UK Inflation Slows: Impact On BOE Rate Cuts And The Pound

Table of Contents

Falling Inflation Figures and Their Causes

The Office for National Statistics (ONS) recently released data revealing a substantial decrease in the UK's inflation rate. While the precise figures vary depending on the specific measure used (CPI, RPI, etc.), the overall trend is clear: inflation is cooling. This welcome news offers some respite from the prolonged period of high inflation that has burdened households and businesses.

Several factors have contributed to this slowdown:

- Decreased Energy Costs: Global energy prices, which soared dramatically in 2022, have begun to retreat. This easing of energy costs has had a significant dampening effect on overall inflation.

- Reduced Import Prices: The weakening of the global economy has led to a decrease in the price of imported goods, reducing inflationary pressures within the UK.

- Slowing Consumer Spending: As consumers grapple with the ongoing cost-of-living crisis, spending has moderated, reducing demand-pull inflation.

- Government Interventions: Government schemes and support packages aimed at mitigating the impact of high energy prices have also played a role in easing inflationary pressures. However, the long-term effectiveness of these interventions remains to be seen.

The Bank of England's Response: Potential for Rate Cuts

The BOE's primary mandate is to maintain price stability. With inflation falling, the Monetary Policy Committee (MPC) is likely to reassess its monetary policy stance. The possibility of future interest rate cuts is now a significant topic of discussion amongst economists and financial analysts.

The MPC's decisions will depend on a number of factors, including the persistence of the inflation slowdown, the strength of the labor market, and the overall outlook for the UK economy. However, several scenarios are possible:

- BOE maintains current interest rates: The MPC might decide to hold interest rates steady to assess the durability of the inflation decline.

- BOE implements a gradual reduction in interest rates: A cautious approach may involve a series of small interest rate cuts over several months.

- BOE implements a significant interest rate cut: A more aggressive approach might be adopted if inflation continues to fall sharply and economic growth remains weak.

Any changes to interest rates will have significant implications for businesses and consumers. Lower interest rates generally reduce borrowing costs, potentially stimulating investment and consumer spending. However, they can also lead to increased inflation if demand rises too quickly.

Impact on the Pound Sterling (GBP): Exchange Rate Fluctuations

Interest rates play a crucial role in determining a currency's value. Lower interest rates generally make a currency less attractive to foreign investors, leading to a potential weakening of the exchange rate. Conversely, higher rates tend to attract investment and strengthen the currency.

The potential BOE rate cuts might therefore lead to a weakening of the pound (GBP) against other major currencies such as the US dollar (USD) and the euro (EUR). This could have important implications for UK businesses:

- Exporters: A weaker pound makes UK exports more competitive in international markets, potentially boosting sales.

- Importers: A weaker pound makes imports more expensive, potentially increasing prices for consumers.

However, it's crucial to remember that other economic factors, such as global economic growth, geopolitical events, and market sentiment, also influence the GBP exchange rate. Possible outcomes include:

- Pound strengthens due to reduced inflation concerns: If the market views the inflation slowdown as positive, investor confidence might increase and push the pound upwards.

- Pound weakens due to lower interest rates: As discussed above, lower interest rates can reduce the attractiveness of the GBP.

- Pound remains relatively stable: The impact of inflation and interest rates might be offset by other factors.

Uncertainty and Market Volatility

Predicting economic outcomes with complete accuracy is impossible. Unexpected events, such as a resurgence in inflation or a sudden deterioration in global economic conditions, could significantly impact the UK economy. This inherent uncertainty contributes to market volatility, meaning fluctuations in inflation, interest rates, and the pound's exchange rate are likely to continue.

Conclusion

The recent slowdown in UK inflation presents a complex scenario with significant implications for the BOE's monetary policy and the pound sterling. While falling inflation offers some relief, the path ahead remains uncertain. The BOE's response, whether it involves rate cuts or maintaining the status quo, will significantly shape the UK's economic trajectory and the value of the GBP. It's crucial to monitor economic indicators closely and stay informed about the evolving situation. To better understand the impact of "UK inflation slows" on your finances and investments, follow the latest news and analysis from reputable sources, and consider further reading on UK economic policy and currency trading. Staying informed is key to navigating this period of economic transition.

Featured Posts

-

Ardisson Vs Baffie Accusations De Machisme Et Reponse Piquante

May 26, 2025

Ardisson Vs Baffie Accusations De Machisme Et Reponse Piquante

May 26, 2025 -

The Short Lived Black Lives Matter Plaza A Case Study In Political Change

May 26, 2025

The Short Lived Black Lives Matter Plaza A Case Study In Political Change

May 26, 2025 -

The Jenson Fw 22 Extended Collection A Detailed Review

May 26, 2025

The Jenson Fw 22 Extended Collection A Detailed Review

May 26, 2025 -

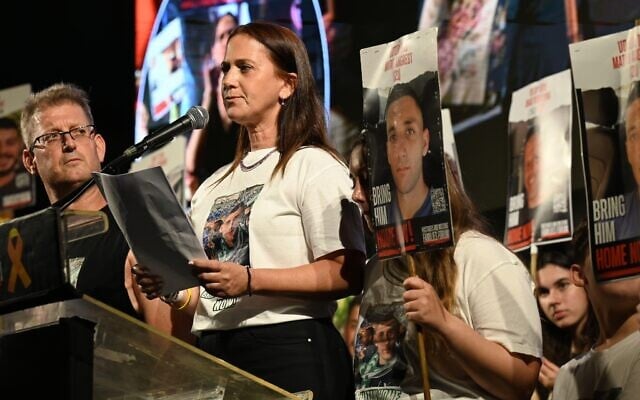

Photo Of Kidnapped Idf Soldier Matan Angrest Reveals Visible Wounds

May 26, 2025

Photo Of Kidnapped Idf Soldier Matan Angrest Reveals Visible Wounds

May 26, 2025 -

The Tumultuous Week How Joe Bidens Post Presidency Plans Went Off Track

May 26, 2025

The Tumultuous Week How Joe Bidens Post Presidency Plans Went Off Track

May 26, 2025

Latest Posts

-

Aamir Khans Daughter Ira Reveals Details Of Andre Agassi Meeting

May 30, 2025

Aamir Khans Daughter Ira Reveals Details Of Andre Agassi Meeting

May 30, 2025 -

La Rivalidad Agassi Rios Un Duelo Memorable En La Historia Del Tenis

May 30, 2025

La Rivalidad Agassi Rios Un Duelo Memorable En La Historia Del Tenis

May 30, 2025 -

Ira Khans Shocking Revelation After Meeting Andre Agassi

May 30, 2025

Ira Khans Shocking Revelation After Meeting Andre Agassi

May 30, 2025 -

El Recuerdo De Agassi Rios Una Bestia Sudamericana En La Cancha

May 30, 2025

El Recuerdo De Agassi Rios Una Bestia Sudamericana En La Cancha

May 30, 2025 -

Steffi Graf Neuer Sport Ehe Mit Agassi Und Ihre Spezielle Regel

May 30, 2025

Steffi Graf Neuer Sport Ehe Mit Agassi Und Ihre Spezielle Regel

May 30, 2025