships, sharing resources or technology without merging their operations directly.

-

Focus on organic growth strategies for increasing market share: Both companies may now redouble their efforts on organic growth, focusing on improving their services, expanding their delivery networks, and attracting new customers through marketing campaigns.

-

Exploration of alternative markets for expansion by both companies: The failed acquisition might prompt both Uber and Foodpanda to explore expansion opportunities in other markets in Asia or globally.

-

Discussion of the long-term impact on the competitive landscape: The failed merger will likely result in a more competitive and dynamic landscape, benefiting consumers in the long run.

Lessons Learned and Implications for Future Mergers in Taiwan

The failed Uber-Foodpanda deal serves as a cautionary tale for future mergers and acquisitions in Taiwan.

-

Suggestions for companies planning similar mergers in Taiwan: Companies planning mergers in Taiwan must conduct thorough due diligence, including a comprehensive assessment of antitrust implications and proactive engagement with the FTC throughout the process.

-

Emphasize the importance of understanding the Taiwanese regulatory environment: A deep understanding of Taiwanese regulatory processes, particularly antitrust regulations, is crucial for navigating the complexities of mergers and acquisitions.

-

Discussion on the need for transparent communication with the FTC: Open and transparent communication with the FTC is essential to build trust and ensure a smooth regulatory review process.

-

Analysis of potential changes to regulatory frameworks following this case: The FTC's actions may influence future regulatory frameworks for mergers and acquisitions in Taiwan.

Conclusion

The collapse of Uber's bid to acquire Foodpanda Taiwan highlights the significant regulatory hurdles facing major players in the rapidly growing food delivery market. The Taiwanese FTC's focus on competition underscores the crucial role of antitrust regulations in shaping the industry's future. The deal's failure emphasizes the importance of thorough due diligence and regulatory compliance for companies considering mergers and acquisitions in Taiwan. Stay informed about the evolving regulatory landscape in Taiwan's food delivery sector; understanding the implications of antitrust laws and the FTC's actions is critical for companies navigating this competitive market. Follow us for further updates on the impact of this failed Uber Foodpanda Taiwan deal.

Featured Posts

-

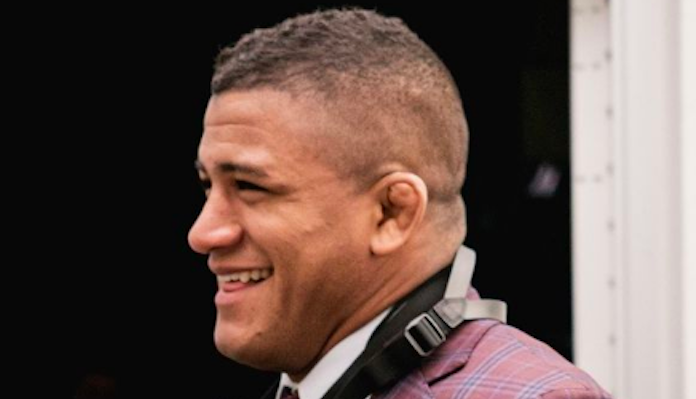

One Result Bothered Gilbert Burns More Than His Losses To Chimaev Della Maddalena And Muhammad

May 19, 2025

One Result Bothered Gilbert Burns More Than His Losses To Chimaev Della Maddalena And Muhammad

May 19, 2025 -

New Photos Jennifer Lawrence And Cooke Maroney After Welcoming Second Child

May 19, 2025

New Photos Jennifer Lawrence And Cooke Maroney After Welcoming Second Child

May 19, 2025 -

Fairness And Access Examining Diversity Policies In Higher Education Admissions

May 19, 2025

Fairness And Access Examining Diversity Policies In Higher Education Admissions

May 19, 2025 -

I Kastoria Giortazei Ton Maio Ethima Kai Ekdiloseis

May 19, 2025

I Kastoria Giortazei Ton Maio Ethima Kai Ekdiloseis

May 19, 2025 -

Kypriako Kai Dimereis Sxeseis Synantisi Kompo Sigiarto Enopsei Proedrias Ee

May 19, 2025

Kypriako Kai Dimereis Sxeseis Synantisi Kompo Sigiarto Enopsei Proedrias Ee

May 19, 2025